FIRMCHECK, A NEW ENTRANT IN ANTI-MONEY LAUNDERING (AML) SOFTWARE FOR ACCOUNTANTS, IS DELIGHTED TO ANNOUNCE THE APPOINTMENT OF KEVIN LORD AS GENERAL MANAGER OF THE UK. WITH A RICH CAREER DEDICATED TO DRIVING TECHNOLOGICAL INNOVATION WITHIN THE ACCOUNTANCY SECTOR, LORD'S APPOINTMENT BRINGS A DYNAMIC AND VISIONARY LEADERSHIP TO THE FOREFRONT AS FIRMCHECK EXPANDS ITS PRESENCE IN THE UK MARKET.

On his new assignment, Kevin Lord stated, "Steering Firmcheck’s venture into the UK is a role I eagerly embrace. Our cutting-edge AML platform possesses exceptional features, and I'm

confident it will redefine the accounting industry in this region."

Kevin Lord brings a wealth of experience and a proven track record in building and leading first-class sales teams in SaaS scale-up environments. His career highlights include:

• Head of Global Sales at Chaser: From January 2022 to September 2023, Lord was instrumental in building and leading field sales teams, contributing to the company's growth.

• Head of Practice Sales at FreeAgent: Lord enjoyed a long career with FreeAgent, and during his tenure from April 2020 to August 2022, Lord played a key role in enhancing the company's reach within the accountancy...

Read more

REDUCER IS BACK!

SEPTEMBER HAS STARTED WITH THE NEWS THAT REDUCER HAS RETURNED TO HELP ACCOUNTANTS MAKE COST-SAVING RECOMMENDATIONS FOR THEIR CLIENTS.

Originally founded in 2017, Reducer grew to become the number one cost-saving platform platform in the UK,

partnering with hundreds of accountants and delivering their bespoke cost advisory service to over 9,000 businesses.

However, in August of last year, the fallout from Brexit, COVID-19, and the energy crisis left them with the need to take a step back and evaluate their options.

“We were in a tough spot, and the future looked bleak,”

explains CEO Rishi Sharma.

“But, while informing our partners of the hiatus, we received an unexpected outpouring of positive feedback and support. Buoyed by the response, a small group of us banded together and vowed to bring Reducer back. It’s been an uphill struggle (and a sea of paperwork), but it’s great to finally say we’re back!”

Deputy launches first end-to-end HR platform for shift workers

THE PLATFORM SEAMLESSLY CONNECTS JOB SEEKERS WITH BUSINESSES, REDUCING THE TIME IT TAKES TO APPLY, ONBOARD AND START A NEW ROLE FROM HOURS TO MINUTES.

of its Deputy HR platform suite to streamline the hiring, onboarding and document management process for shift workers and employers across Australia.

With the Australian Bureau of Statistics (ABS) estimating over 1.8 million

potential workers could enter the workforce — a 12% potential increase in the capacity of our labour market — there is an urgent need for a solution that connects businesses and job seekers efficiently and effectively.

Australian businesses are

There was a restructure with Rishi Sharma, the previous Sales Director and the driving force behind the resurgence, taking over as CEO. Most of the previous team was retained, and, along with a few exciting additions, they have been working hard to bring new ideas to expand and... Find out more looking to simplify their HR processes to find and connect with the right talent quickly.

Deputy is tackling this issue with its release of a new AI-powered end-to-end HR... Find out more

Biweekly Saturday 23rd September 2023 | No. 64 The

September 2023 XU XU

independent user news source for accounting apps and their ecosystems Saturday 23rd

New Apps & Updates

INTRODUCING THE RECEIPT BOT CUSTOMER REFERRAL PROGRAM AND OTHER

WE ARE THRILLED TO ANNOUNCE OUR LATEST FEATURES, IMPROVEMENTS, AND BUG FIXES TO ENRICH YOUR EXPERIENCE.

Our latest release includes the following improvements:

1. Earn Additional Credits from the Customer Referral Program

We have introduced our Customer Referral Program, now available to all active Receipt Bot users. You can refer friends, colleagues, and fellow professionals to join Receipt Bot, and both you and your referrals can enjoy

XU BIWEEKLY - No. 64

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

the benefits.

The referral program is only available to account owners who have subscribed to a paid plan in Receipt Bot.

You can register for the customer referral program by following these steps:

• Step 1 – Navigate to the Subscription & Billing page in the Receipt Bot.

• Step 2 – Select the “Referral Rewards” tab.

• Step 3 – Click the “Join” button.

You will be registered to the Referral Program in Receipt Bot. Referral links will be available to you that can be copied and shared with others.

If anyone registers to Re-

FEATURES

ceipt Bot using your referral link and subscribes to a paid plan, you and the referred user will receive up to 33% additional credits.

Suppose you refer a user who subscribes to the Pro plan in Receipt Bot; you and the referred user will get 600 additional credits.

2. Extract Statements Data Separately by Sub Account

Previously, when you uploaded a bank statement that contained multiple sub-accounts and downloaded the transaction data, it was difficult for users to...

Find out more

Cin7 Core Enhancements 10th September, 2023

FEATURES: UI IMPROVEMENTS FOR QBO INTEGRATION, IMPORT SHOPIFY ORDER TYPE TO SALE ADDITIONAL ATTRIBUTE FIELD, ACKNOWLEDGE WALMART ORDERS FROM CIN7 CORE, AND MORE!

Feature 1: Quickbooks Online – UI improvements for integration settings

Impact area: QuickBooks Online

Introduction: We have made some UI improvements to the integration settings, separating sync options, general, and advanced settings. This does not affect any setting functionality.

Feature 2: Import Shopify order type to sale additional attribute field

Impact area: Shopify integration, Sales module

Introduction: Previously to this release, all Shopify orders downloaded to Cin7 Core looked alike, and there was no way to identify if an order was from online, POS or B2B, etc. With this release, Cin7 Core can pull the order type or source name from the order, letting our customers download this information to the additional attribute set assigned to the sale process. This feature will allow customers to...

Keep reading

SECURING DIRECT DEBIT AUTHORITY FROM YOUR CUSTOMERS HAS ALWAYS BEEN AN INTELLIGENT STRATEGY FOR ENSURING TIMELY PAYMENTS AND A SEAMLESS EXPERIENCE.

But what if we told you there’s a way to capture that commitment even earlier at the application stage?

Introducing our new feature: Direct Debit on Customer or Credit Applications

Getting direct debit authorisation from customers

has been a manual process for many businesses –whether dealing with other businesses or individuals.

Setting up automated payments is a dream state for accounts receivable (AR) teams. This facility ensures on-time payments and saves AR team members a ton of effort and time by not having to chase payments anymore.

Usually, getting that automated payment commitment is done through a Direct Debit Authorisation (DDA) sent to customers after the business has...

Find out more

Flowlens

Product Releases – August 2023

By Rich Dale

NEW XERO CONNECTED

APPS!

QuickHR

MY & SG - QuickHR is a comprehensive HR management system that streamlines HR processes and empowers employees. It offers a user-friendly interface, cost-effectiveness, compliance support, and insights for informed decision-making.

An update has been made to our service job cards so that stock must be fully reserved before the job card can be completed. This is to ensure that stock remains correct on the system (as previously stock could be used but not consumed correctly).

Sales

Commercial Invoices – notes section

A change has been made to the format of commercial invoices to remove the blank page between the line items and the notes starting.

Sales Order – quantity dispatched column

On the Sales Order details tab, we now show the ‘quantity dispatched’ within the Sales Order Line Item Overview. This is to quickly identify the quantity of goods ordered vs the quantity...

Keep reading

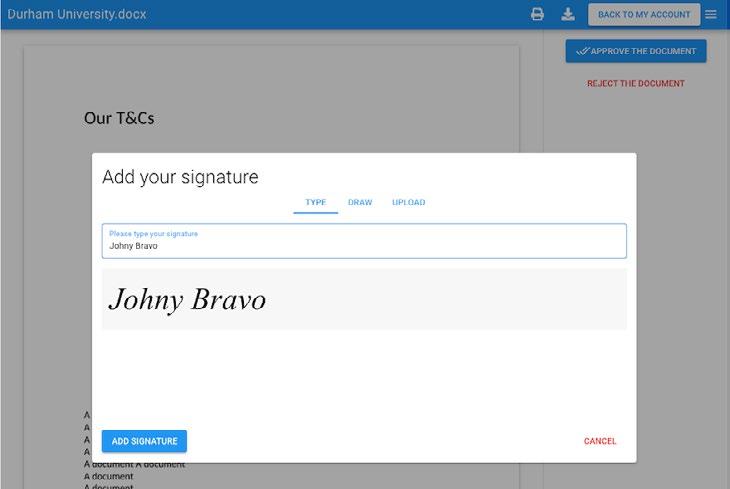

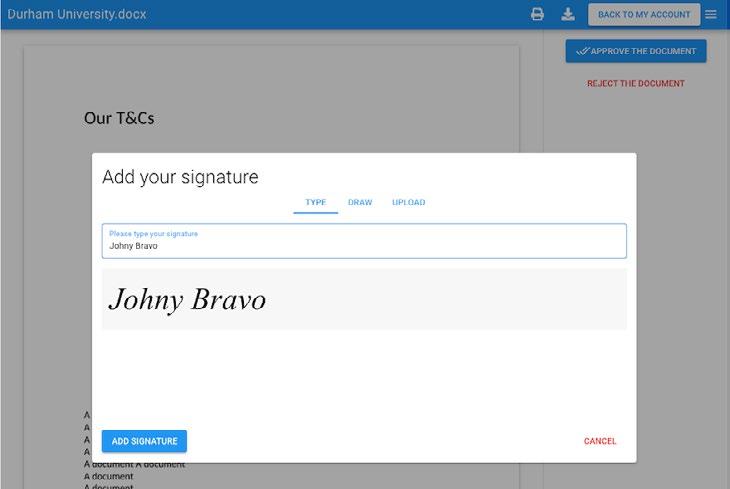

MyDocSafe September (1) Release Notes

WELCOME TO OUR FIRST SEPTEMBER RELEASE ANNOUNCEMENT. HERE IS WHAT IS NEW:

1. New e-sign experience

• We started upgrading our electronic signature user experience. It is a multi-phase process because of a large number of scenarios our platform can be used for. We started with ‘document approval’ –self-approving documents by end users in portals or signing documents sent for signing through third party applications. This release also upgraded the scenario that uses signature tags (such as [#signature.1#]). If you don’t remember what those tags mean, here is a quick reminder: if you send a number of documents for “quick approval” by multi-selecting them and clicking ‘send for quick approval’, we assemble a workflow and send it to the signer. If the signature tags are included in the documents, we will know where to put the signature fields. If the signature tags are missing, we will append the signature to the certificate which is added...

Keep reading

GLOBAL - Take the stress out of the month-end process by capturing all related tasks & putting them in one easily accessible tool. Easy Month End is a team workflow management tool that will make your month ends a breeze. Say goodbye to managing your team’s work allocation and recurring tasks on Excel and Outlook and enjoy a workflow tool made specifically for finance teams.

DevsDen Batchpayments

ZA - This Batch Payments service, offered by the DevsDen Software Company, provides a solution by creating formatted Xero Batch Payments that are specific to the bank you use, ensuring that the payments are correctly processed and deposited.

Easy Month End Basis

GLOBAL - Basis is a cloud-based platform that automates financial planning and reporting for modern teams. Connect Xero to unlock your data for use in forecasting, custom metrics, and dashboard reporting.

SuperOps

GLOBAL - Trusted automation software designed to help MSPs, IT pro's and consultants with resource management & billing operations for client projects and utilization rate management for billable staff.

NumerintBackup

GLOBAL - Sign in with Xero and NumerintBackup will export all the files and receipts attached to your supplier bills and bank spends. HMRC requires you to keep records for at least six years. Whether restructuring, shutting down or moving from a sole trader to a limited company, be prepared with a full attachment backup.

BizzCtrl

UK - Don't let overdue invoices hold you back! The BizzCtrl GetPaid app streamlines debt collection for SMEs. Connect GetPaid with Xero for insight into overdue invoices and make smarter, informed decisions.

Caretaskr

AU - A care platform for small to medium-sized NDIS and Aged Care providers and workers. You can manage your day-today operations from client management to booking staff appointments. With a combined mobile app, you have everything you need in one place.

XU Biweekly | No. 64 2 Saturday 23rd September 2023

TLATEST FLOWLENS BUG FIXES AND ENHANCEMENTS Service

HE

–

must be re-

before Service Job Card can be

Service Job Cards

stock

served

closed

Now you can get a commitment for automated payments right at customer or credit applications in ezyCollect

IF YOU'VE ENJOYED USING THE GOOGLE SHEETS AND EXCEL CONNECTOR, BUT HAVE FELT FRUSTRATED BY NOT BEING ABLE TO BUILD DIVISIONAL REPORTS, THEN WE HAVE GOOD NEWS FOR YOU. THE LATEST FEATURE TO JOIN OUR CONNECTOR FAMILY IS DIVISIONAL REPORTING, NOW AVAILABLE AS AN OPTION FOR THE PROFIT & LOSS, BALANCE SHEET, AND LEDGERS. THIS MEANS YOU CAN EASILY KEEP TRACK OF SEPARATE DIVISIONS WITHIN YOUR BUSINESS AND COMPARE THEM SIDE BY SIDE.

The Connector just keeps getting better

The Connector is a powerful add-on designed to enhance your Syft experience while seamlessly integrating with your favorite spreadsheet tools, Google Sheets and Excel. Now, you can dive into the world of divisional reporting and supercharge your financial analysis.

With this new addition, you can run Divisional Profit and Loss, Balance Sheets, or Ledgers in Excel or Google Sheets and gain insights into the financial performance of individual divisions within your entity. What's more, you can easily compare and contrast the financial data of different...

Read more

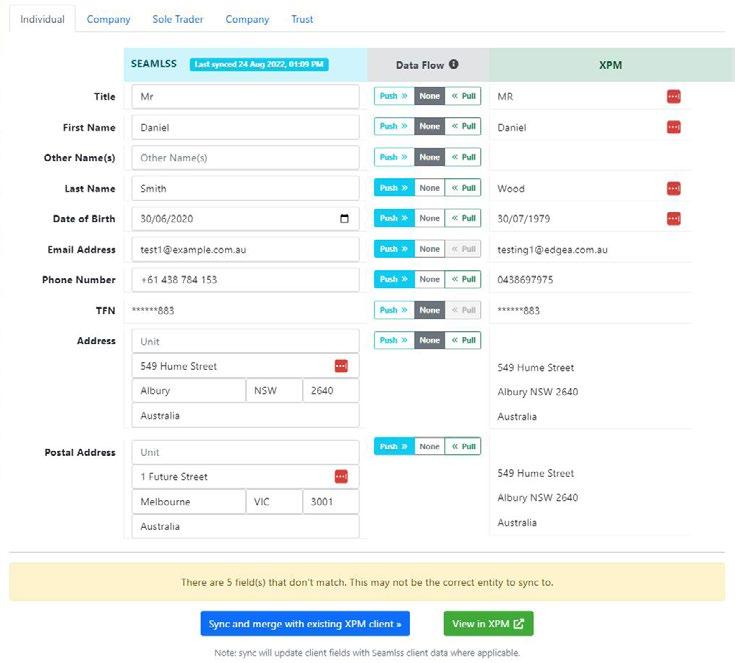

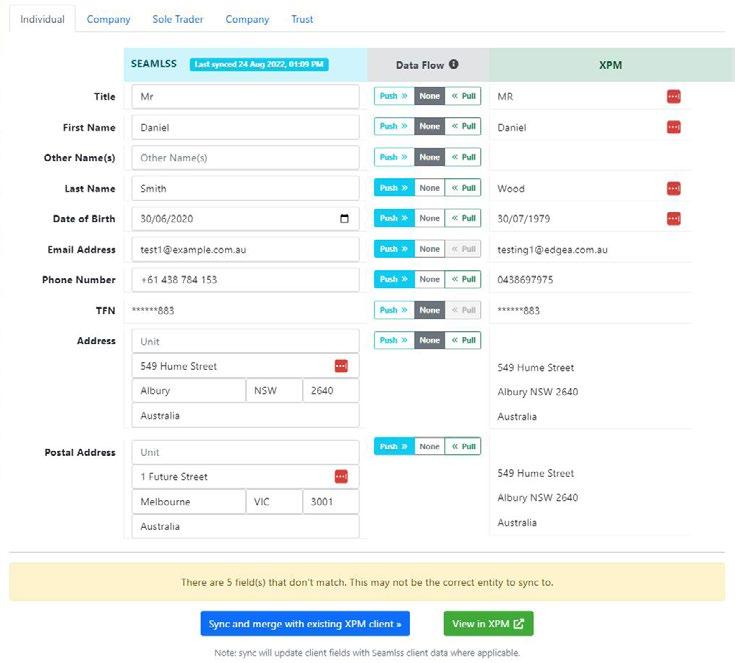

New Feature Alert at Seamlss!

APPROVE’ AND ‘BULK APPROVE’ UPDATES – RAVE FINANCIAL UPDATE

We are thrilled to announce a significant enhancement to our XPM sync process, designed to streamline your data management experience even further.

Now, you can effortlessly push and pull specific pieces of information available, such as Date of Birth, First Name, Middle Name, Last Name, Address, Email, or Phone Number, for both clients and entities. This update grants you greater control and precision in handling your data, ensuring seamless integration and consistency across platforms.

What's more, our system smartly notifies you of any discrepancies between data sets, with a convenient note at the bottom of the pop-up screen indicating the number of fields that don't match. This feature facilitates smoother data management, helping you to keep track and make necessary adjustments with ease.

And for those moments when you prefer not to alter certain data, our new 'none' option comes to the rescue, allowing you to retain the existing data without any changes.

At Seamlss, we are committed to enhancing your experience with every update. Explore these new functionalities today and...

Keep reading

PAIDNICE HELPS SMALL AND BIG BUSINESS GET PAID QUICKER, WITH AUTOMATED LATE FEES, INTEREST, PROMPT PAYMENT DISCOUNTS AND INVOICE REMINDERS.

In our latest update our team has:

• 1 - Launched our Bookkeeping & Accounting partner program.

• 2 - Exhibited to 1500 accountants and bookjeepers at #xerocon in Sydney.

• 3 - Added the ability to void fees, send SMS reminders, use your custom domain to send email reminders from, and a new way to preview upcoming fees or reminders.

Learn more about how we help small business get paid quicker over at our website.

Find out more

NEW XERO CONNECTED APPS!

ProcureDesk

AU, CA, NZ, UK & US - ProcureDesk provides a central place to create, approve and track purchase orders and supplier bills. With ProcureDesk, can set up an approval workflow for matching purchase orders and bills and then sync the data with Xero.

Setyl

GLOBAL - A complete IT management platform used by businesses globally. Track and manage IT assets and software license SaaS spend with Setyl.

THE UPDATED, SAAS-BASED SOFTWARE OFFERS LENDERS MAXIMUM FLEXIBILITY.

Adding to its industry-leading Wiz SaaS product suite, Wolters Kluwer Compliance Solutions now offers Fair Lending Wiz SaaS® to help lenders optimize their fair lending analytics and practices within a single SaaS platform. Fair Lending Wiz SaaS is a cloud-based solution that uses the flexibility of a modular system that facilitates an intuitive compliance workflow to reduce the complexity of managing fair lending risk.

“With the increased regulatory scrutiny seen in today’s banking environment, together with a growing set of data collection requirements, fair lending analytics are more important than ever for lenders to get right,” said Simon Moir, Vice President & Segment Leader of Banking Compliance Solutions. “Fair Lending Wiz SaaS allows lenders to easily access over 25 years of market-leading Wiz intelligence in a way that does not require constant installs and updates.”

Fair Lending Wiz SaaS allows for more users within financial institutions to access compliance insights, giving those institutions the ability to bring more people into...

Read more

ENHANCEMENTS

In this video, Sara Goepel, Karbon's Chief Product Officer, and her team of Product Managers guide you through the latest updates from our end-of-quarter product initiatives.

Get an in-depth look at the recent feature releases and upcoming improvements that are set to elevate your Karbon experience, including:

• New product features (including 2FA in the client portal, bulk work creation, and merging contacts)

• Existing integration updates

Read more

IDENFY, A GLOBAL REGTECH STARTUP OFFERING AI-BASED IDENTITY VERIFICATION AND FRAUD PREVENTION TOOLS, ANNOUNCED PARTNERING WITH KESTRL, A UK-BASED FINTECH COMPANY SPECIALIZING IN ISLAMIC FINANCE, EMPOWERING MUSLIMS TO BUILD WEALTH IN ACCORDANCE WITH THEIR FAITH PRINCIPLES. IDENFY’S ID VERIFICATION, AML SCREENING AND POA VERIFICATION TOOLS WILL HELP KESTRL STAY COMPLIANT WHILE ENSURING EFFICIENT AND SIMPLE CUSTOMER ONBOARDING.

UK - Automated collaborative simple cloud payroll software which will get you to fall in love with payroll! Make your payroll life a pleasure not a chore by choosing us. Discover how great customer service can change how you feel about your payroll software.

Wunderbuild

AU - Wunderbuild is construction management software that assists with critical processes such as estimating, project management, scheduling, budgeting, collaboration, communication and more!

FreshPay Sumday

AU - Accounting software that makes carbon accounting as transparent and robust as financial accounting. Built for accountants and made for businesses of any size, anywhere - Sumday is now.

iDenfy partners with Kestrl to increase conversions through automated KYC and PoA checks

Prior to the app's launch, Kestrl officials assert that they conducted a nationwide survey with the goal of assessing the demand for an Islamic banking solution and understanding whether individuals prioritized aligning their banking practices with their religious beliefs. According to Kestrl, the key issue identified was a lack of awareness among people regarding Islamic banking options. However, the survey showed an actual need from the people who are practicing Muslims.

Fast forward to today, "The Muslim Money App" by Kestrl is a powerful tool that assists its users in achieving

their financial goals. It leverages machine learning to analyze their banking data and create monthly budgets, automate savings, and provide personalized investment recommendations. Available both as a retail app and as a software solution for banks seeking digital transformation, Kestrl facilitates investments in publicly traded companies while ensuring compliance with Shariah standards, informing users of their alignment with Islamic financial principles.

Traditional banks typically allocate 70% of their funds towards lending, which is...

Keep reading

New Apps & Updates XU Biweekly | No. 64 4 Saturday 23rd September 2023

EXPLORE KARBON’S LATEST

WOLTERS KLUWER ENHANCES ITS FAIR LENDING WIZ® SOLUTION FOR CLOUD COMPATIBILITY

In his new role, Penkethman will lead the company’s global product strategy, oversee product development and management and identify new growth opportunities. He will play a crucial role in expanding Simpro’s product portfolio to meet their customers' ever changing business needs.

Penkethman brings over 30 years of international experience in software and hardware technology development to this

good business

MOULA, A LEADING AUSTRALIAN SME LENDER, PROUDLY ANNOUNCES THE CELEBRATION OF ITS 10TH ANNIVERSARY.

Mangopay and Kriya forge strategic partnership to elevate B2B payment experience

position. He has held senior leadership positions at numerous SaaS companies including Spireon where he served a 5-year tenure as their CPO, leading their engineering and product management for cutting-edge fleet SaaS solutions until its acquisition by Solera.

Most recently, he served as the Chief Product Officer at Talend, where he played a pivotal role in shaping the product strategy for robust data integration solutions and services. Under his leadership, Talend’s advancements in the data integration space culminated in its notable acquisition by Qlik, a testament to Penkethman’s ability to drive growth and market presence through innovation.

Read more

Liberis Partners with IPOSG to Offer Revenue Finance to their Merchants in the Retail and Hospitality Sectors

By Kieran Darmody

LIBERIS PARTNERS WITH IPOSG TO PROVIDE INNOVATIVE REVENUE FINANCE SOLUTIONS TO RETAIL AND HOSPITALITY MERCHANTS, REVOLUTIONISING FINANCIAL SUPPORT WITHIN THE IPOSG ECOSYSTEM.

Liberis, the leading embedded finance platform, is thrilled to announce its strategic partnership with IPOSG, a UK-based software development company. Through this collaboration, Liberis will offer its unique Revenue Finance solution, designed to promote growth and prosperity for merchants within the IPOSG ecosystem.

“At Liberis, our commitment is to foster business growth by reimagining fi-

nancial possibilities,” explained Rob Straathof, CEO at Liberis. “This partnership with IPOSG underscores our dedication to providing merchants with a direct path to funding through our embedded finance platform. By offering our Revenue Finance solution, we are enabling businesses to thrive.”

Liberis’ expertise in embedded finance, combined with IPOSG’s reputation as a trusted EPOS applications provider, promises to reshape the landscape of financial support for businesses. This strategic collaboration will allow merchants within the IPOSG ecosystem to access essential funding directly through Liberis’ embedded finance platform.

“We are excited to align with Liberis to bring this in-

novative funding solutions to our customers,” commented Ratna Shiva, Director at IPOSG. “Through this partnership, businesses can now receive the financial support they require to grow and excel. This collaboration exemplifies our commitment to empowering businesses with tailored solutions.”

The partnership will provide a streamlined process for merchants to access funds while focusing on their core operations. Liberis’ Revenue Finance solution will provide the necessary capital to facilitate expansion, innovation, and strategic development within the retail and hospitality sectors....

Find out more

Since its establishment in 2013, Moula has supported small businesses across Australia, empowering them to thrive and grow. As the company commemorates this significant milestone, CEO Gavin Slater reflects on a decade of success, innovation, and dedication to backing good business.

Reflecting on the company’s beginnings, Slater shares, “Our foundation was built upon the aspiration to support SMEs that were overlooked by traditional banks. We set out to revolutionise the lending landscape by harnessing accounting data APIs to assist with assessing SMEs rather than relying solely on physical assets as collateral. This meant we could approve a loan within 24 hours when the banks took 6+ weeks.”

“We recognised that SMEs are short on time and need the certainty of outcome quickly,” Slater explains. “Through increased automation, we set out on a path to create a better customer experience for time-poor business owners. We saw an opportunity to significantly improve the processing...

Keep reading

THIS PARTNERSHIP PROVIDES B2B MARKETPLACES WITH POWERFUL NEW PAYMENTS CAPABILITIES.

MANGOPAY'S ESTABLISHED PAYMENTS INFRASTRUCTURE IS ENHANCED WITH KRIYA'S FLEXIBLE TRADE CREDIT AND PAYLATER SOLUTIONS.

Mangopay, a platform-specific payment infrastructure provider formally announces a strategic partnership with Kriya, a fintech platform offering seamless access to B2B payments and credit, with instant decision-making. This cooperation will allow all Mangopay B2B marketplaces to easily build a dynamic payment experience that removes friction and keeps business

flowing brilliantly. As the B2B marketplace industry continues to grow, the payment experience remains a key differentiator. In collaboration with Kriya, Mangopay reinforces its commitment to leading innovations in the fintech sector. Kriya's commitment to facilitating seamless access to B2B payment and credit options resonates with Mangopay's drive of providing a streamlined, state-of-theart payment infrastructure. Business customers will benefit from a checkout experience with their preferred payment methods and flexible terms, all while platforms enjoy upfront payment with zero risk. Enhancing Mangopay's payout capabilities with a key credit checkout...

Read more

FIRMCHECK, AN INNOVATOR IN ANTI-MONEY LAUNDERING (AML) SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF A NEW, FREE AML COURSE EXPLICITLY TAILORED FOR ACCOUNTANTS IN THE UK. THIS EDUCATIONAL INITIATIVE IS EXPECTED TO HELP THOUSANDS OF ACCOUNTANTS UPSKILL AND MASTER THE ESSENTIAL KNOWLEDGE OF HOW AML SHOULD BE CARRIED OUT IN THE UK'S REGULATORY ENVIRONMENT.

AML for Accountants: An Industry-First

Titled "AML for Accountants," this course offers an introduction to the basic concepts of AML and the regulatory compliance regime in the UK. It stands as one of the first courses of its time created by a software vendor in conjunction with AML experts, focusing exclusively on the accounting industry.

The course aims to provide accountants with the tools and understanding they need to navigate the complex landscape of AML compliance. By offering this course free of charge, Firmcheck reaffirms its commitment to supporting the accounting community and fostering inclusivity and best practices...

Find out more

News & Updates XU Biweekly | No. 64 6 Saturday 23rd September 2023

Moula celebrates a decade of backing

SIMPRO, THE LEADING TOTAL BUSINESS MANAGEMENT SOFTWARE FOR COMMERCIAL AND RESIDENTIAL TRADE SERVICE BUSINESSES, TODAY ANNOUNCED JASON PENKETHMAN WILL JOIN THE EXECUTIVE TEAM AS ITS NEW CHIEF PRODUCT OFFICER.

UPCOMING UK WEBINARS

By Amaya Woods

By Amaya Woods

AM DELIGHTED TO SHARE THAT CHASER HAS BEEN SHORTLISTED FOR TWO AWARDS AT THE CREDIT & COLLECTIONS TECHNOLOGY AWARDS 2023:

• Technology Innovator – Person of the Year (Chaser's CEO, Sonia Dorais)

• Machine Learning in Credit & Collections Solution

The Credit & Collections Technology Awards, launched in 2017, recognize and celebrate those who are pioneering technological advancements within the credit management industry. The nomination for Technology Innovator – Person of the Year recognizes the innovative solutions led by Chaser's CEO, Sonia Dorias in helping SMEs to reduce late payments and improve cash flow. Being recognized as a finalist for Machine Learning in Credit & Collections Solution recognizes the impacts of Payer ratings, Chaser's first artificial intelligence...

Read more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT AND AI POWERED PAPER-TO-DATA SOLUTIONS, IS PROUD TO ANNOUNCE IT HAS BEEN RECOGNISED AS AN ABA100® WINNER FOR BUSINESS INNOVATION IN THE AUSTRALIAN BUSINESS AWARDS 2023 FOR ITS AI-POWERED PAPER-TO-DATA SOLUTION, BGL SMARTDOCS 360.

The Australian Business Awards are an annual comprehensive awards program that recognises organisations demonstrating the core values of business innovation, product innovation, technological achievement and employee engagement via established...

Read more

UPCOMING EVENTS

UPCOMING APAC WEBINARS

XU Biweekly | No. 64 8 Saturday 23rd September 2023

Events & Webinars

Accountant Tools Start a FREE 14-day tr al today every time. Get client docs on time, Secure simp e easy for your cl ents contentsna e com Time for Business Find out more at Dext.com Automate your proposals, billing, payments and workflows. All-in-one place. Get paid faster. Run your business smarter. ignitionapp.com TRY T NOW Largest Cybersecu ty P at o m o the Account ng ndust y Award-winning cloud software and knowledge solutions for your accounting practice. CCH iFirm CCH iKnow CCH Learning → Bills & Expenses The smarter way to handle bookkeeping. Start your free trial today! Cloud Integrators CRM Automate, integrate, and streamline sales & operations Aussie developed & supported Visit www.tallemucrm.com Documents eCommerce tidyinternational com Powerful Software Delightfully Simple Integrates seamlessly with TidyStock and TidyEnterprise to provide a unified solution to your operations. POWERFUL ECOMMERCE Events ASIA'S TOP 100 ACCOUNTING & FINANCE LEADERS FREE down oad ava lable now! Invoicing & Jobs To excel in last-mile delivery first connect the dots Right delivery vworkapp.com Right place Right time Outsourcing Payments Payroll & HR Advance your accounting game with Clarity Street’s best practice learning platform! Join us today: claritystreet.com.au/campus New Zealand Australia ipayroll.co.nz cloudpayroll.com.au New Zealand Australia ipayroll.co.nz cloudpayroll.com.au Practice Management Professional Services W W W B O O K K E E P E R S O R G U K Vocational courses, high expectations and a supportive community make ICB Bookkeepers the best in the world. Find out more about training, developing and hiring bookkeepers. ICB BOOKKEEPERS ARE THE BEST OF THE BEST! Click here to take the assessment! CyberSCORE is a high-level Cyber Security self-assessment that is non-technical. It is non-technical. It is designed to provide accounting firms with a snapshot of their overall Cyber health. Contact us 1300 765 014 www.t4group.com.au sales@t4group.com.au Reporting castawayforecasting.com/xu UNLOCK YOUR POSSIBILITIES ETANI VIRTUAL ASSISTANT EVA FREE 2-Week Trial Real Time Cash Flow Forecasting and Reports Find Out More Year End Classifieds XU Biweekly | No. 64 Saturday 23rd September 2023 9

By Vipul Sheth ACA CTA, Founder & Managing Director, Advancetrack Outsourcing

THE ADVANCETRACK TEAM IN INDIA STEPPED UP DURING COVID, WHEN IT REALLY MATTERED. AND MD VIPUL SHETH KNEW THAT HIS LONGSTANDING TEAM NEEDED A SPECIAL REWARD. A REWARD THAT WAS CONCEIVED BEFORE COVID, BUT MADE ALL THE MORE IMPORTANT BECAUSE OF IT. THIS IS THE STORY OF THEIR LIFE-CHANGING TRIP ABROAD.

They say that professional services firms are nothing without their people. It makes sense that, for us at AdvanceTrack, the same saying rings true.

Quite rightly, we spend a lot of time talking about our operational excellence, and focus on processes, security and scalability. But these are underpinned by the technical expertise and work ethic of our people – without whom we wouldn’t be here.

With that in mind, MD Vipul Sheth discussed with managers in India about a plan to reward and recognise some of our longstanding team members. A fiveday trip to Dubai was then organised for 2021.

Covid got in the way of that plan, while Dubai’s global expo during 2022 meant that we had to hold off the holiday until 2023.

“The team never bugged me about whether the trip would actually happen, but there was no way it was going be off the cards,” explains Vipul. “We just had to be patient.”

First-time travel

And so, in April, some 37 of the AdvanceTrack team went on holiday together. And for 32 of these people, it was their first time abroad.

“When it was announced we were all very excited – a great treat,” says AdvanceTrack’s Mohit Soni. “It wasn’t in our hands so we couldn’t assume anything about it. But it was fun, and no – I didn’t think I would have to work while we were away!”

The itinerary was a full one. There was a desert safari, cruises and city tours, along with free time for them to go shopping.

“They didn’t want me to have them in a conference room,” adds Vipul. “They chose to go to the waterpark instead!”

Team support

Aanal Shah has a young daughter, and was therefore reticent to travel. “But my colleagues said: ‘You must come. Don’t stop yourself.’ Everyone supported me on the holiday with her, and she enjoyed it too.”

“I would say that this is how it is working at AdvanceTrack. All the small things are taken care of for us – we don’t have to ask,” adds Mohit Soni.

Rajni Patel is one of AdvanceTrack’s longest-serving team members. The manager says there were “just a few of us here”. “It’s amazing to see how we’ve grown.”

“I’ve been here eight years and it feels like family,” Aanal Shah adds.

Vipul explains that he wanted to do something that “made us stand out as an organisation”.

“Part of that comes down to us giving opportunities that individually they might otherwise not have done,” says Vipul.

“The fact that we were able to offer that life-changing experience is really what it’s all about. It was an important thing to do.”

Ultimately, without good people, AdvanceTrack doesn’t have a good business – and that is the same for all businesses. “Sometimes that gets forgotten in the world we live in,” explains Vipul. “Profits are one thing and, of course, we operate ‘as a business’, but the long-term wellbeing of our people is a great investment.”

So, what next? “Hopefully something similar for the next group,” replies Vipul. “And then we’ll speak to the long-serving team about what they want!”

AI, outsourcing, automation, the future of accountants… and everything else in between

This article isn’t about technology… no, really. OK, I will talk about technology, but more as a scene-setter than anything else.

Instead, this blog is about you and me. Humans. Or to be more precise, humans that undertake accounting and tax work (and the subset that provide broader business advice). But the tech first.

The world’s largest tech-

nology players have invested in proprietary AI – or are looking to implement versions into their offering. Whereas a lot of the chatter around automation has been focused on easing the burden of rudimentary tasks that accountants undertake, discussions around AI have been around replacing accountants. ‘If the data crunching can be automated, and then next steps of the conversation handled by AI, then why accountants?’

So, is that it for the accountancy profession? Certainly not. Is it the end for it in its current iteration? Perhaps yes.

AI works by aggregating data and making a ‘best fit’ case for a request from us, humans, to provide us with an ‘answer’. This data is quantitative or qualitative. We have seen AI tools produce some very clever ‘scripts’ upon request though, in truth, most of these don’t quite fit the bill – and require us humans to further interpret and edit.

Perhaps the ‘clear-cut’ nature of numbers will be a different story then? Well, we’ve had computational equipment for decades, and the profession is still alive

and well.

Technicians and advisers

It could be argued that the profession is evolving –that as tax and accounting becomes more complex, and businesses require more hand-holding and advice, that we will see a greater distinction between ‘technicians’ and advisers’. This is true, but there is a tension –that relationships have often been borne from initial compliance work. In other words, for the technician/adviser distinction to be made, there will have to be changes in practices’ structure and approach.

The other thing to consider is: micro and small businesses are messy. They’re driven by people with skills and ambition, for whom the numbers, marketing and ‘rules’ get in the way of what they really want to do. They also operate in subtly different ways to each. That’s a lot of lifting and transactional automation for AI to comprehend.

Finally, and back to us as humans doing business. It can be very lonely. And...

Keep reading

Features XU Biweekly | No. 64 10 Saturday 23rd September 2023

Unleashing the Potential of Your Practice: Taking the Leap with Clarity Campus

By Amy Holdsworth, CEO & Founder, Clarity Street

ADVANCE YOUR ACCOUNTING GAME WITH CLARITY STREETS BEST PRACTICE LEARNING PLATFORM

Join the Learning Evolution: Learn at your own pace, gain CPD hours and experience Hassle-Free Education on Clarity Campus

Welcome to a world of transformation - where a team of former Practice Managers meets seasoned Accountants who have experienced both sides of the cloud accounting revolution. Fused with their expertise, their unyielding passion for efficiency strives to streamline and enhance operations for practices with enormous potential – your potential!

Clarity Street: A Decade of Accounting Expertise

The experts at Clarity Street have navigated the unforgiving labyrinth of the accounting landscape for over ten years, leaving no stone unturned. Our keen understanding of the industry’s unique features and

intricacies has shaped our philosophy that each practice has its distinct identity. Therefore, our solutions are customised to synchronise with your workflow rather than being confined within predefined boxes.

We comprehensively view your firm, carefully crafting the ideal blueprint solutions based on your unique needs and challenges. Our dynamic approach has saved our clients thousands of dollars and countless hours by remodelling their inner workings, reorienting teams, and smoothly integrating software solutions.

The Obstacle: Building a Comprehensive Learning and Community Platform

The most common obstacle faced by the numerous firms we’ve worked with is the absence of a software and process-centric learning and community platform.

It’s not just having a series of apps that will make your practice thrive - processes and procedures across those

Parlez-vous français?

apps are equally important for productivity and efficiency. Enter Clarity Campus: our solution covers all your bases, from individual applications to overarching processes, ensuring seamless integration.

Curated as a platform to facilitate easy queries from industry experts and peers, Clarity Campus was conceived from extensive industry conversations and stems from a fundamental understanding of the corresponding needs and frustrations of different firms.

Meet Clarity Campus: Your All-in-One Resource for Accounting Practice Excellence

Consider Clarity Campus a reservoir of resources at your disposal; it is much more than a collection of information - it’s a cohesive platform fostering support, community, and development. Developed to promote growth and inspire forward-thinking within the...

Keep reading

WHY ACCOUNTANTS STRUGGLE TO TURNAROUND INDIVIDUAL TAX RETURNS (ITRS) ON TIME

By James Rose, Co-Founder & CEO, Content Snare

THERE’S NO REASON WHY INDIVIDUAL RETURNS SHOULDN’T BE PROFITABLE FOR YOUR FIRM. WITH THE RIGHT TOOLS, YOU CAN REDUCE TURNAROUND TIME AND ELIMINATE BACK-ANDFORTH WITH CLIENTS.

The end of the financial year (EOFY) can be a tough time for Aussie accounting firms. You have company accounts to file for business clients with 30 June yearends. And you also have individual tax returns (ITRs) for your personal clients to file with the Australian Tax Office (ATO). That’s a lot of compliance work and form-filling to have on your plate at once!

There’s no reason for this heavy ITR workload to end up drowning your team,

though. In fact, by being smart with your use of tech, you can streamline the whole EOFY process.

So, how do you make your ITRs as easy as ABC? We’ll ask:

• What stops you getting your ITRs done and dusted?

• How can you ditch the main ITR challenges?

• Why are ITRs a breeze when you use Content Snare?

Tax season is busy. There’s no getting around that fact. Those months following 30 June, are when the compliance workload ramps up (and your stress levels probably increase a fair bit too!). Getting your individual returns prepared can become a major part of this heavy workload.

Why are ITRs such a big task to take on? Here are five key challenges that will generally make completing these returns an uphill struggle:

• Collecting the clients’ documents – not all individuals will have made the leap to digital. We’re not quite at the ‘pile of tax receipts in a shoe box’ stage of yesteryear, but it still takes plenty of time to collect the receipts, documents and statements you need, in the right format.

• Meeting all the tax compliance requirements – keeping up with tax regulations and the ATO’s changing guidance adds to the workload. It’s also important to make sure you’re claiming every possible...

Find out more

Features XU Biweekly | No. 64 Saturday 23rd September 2023 11

Individual returns can often be frustrating, unprofitable and time-consuming jobs–but no longer.

Paysend and Visa Strengthen Their Strategic Collaboration to Help Transform Global Money Movement

PAYSEND, THE UK FIN-TECH INNOVATOR, AND VISA, THE WORLD’S LEADER IN DIGITAL PAYMENTS, TODAY ANNOUNCED A STRATEGIC COLLABORATION ENABLING PAYSEND’S CUSTOMERS GLOBALLY TO SEND MONEY IN REAL-TIME TO ELIGIBLE VISA CARDS ACROSS 170 COUNTRIES AND TERRITORIES.

The five-year partnership aims to revolutionize international money transfers through Visa Direct, Visa’s real-time money movement network and builds on the companies’ initial collaboration announced in Feb. 2022 allowing Paysend’s US and UK customers to send money internationally and domestically to eligible Visa cards. The announcement also builds on the existing relationship between Paysend and CurrencyCloud-- now

PayPal Introduces On and Off Ramps for Web3 Payments

part of Visa Cross-Border Solutions-- aimed at delivering a tailor-made approach leveraging the latest dynamic, competitive rates in market on Visa Direct’s money movement rails.

Paysend aims to bridge the gap for countries underserved by legacy banking infrastructures by leveraging the power of card networks instead of traditional money transfer channels, creating remarkable advantages in terms of cost and service speed.

“At Visa, we understand the importance of building an efficient and secure money movement network to support our partners,” said Ruben Salazar, Global Head of Visa Direct. “Through our expanded collaboration with Paysend, together we’re enhancing domestic and cross-border money...

Find out more

TODAY WE ARE TAKING ANOTHER STEP IN INCREASING ACCESS TO DIGITAL CURRENCIES BY SIMPLIFYING HOW WALLETS, DAPPS, AND NFT MARKETPLACES CAN ENABLE THEIR CUSTOMERS TO BUY AND SELL SUPPORTED CRYPTO IN THE U.S. (SUBJECT TO APPLICABLE STATE LAW) THROUGH AN INTEGRATION WITH PAYPAL ON AND OFF RAMPS.

Once integrated, web3 merchants can help grow

their user base by connecting to PayPal’s fast and seamless payments experience trusted by millions, while leveraging PayPal’s robust security controls and tools for fraud management, chargebacks and disputes.

PayPal previously launched On Ramps to enable U.S. consumers to directly buy crypto with PayPal through integrations with Metamask and Ledger – with more coming soon. By...

Find out more

Swift and Wise join forces to expand cross-border payment options globally

WISE PLATFORM IS PROUD TO ANNOUNCE AN EXCITING NEW COLLABORATION WITH SWIFT, WHICH WILL HELP INCREASE CROSS-BORDER PAYMENT OPTIONS FOR FINANCIAL INSTITUTIONS AND THEIR CUSTOMERS. THIS SOLUTION WILL OFFER MORE OPTIONS FOR BANKS LOOKING TO ENHANCE THEIR INTERNATIONAL PAYMENTS SERVICES, AND WILL PROVIDE IMPROVED CONVENIENCE FOR CUSTOMERS LOOKING TO SEND MONEY ACROSS BORDERS.

have built a global payments network that makes moving and managing money around the world faster and easier for 16 million personal and business customers.

But we have always known that what we’re building: money without borders for everyone, is bigger than just us. And we don’t necessarily believe that the best place for customers to send and manage money internationally is on the Wise app - it’s with their bank or financial institution.

SAUDI AWWAL BANK HAS ENTERED INTO AN AGREEMENT WITH WISE TO PROVIDE AWWAL CUSTOMERS WITH FAST, SECURE AND COST-EFFECTIVE SOLUTIONS FOR SENDING AND RECEIVING MONEY INTERNATIONALLY.

This agreement will contribute to Awwal achieving the goals of the Kingdom’s Vision 2030 - a financial sector development program designed to stimulate investment. The partnership is also central to First Saudi Bank’s strategy of focusing on providing the latest innovative banking solutions.

Bandar Al-Ghashean, CEO of Wealth Management and Personal Banking at Awwal, said : “This partnership is part of Awwal’s efforts to enable customers to carry out smooth and effective inter-

national transfers, according to the highest standards of quality, speed, and security. We also look forward to continuing our contributions to the development of the financial sector in the Kingdom. And keeping pace with the digital transformation, by providing the best modern digital banking solutions, as we are interested in providing distinguished digital services, according to the best approved technologies that support the rapid development in the financial sector.”

Steve Naudé, Head of Wise Platform, said : “We are pleased to announce this partnership with SAB, which is one of the leading and distinguished banks in the region, through which we aim to make international payments fast and easy and...

Keep reading

checkout suite

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ADDED NEW FEATURES TO ITS OPTIMIZED CHECKOUT SUITE TO HELP USERS INCREASE THEIR REVENUE BY MAKING IT EASIER FOR THEIR CUSTOMERS TO COMPLETE A PURCHASE.

The optimized checkout suite consolidates years of Stripe research into a set of products, tools, and fea-

tures that businesses can integrate into their customer journey with minimal engineering effort. Today’s upgrades—which constitute the single largest bundle of new payments optimizations from Stripe to date—offer vastly more payment method choice for consumers, an easy way for businesses to support the top one-click checkouts, and the industry’s first no-code A/B...

Find out more

From today, financial institutions seeking to innovate their offerings will be able to route Swift payment messages directly to Wise Platform- Wise’s infrastructure solution for banks and major enterprises - through our latest Correspondent Services solution. This will enable their customers to benefit from the speed and convenience of Wise, and the breadth of Swift without needing to implement any major changes to their systems.

Before I go on, let me pause briefly and reflect on how we got here.

Wise was founded over 12 years ago as a money transfer business, helping customers around the world send money internationally quicker and at a lower cost than their traditional high street banks. To make this possible, we

Switching providers creates friction for customers, and many still don’t know they’re getting a bad deal on their international payments. So, about 6 years ago, we built Wise Platform to bring all the benefits of Wise to their bank, where they already are.

In a few short years we have grown extremely fast, and today banks and major enterprises all over the world leverage Wise Platform to power their own cross-border payment offerings, including Monzo, Google Pay, Bank Mandiri and Interactive Brokers.

But there are still challenges to overcome.

Most of our fintech and enterprise partners predominantly access Wise’s network via our easy-touse API solutions, which are fast and easy to integrate.

Read more

FinTech News XU Biweekly | No. 64 14 Saturday 23rd September 2023

Stripe launches the biggest set of upgrades yet for its optimized

SAUDI AWWAL BANK SIGNS PARTNERSHIP AGREEMENT WITH WISE

By Amaya Woods

By Amaya Woods