energy focus

FROM THE ENERGY INDUSTRIES COUNCIL

RENEWABLES

Solar surges in the Middle East and North Africa

From COP26 to Ukraine: Rethinking energy, climate and security

ENERGY TRANSITION

Australia: A golden opportunity for UK exporters

OIL AND GAS

Top five emerging African markets to watch

ISSUE 47 SUMMER 2022

VIEW FROM THE TOP Louise Kingham CBE, Senior VP for Europe & UK Head of Country, bp

Get in touch. T: +44 (0)161 430 6618 E: sales@hughes-safety.com www.hughes-safety.com With over 50 years of trusted expertise, you can rest assured you’re in safe hands. In locations where a reliable water supply cannot be guaranteed, or inadequate water pressure and flow rate are a problem, self-contained safety showers and eye washes are essential to protect the safety of your workforce. Hughes emergency safety showers and eye wash equipment provide you with a safer working environment, greater protection against serious injury and peace of mind that you’re compliant with crucial safety standards. View the full product range at www.hughes-safety.com No constant water supply? No problem! 114L mobile safety shower & eye wash with removable heated jacket (Model STD-H-40K/45G) 1500L tank fed safety shower & eye wash (Model EXP-J-14K/1500) 15L portable eye, face & body wash (Model STD-38G) 38L gravity fed eye wash (Model OptiWash ® ) 50 Years of Manufacturing Excellence Protect your investment with a Hughes Essential Service Contract. Contact us today for a site speci c quote!

FROM THE EIC

5 Foreword

From the Chief Executive

6 View from the top Louise Kingham CBE, Senior Vice President, Europe & UK Head of Country, bp

10 News and events

Updates from the EIC

12 The big question

What do you know now that you wish you’d known when you first started exporting?

14 Special report

Tom Wadlow on the changing dynamics of the energy sector

ENERGY TRANSITION

18 Tap into Australia’s big clean energy prospects

Joe Doleschal Ridnell, Director, JDR Advisers

21 Get ready to capture the CCS opportunity

Dr Madana Leela, Regional Analyst, EIC

14

A new energy reality

RENEWABLES

24 EIC Regional Spotlight

Middle East and North Africa: A brighter future for solar

26 Floating offshore wind: the next big thing in Asia Pacific?

Kevin Liu, Head of Energy and Low Carbon Transition – Asia Pacific, Scottish Development International

18

06 Louise Kingham

29 UK can lead the way on green aviation fuels

Matt Gorman, Chair, Sustainable Aviation

30

Top 5 emerging markets in Africa

The Energy Industries Council 89 Albert Embankment, London SE1 7TP Tel +44 (0)20 7091 8600 Email info@the-eic.com

Chief executive: Stuart Broadley

Should you wish to send your views, please email: info@redactive.co.uk

26 Floating offshore wind in Asia Pacific

Editors Sairah Fawcitt +44(0)20 7880 6200 sairah.fawcitt@redactive.co.uk

Lucas Machado +55 21 3265 7402 lucas.machado@the-eic.com

Account director Tiffany van der Sande

Production director Jane Easterman

Senior designer Gene Cornelius

Picture editor Akin Falope

Content sub-editor Kate Bennett

OIL AND GAS

30 Unlock new oil and gas opportunities in Africa

George Blake, Energy Analyst, EIC

POWER

34 The energy transition needs virtual power plants

Dan Power, Research Analyst – Virtual Power Plants, Guidehouse Insights

NUCLEAR

36 The future is safer, cleaner, cheaper nuclear energy

Simon Newton, Chief Commercial Officer, Moltex Energy

Sales and advertising Richard Hanney +44(0)20 7324 2763 richard.hanney@redactive.co.uk

Energy Focus is online at energyfocus.the-eic.com

ISSN 0957 4883

© 2022 The Energy Industries Council

Energy Focus is the official magazine of the Energy Industries Council (EIC). Views expressed by contributors or advertisers are not necessarily those of the EIC or the editorial team. The EIC will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication. Recycle your magazine’s plastic wrap – check your local LDPE facilities to find out how.

Publisher Redactive Media Group, Fora, 9 Dallington Street, London EC1V 0LN www.redactive.co.uk

Contents ISSUE 47 SUMMER 2022

CBE www.the-eic.com | energy focus 3

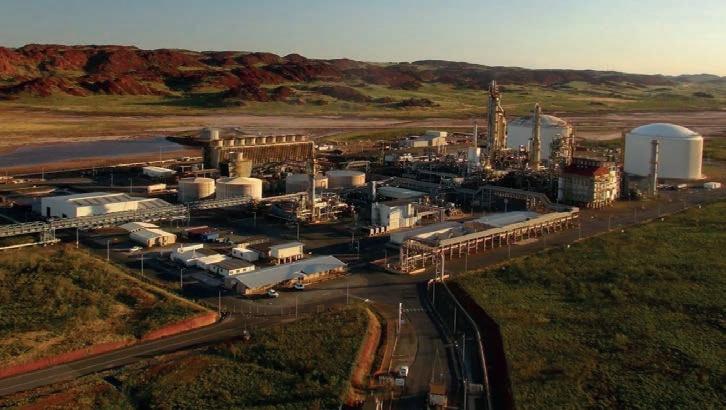

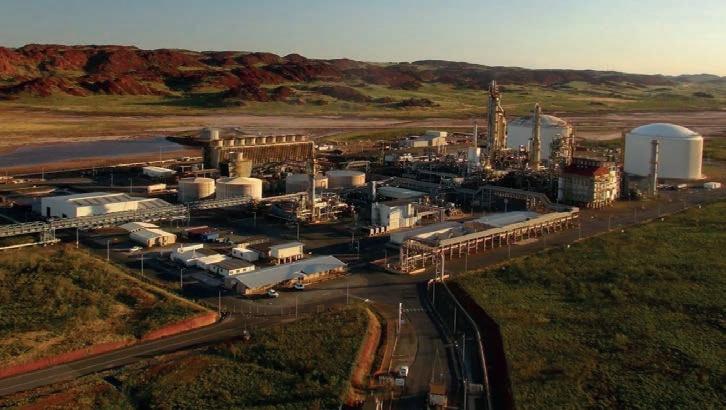

Australia: Cleantech powerhouse

An excellent operational performance does not need many words of explanation, but one simple answer: Bertling. Track the Ecological Footprint for all transports you handle with us to know your emissions, proactively reduce and offset them to strive towards carbon neutrality.

Visit www.bertling.com/sustainability

to find out more.

Stuart Broadley CEO

From the Chief Executive:

In my last foreword, I voiced great concern over the invasion of Ukraine by Russia, and its impacts on the energy industry. Now that the conflict has turned into a protracted war with far-reaching consequences, it is only natural to explore the theme further.

Fearing Russian action in response to sanctions imposed by the EU and the UK, European countries that rely on Russian oil and gas are looking for alternative sources of energy. This has made energy security the over-riding priority, and kick-started high activity around new oil and gas projects – a surprising shift for a world that, only three months earlier, was convinced that it was on the verge of doing away with fossil fuels.

The supply chain, previously under pressure to abandon its oil and gas business due to pressure from staff, government, activists and shareholders, has been given a social licence to discuss and invest in the sector again. Oil and gas seems to be the fastest and most economically viable solution for regaining a position of energy security.

Of course, energy transition has not been abandoned: it continues to be addressed as something that goes hand in hand with energy security. Ministers and CEOs are issuing rallying cries for a balanced energy strategy, not just a transitioning one. Country commitments declared at COP26 (to achieve net zero by 2045 and beyond) remain in place. However, it has become clear that the way to achieve this is not by bringing

conventional energy industries to a standstill overnight.

Such an abrupt change has placed the energy trilemma – the precarious balancing act of energy transition, security and affordability – at a crossroads once again. After the 2014–15 oil crisis, energy affordability dominated, with sustained low oil prices and ruthless cost-cutting across the world’s heavy industries leading to low inflation, lower costs of doing business and lower fuel costs.

This started to change when Brexit, the COVID-19 pandemic and energy transition piled the pressure on urgent government action, in no way seeking ‘the cheapest way’ to address each. This issue’s View from the top interview with Louise Kingham, Senior Vice President for Europe and UK Head of Country at bp, refers to this when she says: “There isn’t a cheap way to get to net zero – but many have said it will be much more expensive not to do so.” With aims to have developed 50GW of net renewable generating capacity by 2030, bp is keenly aware of the efforts necessary for a successful energy transition.

The Ukraine war is also hugely costly for governments and consumers alike, worsening the already high inflation and commodity prices that we were experiencing as we emerged from the pandemic and markets started to rebound. Given this scenario, it’s not unthinkable that the third leg of the trilemma –affordability – is close to breaking point, while the transition and security legs are still arguably hobbled.

The future seems very uncertain. Most business leaders see good-to-great growth rates and are investing again, but margins are tight, skilled people are hard to find and Europe is facing recession. The supply chain, given the chance, will prosper and find a way to deliver step-change growth in these times of plentiful possibilities, albeit mixed with uncertainty.

Inspiration for overcoming this time of uncertainty can be found in The Big Question, in which three EIC members – Fairuz Yahaya from EXS Synergy, Philip Ross from RTR and Dave Anderson from Score Group – are asked about their advice for companies that are willing to start exporting in such a vast and tough market.

The next few months and years are going to be a rollercoaster ride, but we must continue to amplify the voice of the energy supply chain, shaping investments and policies, so that it is best able to take full advantage of the huge scale and range of domestic and global project opportunities across all energy sectors, in an increasingly competitive world.

Stuart Broadley Chief Executive Officer, Energy Industries Council stuart.broadley @the-eic.com

www.the-eic.com | energy focus 5

Foreword

In this edition Energy Focus discusses the investment dilemma faced by the energy industry. Faced with challenges of unprecedented magnitude, from Covid-19 to inflation and a post-COP26 policy shift triggered by energy security concerns, companies are wondering where to go – and how to get there.

View from the top

Louise Kingham

CBE FEI Senior Vice President, Europe & UK Head of Country, bp

CBE FEI Senior Vice President, Europe & UK Head of Country, bp

We want to help the supply chain decarbonise and create new opportunities, both here in the UK and globally

From the EIC

CBE FEI

Louise Kingham

6 energy focus | www.the-eic.com

Louise Kingham talks to Energy Focus about

the UK boost energy security and reach net zero

You recently said you were a bit of a ‘shock to the system’ to bp. Please can you expand on this?

Historically, bp hasn’t brought significant numbers of experienced leaders into the organisation from outside the company. Many have grown into those roles with the company over time within bp – and when you haven’t grown up inside an organisation and its culture, you are inevitably likely to create waves of some kind. But that’s okay.

bp went through the biggest reorganisation in its history only a couple of years ago, and a number of us have joined and been specifically asked to help by being and bringing something different – something additional to the fantastic capabilities that the company already has among its people.

For me, that’s partly about having come from the not-for-profit sector. I come from much smaller organisations, where I didn’t have the luxury of many resources at my fingertips. However, on the flipside, I also didn’t have the natural bureaucracy that large organisations face as collections of many systems and processes, so I bring a very different style to my role. I’m probably more direct than many, I’m at ease in tricky conversations and I’m pragmatic. I use my intuition as much as – and sometimes more than –I use the data before me. And I can get to decisions quickly, often because I had to.

In large organisations with many stakeholders and the will to be really inclusive, that style and approach can sometimes take people by surprise. But, again, that’s okay. We have a lot to get done and it’s going to take a diversity of thought and approaches to do it.

You have achieved a lot in your professional career; what achievement are you most proud of and why?

I’ve always loved my work and with my various teams we have achieved many things I am proud of, spanning three decades in and around the energy industry. The times I have been most proud, though, are when I’ve seen others grow and others win at what they are trying to achieve, and I can reflect that I played a part in helping them get there. For me,

that’s the best reward from being in the privileged position of leading organisations.

If you ask me about a specific moment of pride, there have been a few that stand out for me personally. First, I’d say seeing the convergence in the energy industry coming two decades ago and proposing and delivering the merger of professional bodies to deliver relevant support to the sector ahead of its transition.

Second, again, some years ago, bringing key advocates of climate change together with oil and gas industry leaders – many for the first time – to really debate the industry’s role in finding potential solutions and building that up over time, from discussion to commitments to action.

Finally, bringing industry leaders together to commit to action and accelerate inclusive and diverse cultures in organisations for their people to feel the real benefit of. It’s the same work I am proud to continue for bp today, because there is always more to be done.

Balancing the energy trilemma has never been easy. What is the long-term solution?

I’m not an expert on this one, but when I have had the chance to work with policymakers and those who shape energy systems, the answers here are about balancing trade-offs, including diversity of energy sources and technologies, with the right framework to facilitate early support to drive change and then create market mechanisms which sustain that change economically. At various times in history, we have seen each point on that trilemma take priority, but for me it’s about taking a systems approach to these decisions that works to identify and mitigate the potential unintended consequences.

Is the recent UK energy security strategy doing enough to address energy efficiency?

I would like to see more. It’s always been part of the debate that’s played a minor role, with conversations being dominated by energy supply. I understand why, but it’s meant we have not come up with the solutions at scale that we need. In an ideal world, introducing the best possible energy efficiency into the fabric of our

About Louise Kingham CBE FEI

Louise Kingham CBE joined bp as Senior Vice President for Europe and UK Head of Country in 2021.

Before joining bp, Louise was CEO of the Energy Institute for 18 years, Director General of the Institute of Petroleum and Chief Executive of the Institute of Energy.

Louise is a nonexecutive director of VH Global Sustainable Energy Opportunities plc, the Energy Saving Trust, a member of the POWERful Women Energy Leaders Coalition and an ambassador for 25×25. In 2022, Louise was awarded a CBE for services to the energy industry, having received an OBE in 2011. In 2017 she was awarded an Honorary Doctorate in Science from the University of Bath.

her career and putting the North Sea at the heart of bp’s commitment to help

bp Q&A

FEI: From the EIC www.the-eic.com | energy focus 7

IMAGE:

Louise Kingham CBE

society should warrant enough importance to be a national priority. I appreciate that there are challenges, but I think energy efficiency is where we should start – it should not be our last consideration.

No one seems to talk about the cheapest way to achieve net zero; have you found an answer to this question yet?

That’s because there isn’t a cheap way to get to net zero – but many have said it will be much more expensive not to do so. Some technologies, such as solar and energy efficiency, are less costly and faster to deploy than others. Lightsource bp and its rapid expansion is an incredible example of that. And then there are some at scale, such as hydrogen and carbon capture, utilisation and storage (CCUS). In places such as Teesside we are actively working to create those markets today because we know they will be important in the future. Finally, there is the value that can be realised for customers by integrating these solutions where it makes good sense and great business. And that’s what we do best, layering things such as solar, hydrogen, wind and electric vehicles into one hub or project and delivering it at a scale the industry has never seen before. This is why we plan to invest up to £18bn in the UK’s energy system by the end of 2030

Do you regard the UK supply chain as having particular strengths, compared to other countries, that should be competitive and attractive when exported around the world?

The UK has great capabilities in its supply chain, from the largest of companies to the smallest family-run businesses. The variety allows for opportunity at every level and at every stage of development for projects.

We want to help the supply chain to decarbonise and create new opportunities, both here in the UK and globally. We’ve set up supplier portals for our offshore wind projects and had hundreds of UK companies sign up. I think that reflects the size of the appetite here for businesses to drive this transition. You can go anywhere in the world where they produce oil and gas and hear a Scottish accent – and that’s

what we want to create for CCUS, hydrogen and wind. The UK is a microcosm of our business – it includes everything –and we want to take the supply chain along with us.

How is BP building its net-zero energy workforce?

This has been an incredibly exciting and busy part of our business as of late. Last year we recruited for 100 new positions in wind and 100 new positions in hydrogen. And we are not only creating jobs, we’re also transforming them. If you look at the CFO of Lightsource bp, our vice president of hydrogen market development or the person responsible for pinpointing where we bury the carbon in Teesside, they all came from our traditional upstream business. Those skills are so applicable to other parts of the energy transition and we are putting them to work. But those skills are also still needed to help develop the

lowest-emission barrels possible, and that’s exactly what we’re doing in the UKCS.

bp’s new strategy focuses on going after ‘the best hydrocarbons’ and a commitment to ‘do things better’ –what does this look like in practice?

Hydrocarbons are and will continue to remain at the core of our strategy as we look to reduce our oil and gas production by around 40 %. While we do that, we also want to ensure that what we’re producing is done safely, is of the highest quality and is low in emissions.

One of the ways we’re doing that is through the steps we’re taking to redevelop the Murlach field in the North Sea. The field will be a subsea tieback through our operated Eastern Trough Area Project (ETAP) area; using the existing infrastructure, there will be a reduction of operational impact and emissions.

We are also looking to help others decarbonise, as with our recent agreement with the government of Spain’s Valencia Region, which is centred around our Castellon refinery. We will be working with it to reduce its emissions from private and public transport and from other carbonintensive industries, such as ceramics, in the local area.

Our dedication to producing the best hydrocarbons and delivering on our strategy goes hand in hand with driving digital innovation. It’s what will enable us to meet our aims. When thinking about how we’re going to achieve the aims we’ve set for ourselves, we look to digital innovation to inform us about the safest, most efficient and smartest ways to do so.

Our development of digital twin technology (a virtual model using real-time data) using our Claire Ridge facility as a case study has given us the opportunity to realise the possibilities of optimisation and carbon reduction, which we hope to replicate across our global assets. If this is rolled out, we could reduce emissions by around 500,000 tonnes of CO2 equivalent per year. Lessons and work from the North Sea could then be deployed to other regions. This pioneering of new technology and the power of partnerships mirrors the work we’ve done in our venturing – such as with Flylogix, a methane-detecting drone

By 2030 bp aims to have developed 50GW of net renewable generating capacity

From the EIC: Q&A Louise Kingham CBE FEI 8 energy focus | www.the-eic.com

(Right) Lightsource bp is Europe’s largest solar developer

company that we have invested £3m into. Flylogix combines unmanned aerial vehicles with artificial intelligence to aid the detection of methane, which would help us deliver on aim 4 of our ambition. These capabilities, alongside our investments in gas and low-carbon energy, will enable us to reach net zero.

How important is the UKCS in terms of future oil and gas production, and what activities can we expect to see from BP in the coming months?

The North Sea remains an important resource for bp and indeed the UK government, which recently launched its British Energy Security Strategy, placing a focus on the role of home-grown, lower-carbon oil and gas. As a major British energy company, the most effective way for us at bp support the government’s strategy is to double down on each of our areas of strategy – resilient hydrocarbons, convenience and mobility, and low-carbon energy. In the North Sea today, our focus is to produce safe, reliable and lower-emission oil and gas from our existing production base.

We’re also looking to develop opportunities around our existing facilities and recently confirmed our plans to move forward with the Murlach development in the central North Sea. It’s important to remember that the value generated from continued North Sea oil and gas production supports bp’s ambitious energy transition growth plans in the UK, which include offshore wind, hydrogen production, CCUS and electric vehicle charging infrastructure.

Why is electrification seen as such a significant prize in the North Sea and what’s bp doing in this space?

Power generation offshore accounts for around 70 % of operational emissions, so electrification is a huge prize. And there is a clear steer from government, through the North Sea Transition Deal, that industry needs to place more focus on electrification. bp is right behind that push, working on options to electrify our ETAP facility in the central North Sea.

The UK is now at the heart of bp’s bid to go green with investments into wind power, hydrogen, CCUS and other green energy ventures. Can you tell us more about these projects?

Rapidly growing the renewables business is core to bp’s strategy – by 2030 we aim to have developed 50 GW of net renewable generating capacity. bp currently has a global renewables development pipeline totalling 23GW.

One of our three strategic focus areas is low-carbon electricity and energy, and we are aiming to capture 10% of the lowhydrogen market in core geographies by 2030. Our hydrogen projects – H2Teeside, HyGreen and the work we’re doing with Aberdeen Council to decarbonise heavy transport – all contributes to and will make up 15% of the UK government’s hydrogen target (10 GW).

We’re also investing in wind and solar projects such as Scotwind where, in partnership with EnBw, we’ve shown our continued commitment to the region with at least £1.2bn of spend, investing in

Investing in the UK

bp intends to invest up to £18bn in the UK’s energy system by 2030

North Sea O&G: Investing to produce O&G with fewer emissions and end gas flaring by 2030

Clean cities: Partnership with Aberdeen City Council to provide green energy and mobility solutions

CCUS: Leading Net Zero Teesside Power, and the Northern Endurance Partnership to serve the East Coast Cluster – one of the UK’s first carbon capture and storage projects – and aims to remove nearly 50% of all UK industrial cluster CO2 emissions

Hydrogen: Working to create two large-scale hydrogen facilities – H2Teesside (blue) and HyGreen Teesside (green) – with potential to deliver 15% of the UK’s 10GW hydrogen target by 2030

Offshore wind: Planning to develop three offshore wind projects in the North Sea and Irish Sea, which together could provide enough clean power for more than 6m UK homes

Solar energy: 223 large-scale UK solar projects totalling 1.5GW

EV charging: £1bn investment to develop the UK’s EV charging infrastructure, including tripling public charging points by 2030

UK retail

Currently adding ultra-fast chargers to 1,200+ bp service stations

Scottish ports, shipbuilding and skills, creating an estimated 1,000 direct and indirect jobs. We’re engaging with the Scottish supply chain and community to help in Scotland’s just transition.

Our low-carbon portfolio will not only help us get to net zero, but also create local jobs and, most importantly, produce clean and reliable energy for millions.

IMAGES: bp

Q&A Louise

CBE FEI From the EIC www.the-eic.com | energy focus 9

Kingham

UPDATES FROM THE ENERGY INDUSTRIES COUNCIL

news&events

Conferences from EIC coming up in 2022

Energy Exports Conference

When: 14–15 June 2022

Location: P&J Live, Aberdeen

About the EIC

Established in 1943, the EIC is the leading trade association for companies working in the global energy industries. Our member companies, who supply goods and services across the oil and gas, power, nuclear and renewables sectors, have the experience and expertise that operators and contractors require. As a not-for-profit organisation with offices in key international locations, the EIC’s role is to help members maximise commercial opportunities worldwide.

Events

EIC LIVE events

After 24 months of online conferences and virtual exhibitions, the EIC is delighted to return to in-person events. It has been thrilling to host and participate in physical events over the past few months, making connections face-to-face in a safe and COVID-19-friendly environment. We look forward to welcoming members, energy professionals and organisations to our series of events throughout the year. The EIC Energy Exports Conference is just around the corner, and our international trade team is excited to be organising and managing UK Pavilions for global events, including Gastech 2022 in Italy and WindEnergy Hamburg in Germany.

To find out more and book onto our latest events, visit www.the-eic.com/ Events/Calendar

Why attend? The Energy Exports Conference (EEC), the EIC’s main event of the year, will be returning to a physical format for the first time since 2019 when it takes place this June.

We know how important it is for business owners to find new routes to growth and resilience in these continuing difficult market conditions. EEC provides companies access to hundreds of contacts and multiple new export opportunities.

Listen, engage and connect with international operators, developers, contractors, government and export advisors, ambassadors and trade experts from across the globe. Visit www.the-eic.com/Events/ EEC2022

Gastech 2022

When: 5–8 September 2022

Location: Fiera Milano, Milan

Why attend? Gastech is a landmark event in the industry’s calendar, supporting gas, liquefied natural gas (LNG), hydrogen and low-carbon energy solutions. Celebrating its 50th anniversary in Milan, the four-day exhibition and conference will gather ministers, CEOs, policymakers, business leaders, engineers, innovators and disruptors.

Discussing solutions, challenges and opportunities for net zero and energy transformation 10 months

10 energy focus | www.the-eic.com

after COP26, Gastech provides a forum for exhibitors, sponsors and speakers. If you are interested in exhibiting at Gastech as part of the EIC’s UK Pavilion group, email the International Trade Team at internationaltrade@the-eic.com.

Visit www.the-eic.com/Events/ Exhibitions/Gastech2022

WindEnergy Hamburg Conference

When: 27–30 September 2022

Location: Hamburg Messe, Hamburg

Why attend? WindEnergy Hamburg is the world’s largest expo and global congress for the wind power industry. This four-day event assembles designers, manufacturers, suppliers, financiers, operators and providers – both onshore and offshore – from the international marketplace to meet.

WindEnergy Hamburg focuses on addressing the major issues facing the international wind energy sector. It brings together a high-calibre professional audience and 1,400 exhibitors demonstrating their innovations and solutions from across the industry’s value chain.

The EIC is organising the UK Pavilion at WindEnergy Hamburg. If you are interested in exhibiting with us, contact the International Trade Team by emailing internationaltrade@the-eic.com.

Visit www.the-eic.com/Events/ Exhibitions/WindEnergyHamburg

External affairs

During the past four months, we have had success with the Nuclear Energy (Financing) Act 2022 receiving Royal Assent. We represented members’ views at formal consultation and at Committee Hearing stage, so were pleased to see this pass. We also worked with members to respond to the Department for Business, Energy and Industrial Strategy’s consultation on Supply Chain Plans.

With UKESC, we have focused on discussions around finance and development and carbon capture, utilisation and storage planning. Please see our website for more details and how to get involved.

The team has expanded recently with an External Affairs Advisor and a Communications Advisor, focusing on outward media, joining the EIC.

As we respond to consultations, work with government and raise awareness of political and policy issues, we look forward to carrying on working with you.

NEW REPORTS OUT NOW

Reports

Middle East Operational Renewables EICAsset Map Report

Development for renewable energy in the Middle East has been slow during the past 12 months, as delays in achieving project completion across all energy sectors in the region have been significant.

Due to the global pandemic outbreak, governments across the Middle East have imposed various rules and guidelines for working at construction sites, such as social distancing to keep employees safe and travel bans into their respective countries.

Download the complete Insight report to learn more about the emerging renewables opportunities in the Middle East.

LNG Insight Report

Natural gas, especially LNG, has been at the centre of discussions regarding energy transition in recent years. After the emergence of the coronavirus pandemic and Russia’s recent invasion of Ukraine, it has also been directly linked to energy security and affordability.

By reading the LNG Insight Report, readers will be able to comprehend the role that fossil fuels play globally today and in the future, major players and capacities, as well as the challenges, opportunities, and perspectives for the sector worldwide.

Brazil Country Report 2022

Since the last EIC Brazil Country Report was launched in 2018, the shift in the country’s energy industry, government, economy and society has been dramatic. Download the latest EIC Country Report to learn more about the energy landscape in Brazil, who the major players are, the latest political, economic, social and technological analysis, and advice on doing business in the country.

To buy or download your copy of these reports please visit: www.the-eic.com/ MediaCentre/Publications/Reports

From the EIC News and events www.the-eic.com | energy focus 11

The EEC will be returning to a physical format for the first time since 2019

The BIG question

What do you know now that you wish you’d known when you rst started exporting?

Doing business abroad may bring excellent commercial opportunities, but it is no easy task. As nothing teaches better than experience, Energy Focus asked three members with successful exporting strategies for their advice to help companies at the start of their export journey Energy Focus puts the big question to three members

Fairuz Yahaya

Managing Director at EXS Synergy

We first went to Thailand in 2019 with zero expectations by sponsoring the EIC Connect Energy Thailand, primarily to understand the market. It led to our first success outside Malaysia and instilled confidence in our product’s marketability.

However, exporting remains a daunting proposition, as it can be expensive, and there are always risks associated with a new market. To minimise the risks, I would tell my previous self the following:

1. Utilise trade organisations and agencies. They help companies accelerate their understanding of the target market, client profile and local requirements, rules and regulations, helping to minimise costly mistakes and maximise the chance of success. They also provide information on government incentives for export-related activities, which can help to minimise costs.

2. Learn about trade credit insurance.

Going into a new market and dealing with new clients means entering unknown territory, and one bad paymaster can severely cripple your cash flow. Credit insurance provides some form of protection while we learn about the market.

3. Understand the local culture. Each country has its own preferences, and knowing the little things can go a long way in gaining respect and acceptance.

4. Get a reliable partner. You may earn less, but the right partner can gain you more in

the long term, providing valuable local contacts, market knowledge and better customer experience.

About EXS Synergy

Based in Kuala Lumpur, EXS Synergy was established in 2014. It specialises in electrical and instrumentation (E&I) services, focusing on four key areas: explosion protection (Ex), digital solutions, integrated rental solutions and E&I services. Globally certified by IECEx accreditation, EXS Synergy works with clients within the oil, gas, petrochemical, refinery and renewable energy sectors.

Philip Ross

Managing Director at RTR

Originally founded in Germany in 1969 as a supplier of steel pipes and tubes, RTR quickly expanded and set up its Gateshead, UK office in 1977.

Following changes to our UK domestic market, we decided to focus on exporting as part of our strategy for growth in 2015. We

12 energy focus | www.the-eic.com From the EIC Members’ comment

Learn about trade credit insurance. One bad paymaster can severely cripple your cash flow, and credit insurance provides some form of protection while you learn about the market

have been successful across global markets, including Europe, Australasia, Africa and the Middle East, culminating with the prestigious Queen’s Award for International Trade in 2019.

Today our challenge is to continue innovating and expanding the level of service we deliver to our clients, both internationally and domestically. Looking back to 2015, having a greater understanding of the governance requirements of our target export markets would have been beneficial, for example in terms of determining legal status and establishing a presence in target markets.

There are many options to help you establish a presence in an overseas market, but which one you choose will depend on your company and products.

Knowing more about banking systems and local requirements would also have been helpful. Different countries have different regulations and laws around payments and currency, and some countries have strict rules about local currency and bank accounts. I’d encourage any company

about to start their export journey to research laws that may apply to them and take expert local legal and banking advice.

About RTR

With more than 50 years of industry experience, RTR GmbH & Co. KG is an international specialist provider of steel pipes, boiler tubes, forgings and components for high temperature pressure part applications. It off ers technical and project management solutions for complex projects across power plant repair and maintenance with nuclear, coal, gas and biomass, waste to energy, chemical, petrochemical and alumina industries. RTR supports clients across Europe, Australasia, Africa and the Middle East.

Dave Anderson

Sales and Marketing Director at Score Group

When Score launched its through-valve leak detection, quantification and trending tool MIDAS Meter® in the marketplace, we expected a high uptake in our UK home markets, given its major benefits in valve management and process integrity, efficiency and sustainability. Unfortunately, that early domestic market success did not materialise, primarily for reasons many have subsequently described as ‘perfection paralysis’, so we were encouraged to promote our innovative technology further afield.

Identify global opportunities with EIC

For both first-time and seasoned exporters, the Energy Exports Conference (EEC) is the number one event to identify global trade opportunities in the energy industry.

Covering a wide range of diff erent sectors and projects, EEC provides business advice, access to contacts and discussion panels on energy transition.

To find out more about EEC 2022, taking place in Aberdeen this June, see page 10.

In doing so, we established a successful export trading business model. Markets where we had imagined that there would be less interest in our products, or indeed the capital available to invest in them, immediately adopted the technology. This was in recognition of the significant return on investment impacts that these products could deliver – simply put, these were safer, more efficient and more profitable process operations.

We learned that some of our previous ‘assumptions’ about export markets were well off the mark. In hindsight, if we’d had the reliable market intelligence that there was enthusiasm and strong appetite internationally for innovative new products and engineering solutions, and that non-domestic, international markets were likely going to be the early and enthusiastic adopters of our technology, we would have started there first. On that basis, we would encourage others to consider investing in market intelligence and then pursuing the appropriate export market opportunities.

About Score Group Score Group specialises in valves, fuel systems and accessories, and component manufacture, providing complex engineering solutions to support customers in multiple markets, including defence, nuclear, aerospace, utilities and energy. With facilities in more than 30 locations spanning fi ve continents, the company employs over 1,800 staff, including 350 apprentices. Now in its fi fth decade, its services have expanded to include engineering design, repair and modification, supply, testing, diagnostics and specialist coatings.

I’d encourage any company about to start their export journey to research any laws that may apply to them and take expert local legal and banking advice

We would encourage others to consider investing in market intelligence and then pursuing the appropriate export market opportunities

www.the-eic.com | energy focus 13 Members’ comment: From the EIC

From Cop26 to Ukraine:

As short-term pressures on energy security and affordability begin to mount, Tom Wadlow asks, what does this mean for the energy transition and net zero?

Special report A new energy reality

14 energy focus | www.the-eic.com

Thedynamicsever-changing of the energy sector

It is hard to keep energy away from the news at the moment. The current volatility in the energy market is being felt far and wide. Consumers are facing the reality of rising gas and electricity bills, while businesses across all sectors are struggling to operate at a profit while suffering higher overheads.

What we are currently witnessing cannot be attributed to a single event. The COVID-19 pandemic brought entire economies to a standstill for the best part of two years and disrupted normal supply and demand patterns, while, following commitments made at COP26 in Glasgow, energy transition policies are gathering momentum and will be put under the spotlight once more with the upcoming COP27 conference in Egypt.

Meanwhile, supply chain challenges around transportation, transmission and storage infrastructure have been issues for years and are finally being brought into sharp focus as the world wakes up to what ‘energy security’ truly means.

“Some of the biggest supply chain challenges impacting the energy sector should come as no surprise, as the sector has a long history of insecure supply chains due to geographic resource concentrations,” comments Margaret Kidd, Programme Director and Instructional Assistant Professor in supply chain and logistics technology at the University of Houston.

From one crisis to another

All of this is without mentioning the current crisis in Ukraine. “Substantive challenges are playing out globally at multiple scales,” says Kidd. “Regionally, Europe’s move to decouple from Russian fossil fuel supplies begins with diversifying supply sources, along with committing to time-critical infrastructure investment such as the expansion of infrastructure capacity in terms of liquefied natural gas (LNG) import terminal capacity and regional gas hubs, and connectivity of North African gas pipelines beyond Spain to central Europe.”

The war in Ukraine is already beginning to make its mark on the energy landscape, which begs the questions: how far will the impacts go, and how long will they last?

“In the short-term, steps taken by the countries to reduce or eliminate their purchase of Russian oil and gas will cause economic hardship for many consumers,” says Steve Crolius, President of Carbon Neutral Consulting and a former climate adviser at the Clinton Foundation.

“The price will remain elevated until supply goes back up or demand goes down. Since global demand for energy tends to increase steadily over time, prices in the petroleum market will remain elevated until either Russian oil and gas is reintegrated into the global supply picture, other oil and gas-producing nations increase their rate of production, or alternative sources of energy can be brought online in sufficient quantity.”

In Crolius’s view, these prospects could drag on for years, meaning cost challenges are likely to remain for the foreseeable future without a realistic quick fix. Indeed, sustainable energy systems cannot be built at such a pace that they will meaningfully affect short-term prices.

What does this mean for the energy transition?

One of the most intriguing questions arising from the current situation is what impact recent events will have on the energy transition and net-zero agenda. While the pandemic may have contributed to a rise in conscious consumption, and sustainability awareness being higher than ever, the Ukraine crisis has exposed the vulnerability of nations that do not produce substantial proportions of their own energy. Are we now looking at a trade-off between sustainability and security? Between cost and climate change?

For Stuart Broadley, CEO of the EIC, key questions remain unanswered. “Clearly, the priority is energy security today, almost at any cost,” he says, “and this follows a period of prioritisation on energy transition – again, almost at any cost. No one has answered the question ‘what is the most affordable and cheapest way to achieve net zero?’, and no one seems able to answer what the cheapest way of mitigating the risk of losing Russian oil and gas into Europe is either. Urgency is trumping economics in each case.

“Do I think this will come back to bite us? Absolutely, yes. Affordability, the third leg of the energy trilemma, is long overdue to be considered the priority, but so far is it the lonely laggard.”

Broadley is involved with energy sector innovators and holds conversations with key protagonists on a near-daily basis.

There are also serious puzzles to be solved at a strategic level; from a technological standpoint, the market has never been in a better position to push the energy transition agenda forwards in a way that can tick the long-term security and affordability boxes.

www.the-eic.com | energy focus 15 A new energy reality: Special report

Europe’s move to decouple from Russian fossil fuel supplies begins with diversifying supply sources, along with committing to time-critical infrastructure investment

Margaret Kidd, Programme Director, Supply Chain, University of Houston

“This is a market like no other that I have seen, where all technologies are booming, all at the same time, and the latest announcements about the UK energy security strategy following the Russian invasion of Ukraine have only exacerbated this further,” Broadley says.

“Furthermore, our global data shows that the proportion of energy projects being announced that are cleantech and renewables-focused has increased from 58 % in 2021 to 66% in 2022 so far. Meanwhile, the proportion of project announcements involving mature hydrocarbons has fallen from 22% to 16%.

“However, traditional hydrocarbon markets are stronger than they have been for 10 years as markets struggle to account for the planned and unplanned loss of Russian oil and gas to Europe. And new technologies like hydrogen and carbon capture are being accelerated even faster – again as a defence against premature loss of gas into the system.”

Indeed, the UK government has announced plans for up to 95% of its electricity to come from low-carbon sources by 2030. Central to its new energy security strategy is the construction of eight new nuclear reactors, which will be supported by onshore and offshore wind, solar, and a targeted doubling of planned hydrogen output.

The elephant in the room, as far as the UK is concerned, is fracking. “Although the government will likely bend to political pressure to re-open apparent consideration for fracking, a key issue will be whether it passes the local community buy-in test,” says Broadley.

“This is also why the government may be hesitant to sign off on the large-scale reintroduction of onshore wind, preferring offshore wind instead. However, it appears that the use of some onshore wind is on the table, at least for the time being.”

Elsewhere, LNG has been identified as the cleanest fossil fuel that can aid energy transition and replace Russian supplies. EIC data shows that several EU countries appear to be betting on floating offshore LNG terminals to raise their import capacity. In Germany, the first of several terminals is due to come online before the end of the year, while Italy and the Netherlands are also making moves that will

bring Europe more in line with other global regions, which have so far been more receptive to floating storage and regasification units.

Of course, energy transition relies on the availability of an abundance of resources, including a series of critical minerals that are also subject to acute supply challenges.

“Price fluctuations for minerals such as lithium, cobalt, copper and nickel call for a permanent intergovernmental organisation, similar to OPEC, to co-ordinate and unify mineral policies among member countries to secure fair and stable prices for producers,” Kidd says.

“This could enable an efficient, economic and regular supply of these minerals to consuming nations, a fair return on capital to stakeholders investing in the industry, and global standards for sourcing and social responsibilities to nations where these extractive activities are occurring. Additionally, western countries must expand capabilities for manufacturing, processing and refining of critical minerals, as capacity is highly concentrated in China.”

Stuart

Stuart

Special report: A new energy

reality

This is a market like no other that I have seen, where all technologies are booming, all at the same time, and the latest announcements about the UK energy security strategy following the Russian invasion of Ukraine have only exacerbated this further

Broadley, CEO, EIC

16 energy focus | www.the-eic.com

The longer-term

Looking ahead, although there are sizeable barriers to energy transition, such as the immediate need for energy security and numerous supply chain constraints, failure to drive the agenda forwards now could carry enormous long-term consequences, says Crolius.

“I believe that failure to address the climate crisis in an effective and timely manner will cause an amount of human hardship that will dwarf that being experienced in Ukraine, as horrific as that is,” he says. “Therefore, the better course would be to prioritise investments into sustainable energy systems over efforts to increase fossil fuel production.”

Predicting what the future might look like is, of course, riddled with challenges. Here, up-to-date data and factual insight offers the best form of grounding for both governments and enterprises to base their strategies on.

“The EIC continues to stay abreast of the rapidly-moving picture thanks to our extensive databases and networking capabilities that bring together key stakeholders all around the world on a regular basis,” Broadley says.

“By being a member, together we can move forwards through these difficult issues in a meaningful way, through positive engagement.”

Indeed, such collaboration will only help to advance critical energy transition progress. Here, Crolius predicts that, during the course of this century, a global sustainable energy system will substantially take the place of the legacy fossil energy system – with the world being somewhere in the middle of the process by the time the 2050 net-zero target adopted by the UK and some other nations arrives.

“The faster we can move in this direction, the better for the climate –and the worse for autocratic regimes that are propped up by the export of fossil energy commodities,” he adds.

Broadley agrees that there is no reason to change priorities around net zero, although it may cost more to achieve these ends because of the current urgency to take action.

EIC global data shows

66%

The proportion of new renewables and cleantech projects has increased from 58% in 2021 to 66% in 2022 (to date)

16%

The proportion of hydrocarbon projects being announced has fallen from 22% in 2021 to 16% in 2022 (to date)

10 years

Source: EICDataStream

He concludes: “For ‘UK plc’, this is a unique chance to maximise local content – for the UK energy supply chain to stake its claim for the lion’s share of this technology, leveraging its globally recognised track record of quality and innovation, and proactivity to invest heavily in new capacity and capability, backed up by unwavering government policy to ensure UK energy security of supply.

“By seeding and rooting a UK-based energy transition supply chain, the UK would go on to help the rest of the world reach net zero – a world-class supply chain with capability proven in the UK, competitive globally, for decades to come.”

A new energy reality: Special report: www.the-eic.com | energy focus 17

Sustainable energy systems cannot be built at such a pace that they will meaningfully affect short-term energy prices

Steve Crolius, President, Carbon Neutral Consulting

However, the market is stronger than it’s been in the last

Tap into Australia’s big clean energy opportunities

The UK and Australia share strong trade and investment links, underpinned by an intertwined history and cultural similarities. Outside of Ashes tours and the Rugby World Cup, it is a relationship marked by cooperation and synergy.

This is reflected in the energy sector –the omnipresent Scot Network in Australia can speak to this, where North Sea knowhow has helped support the tremendous growth in Australia’s LNG sector during the past two decades.

Clean energy partnership

There is no indication that this will slow through the energy transition, with opportunities abounding across hydrogen, carbon capture, storage and utilisation (CCUS), and offshore wind.

Critically, these are areas in which UK developers, technology providers and companies through the supply chain can deliver additional expertise into these burgeoning growth areas.

At government-to-government level, the relationship is stronger than ever. The recent signing of a Free Trade Agreement signals a reinvigoration of bilateral trade and investment, while the Australia–UK Clean Technology Partnership has been established to deliver a joint industry ‘challenge’ to increase industry competitiveness, reduce emissions and support economic growth. This partnership is part of the Australian government’s US$400m commitment to building new international technology partnerships. This investment to support the commercialisation of new technologies is just the tip of the iceberg.

Opportunities in CCUS and hydrogen

The Australian government has gone to great lengths to embed CCUS as a priority low-emissions technology. It will soon announce the first recipients of its US$177m Carbon Capture and Storage (CCS) Hubs and Technology Program. The government has also implemented a new methodology for its Emission Reduction Fund, which will enable CCS proponents to accrue Australian carbon credit units from eligible projects. This was pivotal for the final investment decision on Santos’ US$156m Moomba CCS Hub in South Australia.

Another important component of the CCUS growth story is its role in delivering clean hydrogen, or blue hydrogen. Globally, blue hydrogen operations captured 3.7m tonnes of CO2 in 2021, compared to 0.4m tonnes a decade earlier. This would rise substantially if the hydrogen market took off and existing infrastructure was retrofitted with carbon capture.

With its technology-neutral approach, Australia is pursuing both opportunities.

IMAGES: ATCO

Energy Transition Australia 18 energy focus | www.the-eic.com

(Below) ATCO is among the first clean hydrogen movers in Australia

As Australia hurtles toward its clean energy future – prioritising CCUS and hydrogen and backing offshore wind – the UK’s trusted trading partner has much to offer, says Joe Doleschal Ridnell at energy and resources consultancy JDR Advisers

Great fanfare greeted the export of the first tranche of liquified hydrogen from La Trobe’s Valley brown coalfields to Japan in January this year. While the export of liquid hydrogen was important, the CCS element of the project remains to be executed.

Powering ahead with green hydrogen

Hydrogen produced from renewable energy – or green hydrogen – is being pursued with fervour across Australia. Last year the Australian government pumped more than US$71m into three green hydrogen projects, delivered separately by Yara and Engie, ATCO and AGIG.

Since then, the government has committed to investing US$328m into a network of hydrogen hubs to support the scaling up of production and stimulation of demand. Such government investment is being matched with grand ambition from the private sector.

It is hard to miss the plethora of opportunities being pursued by Andrew Forrest and Fortescue Future Industries (FFI). FFI projects are being delivered across the globe, including a 50-50 joint venture with North American hydrogen technology company Plug Power to build an electrolyser gigafactory in Queensland, Australia.

And regardless of policy settings and co-investment, companies through the mining sector are progressing with their decarbonisation agenda, underpinned by clear 2030 and 2050 targets. For example, Rio Tinto will invest US$5.3bn out to 2030, with its operations in the Pilbara alone being earmarked for rapid deployment of 1GW of renewable energy.

Big boost for offshore wind

Offshore wind is also beginning to make inroads. While Australia has a lot of space for onshore wind, several factors are leading to increasing interest in offshore wind; 12 projects with a combined 25GW+ capacity are now in development. The industry is now regulated for the construction,

operation and decommissioning of offshore electricity infrastructure in Australian Commonwealth waters. Offshore wind in Australia has comparable wind speeds to the North Sea and, with new technologies, theoretical capacity factors of 45%–55%.

Doing business in Australia

If you are unfamiliar with the Australian market and do not have a foothold, the best first point of call is your local Austrade and Australian state government representative, whose job is to support your entry into Australia.

There are also several private services that can help you with your ambitions. The key areas of focus from governments are to understand how your business plans to invest in Australia, how your company can address skills and technology gaps, and how you plan to establish yourself in the market over the medium-to-long-term. It is worth reflecting on this before engaging.

After two years, Australia has re-opened to the world and international missions earlier this year are back on the agenda. EIC and other trade associations can be an important avenue to visit the market.

Given Australia’s size and the nuances between different state and territory jurisdictions, it is important to take the time to visit the market and projects you are interested in pursuing to help you make an informed decision.

While the past two years have been difficult, the energy transition has not slowed and the Australian economy has withstood the pandemic incredibly well. Underpinned by strong domestic and regional demand, government investment in industrial capabilities, and an established relationship with the UK, Australia is a market well worth exploring.

By Joe Doleschal Ridnell, Director, JDR Advisers

(Above) Ammonia production (Yara) provides a ready-made end-use case for hydrogen and provides a long-distance transport option

Australia: Energy Transition

www.the-eic.com | energy focus 19

Current and

CAPEX through to 2030 3 blue hydrogen US$1.3bn

US$118.525bn

UK developers, technology providers and companies can deliver additional expertise into the burgeoning growth areas of CCUS, hydrogen and offshore wind

future projects

49 green hydrogen

8 CCS US$3.48bn 1 CCUS US$0.15bn 18 offshore wind US$181.565bn

Get ready to capture the CSS opportunity

Malaysia

The 12th Malaysia Plan 2021–2025, tabled in September 2021, set an ambitious goal for the country to achieve carbon neutrality by 2050.

To help realise this target, solutions including implementing economic instruments such as carbon pricing and carbon tax, and not building new coal power plants, are under consideration. Details on other carbon reduction measures are likely to be announced once long-term, low-carbon strategic development studies have been completed by the end of 2022.

The Ministry of Environment and Water completed the National Climate Change Legal Framework in December 2021, setting the foundation for the development of Malaysia’s Climate Change Act (expected in 2024), which could potentially spur more activity in the carbon capture and storage (CCS) space.

Petronas’ Malaysia Petroleum Management (MPM) has identified more than 46trn cubic feet of potential carbon storage capacity across 16 of Malaysia’s depleted gas reservoirs – 11 of

these sites are at fields offshore Sarawak, and five are offshore Peninsular Malaysia. According to MPM, these depleted fields not only provide storage solutions for domestic projects, but also enable the country to extend its excess storage capacity to third parties, thereby establishing Malaysia as a regional CCS hub.

Malaysia’s national oil company Petronas is currently the country’s leading organisation in the study and development of the CCS sector, focused on the decarbonisation of the upstream industry. It is working on Malaysia’s maiden CCS project, Kasawari CCS (Kasawari Phase 2). This will be the world’s largest offshore CCS project when it starts up in 2025, capturing 4m tonnes of CO2 annually.

The Malaysia Marine & Heavy Engineering–Ranhill Worley consortium and the National Petroleum Construction Company–Technip Energies consortium are currently working on the front-end engineering and design (FEED), competing for the roll-on engineering, procurement, construction, installation and commissioning contract. The final investment decision is expected in November 2022.

www.the-eic.com | energy focus 21

Energy Transition CCS in SE Asia IMAGES: ISTOCK

Carbon capture, utilisation and storage technologies will play an important role in supporting clean energy transitions in south-east Asia, where demand for fossil fuels remains high. As the momentum for the scalable decarbonisation solution grows in the region, UK companies should put Indonesia, Malaysia and Singapore on their export radar, says Dr Madana Leela at EIC Malaysia

MAJOR PROJECTS TO WATCH

Indonesia

In July 2021, Indonesia –the world’s eighth-biggest carbon emitter – moved its goal for carbon neutrality forward, to 2060 or sooner. As well as ramping up renewables targets, the nation is looking to CCS to help realise its ambitions.

Numerous pilot projects have been carried out in order to study the implementation of CCS in Indonesia’s off shore oil and gas fields. Japan Petroleum Exploration, NOC Pertamina and Lemigas have planned to conduct a feasibility study to implement CCS at the Sukowati Oil Field in East Java. According to preliminary studies, CCS could reduce 4,000 tonnes of CO 2 per day.

Pertamina has also conducted a CCS study at the Gundih Gas field in East Java with ITB and several other Japanese institutions. The Gundih Gas field CCS project could reduce emissions by 800 tonnes of CO 2 per day and increase gas production by 16bn cubic feet via enhanced gas recovery.

The largest carbon capture, utilisation and storage (CCUS) project currently in planning in Indonesia is the Vorwata CCS project, which is being worked on by BP as part of more extensive development plans for the Tangguh gas block in eastern Indonesia. Partners include Mitsubishi, Inpex and CNOOC.

Completion is targeted for 2026–2027. By that time,

Singapore

Singapore has stated its aim to achieve net zero by 2050, a revision from its target of achieving carbon neutrality “as soon as viable in the second half of the century”.

The government has announced a carbon price hike, from US$3.66/ tonne to US$18.32/tonne in 2024–25, US$33/tonne in 2026–27, and US$37–59/tonne by 2030. The carbon tax is levied on facilities that emit more than 25,000 tonnes of CO2 annually and applies to about 50 facilities in the industry, power and waste sectors, covering 80% of national emissions.

Singapore has its sights set on CCS and hydrogen to help decarbonise its power and chemicals industry. In 2021 it awarded US$403m to 12 research projects in these areas,

involving large petrochemical firms and local research centres.

The findings of a feasibility study performed by the Singaporean government on CCUS technologies identified CO2 emissions – mainly from power plants and industrial facilities – that could be captured and stored in suitable sub-surface geological formations or converted into useful products such as aggregates and synthetic fuels. The study also mentions the lack of suitable geological formations in Singapore for permanently storing CO2 underground. Singapore will have to explore partnerships with companies and

4m tonnes of CO 2 will be injected back into the reservoir annually, reaching up to 25m tonnes by 2035 and 33m tonnes by 2045. This will remove up to 90% of the reservoir-associated CO 2 , which currently represents nearly half of Tangguh LNG emissions. The companies plan to conduct FEED for the project in mid-2022, subject to the Tangguh Partners’ and further SKK Migas’ approval.

Malaysia

Kasawari Phase 2 CCS

Value: US$900m

Start: 2025

Stage: FEED

Status: Contract awarded

Operator: Petronas

Key contractors: Xodus (feasibility) MMHE-Ranhill Worley (FEED), NPCCTechnip Energies (FEED)

Indonesia

Vorwata CCUS Project

Potential to capture and store four million tonnes per annum (Mtpa) of CO 2 , reaching a total of 25m tonnes of CO 2 (MtCO 2) by 2035 and 33MtCO 2 by 2045

Value: US$3bn

Start: 2027

Stage: Feasibility

Status: Memorandum of Understanding (MoU)

Operator: BP

Sukowati CCS Project

Potential to capture and store 15MtCO 2 for 25 years

Value: US$100m

Start: 2030

Stage: Feasibility

Status: MoU

Operator: Pertamina

Sakakemang CCS Project

Potential to capture and store 1.6Mtpa of CO 2 , 30MtCO 2 over the life of the project

Value: US$100m

other countries with suitable geological formations. Singapore is aiming to realise at least 2m tonnes of carbon capture potential by 2030. Currently, Shell is rolling out the Pulau Bukom CCS project at its complex in Singapore, looking to exploit the potential for a regional CCS hub at its manufacturing site in Pulau Bukom as part of the site’s transformation into the Shell Energy and Chemicals Park Singapore. Shell intends to work with a range of customers, including those in the power sector, to reduce operational CO2 emissions via the CCS hub. ExxonMobil is also planning to build a network of CCS facilities across south-east Asia, with Singapore as collection hub.

By Dr Madana Leela, Regional Analyst, EIC

Start: 2027

Stage: Feasibility

Status: Planning

Operator: Repsol

Ramba CCUS EOR Project

Value: US$50m

Start: 2030

Stage: Feasibility

Status: Planning

Operator: Pertamina

Gundih Field CCUS Project

Potential to capture and store 300,000 tonnes of CO 2 per year

Value: US$49m

Start: 2024

Stage: Feasibility

Status: Planning

Operator: Pertamina

Singapore

Pulau Bukom Carbon Capture and Storage Hub

Value: US$100m

Start: 2025

Stage: Feasibility

Status: Planning

Operator: Shell Energy

22 energy focus | www.the-eic.com Energy Transition: CCS in SE Asia

Your partner for a safer, more secure, more sustainable future Helping you meet the challenges of today: Carbon emissions reduction verification Environmental and energy management certification Energy and renewables inspection Health, safety and wellbeing Supply chain assurance Get in touch enquiries.uk@lrqa.com | www.lrqa.com/uk

Solar A brighter future for

MAJOR PROJECTS TO WATCH

North Kuwait solar PV plant Northern Kuwait

With its exact location yet undecided, North Kuwait is a PV plant proposed by undisclosed private investors to the Ministry of Electricity, Water and Renewable Energy. Now under studies by the Kuwait Authority for Partnership Projects, the 5GW project will require an investment of US$3.5bn. Its objective is to support urban expansion in northern Kuwait, as well as reduce the price for electricity production in the country and create around 2,000 jobs related to the construction and operation of the plant.

Al-Dibdibah PV plant Al Abdaliyah, Kuwait

Al-Dibdibah is the second development phase of the Al Shagaya renewable energy complex, located in a desert area 100km west of Kuwait City, near the Iraqi border. With the first phase being a 70MW demonstration facility designed by the Kuwait Institute for Scientific Research, Al-Dibdibah will extend the complex’s capacity to 3GW. A tender process for consultancy services was opened by KAPP, and reports confirm that seven firms have already made their offers. Energy production is likely to commence by 2026.

Middle

East and

North Africa (MENA)

The global energy industry has been experiencing the impacts of the COVID-19 pandemic for more than two years, and it is no different in the Middle East and North Africa

(MENA), especially for solar power: the region has seen several tenders postponed, logistics hampered and prices rise. For example, the cost of a photovoltaic (PV) module hit

24 energy focus | www.the-eic.com Renewables Middle East and North Africa

(Main image) Mohammed bin Rashid al-Maktoum Solar PV Park in Dubai, UAE

With several projects under construction or at tender phase, considerable growth in solar PV is expected to drive the solar power market in the Middle East and North Africa. Discover new solar energy opportunities in the region with the help of the EIC MENA team

IMAGE: DNV

Solar 1,000 project Algiers, Algeria

Seeking to expand the country’s photovoltaic generation, Solar 1,000 is a solar programme promoted by the Algerian government.

Totalling 1GW and located in 11 different sites of Algiers Province, the initiative consists of a number of solar PV power plants with capacities ranging from 50MW to 300MW.

Algeria’s Ministry of Energy Transition and Renewable Energy launched the tender for these projects and their 25-year concessions in December 2021.

As of February 2022, more than 80 developers had already been attracted by the tender process. Bidding deadline is now scheduled for June 15.

Al Faisalia solar PV plant Makkah, Saudi Arabia

Al Faisalia’s PPA, signed between ACWA Power and Saudi Arabia’s Renewable Energy Project Development Office in April 2021, reached the world’s lowest record tariff of US$1.04/kWh. Located around 80km from Jeddah, Al Faisalia aims to be a 600MW solar plant in the Makkah province.

Sudair solar PV plant Ar-Riyad, Saudi Arabia

Having reached financial close in August 2021, ACWA Power’s Sudair project entails the construction of a 1.5GW solar plant in Ar-Riyad. With start-up scheduled for the second half of 2022, full production will take place in 2023. Larsen & Toubro is the EPC contractor, and NEXTracker is providing its smart solar trackers with TrueCapture technology, which uses machine learning and advanced sensors to maximise performance.

Al Dhafra solar PV plant Abu Dhabi, UAE

Currently under construction by EDF and Jinko Solar (owners of 40% of the project, with TAWA and Masdar holding 60%) since the second half of 2020, the Al Dhafra solar power plant will be the largest photovoltaic facility of the Middle East once completed. With full operation scheduled for 2022 and a 30-year PPA scheme to be valid after that, Al Dhafra’s 2GW of capacity will be enough to support 160,000 homes in the UAE. Before being surpassed by Al Faisalia in April 2021, the project held the world’s lowest record tariff of US$1.35/kWh.

Mohammed bin Rashid al-Maktoum Solar PV Park (Phase V) Dubai, UAE

The fifth implementation phase of the Mohammed bin Rashid (MBR) al-Maktoum project will add 900MW to the complex’s capacity. Civil works, carried out by Shanghai Electric since July 2020, have surpassed 60% of completion in January 2022. Featuring NEXTracker’s TrueCapture technology, output of MBR V will be boosted by up to 30%. Combining PV and concentrated solar power, the finished MBR project will count with a combined capacity of 5GW by 2030.

US$0.30 per watts peak in 2021, a significant increase from below US$0.20 just a year before.

However, along with the current international movement for energy transition, and following a decade of major developments for the renewables industry in MENA, the countries in the region expect to overcome these obstacles via several net-zero programmes – with solar playing a huge part in their success.

Saudi Arabia and the United Arab Emirates (UAE) have designed some of the most ambitious plans. Saudi Arabia’s National Renewable Energy Program intends to grow the country’s renewable energy production to 50% of the matrix by 2050, enabling the installation of more than 50GW in solar projects only. Meanwhile, the UAE’s Energy Strategy 2050 targets 44% of the Emirati matrix to correspond to renewables, with Dubai, its largest city,

aspiring to have the world’s lowest carbon footprint by the mid-century.

When it comes to investments, EICDataStream reveals that the UAE leads the region with CAPEX of US$7.56bn on new solar facilities, closely followed by Egypt (US$7.51bn) and Kuwait (US$6.7bn). The majority of these initiatives – about 65% – are currently under construction, with the remaining 35% currently going through their early development stages.

www.the-eic.com | energy focus 25 Middle East and North Africa: Renewables

Floating offshore wind: the next big thing in Asia Pacific?

Floating offshore wind will open new opportunities in South Korea, China, Taiwan and Japan – but institutional and policy barriers must first be addressed, says Kevin Liu at Scottish Development International

There has been a remarkable transformation of energy strategy across Asia Pacific during the past year.

Ambitious net-zero targets were announced by China, South Korea and Japan ahead of COP26, and even though the climate negotiators in Glasgow failed to agree on stronger commitments to phase out coal, which to date still accounts for the majority of power generation capacity in the region, the major economies of Asia Pacific now share an unrelenting momentum to build out renewable energy in the following decades. Offshore wind, including floating technology, stands to benefit as a proven and scalable solution.

South Korea

While China, Taiwan and Japan are currently the region’s largest fixed-bottom offshore wind markets, South Korea has emerged as its centre of floating offshore wind development. Under its Green New Deal, the South Korean government is targeting 12GW in offshore wind capacity before 2030, primarily by leapfrogging to floating offshore wind. Reacting to favourable government policy and excellent wind resources, several international and Korean developers have announced joint ventures to develop large-scale floating projects, including:

IMAGE: GETTY Renewables Floating off shore wind 26 energy focus | www.the-eic.com

(Below) An off shore floating wind turbine 100m in height and with a bladespan of 40m, stands in the sea off the coast of the town of Naraha in Fukushima, Japan

Equinor and KNOC – Donghae project with 200MW capacity

TotalEnergies and Macquarie – five projects with 2GW total capacity

Shell and CoensHexicon – MunmuBaram project with 1.3GW capacity

Ocean Winds and Aker Offshore Wind –two projects with 1.3GW capacity.

South Korea’s bold position on floating offshore wind is a source of encouragement for UK companies with relevant technologies. However, the country’s strong steel, shipbuilding, electrical and cable industries present tough domestic competition to international players. UK companies are more likely to find success in project planning and management, foundation design and engineering, and installation and commissioning services, as there remains a distinct lack of domestic experience to deliver projects on time and on budget.

China

In 2021, China overtook the UK to become the world’s largest offshore wind market by installed capacity, accounting for 26GW of 54GW worldwide. This has been entirely fixed-bottom, though China’s first floating offshore wind demonstrator was installed in Yangjiang, Guangdong province, in the

second half of 2021, with a single 5.5MW typhoon-resistant turbine. Meanwhile, MingYang Smart Energy, one of China’s top OEMs, has introduced and secured overseas orders for its 11MW floating turbine and is spearheading grid-connected floating offshore wind development in Guangdong waters, which are much deeper than those along China’s eastern coast.

Like South Korea, the China market often gives the impression of being too big and too tough to crack. This sentiment is not without its merits, especially in the current context of highly restrictive entry into China for foreign nationals, which presents obvious business development challenges

in a culture that is systemically reliant on face-to-face relationship building.

However, by their own admission, Chinese developers are acutely aware of their lack of offshore experience, particularly in the operations and maintenance phase, where there is a shortage of skilled crew and digital solutions for integrity management, inspection and repairs. Once the build-out of floating offshore wind begins in earnest, opportunities for UK expertise in subsea structures, such as dynamic cabling, mooring and anchoring solutions, are also likely to emerge.

Taiwan and Japan

Both Japan and Taiwan are highly suited to floating offshore wind, but neither has presented a clear roadmap for its development. Taiwan is arguably the region’s most international offshore wind market, and one that UK companies have secured most successes in, with plans to add a further 15GW from 2026 to 2035. The Taiwanese government has signalled its intention to develop a floating offshore wind demonstrator, led by National Taiwan University and the state-owned shipbuilder CSBC Corporation.

However, Taiwan’s floating policy remains ambiguous and is based on offering the same auction ceiling price as fixedbottom projects for the upcoming Round 3, which has understandably discouraged developers from bidding for floating projects. In that respect, floating offshore wind is unlikely to take off in Taiwan until the pricing mechanism changes or new ways of financing more expensive floating projects become available, such as through corporate power purchase agreements.

In June 2021, Japan launched its first floating offshore wind auction for 16.8MW, which was won by a consortium of six companies, led by Toda Corporation. However, Japan appears more likely to rely on fixed-bottom technology for its offshore wind target of 10 GW by 2030, and would only start to develop large-scale floating projects thereafter to reach its phase two target of 30GW–45GW by 2040

By Kevin Liu, Head of Energy and Low Carbon Transition – Asia Pacific, Scottish Development International

Floating offshore wind: Renewables

www.the-eic.com | energy focus 27

Current and future CAPEX projects planned through to

Japan 3 projects US$5.28bn Taiwan 3 projects US$9bn South Korea 12 projects US$11.33bn

South Korea’s bold position on floating offshore wind is a source of encouragement for UK companies with relevant technologies

2030

STORM-WORK The best performing work basket. +44 1872 321155 info@reflexmarine.com www.reflexmarine.com Don’t let the size fool you.

,

In February 2020, Sustainable Aviation – a UK-based coalition of airlines, aerospace manufacturers, airports and other aviationrelated companies – published a Decarbonisation Road-Map setting out a credible pathway to achieving ‘jet zero’ by 2050. A 2050 goal is vital, but to meet investor, consumer and public expectations, we have to be scaling up solutions and cutting carbon now.

Achieving jet zero