Australian food producers are having their right to use the word ‘Agrumato’ challenged, with an Italian entity attempting to trademark the term in Australia.

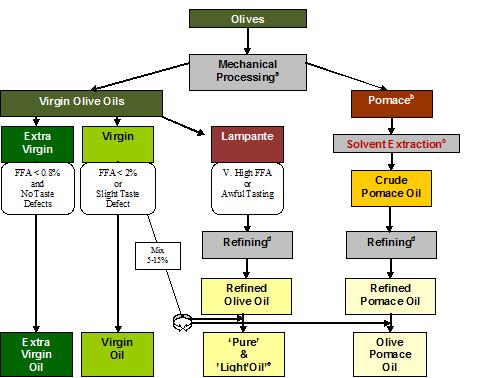

In January 2022 IP Australia received an application from an Italian company seeking to register a trademark over the word ‘Agrumato’. The company claims to have created the process of co-processing citrus and olives to produce citrus flavoured oil, a product it calls ‘Agrumato’. Despite being recognised as an historical practice in the Abruzzo region, the company has successfully trademarked the term as a brand in Italy and also in the US.

The AOA was made aware of the company’s intentions in early 2022 when several Australian producers received legal notices to cease using ‘Agrumato’ on their products. This notification referenced the company’s trademark in Europe but has no legal standing here, as the term is not trademarked in Australia.

The AOA has subsequently monitored the application throughout the examination process (during which no public input is available) and can confirm that in midJanuary this year it was accepted by IP Australia.

Importantly, however, during the examination process there were a number of Adverse Report communications between IP Australia and the applicants, resulting in changes to the listings of products to be covered by the trademark application acceptance.

Specifically, the items “edible oils and fats; extra virgin olive oil for food” had been removed from the Class 29 application category, with “olive pastes” now the only olive-related product listed.

Note: the application scope includes an additional wide range of food items with no relation to olives co-processed with citrus or other flavouring elements. See full list below.

Upon acceptance the application moved into the Opposition period, which provided a two-month period (to mid-March) for lodgment of opposition to the granting of the trademark.

The AOA immediately commenced co-ordination of a collective opposition submission on behalf of Australian producers: anyone whose business may be

THE INNOVATIVE AND QUALITY RANGE FROM

impacted by the granting of the trademark (i.e. those currently marketing, or planning to market, olive oils labelled ‘Agrumato’) was invited to send details of their opposition to the AOA by late February. Opposition submissions were then collated and included in an industry-representative opposition which has been submitted by the AOA. Information was also provided to producers who wished to lodge their own individual opposition.

Prior to preparing the industry opposition submission, the AOA sought to further determine the probable impact of the application on Australian flavoured oil producers.

On 19 January AOA CEO Michael Southan requested confirmation from IP Australia “that Trade Mark No. 2248457 for Agrumato does not apply to Extra Virgin Olive Oil or Olive Oil” and received the following reply:

“I can confirm the current classifications listed on trade mark 2248457 are:

Class 29: Dried, frozen and cooked fruits and vegetables; gelatin; jams; marmalade; milk products; olive pastes.

Class 30: Coffee, tea, cocoa and artificial coffee; rice; tapioca and sago; flour and preparations made from cereals; bread,

pastries and confectionery; ice cream; sugar; honey; molasses syrup for culinary purposes; yeast; baking-powder; salt; vinegar; mustard; spices.”

Ongoing concern

Southan said that the removal of the references to olive oil are positive, however there is still concern about the term being trademarked for any food products.

“It’s been removed for olive oil, which appears to show that IP Australia have identified its existing common usage by Australian flavoured olive oil producers,” he said.

“It still applies to ‘olive pastes’, however, and there is the chance that an owner of the trademark could apply pressure on Australian olive producers to stop using the term. While there would be no legal standing for this as it would not apply to olive oil, a cease and desist letter from lawyers, and the subsequent actions to deal with it, would cause unnecessary stress and time/ cost expense for our producers. And they may not all be aware of the true status of the trademark, so may act unnecessarily on the contact.

“We know that the company has already also trademarked the term in the US, where the industry was unaware of the application and therefore did not have the chance

The term 'Agrumato' is in common usage by consumers and retailers across the globe, and has been in official AOA use for many years to define co-processed flavoured oils.

There are many reasons why the granting of an Australian trademark for the term ‘Agrumato’ is inappropriate. Here are the main ones:

• The term is in common usage in Australia, New Zealand and other countries across the globe, by both producers and consumers.

• The term has appeared in official AOA publications for at least 10 years. For example, the Australian Olive Industry Code of Practice, Second EditionOctober 2013 includes a section on “Recommended label terminology to be used for flavoured (Agrumato style) olive oils”.

*Note: this directly refutes the applicant’s claim that “the words in the Mark have no meaning in English”.

• The practice of co-processing citrus and olives for oil has an even longer history, acknowledged well before it was formalised as the trademarked (in Italy) brand AGRUMATO® in 1989 - e.g.

“In the region of Abruzzo, bordering the Adriatic Sea, olive farmers have traditionally created citrus oils for family and friends but was kept always at home for personal use, never sold. The crisp freshness of Agrumato is achieved by the whole-fruit crushing process, which cannot be duplicated by the more common infusion method of other citrus flavored oils.” - www.italco.com

“Traditionally in this region of Italy, olive farmers have celebrated the end of the harvest by crushing lemons with freshly picked olives. The Ricci family had the ingenuity to bottle this unique oil, reviving a nearly forgotten Abruzzese tradition, as well as create new flavors with different citrus fruits.” - www.manicaretti.com

• The applicant’s own website states that co-processed oil is not a new product, rather the brand and trademark were:

“Created by visionary minds determined to revolutionize the very essence of a halfknown and forgotten product, lemon oil would have disappeared for good, were it not for the insight and passion of the Ricci brothers.” - www.agrumato.it

• The term - again, as referenced on the applicant’s own website - relates to products comprised of olive oil and (generally) citrus: “… these extraordinary seasonings based on Extra Virgin Olive Oil and Citrus.” - www.agrumato.it

The trademarking of the term in relation to the wide range of entirely unrelated food products in the application is therefore irrelevant and inappropriate.

to oppose it. A number of flavoured oil producers are now being forced to change their labelling and cease using the term. This is no doubt what would have happened here without due diligence by IP Australia and opposition from the olive industry.

“Australian consumers also know ‘Agrumato’ as a term for co-processed flavoured oils - as do producers and consumers around the globe - and we believe that trademarking the term for other food products is inappropriate.

STARK L — 37mm cutting capacity, powerful 21.6v Lithium Ion Cordless plug in battery power, Pole mountable, available with 2 or 3 batteries as required. Ideal for Olive and fruit orchards.

T-Fox —

“We have documented these and other reasons in our industry opposition and hope they assist IP Australia in deciding the trademark should not be granted in any form.”

To view the full details of the application, go to www.search.ipaustralia.gov.au/ trademarks and search for ‘Agrumato’.

We’ll also update on progress in the June edition of Olivegrower & Processor

STARK L — Telescopic Extension Pole - 1.5mtr to 2.3mtr, Carbon Fibre material, easily gives you the option to transform your STARK L into a tool that will prune high up into the canopy of your trees.

ALICE 58 Premium –Market leading harvester with improved speed options through 58v Brushless Motor, lighter and longer lasting parts, lighter Carbon Fibre Poles as well as optional Aluminium Pole alternative. Can be run off 12v Battery or new 58v Backpack alternative.

For more information and the nearest stockist in your area, contact us on P: 08 8351 8611

1 Marlow Road, Keswick 5035 South Australia E: info@eclipseenterprises.com.au W: www.eclipseenterprises.com.au

The AOA has gone into bat for olive growers in the Mudgee region, putting its national organisation body weight behind the fight to stop a toxic mine being developed in the area.

Background

Development assessment is currently underway of an application by Bowdens Silver Pty Ltd for “an open cut silver mine and associated infrastructure” being constructed at Lue, in the Mid-Western Regional local government area (LGA) of NSW. The site is very close to the popular Mudgee-Rylstone tourist trail and surrounded by agriculture, while the LGA contains 44,400 olive trees planted over 336 hectares. This includes a significant international award-winning olive business less than five km from the mine. Opposition to the mine has been led by the Lue Action Group (LAG), a local volunteer group formed to ensure responsible development of the region. The LAG is opposed to the Bowdens mine proposal on the basis that the mine would have unacceptable impacts on the community, its people and the surrounding environment in the short, medium and long term.

Following a now-closed public submission period, the NSW Independent Planning Commission (IPC) will determine whether the project will go ahead. There is no official timeline for the decision.

While the mine is purported to be predominantly extracting silver, closer scrutiny has revealed that the greatest quantities of mineral extracted will be zinc and lead. Bowdens' own projected ore volumes show that silver will, in fact, be the minority element extracted, accounting for 1,880 tonnes (T) compared with lead (95,000T) and zinc (130,000T). This means that 50 times more lead than silver will be produced over the life of the mine.

The LAG describes the mine as a “potential environmental disaster”, threatening water security and quality, and exposing the community and environment to both the long-term effects of contamination from the tailings dam and dangerous lead exposure.

The proposed 112.5 hectare tailings dam lies across a fault line at the headwaters of the Lawson Creek, which flows into the Cudgegong River at Mudgee. Containing poisonous materials like cyanide, arsenic

and lead particles, Bowdens predicts a best case scenario of 170,000L of leakage per day.

But the dangers from lead exposure exist from all stages of the mining process - and well beyond - the LAG says, as “the only safe place for lead is in the ground”. Even very low levels of exposure can have lifelong detrimental health effects and are particularly dangerous for children.

However the LAG says that “The data Bowdens uses in its project proposal underestimates community exposure levels of lead. It ignores concentrate, mine ore materials or tailings as potential sources of lead dust and fails to analyse the effect of peak wind events.”

The AOA agrees, and is concerned about the very likely impact of olive oil from the region being contaminated with lead. So AOA Michael Southan did his own research into lead and plants, and presented the NSW IPC with a more realistic set of facts.

“I dug back into the original consultants’ reports that the department had used to give the go ahead for the mine, and there were things that didn’t line up with what the consultants had said,” he said.

“Most significantly, the NSW Department of Planning and Environment (DPE) report,

under Agricultural Impacts, states that ‘enRiskS also determined that contributions of lead to soil and water would be negligible … enRiskS also noted that lead is poorly taken up into plants, so impacts on crops are unlikely’.

“In addition, the report indicated that the bioaccessibility of lead was 33% - but in soil samples taken at 0-5 cm, with only one taken from 30-60 cm, so how representative is this of the mine? And it goes on to say that this value ‘… only relates to the ingestion of soil or dust, not the ingestion of lead from any other media such as water or food products’.

“So gathered some relevant scientific data, put some slides together and put it to the IPC at the public consultation hearings. I showed that lead IS taken up by plants, and it WILL go into the water table.

“Noting that the reports outline Acid Mine Drainage (AMD) as a significant risk in this project, and that Low pH or acidic water created by AMD solubilizes heavy metals, I drew their attention to the fact that solubilised lead reaching the water table and water courses presents a significant pathway for lead to be taken up by plants (olives) from soil water and irrigation water from bores, dams, and creek water. The enRiskS report did not address this significant pathway for lead to enter local food production.

Threats to olive industry

“I was there primarily to represent our industry, so I made them aware that, as lead is absorbed by plants mainly through the roots from soil solution and causes lipid peroxidation, in the case of olive trees it destroys the quality of the oil produced. “I stressed that approval of the mine would put the valuable ‘clean, green, exceptional quality’ reputation of Australian EVOO at risk - threatening the viability of both local producers and the national industry.”

The AOA’s support of the Mudgee region growers’ fight to stop the mine is just one example of the organisation’s ongoing advocacy work, and Southan said he wants producers to know that they’re not alone in these sorts of situations.

“As a smaller industry body we may not have the big dollars or clout that the grain or cattle associations do but we have a smart, pro-active and politically savvy board, backed by a strong network of industry experts and associates,” he said.

“We can’t promise to always ‘win’ but we’ll support our producers where we can, flying the flag for issues prioritised by the board to efficiently use our limited resources.”

There’s more detail on the mine and the opposition on the Lue Action Group website, www.lueactiongroup.org, where you’ll also find a link to all proposal documentation on the NSW Department of Planning and Environment website.

The AOA has welcomed two new Directors to its Board, with Westerly Isbaih and Jared Bettio both signing on in late-2022. We asked them a few questions to help members get to know them better.

Westerly Isbaih, Director - Tasmania

Westerly Isbaih is Sales and Marketing Manager for awardwinning EVOO and table olive producer ALTO Olives, and lives in Hobart, Tasmania.

OG&P: Why did you want to join the AOA Board?

WI: To be honest I was hesitant because I already work full-time for our family business, ALTO Olives, and full-time as a mother to my five-year-old boy, so was unsure that could take on another big responsibility. But then I figured that I have always been a strong and very vocal advocate for the Australian olive industry in the work that I do, which involves educating as many people as possible about why they should choose to buy Australian EVOOs.

I am also a big believer in giving back, and this is a way that I can do that for the industry and community that has given me much joy, many challenges, and serious job satisfaction in my career so far. And at the end of the day believe with all my heart in this industry and the foods that we grow, produce and sell, and I want see it do well.

OG&P: What do you bring to the role?

WI: I have been working in the broader food industry for almost 20 years now, with the last 16 having a specific focus on Australian EVOO and table olives - in the sales and marketing of our own brand, ALTO Olives, and in the countless olive oil and table olive competitions I have judged in. Also in my role as an EVOO educator bringing the message of why consumers should be choosing to purchase Australian EVOOs and table olives, whether in a professional kitchen or for their own home cooking. I believe that all of these skills, as well as my vast food industry experience and connections, can be utilized at a more macro level by being part of the board.

Plus I have enthusiasm for days.

OG&P: Are there any particular issues you’re keen to focus on?

WI: believe that we as an industry are not yet seen as part of the bigger conversation around food, health and sustainability in this

country, and we really should be. There is no point only getting the message out to other olive folk, our messaging needs to reach a much wider audience.

Chefs, retailers, consumers, health professionals, media folkbasically everyone that values good food that is grown and produced sustainably and that also happens to be so damn good for us to eat from a health perspective - should all be shouting from the rooftops about Australian EVOO and table olives, or at least valuing our products and having an understanding about what it costs to produce the quality that we generally do.

But we still face the issue of EVOO being seen by many as a commodity item, and that means that people are not willing to pay for it. And that is a problem. Good, wholesome, healthy food isn’t cheap to produce. Why should EVOO be any different?

OG&P: What you see as the opportunities for the industry right now?

WI: Olives are one of the oldest cultivated foods on earth and the EVOO that they make is well researched and documented as being one of the healthiest fats we can consume. We are currently facing a global health crisis, particularly in the Western world, of inflammatory diseases, diabetes and heart disease. Diet, along with exercise, has everything to do with solving these problems. And EVOO is an important part of that solution. And guess what? That is what we do. We collectively produce one of the oldest, healthiest and most

important foods on the planet. We need to mine that opportunity for all it’s worth!

And the fact that we are also facing an environmental crisis, and that we all grow trees that are very efficient at sequestering carbon back into the soil, well there must be an opportunity in there somewhere too.

OG&P: And the challenges?

WI: There are loads, as there are in any industry, but for me the fact that we don’t have funds for more effective marketing of our amazing industry is a big one. And don’t know what the answer to that is.

All I know is that there is power in the collective and that we need to be working together to promote ourselves on an industry level, not just an individual one. And that we need to be a part of the bigger conversation around food, health and sustainability for the future.

Jared Bettio - Director

Jared Bettio brings hands-on production experience to the Board, as a grower, processor and General Manager of his family’s SA-based business, Rio Vista Olives.

OG&P: Why did you want to join the AOA Board?

JB: I want the industry to thrive and I wanted to make sure that happens.

My perspective is a bit different because I grow, process and I sell. I’m involved from one end to other, and hands-on with it all, and being part of the AOA Board means I can be hands-on in trying to promote the industry better. I’m also part of Olives SA, and on their Board, but the scope there is more limited.

I’m really interested in promotion to chefs and the food service industry, in particular, and keen to see the industry work hand-inhand with them to raise the profile of olive oil. I’d like them to become like they are with the wine industry, where there’s promotion of how food and wine complement each other.

OG&P: What do you bring to the role?

JB: A big picture perspective.

From my limited time in the industry, I’ve gained contacts in Italy, Spain and Northern Europe. I’m in the loop with what the market is demanding and the direction that the international market is going. And at the moment, ultra-high polyphenol oil is the way we’re going.

So one of the main things I can contribute is a wider perspective than what we get inside Australia.

OG&P: Are there any particular issues you’re keen to focus on?

JB: want to see the industry being viable for a small grower, like it is Europe.

In Italy a grower can live off a grove of 800-1200 trees because they get paid properly for their oil. Yes, they get subsidies to some degree but what they get paid at the mill per litre is about double what we get. It should be the same here.

It’s really bad to see how many Australian groves are being pushed out or becoming derelict, and want to see that it become viable for small growers to keep their groves.

That’s my goal, to do that at Board level.

OG&P: What you see as the opportunities for the industry right now?

JB: The opportunity is that we’re not bound by tradition in this country; we’re willing to innovate and try new things and be at the cutting edge. So Australian producers have the opportunity to be at the top of the industry across the globe.

OG&P: And the challenges?

JB: We are not taken seriously compared to European producers, even by Australian consumers. It’s a matter of us as an industry being seen as a top-end product around the world. That’s the challenge we need to meet.

AOA CEO Michael Southan said Westerly and Jared are very positive additions to the Board.

“It’s terrific having two new directors join the board and, as younger members of the industry, Westerly and Jared both bring a new perspective and enthusiasm. They’ve already contributed greatly at the first couple of board meetings they’ve attended,” he said.

“And each have strengths in different focus areas, Westerly in marketing and food service, and Jared in business and project management from his past life as a builder.

“They’re both really engaged and proactive, and we’re all looking forward to seeing what we can achieve over the next few years.”

Thanks to all the small-batch processors who have sent us their details: they’re now on our register, which we reference to connect processors with people wanting to utilise their services.

The Olivegrower and AOA team regularly receive enquiries from people looking for small-batch processors, so we’ve put a register together which enables us to connect producers with small crops and processors who can process for them, to the mutual benefit of both.

We’d like to include all processors across Australia and New Zealand willing and able to process small batches of olives, both individually and also those offering group crushings.

If this is you, please send your details to Olivegrower editor Gerri Nelligan, including contact and pricing details, minimum quantities required, and whether you will crush individually or on a “mix and percentage” basis.

We’ve got a good list already, and it’s worked well in recent years, so we’re keen to make the register as complete as possible. Please send us your details so we can add you to the list – it could mean valuable additional work for your business. In particular, we’re keen to hear from small batch processors in New South Wales, South Australia and Queensland

To be included on the register, please email your details to Olivegrower editor Gerri Nelligan at e ditor@olivegrower.com.au

•

The 2023 US News Best Diet rating has yet again confirmed what we all know: that the Mediterranean diet is THE Best Diet for those wanting to eat healthier. The olive oil-rich eating regime took the #1 spot in the Best Diets Overall category, racking up six consecutive years as the survey’s outright winner.

Awarded a score of 4.6/5 - even higher than last year’s top score of 4.2/5 - the Mediterranean diet also ranked first in four other categories, making its total #1 tally:

• #1 in Best Diets Overall

#1 in Best Plant-Based Diets

• #1 in Best Diets for Healthy Eating

• #1 in Best Diets for Bone and Joint Health (tie)

• #1 in Best Family Friendly Diets (tie)

The Mediterranean diet was among the top ratings in three additional categories:

#2 in Best Diets for Heart Health

• #2 in Best Diets for Diabetes

• #3 in Easiest Diets to Follow making it among the top three in eight out of the 11 categories rated, from the 24 diets included.

In fact, the only categories in which the Mediterranean diet didn’t make the top rankings were those related to weight loss. That’s not surprising, given that it focuses on overall diet quality rather than a single nutrient or food group. It also focuses on long-term health benefits and lifestyle accessibility rather than ‘dieting’ as such and was therefore ranked at equal #5 in Best Weight-Loss Diets (from #12 in 2022) and equal #21 in Best Fast Weight-Loss Diets (#25 in 2022). The former no doubt reflects the many scientific studies which have proven that a Mediterranean way of eating is an effective diet for weight loss and weight maintenance.

The 2023 Best Diet Review also notes the significance of inflammation in many health conditions, with coronary heart disease, major depression and cancer - among others - linked to increased levels of inflammatory markers in the blood.

It references red wine and olive oil as elements of the Mediterranean diet with anti-inflammatory properties and we were pleased to read the comment:

“However, the type of olive oil appears to matter. The refined varieties are mostly devoid of the antioxidants in extra-virgin olive oil, created from the first pressing of the ripe olive fruit.”

Confirming the validity of previous results, the overall top four ranking diets for 2023 were a repeat of last year’s listing, with the DASH (Dietary Approaches to Stop Hypertension) Diet and Flexitarian Diet tied at #2 (Flexitarian #3 in 2022) and the Mind Diet at #4.

All of these diets emphasise an increase in plant-based foods and support the consumption of “healthy fats” - with olive oil specified in all - along with a decrease in saturated fats.

The US News’ diet rating website in fact describes the Mediterranean diet pyramid as emphasizing the consumption of olive oil. We were pleased to read also the reference to olive oil as “a cooking staple in

Mediterranean recipes”, as well the accepted “key salad dressing ingredient”.

The ranking process

Now in its 13th year, the annual US News Best Diets listing ranks current popular diets across a number of categories, rating their effects on aspects including heart health, short- and long-term weight loss, ease of following, safety and nutrition.

For the 2023 listing, detailed assessments of 38 diets were prepared by US News and reviewed by a panel of 33 nationally recognized experts in nutrition, obesity, food psychology and chronic disease management. The experts then rated each diet based on various criteria, with the total scores out of five (highest) used to construct the Best Diets rankings across the 11 categories.

Source: www.usnews.com.

One of the main aims of the Australian International Olive Awards (AIOA) is nurturing growers and producers to improve and further develop their products. All entries receive substantial feedback from the judges, who also provide enlightening commentary on the overall quality and seasonal trends of each year’s oils and olives. There’s a lot we can learn from their feedback, so let’s take a look at what the 2022 AIOA judges had to say about last year’s entries.

One of the stand-out sentiments of the 2022 international judging panels was that Australian producers are continuing to push the quality envelope.

As AOA CEO Michael Southan stated in his foreword to the 2022 AIOA Results Book:

“The judges noted that, even after a challenging harvest, the quality had lifted compared with previous years. The best oils were superb and the superb oils were many.”

Event convenor and Chief Steward Trudie Michels agreed, commenting that “feedback was that the extra virgin and flavoured oils in general were quite spectacular, and table olive quality was also very good. The entries in the

Specialty Olives class were particularly good, and were a delight to taste.”

That was reflected in the competition results, with the average judges’ score for 2022 AIOA entries rising to an impressive 82.5/100, a very high Silver. This was an increase on both the 2021 average score of 78.2 and 2020’s previous high of 81.7.

Silver and Gold medals also dominated the results, and 89% of entries were awarded a medal.

Praise from the judges

Here’s what some of the judges had to say about the high quality of 2022 entries, in their own words:

HARVESTING

• $220/hr using vibrating trunk shaker - depending on

• management of grove, elevation and yield, can average $3/tree

• 15 years’ experience with small, medium and large machines to cater for all groves, with option of 5, 6, 7, 8 metre umbrellas

• No job too small or too large

• 5 harvesters available

cONTRacT haRVeSTING – FROM $2.50 PeR TRee, cONDITIONS aPPLy

PROCESSING: We are affiliated with 8 processing plants using latest technology that can extract maximum yield and quality of oil.

PROCESSING RATES:

cOMPLeTe cOMMeRcIaL PROceSSING LINe

• Up to 1 ton from $350/ton

• 1-4 ton from $300/ton

• Over 4 ton from $200/ton

• No start-up fee

• Bin hire $1/bin/day

TRANSPORT: $185 per hr including truck and driver MARKET: We have buyers available to buy your oil

product featured.

CONSULTING – COMMONSENSE ADVICE FOR A MORE VIABLE GROVE

With 15 years experience harvesting over 400 groves all aver Australia and having escorted 11 olive study tours worldwide, I have much knowledge to share with you regarding: WATERING, PRUNING, WEEDING, VARIETIES, SPACINGS, FERTIGATION that will increase your yield.

M: 0429377886

E: tomtiganikingsford@gmail.com

Dr Agustí Romero, Spanish panel

“This year, some of the samples were surprisingly clean, complex, and balanced … Some of the best had particularities, like an enhanced green volatile or some clear tropical fruits undertones, very difficult to obtain. To sum up, the set of samples assessed by the Spanish jury was of very good quality and not far from the best oils produced in our country.”

“The outstanding oils were excellent, with intense, complex fruity aromas, that transferred well to the palate. In the mouth, the complexity increased with a range of interesting flavours. These oils were fresh and lively, very well balanced, rounded, and harmonious and had excellent persistence.”

“If I could sum up the oils in one word, it would be ‘crafted’. Producers are crafting higher quality oils than ever before.”

Constructive comment from the judges … While quality overall was lauded, and no extra virgin olive oil entries in this year’s competition failed the chemical analysis, a number were not awarded medals. Judging comment attributed this to issues including: lack of fruit freshness, aroma and flavour intensity; oily mouthfeel; short length; unbalanced bitterness, pungency, and astringency; and/or evidence of defects.

What makes a Gold medal flavoured oil?

On first impression a gold medal flavoured oil is fresh and fault free. On smelling the oil, it shows excellent intensity of the flavouring element/s (lemon, rosemary, etc.). It has varying attractive aromas highlighting the flavouring element/s and where possible fresh olive oil. The aromas and flavours are authentic and pure representations of the flavouring (not artificial).

In the mouth the aromas transfer to the palate and are as intense or more intense than on the nose. It tastes fresh, vibrant, and clean. The oil feels light (not oily) on the palate. The oil’s level of bitterness, pepper and/or astringency is balanced with the flavouring element/s. A gold medal oil has a flavourful lingering finish.

A gold medal flavoured oil showcases the flavouring element/s purely, and will be fresh, balanced, complex and harmonious. You will want to get in the kitchen and start cooking.

complexity and ‘wow’ factors that make for outstanding oils”.

“Some had good aromas but then did not deliver the same intensity on the palate and the reverse was also noted - a very low aroma with increased intensity in the mouth.

“Some of the oils were unbalanced, with low fruitiness and high levels of pungency and/or bitterness. Many of them were no longer fresh.”

Causative factors suggested by the various judging panels include:

over-ripe olives harvested

• elevated paste temperatures during processing

poor/less than ideal storage conditions, especially for delicate oils

*as these often have low polyphenol levels, storage in stainless steel under an inert gas and at temperatures of around 15°C are essential to maintain their quality.

• deficient post-harvest management, promoting yeast proliferation *time from harvest to processing is the most crucial element here.

Go for Gold!

The results listings for all medal-winning entries, along with more detailed competition information and statistics, are available by downloading the official 2022 AIOA Results Book from the competition website: www.internationaloliveawardsaustralia.com.au

What makes a Gold medal table olive?

On first impression a gold medal table olive has an attractive fresh-looking appearance, with an absence of skin blemishes, pock marks and bruises. The olive’s colour, size and shape are consistent with the class entered. The olive’s aroma (and brine) is fresh and fault free. On the palate the olive’s skin is firm but easy to bite (not tough). Flesh on green olives is firm but not woody. Flesh on black olives has reduced levels of firmness (i.e. softer) but not mushy.

Enrique García-Tenorio, Spanish panel

“Tasting once again the excellent Australian EVOO is for me an unforgettable experience that I look forward to every year and thank the Australian International Olive Awards for making it possible. The Aussie oils that we have tasted usually have a friendly mouth entry, which gives way to a feeling of spiciness and bitterness, that appears in its fair measure, perfectly coupled with complex and countless notes of fruitiness, to give rise to a remarkable sense of balance and persistence.”

“What a varied selection of flavoured oils we have this year. The rich and fragrant aromas and flavours range from citrus and truffle to garlic, chilli, and rosemary. All the flavoured oils are unique in their representation, and it was an absolute pleasure to taste and enjoy them. Hats off to the olive growers and blenders for doing a tremendous job and mastering the art of making delicious, flavoured oils.”

Spanish judge Dr Agustí Romero said that, while defects were “neither detected nor suspected” for the majority of samples tasted by his panel, “some less relevant quality problems were detected. These related to deficient post-harvest management that promotes yeast proliferation. This can degrade part of the flesh biophenols, producing volatile phenols that can mask the fruitiness with anomalous odor, resulting in a lower total score.

“The same happens when oils are not

What makes a Gold medal extra virgin olive oil?

When first smelling a gold medal extra virgin olive oil it is fresh and clean (fault free). It shows excellent fruit intensity with a variety of different aromas and scents.

filtered, mainly when they came from twophase systems.”

The New Zealand panel noted that, while all oils “were of an acceptable extra virgin quality, only a handful had the vibrancy,

If you missed out on a medal this year, or received a disappointing point score, please take the judges’ constructive feedback onboard. Then access the wealth of bestpractice resources and information available through the AOA, and use them all to achieve Gold medal quality in 2023 - and beyond.

The olive has excellent olive flavour. Any added flavourings or fillings (herb, EVOO, garlic) compliment the olive flavour, not overwhelm it. Bitterness, acidity, and salt levels are balanced, and none are overpowering.

A gold medal table olive is balanced, has great texture and is complex, with a long flavourful finish. You will want to eat the whole bowl.

“I have been involved in judging table olives since the inception of these classes in our competitions. have watched the standard rise with each show. I am aware of how difficult it can be to produce uniform product and am in awe of the standard some of our producers have reached.”

“It was a very good season for delicate oils, flavoured oils, and table olives, all of which made our job of judging best in those categories very challenging. The delicate extra virgin olive oils stood out for aroma smoothness and integration of lovely flavours.”

In the mouth the aromas transfer to the palate and are as intense or more intense than on the nose. It tastes fresh, vibrant, and clean. The oil feels light and creamy (not oily) on the palate. Depending on oil style, bitterness, pepper and/or astringency are present in varying degrees. A mild oil has little or no levels of pepper and pungency whilst a robust oil has significantly higher levels. Either way, they are in balance and do not overpower the fruit or mouthfeel.

A gold medal oil has a flavourful, lingering finish. The oil is fresh, balanced, complex and harmonious. You will want to drink it.

Chris and Andrea McCallum, Devon Siding Olives - Devon North, VIC

• Champion Victorian EVOO - Devon Siding Olives Frantoio

• Gold - Devon Siding Olives Frantoio

• Gold - Devon Siding Olives Hardy’s Mammoth Chris and Andrea missed out on attending the AIOA Presentation Dinner due to a flood-induced flight cancellation, so donned their gala outfits at home to celebrate their award.

Anne and Robert Ashbolt, Ashbolt FarmDerwent Valley, TAS Gold - Ashbolt Farm Ashbolt RL

• Silver - Ashbolt Farm Ashbolt FH

AIOA President Mike Thomsett with Rod Lingard, The Olive Press - Wellington, NZ

• Reserve Champion Italian Varietal - The Olive Press Pressed Gold Leccino

Gold - The Olive Press Pressed Gold Leccino

• Gold - The Olive Press Pressed Gold Picual

• Gold - The Olive Press Kaffir Lime Agrumato

• Gold - The Olive Press Midori Yuzu Olive Oil Silver - The Olive Press Rosmarino Blu Toscano Agrumato

Joo-Yee Lieu and Bruce Spinks, Wollundry Grove OlivesBrucedale, NSW

• Gold - Wollundry Grove Olives Spanish Blend Gold - Wollundry Grove Olives Distinctive

• Silver - Wollundry Grove Olives Delicate Travel issues stopped Joo-Yee and Bruce Spinks from making the award presentations, so they sent another of their creative grove shots to celebrate their 2022 AIOA success.

For those who haven’t seized the opportunity yet, here’s a quick reminder that entry of the AIOA now comes with yet another benefit – the opportunity to purchase the professional product images taken for the official AIOA Results Booklet.

The reflective nature of glass means bottles are a pain to photograph, and lighting is difficult with any form of packaging and product shape, so good product shots are hard to achieve for the average producer. And it’s expensive to have them taken professionally, particularly for small producers with only a few products.

So the official AIOA product images are now being made available to entrants at a minimal cost, to assist with marketing and promotion of your products.

Taken by a professional photographer, each is a stock shot with a white background. This makes them very versatile, and able to be included in any promotional opportunity: for use on your own website, Facebook page or Instagram feed, or provided to media.

This is a great opportunity to present your products in a professional light - don’t miss out, you can still order yours now!

Jenny Masters and Geoff Treloar, W2OlivesWagga Wagga, NSW

Champion Mild EVOO - W2Olives EVOO

• Gold - W2Olives EVOO

• Gold - W2O Basil Agrumato

Reserve Champion Mild EVOO - Pendleton Olive Estate Reserve

• Gold - Pendleton Olive Estate Reserve Gold - Pendleton Olive Estate Classic

• Gold - Pendleton Olive Estate Blood Orange Agrumato

• Silver - Pendleton Olive Estate Lemon Agrumato

The artwork is provided in a high-resolution format, so is also suitable for reproduction in hard print - e.g. magazines, flyers and brochures.

The cost is $35 (+ GST) per product shot, which can be ordered online from the AOA website: www.australianolives.com.au - resources - shop - decals

Whether via nature or nurture, many of us seem destined for our life’s chosen path. For Diana Olive Oil’s Domenic Scarfo that path was olive oil production, with both the passion and talent for the process literally passed down in his blood.

The South Australian producer was one of the highest achievers of the 2022 Australian International Olive Awards (AIOA), taking the trophy for Best Extra Virgin Olive Oil of Show - Commercial Volume for the Diana Novello. Earning a judges’ score of 94/100, the Gold medal winning Novello was also named Champion Medium Extra Virgin Olive Oil and Champion South Australian Extra Virgin Olive Oil.

The accolades topped off a great year for the Diana team, following hot on the heels of high-pointed Gold and Silver medals at the 2022 Royal Adelaide Olive Awards. They add to a 10-year cache of awards earned across Diana’s range of EVOOs, encompassing Gold, Silver and Bronze medals and Best of Show Awards, along with three successive Processor of the Year trophies at the SA awards.

Located in the renowned Fleurieu Peninsula food and wine region, 45km south of Adelaide, Diana Olive Oil is a family business spanning three generations.

Having grown up in the business, Domenic Scarfo is now General Manager, and said the company’s business - and brand reputation - has been built on a combination of shared family tradition and a commitment

to ongoing innovation and improvement.

“The Scarfo family have always been involved in olive oil production, even before the family migrated to Australia, so it was only natural that it continued once they were here,” he said.

“For my generation, it’s what we’ve known and done all our lives. Caring for the grove, harvesting, processing … these are skill and techniques that have been learned from previous generations, that are then constantly changing and evolving as newer techniques and technology is integrated.

“Diana Olive Oil pioneered the traditional basket press process in 1989, using olives grown on the family estate, and subsequently commenced processing for other growers.

“Through continual research and innovation in olive oil manufacturing, we established the business as an important industry production resource. We have evolved and expanded to other services over the years and now provide processing and bulk storage services through our state-ofthe-art equipment and facilities.

“Our advisory service also allows olive growers from around the region to utilise the

skills, experience and facilities at Diana Olive Oil to maximise the results they get from their own crop.

Quality by control

“Using proven techniques to deliver outstanding quality, we service customers both locally and globally. By controlling the complete cycle from planting, harvesting, and processing through to packaging and labelling, these customers can be confident

that their olive oil has been produced to the most rigorous standards, managed in a controlled and carefully co-ordinated system.

“Our consistent commitment to service and quality over the years has enabled Diana to become well-known as a reliable, costeffective company with excellent results in terms of high-end sustainable manufacturing and product management across Australia and overseas.”

“The experience gained from contract processing - coupled with ongoing innovation and modern technology - has certainly contributed to producing award-winning products.”

"... we haven’t limited ourselves to sourcing from one grove or certain varietals, but we draw from all across the state, and from as many growers as possible, to ensure we can deliver the best product outcome for each of our customers.”

As with all our Olivegrower profile interviews, we finished by asking Domenic what he loves best about being an olive oil producer and also what he really doesn’t enjoy.

The first part was simple:

“The opportunity to meet new people across a global industry.”

The second was “not applicable”, which we guess means he’s pretty positive about the industry, and his role in it.

It’s funny how often that’s the case with olive people!

And Domenic said his job is dedicated to make sure that continues.

“My role within the business is to ensure that Diana is represented as a national leader, achieving the best outcome for both growers and customers.”

While they originally pressed only their own estate-grown olives, Domenic said Diana’s wide experience in meeting client needs has seen them move to a multi-sourcing model.

“Diana prides itself on its ability to provide a superior service to its customers and that includes ensuring suitability of product for each client we work with,” he said.

‘That means we haven’t limited ourselves to sourcing from one grove or certain varietals, but we draw from all across the state, and from as many growers as possible, to ensure we can deliver the best product outcome for each of our customers.”

Meeting a processing need

Contract processing is a substantial element of Diana Olive Oil’s overall business and Domenic said it has provided benefits across the board.

“We naturally transitioned into contract processing after seeing a need for it within the industry. Meeting that demand has allowed the business to grow, and has led to Diana Olive Oil being able to offer the range of products and services that it does today,” he said.

“We also believe the experience gainedcoupled with ongoing innovation and modern technology - has certainly contributed to producing award-winning products.”

Those products include both oils for other customer brands across Australia and overseas, and Diana’s own self-labelled products. Once again aimed at meeting demand, Diana’s products come in flavour and size options which cater for a range of consumer tastes and needs.

2 Day Workshop, Rio Vista Olives, Mypolonga, SA.

Thursday, 13 April

9.00am – 5.00pm: Principles and practices

Evening: Networking dinner

Venue: Rio Vista Olives, Dinner TBC

Friday, 14 April

9.00am – 1.00pm: Practical processing session and tasting of trial oils

1.00pm – 1.45pm: Lunch

Venue: Rio Vista Olives

*Workshop includes on-demand pre-event webinar

Cost: $275 levy payers/AOA members; $375 others Visit

Registrations close 4 April 2023. Numbers limited – register now, don’t miss out!

The AIOA Best of Show-winning Novello EVOO (‘The new one’) is produced from the very first harvest of the season, with select batches of olives used to make a flavoursome, character-driven olive oil. Minimal production means it is sold only in a 250ml bottle.

Diana Red Label EVOO is made from riper olives picked mid-way through the harvest season. A ‘sweeter’ oil with a milder fruit intensity, the red label will not overpower the flavour of food and is ideal for general cooking. It is available in a range of package sizes to suit varying consumer needs, from 250ml and 500ml glass bottles to two litre casks and - for higher volume EVOO usersa 20 litre bulk pack with pourer tap. They also sell a 20 litre bulk pack Chef's Blend, providing the food service industry with high quality EVOO at an economical price.

While it’s clear that adoption of new techniques and technology is integral to Diana’s success and reputation, Domenic says he doesn’t think they really do anything differently to other high-quality producers. Rather, he said, it’s about knowing the ‘DNA’ of the fruit you’re working with.

“We believe it’s a combination of soil, climate and variety that makes a really good oil, and then the experience to know how that will translate into the oil,” he said.

“All of those factors make a difference to the oil quality, as some locations and varieties may favour a particular soil or climate that others don’t.”

We all know that there’s a lot of time and effort that goes into making that translation, and Domenic said that winning Best of Show at the Australian International is a welcome reward.

“It’s great acknowledgment for all the hard work put in,” he said.

“From a business point of view, it’s also a good tool to show our customers what we are achieving. People purchasing in the category understand that EVOO is the quality grade to purchase for "the better oil" and, while I don’t believe that consumers as a whole specifically target award-winning oils, their decision may be supplemented by relevant awards.

“I think these competitions are good for the industry too, to showcase their best of the best.”

More information: www.dianaoliveoil.com.au.

R&D Insights contains the latest levy-funded R&D project updates, research findings and related industry resources, which all happen under the Hort Innovation Olive Fund.

Hort Innovation partners with leading service providers to complete a range of R&D projects to ensure the long-term sustainability and profitability of the olive industry.

The AOA team have planning well underway for another round of industry knowledge-sharing events, run as part of the ongoing olive levy project Australian olive industry communications and extension program (OL18000).

Among the first events locked in is the annual Processing Workshop, one of the most in-demand events on the AOA’s calendar. Previously held in Boort, Victoria (and online during COVID lockdowns), the workshop is this year being held at Mypolonga, in South Australia’s Murraylands region, hosted by award-winning producers Rio Vista Olives.

“It demonstrated that it’s not

Making great EVOO is all about ensuring quality at every stage of the process, so the comprehensive twoday course covers it all - from grove management for optimal fruit quality to best-practice processing and storage. Along the way attendees learn a lot about olive oil chemistry, and get the answers to many of those frustrating “why did/does that happen to my

just a case of getting your olives in the machine and turning it on: you really have to investigate your fruit and then work with what you’ve got.”International production consultant Pablo Canamasas will take attendees through the fruit testing and preparation regime before heading inside for processing trials. State-of-the-art equipment, combined with a commitment to service and quality, has seen Diana grow to become a respected industry production resource servicing customers across Australia and overseas. With a judges’ score of 94/100, the Gold medal-winning Diana Novello was awarded the trophies for Best Extra Virgin Olive Oil of Show - Commercial Volume, Champion Medium Extra Virgin Olive Oil and Champion South Australian Extra Virgin Olive Oil.

"Caring for the grove, harvesting, processing … these are skill and techniques that have been learned from previous generations, that are then constantly changing and evolving as newer techniques and technology is integrated."

2023

When:

13-14 April 2023

*Pre-event webinar on demand

Where:

Rio Vista Olives, 262 Carawatha Drive, Mypolonga, SA

Presenters:

International Olive Oil Consultant

Pablo Canamasas - Quality, Chemistry, Processing

Rio Vista Olives Master Miller

Jared Bettio - Processing

Rio Vista Olives Marketing

Manager Sarah Ascuitto - EVOO

Tasting/Identifying Defects

Cost:

$275 - AOA members/levy payers

$375 - non-member/processor/ other industry

More information: www.olivebiz.com.au

oil?” questions, as the focus moves firmly onto the practical aspects of oil extraction.

Guiding participants through all this information is Pablo Canamasas, international olive oil consultant, processing expert and EVOO judge. He will be joined this year by Rio Vista Olives’ Master Miller Jared Bettio, a multi-award-winning olive grower and EVOO producer. Rio Vista also provide contract processing services for growers across the Adelaide Hills and Murraylands regions, so Jared knows a lot about dealing with widely varying batches of fruit.

Their combined wealth of knowledge and practical experience will ensure complex detail presented in a userfriendly format, making this a course for growers and producers at every stage and capacity.

Primed to process

An integral part of the workshop program is the pre-event webinar, which has been recorded and is available on-demand for registrants for viewing prior to the physical course.

Run by Canamasas, the webinar covers a good chunk of the course’s theoretical learning, with topics including grove management practices and their impact on quality; determining optimal harvesting times; oil storage and filtration; and a comprehensive look at the parameters determining olive oil quality and shelf life.

What information do YOU want?

Two of the “sell-out” elements of the industry communications and extension project are the national field day programs and the annual production workshops. Both are locked into the continuing five-year program, with some elements confirmed, but the organisers are keen to know what other topics you would like to see covered.

• Field days: what would you like them to focus on? Where should they be held in your state?

• Workshops: currently cover processing of EVOO and table olives. Are you interested in learning about producing flavoured olive oil?

Suggestions for webinar topics, fact sheets and other project outputs are also most welcome.

Please email your feedback to Liz at secretariat@australianolives.com.au. And many thanks to those of you who have already sent through your feedback!

and processes from grove to finished product.

Topics covered on Day 1 include fruit preparation; crushing and malaxing; horizontal and vertical centrifugation; impacts on oil quality; extraction efficiency; settling and storage.

The Day 2 program moves on to hands-on demonstrations of the processing methods and practices discussed the previous day. Fruit will be processed using different paste preparation approaches to evaluate oil extraction efficiency and quality, and the session will finish with a

tasting of the oils obtained during the trials and discussion around the results.

A networking dinner on Day 1 is also included, along with lunches and morning/afternoon tea breaks.

Register early

Places for the Processing Workshop are limited and sell out quickly each year, so if you’re keen to learn the science and best practice of producing high-quality EVOO, jump online and book your spot NOW! Register via ‘Events’ on the OliveBiz website - www.olivebiz.com.au

Applications are now open for the 2023 round of Churchill Fellowships, offering the opportunity to travel overseas and investigate a topic or issue you are passionate about.

Rounding out the presenting team is Rio Vista Marketing Manager Sarah Ascuitto, an AIOA judge and internationally qualified Olive Oil Sommelier. A master of descriptives with a brilliant palate, Sarah will take attendees through a tasting of EVOOs to identify significant characteristics, including common defects.

Providing an overview of the process prior to the workshop, the webinar allows attendees to get a handle on the science and theory before they experience the practical side.

The rest of the program happens at Rio Vista Olives’ Mypolonga grove and mill, where Canamasas and Bettio will work through the practices

Churchill Fellowships are a nonacademic award available to Australians from all walks of life, with no formal qualifications required to meet the criteria. Recipients receive fully-funded travel for four to eight weeks, and support from the Winston Churchill Trust, so they can spend time with international leaders in their field of interest, visiting and gleaning insights from abroad, and then bring their newfound knowledge and ideas home to benefit their industry or community.

Horticulture Fellowships

Hort Innovation has joined forces with the Churchill Trust to offer three

Fellowships annually, each valued at around $26,000, to drive innovation and transformation within Australia’s horticulture industry.

Run under the ongoing project

Churchill Fellowships (LP16002), the Fellowships are open to any industry participant with an idea for a research project that can benefit the horticultural sector. The topic of focus is completely up to the applicant, with a diverse range covered by the more than 4600 Fellows involved since the program started in 1965.

Each Fellow designs their own itinerary, however, applicants are expected to have worked through

the issue thoroughly in Australia, exhausting locally available knowledge. Importantly, they must also be able to demonstrate the potential benefits to their sector or community, and be willing to share the findings on their return.

The application round closes 1 May 2023 and recipients will be announced in September 2023, for travel in 2024.

For more information and to apply, go to www.churchilltrust.com.auBecome a Fellow

Churchill Fellowships are funded by the Hort Frontiers Leadership Fund, with co-investment from the Winston Churchill Memorial Foundation and contributions from the Australian Government.

“The results of the trial show that a few minor adjustments make a huge difference in terms of your output.”AIOA judge and internationally qualified Olive Oil Sommelier Sarah Ascuitto will lead a tasting of EVOOs to identify common defects and characteristics.

“It’s a fabulous course and I learned so much. We’ll definitely be changing practices from this.”

Protection from the olive industry’s number one disease risk, Xylella fastidiosa, could be on the horizon, thanks to an $8.7M investment by Hort Innovation to trial tree immunisations against the deadly bacteria. The project will also trial immunisation against Huanglongbing (HLB), a disease with similarly devastating outcomes for citrus trees.

Hort Innovation chief executive Brett Fifield said the project aims to safeguard key Australian horticulture industries by immunising trees with RNA-based technology, similar to coronavirus vaccines for humans. The RNA immunisations cause the tree’s cells to produce chemicals targeting the specific pathogens.

Investing in preparedness

“Xylella and HLB are two of the most threatening bacteria in fruit and nut trees worldwide, and if they found their way into Australia, the results would be catastrophic,” Fifield said.

“While these threats are not in Australia currently, being ready is crucial. This project is about preparedness, and adds to the more than $60M investment Hort Innovation is delivering in biosecurity measures to support and protect Australia’s $15.2B horticulture industries.

“The trial will begin with citrus and table grapes, and we will explore opportunities for this technology in almonds, avocados, olives and summerfruit.”

Combining technologies

The trial will be delivered through Hort Innovation and led by USbased agricultural biotechnology company Silvec Biologics, alongside the University of Queensland (UQ). Researchers will employ Silvec Biologics’ RNA-based plant immunisation technology, combined with Australian-developed BioClay™ technology to improve the delivery.

"The main challenge for RNA-based technology is not the development of the active ingredient but rather the delivery mechanism,” Silvec Biologics president Dr Rafael Simon said.

BioClay™ is an innovative topical protection medium which primes the plant’s own defences - in a similar way to how a vaccine works - helping the plant to attack specific crop pests and pathogens naturally.

It was developed through a three-year Hort Innovation multi-industry levy project, Novel topical vegetable, cotton virus and whitefly protection (VG16037), with research led by the University of Queensland. Run from 2018 to 2021, the project had a range of co-investors and aimed to minimise the economic impact of pests and diseases in major crops.

The project was grounded on two issues around crop protection:

Using clay particles as carriers, the research team developed the BioClay™ technology to deliver pesttargeting RNAi effectors that are stable, do not wash off and provide an extended window of protection. The clay particles naturally degrade on the leaf surface, alleviating any concerns about residues.

This project focused on developing the BioClay™ platform to target several major crop viruses and Silverleaf whitefly (SLW).

“BioClay™ protects the doublestranded RNA, enhancing the active ingredient delivery into trees, and has been validated for viruses, insect pests and fungi in multiple crop host systems. We will therefore leverage the locally-developed BioClay™ platform to improve the introduction of our vectors into trees.”

US trials ensure Australian biosecurity safety

Hort Innovation Acting Head of Production R&D Vino Rajandran said that, while this is an Australian-led project, the trial will be run off-shore.

“The trials are actually taking place in the US, where the pathogens are already present. There is no Xylella or HLB here, so it’s all safe that way,” he said.

“The biotech company are working to deliver a ‘vaccine’ by inoculating the budwood and introducing that into the trees. That will then stay in the tree system and fight the Xylella or other pathogen. And UQ will see if they can use BioClay™ as a system to affectively deliver the vaccine.

“They’re also going to test how persistent the vaccine will be; whether it will stay in the plant system and provide ongoing protection. That will happen in California, looking at table grapes and Xylella.

“If the trials are successful, the aim for the future would be to use the BioClay™ delivery for existing orchards, with new orchards established from nursery stock grown from inoculated mother trees.

Olives in scope

Rajandran said that while the initial work is on citrus and grape vines, olive growers will benefit from the project.

“Olive work is being done within the scope of the five-year project,” he said.

“By year four we will have at least a preliminary outcome and will be doing some lab-based tests with olives at that point.

“And once the technology is proven and marketable, it will be brought to Australia. We are a prioritised market now because of our investment, so if it does work we’ll definitely get access to it.”

AOA CEO Michael Southan said the technology would be a game-changer in the case of a local Xylella incursion.

“It’s the difference between being able to deal with Xylella if it becomes an established disease in Australia vs the industry disappearing if it did,” he said.

Firstly, the recognition that resistance, lack of pathogen specificity, residues, run-off into waterways and potential harm to human health and the environment are major issues with current crop protection practices. To this end, there was an obvious need for a new nonGM environmentally-friendly, safe and sustainable crop protection approach.

Secondly, the opportunities presented by RNA interference (RNAi) - and the limitations in its use.

RNAi is a strategy to engineer transgenic crops for the management of viruses, insects, nematodes and fungi.

*Transgenic describes an organism that contains genetic material into which DNA from an unrelated organism has been artificially introduced.

Topical application or spraying of double-stranded RNA (dsRNA) without the need for genetic modification presents a novel crop protection platform which is almost like ‘nature versus nature’, where a gene sequence from the pathogen is used to kill the pathogen itself. However, a major obstacle to commercialisation for horticultural use has been the instability of topically applied dsRNA on plants.

The two components of the platform, dsRNA and clay, were designed, modified, engineered and synthesised to industry-relevant parameters, including selection and isolation of the genes critical to survival of the viruses and SLW.

Spray application of BioClay™ for viruses was validated through multiple glasshouse and field trials, where it was found to provide protection against the viruses with no adverse effect on plant growth. For SLW, the BioClay™ platform was developed to target all stages of whitefly (eggs, nymphs, and adults), with the spray resulting in significant egg and nymph mortality. It was shown that dsRNA can enter into leaves of different host plants, moves systemically in both directions and is also taken up by whitefly feeding on the treated plants.

While the technology still needs to be validated at scale, the researchers concluded that:

“The Australian-owned and invented non-GM, nontoxic, target specific, easy to adopt and environment, grower, and consumer-friendly BioClay™ platform means clean, green produce for domestic consumption and exports, and preparedness for biosecurity threats.”

More information: www.horticulture.com.au.

“It very positive, and is a great example of using technology and research from other areas - in this case medicine - to develop a new technology to protect the Australian tree crop from these diseases.

“But this is a long way off and in the meantime, it’s important for the olive industry to observe and promote best practice in biosecurity measures to ensure Xylella doesn’t get to us before we can get to it.

“It’s not an opportunity to drop our guard: we need to maintain continuing vigilance in terms of biosecurity on our properties.”

This tree immunisation trial is funded by the Hort Frontiers strategic partnership initiative, which facilitates collaborative, cross-industry investments on longer-term and more complex themes identified as critical for Australian horticulture by 2030 and beyond. The aim is to better equip Australian horticulture for the future ahead through innovation and transformational R&D.

Hort Frontiers funds are sourced from a wide range of co-investors, including commercial businesses, research agencies, government departments and education institutions, as well as Australian Government contributions. Levy funds can also be invested if advised by an individual industry's Strategic Investment Advisory Panel.

While the individual goals of co-investment partners may differ, Hort Frontiers projects need to benefit all of horticulture to be considered suitable investments.

The latest edition of the Australian Horticulture Statistics Handbook is now available, providing data across the Australian horticulture industry for the year ending June 2022.

The data shows growth in both horticulture production volumes and values since the Handbook’s inception in 2012/13, with an additional 850,000T (tonnes) produced in 2021/22 and the annual value up by $6.15B (billion).

Overall horticulture figures 2021-2022

The horticulture sector overall achieved $15,622.4B in production value in 2021-2022, an increase of 3% from $15,241.1B in 2020-2021. There was mixed performance across the various commodity groups, with the major contributors of value growth being the vegetable and nut categories – which increased 12.9% and 16% respectively.

Total production

Total production across all horticultural products in 2021/22 was 6,545,575T (6,629,506T year ending June 2021).

Fruit accounted for well over a third of that figure at 2,551,741T (2,542,439T), with olives at 77,000T (130,000T).

Total value

Total value of all horticultural products in 2021/22 was $15,622.4M ($15,236.6M), with fruit again accounting for more than a third of that amount at $5,521.9M ($5,752.1M).

The production value of olives was $95.5m ($161.2M), ranking the industry at 18th (12th) in the fruit category.

Total exports

For the year ending June 2022, Australia exported $2.75B worth of horticultural products ($2.65B), with fresh fruit once again the largest value export grouping at $1,224.8M ($1,216.4M). Processed fruit accounted for $149.8M of the total ($154.7M), including olives and olive oil at $23.1M ($13.5M).

Total imports

For the year ending June 2022, Australia imported $2.84B ($3.03B)

worth of horticultural products. Processed fruit was again the largest value import grouping at $1,081M ($1,111.7M), including olives and olive oil valued at $175.7M ($244.2M).

The handbook covers four industry category sections - Vegetables, Fruit, Nuts, and Other horticulture.

Undoubtedly the most important element of the Fruit section (to us, anyway!) is the Olives Overview, providing a snapshot of the Australian olive industry for the 2021/22 year.

Key statistics include:

state-by-state production for the year has remained stable over recent years, with percentages remaining at: Victoria 69%, South

Australia and WA 11% each (WA 10% in 2020/21)) New South Wales 9%, and Queensland and Tasmania both <1% (QLD 1% in 2020/21);

the production area recorded also remained stable at 21,250 ha;

The international trade figures for 2021/22 saw differing outcomes for olive oil exports from and imports to Australia:

1,758T of olive oil was exported, down 15% on the 2020/21 figure of 2,061T. This followed the previous downward trend of a 23% reduction in 2019/20 (from 2,681T);

consequently the value of olive oil exports also decreased, but only by 10%, from $14.2M in 2020/2021 to $M12.8 in 2021/22. This is approximately two-third of the 2019/2020 value figure of $M18.8;

reversing the previous threeyear trend, olive oil imports also decreased, the 2021/22 figure of just 22,165T equating to a 40% reduction on the 37,201T in 2020/21. This is also a significant reduction from the 36,467T imported in 2019/20;

For the year ending June 2022, Australia imported 22,165 tonnes of olive oil ( this number does not include table olives). The exports and imports of olive oil over the last five financial years are profiled in the graph below, where imports are counted as negative tonnes.

1.25kg

annual production decreased by 41%, from the previous year’s record 130,000T to 77,000T. This is, however, a substantial increase on the 2019/20 harvest figure of 50,000T (previous ‘off-year’);

2021/22 based on the volume supplied.

production value also saw a parallel decrease, down 41% from $M161.2 in 2021/22 to $M55.5 ($M62 in 2019/20);

around 98% of the fruit crop was extracted for oil, producing 12,049T of olive oil; again, a substantial decrease from 20,678T in 2020/21 but more than 50% higher than the 8,662T produced in 2019/20;

the remaining fruit was used for table olive production, once again almost all for the domestic market;

the wholesale value of oil produced was $201.5M, down from $320.6M in 2020/21 and also the $M224 figure in 2019/20;

consumption of olive oil per capita, based on volume supplied, was 1.25kg, substantially lower than the 2.17kg figure in 2020/21 and also that of the previous two years.

the value of olive oil imports also saw a 35% decrease, down from $175.8M in 2020/21 to $114.2M in 2021/22 ($178.8M in 2019/20).

Note: no figures or information are provided for table olives.

While the dramatic decline (-40%) in olive oil imports from 2020/21 to 2021/22 is no doubt partially due to the impacts of the COVID-induced global supply chain disruption, we can also hope that this means that Australian olive oil (hence EVOO quality) has filled the gap and many more consumers are now aware of the exceptional quality of locallyproduced EVOO.

Now in its 8th edition, the Handbook is the leading resource for national horticulture statistics and market information. Produced annually by Hort Innovation, it contains the latest production, international trade, processing volumes and fresh market distribution data available, across 75 horticultural categories.

It captures the previous financial year’s data, drawn from supply chain sources including international trade

statistics and industry peak bodies.

It includes information on retail and food service use, exports and imports, share of production by State and Territory, wholesale value, and volume. The information available varies depending on the product and availability of relevant data.

The handbook is published as an interactive online dashboard enabling search functionality, with formats for both computer and mobile phone use. The original handbook format is also

available as separate downloadable PDF documents covering five category sections: Fruit (including olives), Vegetables, Nuts, Other Horticulture and Trade Analysis.

Both versions are available at www. horticulture.com.au/hortstats.

The Australian Horticulture Statistics Handbook 2021-22 was produced by the across-industry levy investment project Australian Horticulture Statistics Handbook 2021-22 to 202324 (MT21006).

DRAFT : Not for d

Hort Innovation has joined forces with nine other research and development corporations (RDCs) to launch a $19m investment to tackle climate change impacts on agriculture.

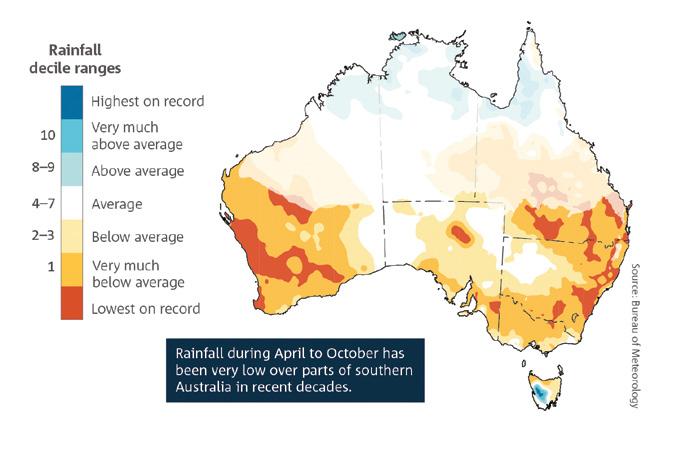

Led by Agricultural Innovation Australia, the Agri-Climate Outlooks project will build industry understanding and management of short-term climate risks and foster long-term resilience.

The four-year program will enable the Bureau of Meteorology (The Bureau, formerly BOM) to improve and greatly enhance seasonal outlook services provided to Australian producers. The Bureau estimates the initiative could potentially generate up to $68 million in value annually for agriculture.

Collaborative RDC program

Agri-Climate Outlooks is funded through cross-sectoral investment via a collaboration of 10 of Australia’s Rural Research and Development Corporations (RDCs): Meat & Livestock Australia, Australian Eggs, Australian Wool Innovation, Dairy Australia, AgriFutures Australia, Grains Research and Development Corporation, Fisheries Research and Development Corporation, Cotton Research and Development Corporation, Sugar Research Australia and Hort Innovation.

AIA CEO Sam Brown described the collaboration as ‘ground-breaking’ in its structure, seeing RDCs working together on a large-scale project with common goals to help growers and production enterprises mitigate the impacts of climate.

“Climate variability is proving to have a significant and devastating impact on agricultural and food production, as we have seen with recent floods, extreme weather events and the subsequent food shortages and supply chain challenges,” he said.

“Growers need the most reliable, accurate and timely seasonal forecasting information to help them manage and adapt to changing

climates. This initiative will improve the relevance, trust and ease of use of climate information in their decisionmaking via a whole-of-sector approach to agricultural innovation.”

Specific and dedicated Agri-Climate Outlooks will develop decision-specific digital forecast tools and products tailored to specific commodities. The program will also support improvements to Australia's dedicated weather forecast modelling system.

“This initiative will involve deep engagement across the industry to identify high-impact weather- and climate-dependent decisions which growers make, and then design fitfor-purpose products and services to support those decisions,” The Bureau's General Manager, Agriculture and Water Matthew Coulton said.

"It will also contribute to improving the accuracy of the underlying forecast, which will provide benefit across all growing and production industries now and into the future."

Program workstreams

The Bureau will manage five AgriClimate Outlooks workstreams, between them covering products, services, support and industry capability building:

1. establishment of a dedicated team of agri-climate specialists to provide relevant insights to support growers with climate-related decision-making;

2. upskilling and training for growers and their advisers to accurately interpret and utilise weather, climate and water products to inform agricultural decisions;

3. development of easy to understand, decision-specific forecast products, delivered via appropriate digital channels;

4. development of methods to overlay skill on the Bureau's seasonal outlook products and promote the methods as

best practice to other seasonal outlook service providers; and

5. improvements to Australia's high calibre sovereign seasonal forecasting, through improved accuracy of multiweek through to seasonal forecasts. This will help ensure the future stability of the Australian agriculture sector and increase the potential magnitude of benefits delivered via Workstreams 1-4.

These workstreams strategically leverage previous investments made by RDCs and the Australian Government in improving climate and weather capabilities, including the Climate Services for Agriculture platform.

Delivered by CSIRO and the Bureau of Meteorology, the Climate Services for Agriculture (CSA) prototype aims to help Australian farmers to adapt to climate variability and related trends, thereby improving the viability of their businesses.

The CSA prototype is unique in that it helps users understand the historical, seasonal and future climate at their specific location, to inform decisions for their business. It provides:

historical data from 1961-2020;

seasonal forecasts from 1-3 months; and

future climate projections to 2030, 2050 and 2070.