BC ADVANTAGE May /June 2024 | Issue 19.3 Providing resources for medical practices and the people behind them www.billing-coding.com Five Critical Comparisons to Evaluate AI in RCM Understanding the Changes in the CMS-HCC Model V28 Regulatory Issues Facing Radiology Groups in 2024 How Lab Benefits Management Can Smooth the Transition to Value-Based Care Considerations for Whistleblowers and Companies www.billing-coding.com/ceus

remember a time with black and white changing the TV channel (and yes, by manthe remote control), no dishwashing rotary telephones with cords, manual windows, food that didn’t have a bunch of words that made up the ingredient descripeverywhere on my bike. Life has changed, for us all in so many ways. We have change/update in our lifetime. And now used in many parts of our lives, whether like it or not. I get that it helps in many simplilearn.com, it is being used in diagnose diseases and develop new drugs and finance, it is being used to detect fraud, provide investment advice. We get to ask “thing” in our phones and get answers that were possible. We don’t need to think How long is it until we don’t know what just accept what we are told without

articles on AI, and both raise great points reading mindfully. Amy Wilcox, CPMA, from Find-A-Code has also written on and how AI ties into healthcare, and Fathom has written about five critical evaluate AI in RCM. Both perspectives show tasks within the medical administraa sidenote: Rachel Rose, JD, MBA has a about this in our CEU Center that digs a

little deeper on a domestic level and explains NIST).

We’ve got some other interesting articles for you in this issue. Debbie Jones from Medical Coding Buff has written about Zika—that virus that got our attention nearly 10 years ago. It’s still around, and she has provided coding exercises for you to complete. We also have contributions from Sonal Patel, Rachel Rose, Sandy Coffta, Leigh Poland, Teri GatchelSchmidt, and a new writer, Dr. Bill Kerr.

I hope you enjoy!

Until next time.

3 BC Advantage Magazine www.billing-coding.com

Letter Storm Kulhan M.A. editorial@billing-coding.com storm@billing-coding.com Subscriptions: To start a new subscription, please visit www.billing-coding.com/subscribe Renewals: Keep your rate locked in for life! www.billing-coding.com/renewals Change of address: Email subscriptions@billing-coding.com or call 864 228 7310 Advantage is published bimonthly by Billing-Coding, Inc. P.O. Box 1388, Newland, NC 28657 7310 Fax: (888) 573 7210 email: subscriptions@billing-coding.com / www.billing-coding.com coo Nichole Anderson, CPC nichole@billing-coding.com subscriptions manager Ashley Knight ashley@billing-coding.com advertising sales@billing-coding.com

10: Coding for Zika: Unraveling the Threat of a Silent Predator

16: Regulatory Issues Facing Radiology Groups in 2024

20: How Lab Benefits Management Can Smooth the Transition to Value-Based Care

24: Understanding the Changes in the CMS-HCC Model V28

34: Artificial Intelligence in Healthcare: A Medical Coder’s Perspective

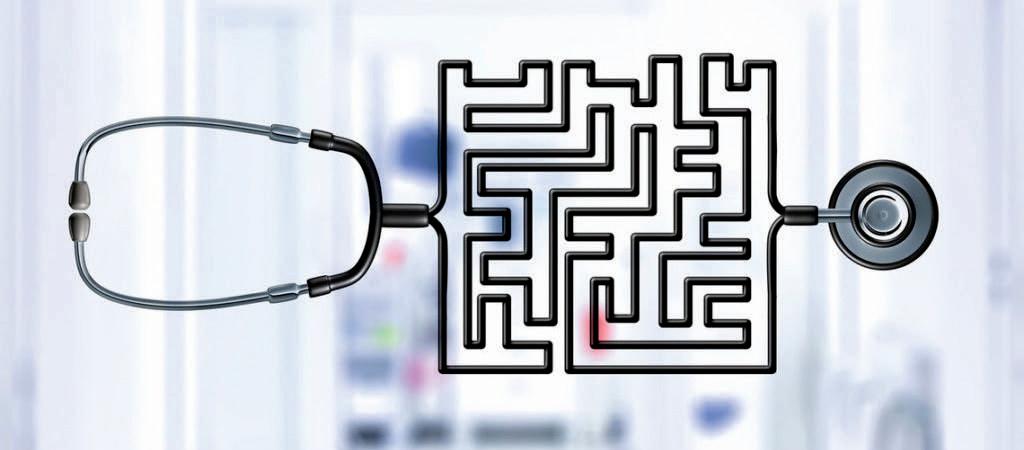

38: Navigating the Maze of ASC Claim Denials: Proven Strategies for a Seamless Process

42: Five Critical Comparisons to Evaluate AI in RCM

46: Monthly Spotlight on Fraud, Waste, and Abuse

7. News / Updates

4 BC Advantage Magazine www.billing-coding.com

CONTENTS FEATURES

OTHERS

MAY / JUNE 2024 - ISSUE 19.3 28 MAGAZINES | CEUS | WEBINARS

50. Reviews 25 Modifier Reference Card: PRINT AND SHIP Evaluation & Management Reference Guide & Workbook 2024 Edition

Considerations for Whistleblowers and Companies

EXPERT Contributors this issue

Sandy Coffta is Vice President of Client Services with Healthcare Administrative Partners. In this role, Sandy oversees the team responsible for achieving and maintaining the company’s consistently high retention and referral rates. Ms. Coffta has over 17 years of experience in client relationship management, including reimbursement analysis, workflow optimization, and compliance education. She specializes in business intelligence and reporting development, is a subject matter expert in radiology practice billing, and has deep expertise in resolving payor disputes and contract issues. www.hapusa.com

Teri Gatchel-Schmidt is the Vice President of Consulting & Business Development at SYNERGEN Health. Teri GatchelSchmidt, MBA, CPC, brings over 28 years of experience in the healthcare industry as a practice administrator, operational leader, and revenue cycle optimization consultant to large health systems and physician organizations. Ms. Schmidt has worked during the past 18 years consulting extensively with healthcare systems to enhance their financial performance in academic and physician ambulatory-based settings. www.synergenhealth.com

Debbie Jones, CPC, CCA, is the writer and founder of Medical Coding Buff, a blog about medical coding. She helps individuals starting in their medical coding education who are interested in sitting for their CPC credentials. Besides her many articles on medical coding, she strives to make learning fun, engaging, and interactive by providing quizzes, multiple-choice challenges, and crossword puzzles. Receiving an Associate degree from Colorado Technical University (CTU-O) in 2012 in Medical Billing and Coding, Debbie graduated with highest honors. From there, she went on to earn her CCA, CPC-A (now CPC), and HCS-D credentials. You can reach Debbie at debbie@medicalcodingbuff.com or through her website at medicalcodingbuff.com

Bill Kerr, MD, MBA, is the founder and CEO of Avalon Healthcare Solutions, the world’s first lab insights company. www.avalonhcs.com

Sonal Patel, BA, CPMA, CPC, CMC, ICDCM, is CEO and Principal Strategist at SP Collaborative, LLC. www.spcollaborative.net

Leigh Poland, RHIA, CCS, is Vice President-Coding Service Product Line, for AGS Health.

Rachel V. Rose, JD, MBA, is an Attorney at Law, in Houston, TX. Rachel advises clients on healthcare, cybersecurity, securities law and qui tam matters. She also teaches bioethics at Baylor College of Medicine. She has been consecutively named by Houstonia Magazine as a Top Lawyer (Healthcare) and to the National Women Trial Lawyer’s Top 25. She can be reached at rvrose@rvrose.com. www.rvrose.com

Austin Ward is Head of Growth at Fathom, the leader in autonomous medical coding. He oversees the company’s go-to-market efforts and client analytics. He brings broad experience in health systems, technology, and data science and has worked at BCG, the Bill & Melinda Gates Foundation, and in venture capital. He holds an MBA from Stanford University, MPA from Harvard University, and BAs from the University of Chicago. www.fathomhealth.com

Aimee L. Wilcox, CPMA, CCS-P, CST, MA, MT, is a medical coding, billing, and auditing consultant, author, and educator with more than 30 years of clinical and administrative experience in healthcare, coding, billing, and auditing. Medicine, including coding and billing, is a constantly changing field full of challenges and learning and she loves both. Aimee believes there are talented medical professionals who, with proper training and excellent information, can continue to practice the art of healing while feeling secure in their billing and reimbursement for such care.

FindACode.com

5 BC Advantage Magazine www.billing-coding.com

We are always interested in hearing from any industry experts who would like to get published in our national magazine. Email us at editorial@billing-coding.com to request a copy of our editorial guidelines and benefits.

BECOME PART OF SOMETHING BIGGER BC ADVANTAGE Jan Feb 2022 Issue 17.1 Providing resources for medical practices and the people behind them www.billing-coding.com 2022 E/M Clarifications Continue The DOJ’s Civil Cyber-Fraud Initiative and the Importance of NIST Marketing Billing & RCM Services to Doctors During a Pandemic January is Glaucoma Awareness Month: Spread the Word, Protect Vision This Year’s ICD-10 Changes Pose Risks to Medicare Advantage Compliance

2023 E/M CHANGES

Puzzled by Health Care Issues?

Offering Customized Solutions To Practices For Over 30 Years!

• Apply the 2023 E/M definitions and guidelines in CPT to the medical record.

AUDITING SOLUTIONS

CONSULTING SOLUTIONS

• Physician/provider education on multiple specialties.

EDUCATION SOLUTIONS

CHCS provides many types of audits for CPT and/or diagnosis.

• CPT, ICD-10-CM, E/M, and specialty specific education solutions.

• Demonstrate to physicians and other providers proper documentation that supports the level of services reported.

In 2021, the office/other outpatient codes and guidelines went through revisions. For 2023, the rest of the E/M sections underwent a major overhaul. We cover all sections revised with comprehension checks to ensure attendees will be able to:

• Utilize the revised 2023 Medical Decision Making (MDM) Table in CPT to review E/M services.

Education can be customized for your practice, department, or group. Services can be performed on-site, or virtually through our eLearning platform.

Betty A. Hovey is a seasoned healthcare professional with over three decades of experience in the field. She has extensive experience conducting audits for medical practices and payors. She specializes in educating various groups including coding professionals, auditors, doctors, APPs, payors, and others on coding, billing and related topics. Betty is a highly sought-after speaker and has co-authored manuals on ICD-10-CM, ICD-10-PCS, E/M, and various CPT specialty areas.

6 BC Advantage Magazine www.billing-coding.com 31 BC Advantage Magazine www.billing-coding.com WE

S H C C COMPLIANT HEALTH CARE SOLUTIONS Contact Us For a Solution Today! info@chcs.consulting 630.200.6352 www.CHCS.consulting

HAVE SOLUTIONS!

| Author

Health Care Consultant | Educator | Speaker

Betty A. Hovey, BSHAM, CCS-P, CDIP, CPC, COC, CPMA, CPCD, CPB, CPC-I

Epic Plans to Launch AI Validation Software for Healthcare Organizations to Test, Monitor Models

is reported to generate $10 billion in annual revenue across 134 care sites.

More details to follow.

As artificial intelligence (AI) rapidly advances in healthcare, the industry is grappling with how to evaluate AI models for accuracy and performance and monitor the technology for any downstream adverse outcomes.

EHR giant Epic plans to release an AI validation software suite to enable healthcare organizations to evaluate AI models at the local level and monitor those systems over time, Seth Hain, Epic senior vice president of R&D, said in an exclusive interview.

Epic has developed an AI software suite, what the company calls an “AI trust and assurance software suite,” that automates data collection and mapping to provide near real-time metrics and analysis on AI models. The automation creates consistency and eliminates the need for healthcare organization data scientists to do their own data mapping—the most time-consuming aspect of validation, according to Hain.

The key is to enable AI testing and validation at a local level and allow ongoing monitoring at scale, Hain noted.

“We’ll provide health systems with the ability to combine their local information about the outcomes around their workflows, alongside the information about the AI models that they’re using, and they will be able to use that both for evaluation and then importantly, ongoing monitoring of those models in their local contexts,” Hain said during the interview.

Source: fiercehealthcare

Kaiser Permanente’s Risant Health Acquires Geisinger

Kaiser Permanente’s entity, Risant Health, has acquired Geisinger Health, completing a transaction that was finalized March 31 and announced recently by both Risant Health and Geisinger.

No terms of the acquisition were announced by either party; although, Risant announced in its news release that it intends to acquire four or five community-based health systems within the next five years.

Risant Health, a non-profit, charitable organization headquartered in Washington, DC, was created by Kaiser Foundation Hospitals in 2023. Pennsylvania-based Geisinger, a non-profit system,

Source: ICD-10 Monitor

Young Adults Prescribed ADHD Stimulants May Face Higher Risk of Cardiomyopathy

Young adults with attention-deficit/hyperactivity disorder (ADHD) who were prescribed stimulant medications were significantly more likely to develop cardiomyopathy than those who were not prescribed stimulants, according to new research. Moreover, the risk was observed to increase with the duration of treatment.

Data showed that young adults with ADHD who were prescribed stimulants were 17% more likely to have cardiomyopathy at one year and 57% more likely to develop cardiomyopathy at eight years compared to those who were not prescribed stimulants.

The findings were presented at the American College of Cardiology 73rd Scientific Sessions, held April 6-8, 2024, in Atlanta, Georgia.

Source: patientcareonline

Change Healthcare Cyberattack Causes Dire Billing Crisis

A recent cyberattack on Change Healthcare, a sizable unit of UnitedHealth Group, brought new repercussions rarely seen in a cyberattack. As a result of the threat actor’s actions, healthcare systems and providers suffered cash flow issues, which resulted in providers being unable to pay their rent, owners dipping into their personal savings, and patients being prevented from receiving important medications.

Most importantly, patients are unable to get insurance approval for procedures, surgeries, and prescriptions, which can affect their health outcomes.

Ransomware Attacks Shut Down Systems for Weeks

Change Healthcare was the victim of a ransomware attack by ALPHV, also known as BlackCat. Change Healthcare provides pharmacy claims transactions, provider claims processing, patient access and financial clearance, provider payments, authorizations,

7 BC Advantage Magazine www.billing-coding.com.com

and medical necessity reviews. Every year, Change processes 15 billion healthcare transactions and touches one in three patient records.

According to Change Healthcare’s statement on their website, when they discovered that a threat actor gained access to one of their environments, they disconnected their systems to limit the impact. The attack caused Change to shut down for several weeks. While some services are back online, Change Health is currently working on getting all operations up and running again. During this time, providers, including hospitals, pharmacies, and private practices, were unable to access the systems to perform functions, including getting reimbursed for patient services and preauthorization for patients.

According to Wired, UnitedHealth, which owns Change Health, reportedly paid $22 million in ransom. Although ALPHV’s dark web sites and decryption keys were seized by the FBI in December 2023, the organization still managed to pull off one of the most disruptive healthcare attacks only a few months later. ALPHV’s dark website recently listed 28 other corporate victims of their attacks.

Attack Causes Trickle-Down Effect

One of the most damaging parts of the cyberattack is the trickle-down effect from Change to providers to patients. Cybersecurity Dive uncovered a range of impacts, from providers not seeing new patients due to not being able to verify insurance eligibility to hospitals unable to use their typical billing processes. Pharmacists cannot accurately determine patient copays, resulting in them either taking estimated payments or requiring patients to pay the full amount for their medications.

Many providers are struggling to pay their expenses without insurance reimbursement for services. Molly Fulton, the Chief Operating Officer at Arlington Urgent Care, told the New York Times that their five urgent care centers had around $650,000 in unpaid insurance reimbursements. To stay open, the owners are using their personal savings and opening lines of credit through their bank to cover employee paychecks, rent, and other business expenses.

Healthcare remains one of the industries most targeted by cyber criminals. The IBM X-Force Threat Intelligence Index 2024 reported that healthcare is the third-most targeted industry in North America, moving up from fourth place the previous year. The majority of healthcare incidents (43%) involved threat actors using legitimate tools for malicious

purposes, while spam campaigns and malware cases each accounted for 29% of incidents.

The Impact of the Attack Going Forward

As Change Healthcare continues to get its systems back online, many questions still remain unanswered, such as what the organization’s liability will be. As the aftermath is being sorted out, many experts are interested in seeing how the organization may be held financially responsible for their customers’ current situation due to billing and payment issues.

Along with the Change Healthcare incident, cyberattacks that have affected critical infrastructure, such as the Colonial Pipeline attack, are prompting businesses and the federal government to review and adjust their processes to reduce the impact of future attacks. These attacks will likely compel changes in the future, affecting the U.S. healthcare system and the cybersecurity industry as a whole.

To learn how IBM X-Force can help you with anything regarding cybersecurity, including incident response, threat intelligence, or offensive security services, or if you are experiencing cybersecurity issues or an incident, contact X-Force to help: U.S. hotline 1-888-241-9812 | Global hotline (+001) 312-212-8034.

Source: securityintelligence

Why Medicare’s Experts See Need to Tie Physician Pay to Inflation

While the AMA “appreciates MedPAC’s acknowledgement that the current Medicare physician payment system is inadequate,” the recommended update doesn’t go far enough to address Medicare payments to physicians, AMA President Jesse M. Ehrenfeld, MD, MPH, said after the recent announcement.

“MedPAC’s decision recognizes that physician pay is lagging far behind the cost of practicing medicine. Yet, an update tied to 50% of MEI—as MedPAC recommended—will cause physician payment to fall even further behind increases in the cost of providing care. As one of the only Medicare providers without an inflationary payment update, physicians have waited a long time for this change,” he said.

A better solution is for Congress to pass the bipartisan Strengthening Medicare for Patients and Providers Act, H.R. 2474, Dr. Ehrenfeld said. The legislation would provide physicians with an annual, permanent inflationary payment update

8 BC Advantage Magazine www.billing-coding.com

in Medicare tied to the Medicare Economic Index.

“Patients, physicians, and many members of Congress recognize the need to stop the annual cycle of pay cuts and patches and enact permanent Medicare payment updates,” he said. “The AMA is ready to offer solid policy proposals to jump-start this reform effort. Tomorrow is not too soon.”

Leading the charge to reform Medicare pay is the first pillar of the AMA Recovery Plan for America’s Physicians.

The AMA has challenged Congress to work on systemic reforms and make Medicare work better for you and your patients. The AMA’s work will continue, fighting tirelessly against future cuts—and against all barriers to patient care.

Why it is important: When adjusted for inflation, Medicare payments to physicians—caring for the nation’s 65 million older American adults—fell dramatically between 2001 and 2024.

The MedPAC recommendation came shortly “after Congress allowed an approximate 2% cut in Medicare payments to become law,” Dr. Ehrenfeld noted. “And it also comes as physicians deal with the cyberattack at Change Healthcare, another financial blow to the survival to private practices. Years of Medicare cuts, COVID-19, and inflation weakened physician practices’ ability to absorb all these shocks.”

Physicians fall into the only group that does not automatically get an annual increase based on the Medicare Economic Index to cover the rising costs of doing business. If physicians got the same adjustments that hospitals and other health professionals are getting, doctors would have seen a 4.6% increase in payment in 2024.

Passing the Strengthening Medicare for Patients and Providers Act—introduced by California Democratic Reps. Raul Ruiz, MD, and Ami Bera, MD, along with Republicans Larry Bucshon, MD, of Indiana, and Mariannette Miller-Meeks, MD, of Iowa— would help Congress finally reform the outdated Medicare payment system so that physicians can continue to provide the nation’s growing senior population with quality care.

Source: AMA

Alaska Legislature Boosts Allowable Payments From Fund That Covers Fishers’ Crew Medical Costs

Maximum payouts from a fund that covers medical costs of injured seafood harvesters would be boosted under a bill that won final passage in the Alaska Legislature recently.

The measure, Senate Bill 93, would boost allowable payouts from the Fishermen’s Fund to $15,000 per injury or disablement from the current $10,000 maximum.

The Fishermen’s Fund serves as something of a stand-in for workers’ compensation. Commercial fishers in Alaska are not covered by workers’ compensation insurance. The fund, which predates statehood, is administered by the Alaska Department of Labor and Workforce Development and is considered “an emergency fund payer of last resort” after insurance policies and other sources of medical payment are used. The fund also collects statistics on fishery-related injuries.

The fund is financed directly by commercial fishers through their license and permit fees. The change in maximum payouts under the fund would incur no new cost to the Alaska Department of Labor and Workforce Development, according to the fiscal notes submitted for lawmakers’ review.

In addition to raising the allowable payments for injury events, the bill would boost maximum payouts to owners of commercial fishing vessels for coverage of insurance deductibles for injured or sick crew members. Under the bill, that maximum payout would be boosted to $15,000 from $5,000.

The bill addresses a particular problem that was brought up by fishing organizations during the committee process. While federal law requires vessel owners to carry insurance, many of those policies excluded coverage for medical costs of crew members who were sickened by COVID-19. Through an amendment made on the Senate floor just before May 3 passage in that body, lawmakers added a provision to enable the Fishermen’s Fund to make payments for costs incurred to treat viral infections, classifying those as being among the occupational diseases that affect fishers.

Also added in that amendment was a provision allowing maximum payments to fall back down to $10,000 if the total value of the Fishermen’s Fund falls below $7.5 million. If the fund’s value is below $5 million, maximum benefits would be capped at $5,000, according to the bill. The intent is to protect the fund financially, lawmakers said.

Source: juneauempire

9 BC Advantage Magazine www.billing-coding.com.com

Coding

Coding for Zika: Unraveling the Threat of a Silent Predator

When we consider treacherous animals, our thoughts may drift to lions, bears, and sharks. Yet, the true menace is a far less conspicuous creature: the mosquito. This seemingly harmless insect can spread many deadly diseases, including Zika, dengue fever, yellow fever, and West Nile virus. In this article, our focus is on the Zika virus, exploring its means of transmission, presenting symptoms, diagnostic methods, and available treatments. Furthermore, we shed light on medical coding for Zika, providing nine detailed examples to simplify the accurate assignment of ICD-10-CM codes in accordance with established guidelines and conventions.

Zika, also known as Zika virus disease, Zika virus fever, or Zika virus infection, is an infectious disease caused by the Zika virus, primarily transmitted by infected Aedes species mosquitoes. These mosquitoes are active throughout the day, posing a continuous threat. Moreover, Zika can be transmitted from a pregnant woman to her fetus, through sexual contact, and possibly via blood transfusion. This virus infection is particularly alarming

for at-risk populations and can significantly impact pregnant women and their fetuses. Presently, no vaccine exists for Zika prevention nor a specific treatment for the disease.

The History of Zika

The first case of the Zika virus was identified in 2007, with a significant outbreak occurring in Brazil in 2015.

10 BC Advantage Magazine www.billing-coding.com

This outbreak led to reports of Guillain-Barre syndrome and adverse pregnancy outcomes, such as congenital disabilities, preterm births, and spontaneous abortions. Subsequently, annual alerts regarding Zika outbreaks have become customary. In February 2024, several countries and territories in the Region of the Americas reported a significant increase in locally transmitted Zika cases, emphasizing the urgent need for intensified efforts to control the primary vector of disease transmission, the Aedes aegypti mosquito.

Understanding the Symptoms

The symptoms of Zika virus infection can vary widely, with some individuals displaying no symptoms at all while others experience mild symptoms lasting 2 to 7 days. Common manifestations include fever, rash, headache, joint pain, conjunctivitis, and muscle pain. These symptoms closely resemble those of other mosquito-borne viruses like dengue and chikungunya. Given the asymptomatic nature of many cases, individuals may remain unaware of their infection. While Zika rarely proves fatal, it poses substantial risks to pregnant women and their fetuses.

Diagnostic Approaches

Diagnosing Zika typically involves a thorough assessment of the patient’s recent travel history and symptoms, followed by blood or urine tests to confirm the presence of the virus. Molecular or serological tests are recommended for symptomatic individuals with a history of travel to regions experiencing Zika outbreaks. In pregnant women, a molecular test is preferred, especially if Zikarelated abnormalities are detected during ultrasound examinations or if adverse pregnancy outcomes occur. Additionally, there is a risk of sexual transmission, necessitating testing for individuals with potential exposure.

Treatment and Complications

Regrettably, no specific treatment or vaccine is available for Zika virus infection. Nevertheless, several investigational vaccines are under development. Management typically involves rest, hydration, and pain relief with medications like acetaminophen

(Tylenol). However, Zika’s potential complications are a cause for serious concern due to associations with Guillain-Barre syndrome, neuropathy, myelitis, and, most alarmingly, congenital abnormalities such as microcephaly in infants born to infected mothers.

Prevention of Zika

Preventing Zika virus disease primarily involves reducing exposure to mosquitoes, mainly the Aedes species, which transmits the virus. Precautions include using insect repellents containing DEET, wearing long-sleeved clothing, and using screens on windows and doors to prevent mosquitoes from entering living spaces. Additionally, eliminating standing water where mosquitoes breed, such as in flower pots, buckets, and gutters, is crucial. Travelers to areas with Zika outbreaks should take extra safeguards, such as staying in accommodations with air conditioning or screened windows and using mosquito nets while sleeping. Pregnant women, in particular, should avoid travel to areas with active Zika transmission to reduce the risk of congenital disabilities associated with the virus.

Coding for Zika Virus Disease in ICD-10-CM

Coding for Zika virus disease varies according to its distinct clinical presentations and implications, particularly for pregnancy. Acquired Zika infections are classified under A92.5, whereas congenital cases are coded as P35.4. Correct coding is based on the ICD-10-CM Official Guidelines for Coding and Reporting, primarily when documenting suspected or confirmed cases.

The Zika-related guidelines, which complement the coding conventions and instructions, are as follows:

• Code only a confirmed diagnosis of Zika virus (A92.5 - Zika virus disease) as documented by the provider.

• For hospital inpatient coding, confirmation of Zika does not require documentation of the type of test performed. Instead, the provider’s diagnostic statement that the condition is confirmed is sufficient. This rule applies to any stated mode of transmission.

11 BC Advantage Magazine www.billing-coding.com

• If the provider documents “suspected,” “possible,” or “probable” Zika, do not assign A92.5. Instead, assign a code or codes explaining the reason for the encounter (such as fever, rash, or joint pain) or Z20.821 - Contact with and (suspected) exposure to Zika virus.

• For inpatient coding only: If the diagnosis documented at the time of discharge is qualified as “probable,” “suspected,” “likely,” “questionable,” “possible,” or “still to be ruled out,” “compatible with,” “consistent with,” or other similar terms indicating uncertainty, code the condition as if it existed or was established. The basis for these guidelines is the diagnostic workup, arrangements for further workup or observation, and initial therapeutic approach that corresponds most closely with the established diagnosis.

To illustrate correct coding, we provide a series of coding examples and detailed rationales to demonstrate appropriate ICD-10-CM coding for Zika virus disease.

Zika Coding Examples

Solve the following coding exercises, and then review the answers and rationales in the next section.

1. A patient presents to her physician with headache, fever, conjunctivitis bilaterally, and arthralgia in the hands and feet. The patient is tested and diagnosed with Zika virus disease.

2. A pregnant woman diagnosed with Zika virus transmitted the infection to her fetus in utero, which manifested into microcephaly. Code for the baby’s record.

3. A 37-year-old male presents with a low-grade fever, rash, and acute conjunctivitis bilaterally. The patient has just returned from a trip to Brazil. After examination and testing for the Zika virus, the patient is diagnosed with suspected Zika.

4. A patient is seen due to concerns after being exposed to the Zika virus. She currently has no symptoms, and test results are unknown.

5. A pregnant patient in her second trimester has tested positive for Zika virus fever.

6. A pregnant woman is seen today for prenatal care. She is in her 28th week of gestation, has a confirmed diagnosis of Zika virus infection, and a previously diagnosed case of suspected fetal anomalies. Code for the mother’s record.

7. A woman in her 8th week of pregnancy is seen by her obstetrician for a prenatal visit. She reports that her sexual partner has been diagnosed with Zika virus, but she has no symptoms of the virus.

8. The patient has been diagnosed with Zika virus fever. Before prescribing methacycline, a tetracycline antibiotic, an antibiotic sensitivity test is performed, and the patient is found to be resistant to the antibiotic.

9. A patient was diagnosed with Guillain-Barre syndrome, which is linked to a recent Zika virus infection. The patient no longer has Zika.

Answers and Rationales

1. Answer:

• A92.5 - Zika virus disease

Rationale: This is an acquired case of Zika virus disease, which has been confirmed. There is no need to code for the symptoms, as they are integral to Zika, and the classification does not instruct the coder to do otherwise. Under A92.5 (Zika virus disease), there is a non-exhaustive list of inclusion terms, including Zika virus fever, Zika virus infection, and Zika NOS.

2. Answer:

• P35.4 - Congenital Zika virus disease

• Q02 - Microcephaly

Rationale: The infant was born with Zika, which resulted in a congenital complication—microcephaly (smaller than normal head size). Congenital Zika virus disease is coded as P35.4. At P35.4, a “Use additional” note tells us to code to identify manifestations of congenital Zika virus disease, which is microcephaly. According to the note, microcephaly is reported with Q02 and is sequenced after P35.4. Codes from this chapter are for use on newborn records only and can never be used on maternal records. Looking at Q02 - Microcephaly, in the Tabular, a “Code First” note instructs us to code for congenital Zika virus disease, if applicable.

3. Answer:

• R50.9 - Fever, unspecified

12 BC Advantage Magazine www.billing-coding.com

21 - 30 Staff - $40.00 per staff 31 - 50 Staff - $30.00 per staff 51 - 100+ Staff - $25.00 per staff

for more information.

Strengthen your team with a “BC Advantage Group Subscription” You select the number of staff subscriptions needed, and we create a discounted group price for you, which includes all resources for each staff member. 5 - 10 Staff - $60.00 per staff 11 - 20 Staff - $50.00 per staff

Please visit www.billing-coding.com/group

• R21 - Rash, and other nonspecific skin eruption

• H10.33 - Unspecified acute conjunctivitis, bilateral

Rationale: Fever, rash, and conjunctivitis are common symptoms of the Zika virus and should not be coded when a confirmed diagnosis of Zika is documented. In this case, however, the diagnosis is “suspected” Zika, so in outpatient coding, we must code for the symptoms to explain the encounter, as specified by the coding guidelines. Fever (R50.9) and acute conjunctivitis (H10.33) are reported with “unspecified” codes, as the particular types are not documented. Furthermore, as documented, a nonspecific type of skin rash is assigned to R21.

4. Answer:

• Z20.821 - Contact with and (suspected) exposure to Zika virus

Rationale: The patient is asymptomatic but is being screened for Zika due to (suspected) exposure and being at risk of acquiring and possibly further spreading the disease to others. When there are no symptoms or confirmation of Zika, assign Z20.821 - Contact with and (suspected) exposure to Zika virus.

5. Answer:

• O98.512 - Other viral diseases complicating pregnancy, second trimester

• A92.5 - Zika virus disease

Rationale: A confirmed diagnosis of Zika virus fever is reported, which is complicating the woman’s pregnancy. A confirmed Zika diagnosis is reported with A92.5. An “Excludes2” note instructs the coder to assign O98.- for infectious and parasitic diseases complicating pregnancy, childbirth, and the puerperium. The patient is pregnant and in her second trimester, so we must assign O98.512 - Other viral diseases complicating pregnancy, second trimester. A “Use additional” note at O98 states that a code from Chapter 1 must be reported to identify the specific infection or parasitic disease (A92.5 - Zika virus disease). This note also explains the sequencing of the two codes; O98.512 is sequenced first, followed by A92.5. Finally, a note tells us that codes from this chapter are for use only on

maternal records, never on newborn records.

6. Answer:

• O35.3XX0 - Maternal care for (suspected) damage to fetus from viral disease in mother, not applicable or unspecified

• O98.513 - Other viral diseases complicating pregnancy, third trimester

• A92.5 - Zika virus disease

• Z3A.28 - 28 weeks gestation of pregnancy

Rationale: The pregnant patient has been diagnosed with Zika virus infection and suspected fetal anomalies. Again, the code for a confirmed diagnosis of Zika is A92.5. An “Excludes2” note in Chapter 1 indicates that infectious and parasitic diseases complicating pregnancy, childbirth, and the puerperium must be coded to O98.-. Since the patient is 28 weeks pregnant and in her third trimester, the coder must assign O98.513 (Other viral diseases complicating pregnancy, third trimester). Under O98, a “Use additional” note tells us to assign a code from Chapter 1 to identify specific infectious or parasitic disease, which is A92.5. Another instructional note tells the coder to use an additional code, if applicable, from category Z3A, Weeks of Gestation, to identify the specific week of the pregnancy, if known. For 28 weeks gestation of pregnancy, we need to assign Z3A.28. The “Code First” note at Z3A tells the coder to sequence the obstetric condition or encounter for delivery, which, in this case, is O35.3XX0. These codes must be used only on the mother’s record.

7. Answer:

• Z34.91 - Encounter for supervision of normal pregnancy, unspecified, first trimester

• Z20.821 - Contact with and (suspected) exposure to Zika virus

Rationale: The patient presents for a regular prenatal visit and is in her 8th week of pregnancy or first trimester. The documentation does not specify first pregnancy, normal pregnancy, or other types of pregnancy, so we must assign an “unspecified” code, Z34.91 (Encounter for supervision of normal pregnancy, unspecified, first trimester). A code must

14 BC Advantage Magazine www.billing-coding.com

also be assigned from category Z20.- to report her exposure to the Zika virus and potential risk. This code, Z20.821 (Contact with and [suspected] exposure to Zika virus), is used when there are no symptoms and to report testing for the infection. Furthermore, if the patient is diagnosed with Zika, it must be coded and sequenced after the Z20.- code. In this case, however, nothing has been documented as to a Zika diagnosis.

8. Answer:

• A92.5 - Zika virus disease

• Z16.29 - Resistance to other single specified antibiotic

Rationale: Zika virus fever, an inclusion term listed under A92.5 - Zika virus disease, is assigned for the confirmed diagnosis. A “Use additional” note indicates that a code from Z16.- must be assigned to identify resistance to antimicrobial drugs. The documentation states the patient is resistant to methacycline, a tetracycline antibiotic. Since there is no specific code for this type of drug, we must code to “other” and assign Z16.29 (Resistance to other single specified antibiotic). Inclusion terms listed under Z16.29 are Resistance to aminoglycosides, Resistance to macrolides, Resistance to sulfonamides, and Resistance to tetracyclines. There is a “Code First” note at Z16 to sequence the code for the infection before Z16.29.

9. Answer:

• G61.0 - Guillain-Barre syndrome

• B94.8 - Sequelae of other specified infectious and parasitic diseases

Rationale: Guillain-Barre syndrome (GBS) developed as a sequela, or late effect, of Zika. The code for Guillain-Barre syndrome is G61.0, with inclusion terms listed as Acute (post-) infective polyneuritis and Miller Fisher syndrome. An “Excludes2” note at G00-G99 tells the coder to assign a code from A00-B99 for certain infectious and parasitic diseases. Since Zika is no longer present, we cannot code A92.5. However, since GBS is a sequela of Zika, B94.8 - Sequelae of other specified infectious and parasitic diseases, must be assigned. A “Code First” note at B90-B94 also instructs the

coder to sequence the code for the condition resulting from the infectious or parasitic disease before B94.8.

Conclusion

In the world of infectious diseases, Zika has the potential to cause widespread devastation, especially among vulnerable populations. Effective management requires various approaches: prevention, diagnosis, and supportive care. Furthermore, accurate medical coding is vital to capturing the distinctions of Zika’s impact on healthcare systems. By understanding and implementing the coding guidelines and conventions related to acquired and congenital Zika virus disease and its complications, coders can ensure timely and appropriate reimbursement and improve patient safety.

Debbie Jones, CPC, CCA, is the writer and founder of Medical Coding Buff, a blog about medical coding. She helps individuals starting in their medical coding education who are interested in sitting for their CPC credentials. Besides her many articles on medical coding, she strives to make learning fun, engaging, and interactive by providing quizzes, multiple-choice challenges, and crossword puzzles. Receiving an associate degree from Colorado Technical University (CTU-O) in 2012 in Medical Billing and Coding, Debbie graduated with highest honors. From there, she went on to earn her CCA, CPC-A (now CPC), and HCS-D credentials. She is a member of AAPC and AHIMA and a contributing writer for BC Advantage and JustCoding. Her previous healthcare experience includes writing exam questions for CertificationCoachingOrg (CCO) and CodeProU, as well as home health coding for SelmanHolman & Associates. She started her career in healthcare as a hospital admitting clerk before moving on to medical transcription for five years. Before that, she had 20+ years of experience as a secretary/administrative assistant where communications, attention to detail, and implementing and developing office procedures and record systems were part of her daily responsibilities. You can reach Debbie at debbie@ medicalcodingbuff.com or through her website at medicalcodingbuff.com.

15 BC Advantage Magazine www.billing-coding.com

Regulatory Issues Facing Radiology Groups in 2024

We pay a lot of attention to government regulation in healthcare, especially the Medicare Physician Fee Schedule (MPFS) that influences reimbursement not only from Medicare but also from other payors since many commercial contracts are tied to the MPFS. Although it is the object of most focus, the Centers for Medicare and Medicaid Services (CMS) is not the only agency that regulates healthcare.

Medicare Physician Fee Schedule

As of this writing, Medicare reimbursement for 2024 is nominally 3.4% lower across the board than it was in 2023 due to the statutory calculation that goes into the fee schedule conversion factor.

Several pieces of legislation are pending in Congress that would modify the pricing methodology:

• The Preserving Seniors’ Access to Physicians Act of 2023 (H.R. 6683) was introduced December 7, 2023, to make a one-time adjustment to the MPFS for 2024 by returning the conversion factor to the 2023 level. Although there are 56 cosponsors, it is sitting with the House Subcommittee on Health as of December 8 with no further action.

• The Physician Fee Schedule Update and Improvements Act (H.R. 6545) was introduced

16 BC Advantage Magazine www.billing-coding.com

Management

Practice

December 1, 2023, and it is with the Committee on Energy and Commerce as of December 6. It would make several short-term fixes to the fee schedule, but, more importantly, it would begin to tie the conversion factor adjustment to the Medicare Economic Index, which is a more relevant measure of practice costs.

• The Strengthening Medicare for Patients and Providers Act (H.R. 2474) was introduced April 3, 2023. It would make a permanent change to the conversion factor calculation by tying it to the Medicare Economic Index. Although there are 82 cosponsors, it has remained in the Subcommittee on Health since April 14, 2023.

The conversion factor is just the beginning of the story because there are quite a few factors that go into determining the final rate that your practice is paid for Medicare services. The valuation of some procedures is revised periodically under the Relative Value Unit (RVU) system based on an assessment of the level of work and the cost of providing the procedure. In some geographic areas, changes to the Geographic Practice Cost Index (GPCI) are significant. We will analyze the impact of those various changes in an upcoming article.

Appropriate Use Criteria (AUC)

The MPFS Final Rule for 2024 included a suspension of the regulation what would have penalized radiologists for the failure of ordering physicians to consult AUC when ordering advanced diagnostic imaging. All Medicare contractors were recently instructed to remove national and local edits related to the AUC program as of January 1, 2025, according to a report, “CMS Puts Final Nail in the Coffin of Medicare Advanced Diagnostic Imaging AUC Program” (2024) by Tom Greeson of Reed Smith.

The No Surprises Act (NSA)

Since it became effective on January 1, 2022, there have been numerous legal challenges to the portion of the NSA dealing with the Independent Dispute Resolution (IDR) process. The challenges have come from the physician community because the IDR process defined within the NSA to determine a price for services was unfairly skewed to the benefit of the insurance company payors. There are also concerns about the administrative fees related to filing a dispute, and the way the system of batching claims is set out. Although some changes have been made to the NSA regulations, the provider community is continuing to push for a fairer system.

For radiology practices, use of the IDR process has been minimal. Radiology practices typically participate with most payors, especially those with which their hospital participates, thus avoiding situations where a dispute over a non-covered service would arise. Fees for individual radiology procedures also tend to be relatively low, which means that the cost of filing a dispute would generally outweigh the benefit of increased reimbursement. Improvement of the ability to batch claims would possibly provide an avenue for the filing of disputes in certain circumstances.

Breast Density Notification

Mammography providers have until September 10, 2024, to comply with the U.S. Food and Drug Administration (FDA) requirement that they must notify their patients about the density of their breasts. The requirement was first announced in March 2023 for facilities that are subject to the Mammography Quality Standards Act (MQSA). A recent bulletin, “Important Information: Final Rule to Amend the Mammography Quality Standards Act (MQSA),” by the FDA states: “It is important to note that FDA may take enforcement action for noncompliance with the MQSA regulations, whether observed during an annual inspection or determined by other means.”

17 BC Advantage Magazine www.billing-coding.com

The bulletin also gives the new items that MQSA inspectors will be looking for, including:

• Mammography reporting criteria with assessment of findings classified into specific categories;

• Patient lay summaries that include the specified statements listed in the bulletin;

• Criteria for communication of results when the assessment is “suspicious” or “highly suggestive of malignancy”; and

• A medical outcomes audit.

Most states already have breast density notification regulations in effect—only 12 do not. The federal regulations may be more or less stringent than some states’ but it likely will serve to standardize reporting nationwide.

Information Blocking Rules

Compliance with the CMS Information Blocking requirements went into effect on April 5, 2021. As Healthcare Administrative Partners reported in “How the New Information Blocking Law Will Impact Your Radiology Practice” (2021), “The intent of the law is to promote the free flow of relevant healthcare information between providers and to ensure that patients can access their own information where and when they need it. A better name might have been the ‘information sharing’ or ‘anti-information blocking’ law!” There have not been any penalties for failure to comply with the law, but a proposed rule issued on November 1, 2023, includes disincentives for providers found to be in violation.

According to the American College of Radiology, in “CMS Proposes Disincentives for Providers for Information Blocking” (2023), “The program has significantly evolved since [April 5, 2021], with major regulatory changes and publication of assorted HHS guidance, including on compliance issues raised by the American College of Radiology® (ACR®).”

ACR reports that the provider disincentives that would be used in place of financial penalties are as follows:

• Eligible hospitals be considered meaningful record (EHR) system

• Participants in the System Quality Payment sidered a meaningful during the performance

• Accountable care organizations pants, or ACO providers/suppliers to participate as, or

Radiology Business reported, Over Record-Sharing Provision (2023), on a panel discussion RSNA national meeting on the information blocking rights to immediate access

Following a 60-day comment a final rule will be issued mentation.

Conclusion

• Information about violations would be published online.

We will continue to follow developments on these and other issues that will affect your practice.

Sandy Coffta is Vice President of Client Services with Healthcare Administrative Partners. In this role, Sandy oversees the team responsible for achieving and maintaining the company’s consistently high retention and referral rates. Ms. Coffta has over 17 years of experience in client relationship management, including reimbursement analysis, workflow optimization, and compliance education.

She specializes in business intelligence and reporting development, is a subject matter expert in radiology practice billing, and has deep expertise in resolving payor disputes and contract issues.

www.hapusa.com

18 BC Advantage Magazine www.billing-coding.com

19 BC Advantage Magazine www.billing-coding.com YOUR FULL SERVICE RADIOLOGY RCM PROVIDER www.hapusa.com info@hapusa.com NEED CEUs? BC Advantage CEU/Webinar Library: The FAST, EASY, and AFFORDABLE way to earn your CEUs each year! https://www.billing-coding.com/ceus BC ADVANTAGE Providing resources for medical practices and the people behind them Provider Agreement Auditing Skin Grafting Services Why Are You In The Room To See The Patient? Denial Management is Key to Profitability www.billing-coding.com Earn 30+ CEUs each year, included with your magazine subscription www.billing-coding.com/CEU CMS Revises Guidance Regarding the Use of Statistical Sampling for Overpayment Estimation BC ADVANTAGE November December 2023 Issue 18.6 Providing resources for medical practices and the people behind them www.billing-coding.com Pediatric Craniosynostosis Coding in ICD-10-CM Whistleblowers and Company Data: To Collect Not Collect Missing HCC Codes Leave Money on the Table Why Support for H.R. 2474 Is Important Your Radiology Practice 2024 ICD-10-CM Code Changes

How Lab Benefits Management Can Smooth the Transition to Value-Based Care Practice Management

Switching the U.S. healthcare system from the traditional fee-for-service model to value-based care is an enormous undertaking. It requires no less than changing how healthcare is thought of, delivered, measured, and paid for.

Cue the old saying about how long it takes to turn a supertanker. The VBC transition is such a huge task that it’s important to take advantage of all reforms that will allow the goal to be accomplished more quickly and easily.

Though often overlooked for broader and more visible initiatives, lab benefits management (LBM) is one way to accelerate the transition.

Consider how essential lab testing is to healthcare.

According to the CDC, 14 billion clinical lab tests are performed annually in the U.S., making them the most utilized medical benefit. Lab results drive roughly 70% of clinical decisions. Despite its ubiquity and importance, as reported in “Current State of Laboratory Test Utilization Practices in the Clinical Laboratory” (pubmed. ncbi.nlm.nih.gov), lab spending is under-scrutinized, resulting in 20% to 30% of lab testing potentially being unnecessary.

20 BC Advantage Magazine www.billing-coding.com

And lab testing is expensive. In 2021, Medicare spent $9.3 billion on tests, a record 17% increase from the previous year. The fastest-growing sector of lab testing is genetic testing, which accounts for 10% of testing, but 30% of the cost. Biomarker legislation recently passed by states will only increase the volume and cost of testing.

Medicare and Medicaid have been leading the shift to VBC, but private health insurers are ramping up their efforts. In light of lab testing’s cost, criticality, and ubiquity, it stands to reason that LBM must be part of their efforts. Let’s see how it helps health plans achieve the three primary goals of VBC.

LBM Improves Care

With test results informing most clinical decisions, it’s essential that providers order the right tests and be assured that they are clinically valid and performed correctly. An LBM partner guided by evidence-based medicine, independent review, and robust quality control measures can help plans ensure the utility of the tests.

This is particularly important for genetic testing. There are more than 175,000 tests on the market, and the number is growing at a rate of more than 10 new tests daily. Health plans and providers do not have the resources to determine the utility of each test and need the help of an LBM partner with the ability to independently evaluate them.

Also, by preventing the misuse and overuse of tests, LBM reduces the number of false-positive and false-negative results and subsequent harm to patients. Failure to order the right test affects over 30% of genetic lab orders, which might lead to an incorrect or missed diagnosis. For example, the mismatch of biomarker test results with the recommended oncology treatment, which in Non-Small Cell Lung Cancer (NSCLC), as reported in “Diagnosis, Testing, Treatment, and Outcomes Among Patients With Advanced Non-Small Cell Lung Cancer in the United States” (ncbi.nlm.nih.gov), has been found to be 44%, leads to lower quality outcomes and waste in drug spend.

LBM has benefits for population health, as well.

Advanced LBM incorporating analytics and machine learning can help health plans identify and stage members with chronic conditions. In a

WEBINAR - CEU Approved

Distinguishing a BAA from a DUA and Protecting Both Consumer and Patient Health Data

Presenter: Rachel Rose, JD, MBA

Time: 46 minutes

Distinguishing a business associate agreement (BAA) from a data use agreement (DUA) still perplexes those in the healthcare industry. Reviewing the historical timeline of legislative history cements that these are not new agreements under new regulations. This webinar focuses on this understanding to ensure protection of health data for both consumers and patients.

21 BC Advantage Magazine www.billing-coding.com

to all members

FREE

www.billing-coding.com/ceus to access this webinar

Please visit

recent pilot program, two regional Blue Cross Blue Shield plans working with an LBM partner with access to claims data and lab result values from multiple tests were able to identify and stratify high-risk chronic kidney disease patients across all stages. Armed with this information, the plans were able to follow up with patients and their providers to get them treatment.

This analysis could be expanded to other diseases with the result that patients are identified and staged sooner so providers can treat them earlier. This will result in patients living longer, healthier lives and reducing their care costs.

LBM Controls Cost

Controlling and reducing runaway healthcare costs is another goal of VBC. While lab testing is a relatively small part of overall healthcare spending, it is growing, partially fueled by the rise in genetic testing and precision medicine.

Historically, lab testing has been prone to overcharging and misuse, such as labs adding unnecessary assays, partly due to a lack of oversight, poor coding and tracking, and inadequate regulation. The growth in genetic testing has worsened these problems. An LBM program with strict quality control, precise tracking, and clinically validated reviews can reduce the amount of fraud, waste, and abuse.

LBM also controls costs by routing testing to a network of trusted independent labs. Data shows that employer-based insurance typically pays three times more for clinical lab tests when billed by hospital outpatient departments compared to identical tests at physician offices and independent labs.

LBM Improves the Healthcare Experience

The third goal of VBC, improving the healthcare experience, is the hardest to measure, but no less important than the other two. Here, again, LBM can help.

By ensuring that lab testing is necessary, accurate, and applicable, an LBM partner can ease workloads on provid-

ers, insurers, and labs.

Providers, who are often caught in the middle between labs and plans, can proceed more confidently knowing that the tests they order are clinically validated and will be performed correctly. And prior authorization requests can be reduced or eliminated for qualified providers. For patients, quality control in testing means fewer errors, unnecessary tests, and procedures, which saves them money and improves their outcomes.

A proven LBM system reduces conflict between providers and plans, saving both parties time and money.

We’ve seen how LBM helps healthcare achieve the triple aims of value-based care: improving the healthcare experience, improving the health of individuals and populations, and reducing costs. As the healthcare supertanker continues turning toward VBC, LBM can provide a necessary thrust in the right direction.

Bill Kerr, MD, MBA, is the founder and CEO of Avalon Healthcare Solutions, the world’s first lab insights company.

Lab testing is the gateway for appropriate diagnosis and treatment care planning. That’s why if you want to find value-driven care success, you need to start at the source.

We generate actionable lab-driven insights in real time to proactively ensure appropriate care and enhance clinical outcomes.

This is more than data. It’s actionable lab-driven insights.

As a result, we all save. Not just dollars. But we save time, waste, and uncertainty.

We also build momentum for value-driven care.

Together, we can shape the healthcare of tomorrow with the digitized lab values we have today.

https://www.avalonhcs.com/

22 BC Advantage Magazine www.billing-coding.com

Practice Management

Understanding the Changes in the CMS-HCC Model V28

The New Year brought with it a long-overdue overhaul of the Centers for Medicare and Medicaid Services (CMS) hierarchical condition categories (HCC), ushering in the 28th version of the model used to assign risk adjustment factor (RAF) scores and estimate future healthcare costs for Medicare Advantage patients.

The upgrade aligns the underlying HCC methodology with the ICD-10-CM code set, which the rest of the healthcare system has been using since 2015. As such, it requires greater specificity in documentation and code assignment—both of which are imperative for accurate risk adjustment.

What’s Different in V28

Designed to reflect more recent utilization, cost, and diagnostic patterns, the changes made in version 28

(V28) focus primarily on those HCC codes with the highest variations between Medicare Advantage and fee-for-service. To improve payment accuracy, HCC V28 incorporates newer data and includes clinically based adjustments to ensure that conditions are stable predictors of costs.

HCC V28 will be phased in over a three-year period, with a blend of 33% from the V28 model and 67% from the V24 model for 2023 dates of service, 67% for 2024 dates of service, and fully phased in at 100% for 2025 dates of

24 BC Advantage Magazine www.billing-coding.com

service.

Among the most significant changes in V28 are:

• An increase in the number of HCC categories from 86 to 115

• A decrease in the number of HCC codes (ICD-10-CM codes) from 9,797 to 7,770

• Deletion of approximately 2,294 codes and addition of 268 codes

• Re-numbering and changing HCCs

• Changes to the HCC coefficient values (risk scores that map to each HCC category)

For example, malnutrition has been excluded, and HCC 35 has been added for pancreas transplant status.

Further:

• The skin disease group now groups to a hierarchy that differentiates pressure ulcers and chronic ulcers of the skin by severity or depth of the wound.

• The neoplasm disease hierarchy increases from five to seven levels.

• HCC 85 related to heart failure has been eliminated.

• Heart failure has been expanded to seven HCCs, including heart transplant status (HCC 221).

HCC V28 also impacts RAF scores, which determine the amount paid by CMS to a health plan per patient. Because their RAF scores—and therefore their anticipated costs of care—are higher, Medicare Advantage plans are paid at a higher rate for patients with multiple conditions and/or conditions with greater levels of severity.

In 2023, those plans were paid on HCC V24—the 2020 version that was established using ICD-9-CM claims coded data. Under V28, CMS finalized revisions for the Part C risk adjustment model that incorporate recalibration and clinical reclassification of HCCs, updating the data year to 2018 diagnoses and 2019 expenditures from V24’s 2014 and 2015,

respectively. The denominator year used to calculate risk scores was also updated to 2020 in V28 from 2015 under V24.

Constraining

CMS reclassified HCC mappings in V28 using a process known as constraining, under which related HCCs are given the same coefficients. For example, diabetic disorders contribute the same to the RAF score whether the patient has uncomplicated diabetes or diabetes with complications.

However:

• Type 2 diabetes mellitus without complications (E11.9) receives a slightly higher risk score in V28 than it currently does in V24 (from 0.105 to 0.166).

• A patient with diabetes with peripheral vascular disease in V24 has risk scores of 0.302 + 0.288 (0.590), but under V28 receives a risk score of only 0.166.

Overall, this will result in a significant reduction in RAF scores for patients with acute or chronic complications from diabetes.

According to CMS, V28 will result in a more appropriate relative weight, reflecting recent utilization, coding, and expenses. Additionally, the CY 2024 impact on Medicare Advantage risk scores is projected to be -3.12%. This will translate into an $11 billion net savings to the Medicare Trust Fund in 2024.

Documentation Is Key

Accurate risk adjustment has always depended on the specificity of documentation and diagnostic coding. HCC V28 will require even greater specificity in documentation and code assignment to ensure that the true level of the Medicare Advantage patients’ illness severity is captured and provides CMS with coded data for future analysis in model recommendations.

25 BC Advantage Magazine www.billing-coding.com

As such, it is important to continue documenting against the MEAT (Monitoring, Evaluation, Assessment, Treatment) criteria—the four factors that establish the presence of a diagnosis during a patient visit and ensure proper documentation. Additionally, because of the staged transition, providers will be reimbursed under two different models until V28 is fully implemented, based on both the date of service and the percentage of the new model that has been deployed. Documentation and coding will need to support both.

RAF Score Calculation

Also due to the phased-in approach, the calculation of RAF scores during the transition phase requires use of both V24 and V28 models. The first step is to calculate risk scores for both the V24 and V28 models. The next step is to calculate the risk score as the sum of 33% of the adjusted V28 CMSHCC model risk score and 67% of the adjusted V24 risk score.

Example: Jane is a 93-year-old female who has diabetic amyotrophy, fatal familial insomnia, CKD stage 3A, and toxic liver diseases with hepatic necrosis and coma. The table below illustrates how the RAF score is computed for CY 2024.

See Table Below

Succeeding During the Transition

Managing two versions of HCC models during the transition creates challenges for providers and health plans.

Conditions that are considered as HCC in one version may not be in the other. Additionally, even if a diagnosis is an HCC in both versions, the actual HCC and RAF scores may be different.

Conclusion

Health plans and providers should identify the top HCCs among their patient population to examine and understand the potential impact of the two model versions. Investing in technologies that allow for more specific documentation, as well as accurate and efficient coding of large volumes of clinical documents, will be vital strategies to enable health plans, providers, and other stakeholders to effectively manage their risk adjustment program.

Leigh Poland, RHIA, CCS, is Vice President, Coding Service Product Line, for AGS Health.

What We Do.

We use technology and expertise to yield the revenue to realize your vision.

At AGS Health, we use a combination of AI-enhanced technology, data-driven services, and specialized support to maximize the performance of your revenue cycle. This means you can focus on the most important part of your business: caring for patients.

https://www.agshealth.com/

26 BC Advantage Magazine www.billing-coding.com

Diagnosis V28 HCC Model V24 HCC Model RAF Score (V28) RAF Score (V24) Diabetic amyotrophy (E11.44) HCC 37 HCC 18 0.166 0.302 Fatal familial insomnia (A81.83) HCC 127 HCC 52 0.341 0.346 Paroxysmal atrial fibrillation (I48.0) HCC 238 HCC 96 0.299 0.268 Chronic kidney disease, stage 3a (N18.31) HCC 329 HCC 108 0.127 0.288 Toxic liver disease with hepatic necrosis, with coma (K71.11) - HCC 27 - 0.515 4 payment HCC counts 5 payment HCC counts 0.050 0.077 93-year-old female (demographic factor) - - 0.737 0.783 Total raw risk score 1.72 2.579 Blending formula 33%*1.72 67%*2.579 Blended risk score 0.568 1.728 Final risk score 2.296

This comprehensive training will help you achieve:

Higher payment approval rates

Faster receipt of payments

Reduction in claim denials

Confidence to overcome RCM challenges

27 BC Advantage Magazine www.billing-coding.com 19 BC Advantage Magazine www.billing-coding.com

Coding Billing

Compliance Auditing ©2022 Practice Management Institute ®

1983

Group

259-5562

New Online Training Course for Medical Office Managers

Management

Improving the business of medicine through education since

Train Your

(800)

Review the full curriculum now at: pmiMD.com/RCMM Revenue Cycle Management Mastery Created and taught by Revenue Cycle Management Thought Leaders Taya (Shawntea) Moheiser, EMBA, CMPE, CMOM, and Kem Tolliver, CMPE, CPC, CMOM Authors of: Revenue Cycle Management: Don't Get Lost In The Financial Maze Published by the Medical Group Management Association (MGMA)

Legal

Considerations for Whistleblowers and Companies

In June 2022, I wrote an article, “The False Claims Act and the Seal: What Whistleblowers Need to Know,” which I encourage everyone reading this article to also read.

The United States Supreme Court’s decision in United States ex rel. Polansky v. Executive Health Resources (599 U.S. 419; 2023) confirmed that the United States government has nearly unfettered discretion “to dismiss a [federal False Claims Act] suit over a relator’s objection” (Id. at 423; see also State ex rel. Fox v. Thornley, 2023 IL App [4th]; citing Polansky as instructive when interpreting the Illinois False Claims Act).

As the Court held in Polansky:

“The Third Circuit, though, was right to note that [section 4(c)](2)(A) motions will satisfy [Federal Rule of Civil Procedure] 41 in all but the most exceptional cases… The inquiry is necessarily ‘contextual.’ And in this context, the government’s views are entitled to substantial deference. A qui tam suit, as we have explained, is on behalf of and in the name of the government. The suit alleges injury to the government alone. And the government, once it has intervened, assumes primary responsibility for the action. Given all that, a district court should think several times over before denying a motion to dismiss. If the government offers a reasonable argument for why the burdens of continued litigation outweigh its benefits, the court should grant the motion. And that is so even if the relator presents a credible assessment to the contrary” (Id. at 437-38).

In essence, the U.S. Department of Justice (DOJ) is given a lot of deference in a 3730(c)(2)(A) dismissal; however, the U.S. Supreme Court left the window open for specific instances, which we have not seen yet, where the relator would prevail over the objections of the government. It is also important to note that the government rarely uses its dismissal power under 3730(c)(2)(A).

With this backdrop painted, it brings me to related items that potential clients ask, clients re-ask, and audience members at presentations and webinars pose. This article addresses these questions from the whistleblower vantage point and a compliance perspective.

Questions and Answers (Q&A)

Here are five common questions that I receive, with answers that I routinely provide. The disclaimer, facts, and circumstances, as well as other portions of the statute, could change the response, and it is for this reason that the responses are not meant to constitute legal advice.

Q: What is the difference between intervention, declination, and dismissal at the point the case is about to be unsealed?

A: Under 31 U.S.C. §3730(b)(1), aka “qui tam provision,” a person “may bring a civil action for a violation of section 3729 for the person and for the United States government. The action shall be brought in the name of the government.” In other words, the government is always the ultimate party in interest in an FCA case brought under the qui tam provision. The ability of the federal government (or a state government under its respective state law) to intervene in the case or decline the case and allow the relator’s counsel to move forward (see infra) is the government’s decision. If the government declines to intervene, then a separate conversation takes place between the relator and his/her/their lawyer(s) to decide whether or not to pursue the case.

An important point to note at the outset is that the government declines approximately eighty percent (80%) of the FCA whistleblower cases that it receives. To paraphrase what the federal and state governments have set forth in different statements of interest in various cases, just because the government declines a case does not mean that the case lacks merit. Indeed, as a September 26, 2022, DOJ Press Release shows:

“Pharmaceutical company Biogen Inc. (Biogen), based in Cambridge, Massachusetts, has agreed to pay $900 million to resolve allegations that it caused the submission of false claims to Medicare and Medicaid by paying kickbacks to physicians to induce them to prescribe Biogen drugs. [This settlement] resolves a lawsuit filed and litigated by former Biogen employee Michael Bawduniak against Biogen under the qui tam or whistleblower provisions of the federal False Claims Act, which permit a private party (known as a relator) to file a lawsuit on behalf of the United States and receive a portion of any recovery. The United States may intervene in the action or, as in this case, the relator may proceed with the lawsuit.”

Regardless of whether the government intervenes or declines at the outset, there are additional items to be aware of, as indicated herein.

Q: Will the relator get regular updates throughout the case on its investigation?

30 BC Advantage Magazine www.billing-coding.com

Approving CEU and Webinar Associations

BC Advantage is proud to offer CEUs to the following leading associations. All of the associations listed below offer unique and professional certified courses and certifications. Please take a few minutes and visit each one and let them know you are a BC Advantage member for any discounts offered.

AAPC

American Dental Coders Association (ADCA)

Association of Health Care Auditors and Educators (AHCAE)

American Health Information Management Association (AHIMA)

American Institute of Healthcare Compliance (AIHC)

Association of Professional Medical Billers & Administrators (APMBA)

Association of Registered Healthcare Professionals (ARHCP)

Healthcare Billing and Management Association (HBMA)

Medical Association of Billers (MAB)

Med-Certification

National Alliance of Medical Auditing Specialists (NAMAS)

Professional Association of Health Care Office Management (PAHCOM)

Professional Healthcare Institute of America (PHIA)

Practice Management Institute (PMI)

PMRNC

QPro

www.aapc.com

www.adcaonline.org

www.ahcae.org

www.ahima.org

www.aihc-assn.org

www.theapmba.com

www.arhcp.com

www.hbma.org

www.mabillers.com

www.med-certification.com

www.namas.co

www.pahcom.com

www.phia.com

www.pmimd.com

www.billerswebsite.com

www.qpro.com

31 BC Advantage Magazine www.billing-coding.com

NEED CEUs? BC ADVANTAGE Nov/Dec 2019 Issue 14.6 Providing resources for medical practices and the people behind them Provider Agreement Auditing Skin Grafting Services Why Are You In The Room To See The Patient? Denial Management is Key to Profitability www.billing-coding.com Earn 30+ CEUs each year, included with your magazine subscription - www.billing-coding.com/CEU CMS Revises Guidance Regarding the Use of Statistical Sampling for Overpayment Estimation EARN OVER 30 CEUs each year at no additional cost to your magazine subscription! https://www.billing-coding.com/ceus

A: In general, after the relator’s interview with the government, if the government has questions or needs assistance, they will ask relator’s counsel throughout the process. Sometimes, there are additional relator interviews or information that is requested by the government either of the relator or of their counsel. A relator should not expect regular, detailed updates from the government during the course of the investigation. Additionally, as the government always iterates, once the case is under seal, it is the government’s investigation. Unless a relator is provided information without asking or stumbles across information that is relevant during the course of their regular duties, they should not continue to acquire information directly.

Q: Will the name of the relator come out from under seal in the public domain?

A: Yes. In all but the rarest of circumstances when a separate motion is filed in the court where the case is pending by the relator’s counsel with the blessing of the U.S. Department of Justice, a relator’s name will become public.

Q: Can a defendant retaliate against me after a case?

A: 31 U.S.C. §3730(h), which was amended in 2009 and 2010, is the provision of the False Claims Act that addresses the prohibition against retaliation. Unlike other provisions in the FCA, the government does not prosecute “h” claims and there is a state law component to them. A recent Sixth Circuit case is illustrative. In United States ex rel. Felten v. William Beaumont Hospital (993 F.3d 428, 432; 6th Cir. 2021), the Sixth Circuit concluded:

“While there are textual clues suggesting that § 3730(h)(1) could be read to extend to former employees, the Sixth Circuit found that the statute’s use of ‘employee’ was ambiguous. To resolve that ambiguity, the court honed in on Congressional intent and the purposes of the FCA. ‘The FCA is designed to discourage fraud against the government.’ Its anti-retaliation provision promotes that end by encouraging employees to report fraud by ‘protect[ing] persons who assist [in its] discovery and prosecution.’ If employers can simply threaten,

harass, and discriminate against employees without repercussion as long as they fire them first, the court reasoned, potential whistleblowers could be dissuaded from reporting fraud against the government. For that reason, the Sixth Circuit held that the anti-retaliation provision of the FCA may be invoked by a former employee for post-termination retaliation by a former employer” (Id. at 434).

The Sixth Circuit specifically pointed out: “Likewise, the provision for special damages can provide relief to former employees. That provision explicitly remedies ‘discrimination’—misconduct that is not dependent on whether the plaintiff is still an employee,” referring to § 3730(h) (2), “Relief...shall include...compensation for any special damages sustained as a result of the discrimination....” (Id. at 434).

Felten also indicated: “Nobody disputes that former employees can obtain relief under the anti-retaliation provision. For example, the FCA creates a specific cause of action for retaliatory discharge, which can be brought only by discharged (former) employees. Or an employee might quit or retire after their employer mistreats them because of their FCA-protected activity. These former employees, however, would have been current employees when they were retaliated against.”

Q: Is credit given by the government for comprehensive compliance programs as a mitigating factor in enforcement actions?

A: Yes. In healthcare, HHS-OIG has the discretion, as it recently indicated in its November 2023 Compliance Guidance. Additionally, the DOJ has a list of factors that it considers in both civil and criminal cases in the Justice Manual.

Conclusion

In my experience, the decision to become a whistleblower is not an easy one for most people. The reason is because some companies and their counsel are caustic and ruthless. In reality, instead of forcing a whistleblower out or firing them, which is a form of retaliation, companies should take the opportunity to adhere to substantive and

32 BC Advantage Magazine www.billing-coding.com