JUNE 2023 www.ethanolproducer.com More Producers Adopting Protein Technology Page 36 INTO GOLD Turning Grain PLUS LSCP’s 20-Year Journey of Growth Page 26 Get A Tighter Lock on LDAR Page 44

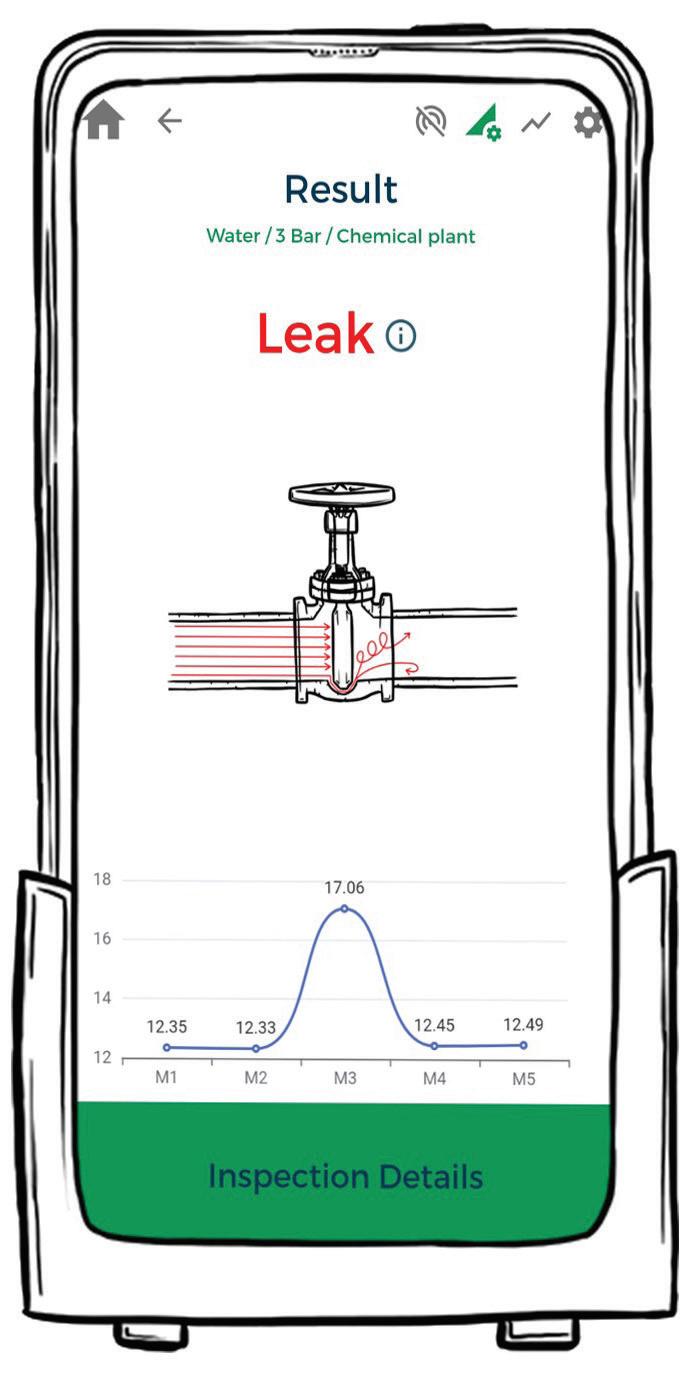

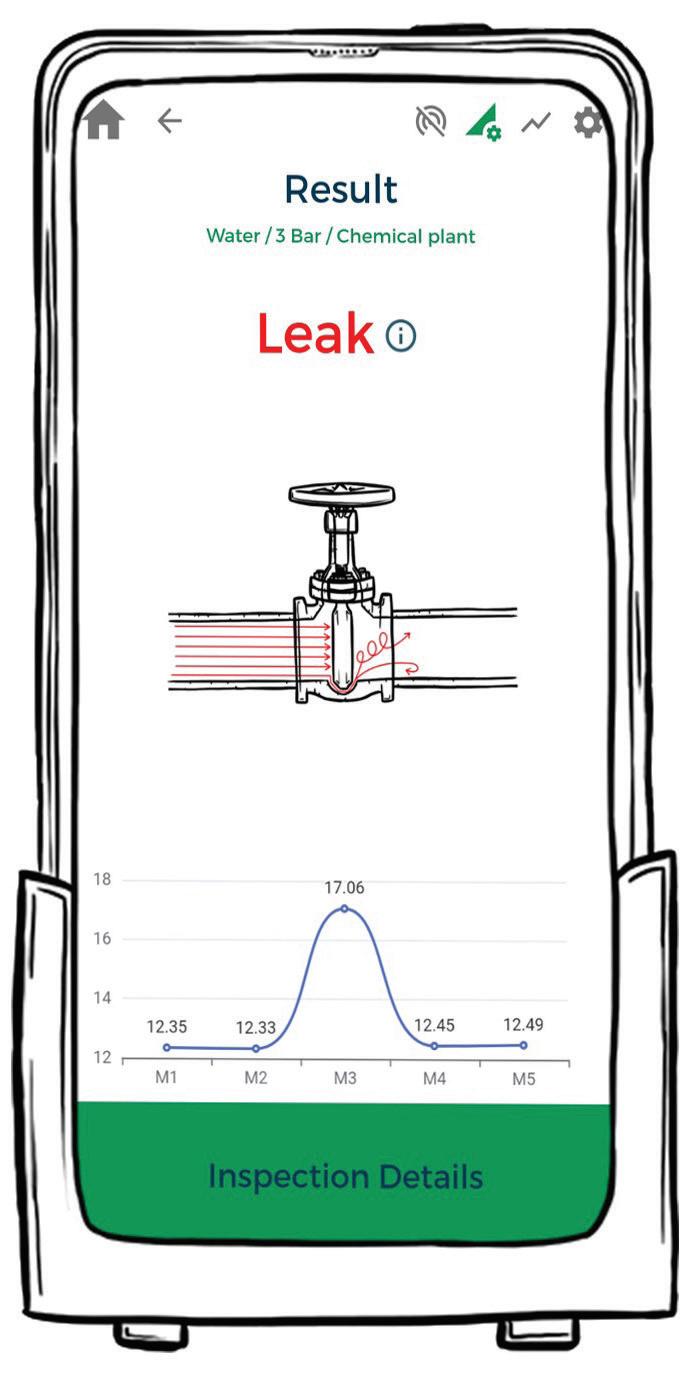

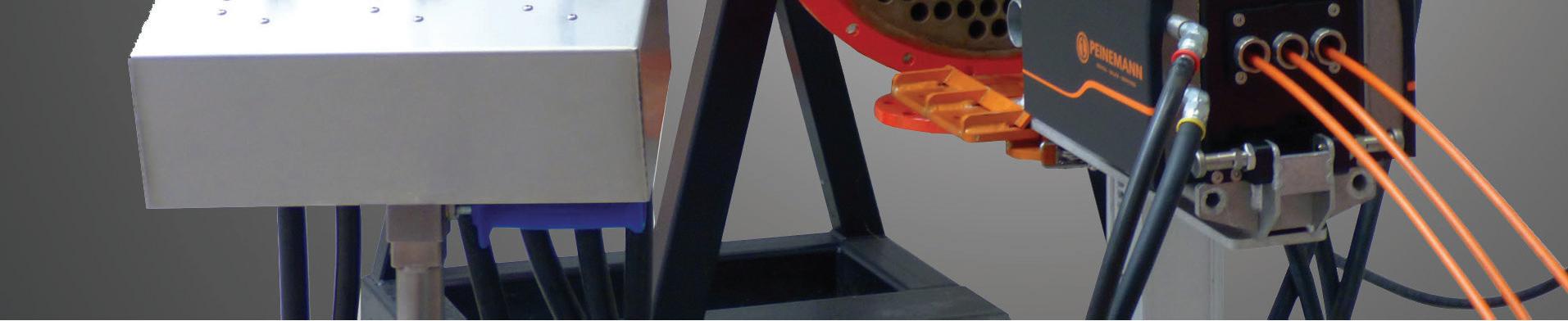

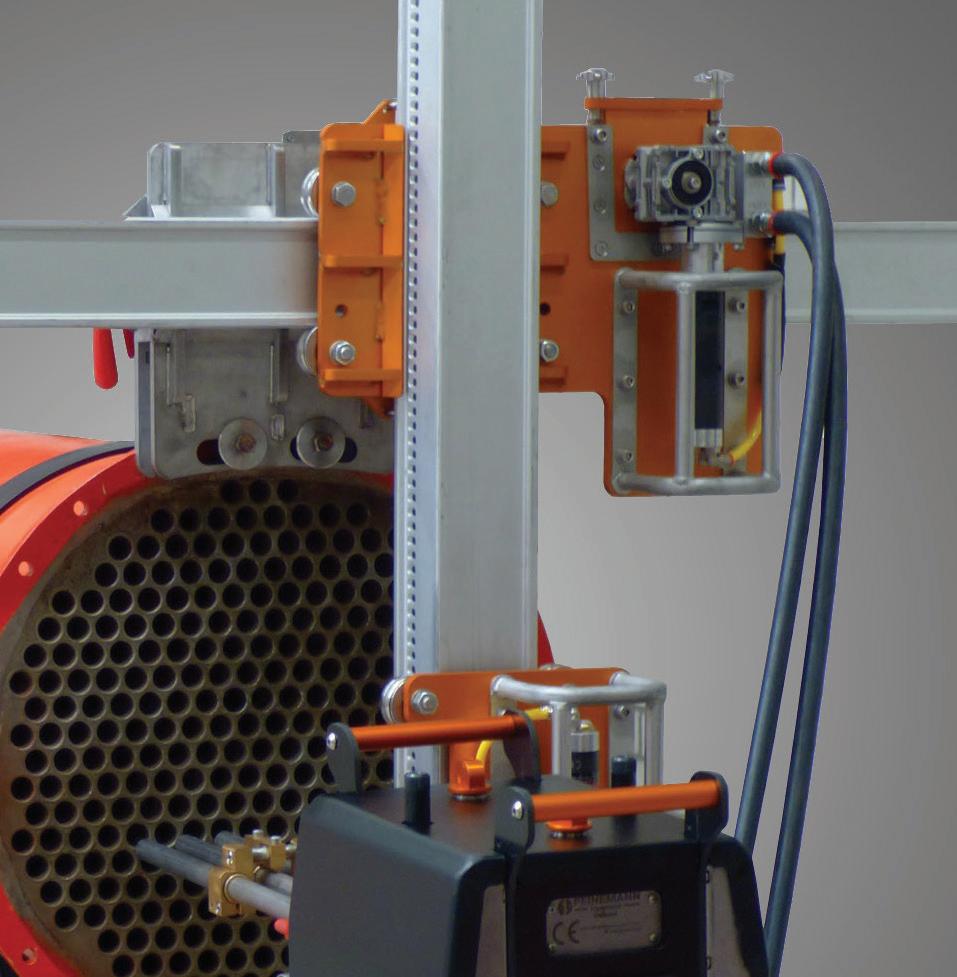

4 | ETHANOL PRODUCER MAGAZINE | JUNE 2023 DEPARTMENTS 5 AD INDEX/EVENTS CALENDAR 6 EDITOR'S NOTE CI Reduction at the Plant and On the Farm By Tom Bryan 8 VIEW FROM THE HILL The Importance of the Next Generation Fuels Act By Geoff Cooper 12 GLOBAL SCENE U.S. Grains Council Celebrates Japanese Ethanol Ruling By Mackenzie Boubin 14 BUSINESS BRIEFS 43 MARKETPLACE FEATURES 16 FARM Sequestration In the Field Factoring climate-smart farming into ethanol's CI By Katie Schroeder 26 PRODUCTION Climbing Higher Over Time LSCP's two decades of incremental growth By Katie Schroeder Ethanol Producer Magazine: (USPS No. 023-974) June 2023, Vol. 29, Issue 6. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. 36 DIVERSIFICATION Going for Gold Catching up with ICM's APP system installations By Luke Geiver 44 ENVIRONMENTAL Tighter LDAR Protocols Making your facility compliance, audit ready By Luke Geiver 52 CELLULOSIC Wood Ethanol Alongside Corn A next-generation idea for today's plants By Susanne Retka Schill SPOTLIGHTS 60 VEOLIA A Collaborative Partner of Choice for the Ethanol Industry By Katie Schroeder 61 PREMIUM PLANT SERVICES A Trusted Name In Shutdown Cleaning By Katie Schroeder Contents JUNE 2023 VOLUME 29 ISSUE 6 16 26 36 44 52 CONTRIBUTIONS 62 TECHNOLOGY Valve Inspection Gets Easier Mobile app for phones provides instant results By Michael Hettegger 66 CONSTRUCTION CHP and Carbon Capture: Keys to Unlocking Part of the Net-Zero Fuels Equation Fagen Inc. ready for ethanol's latest projects By

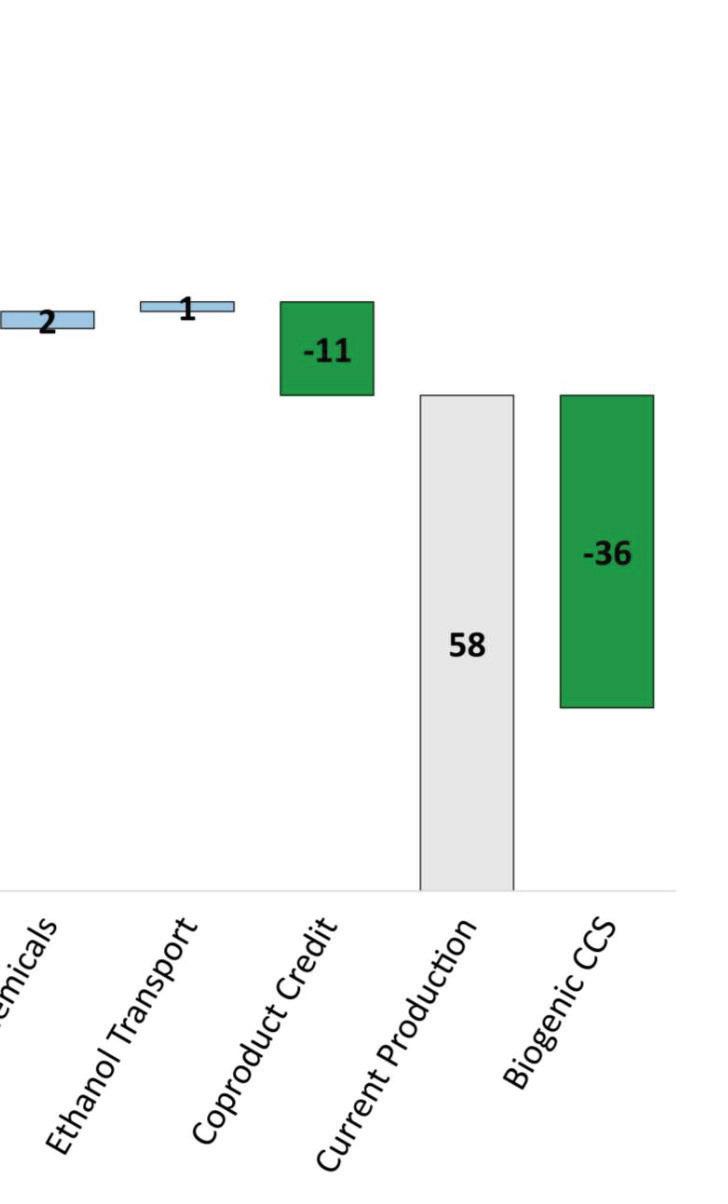

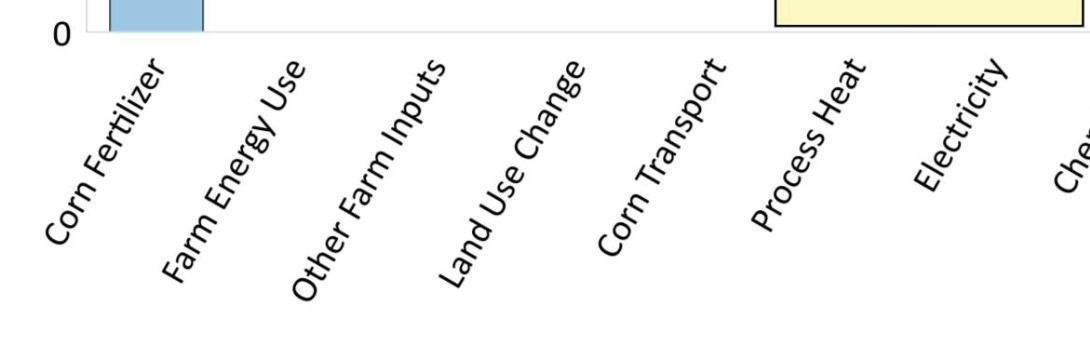

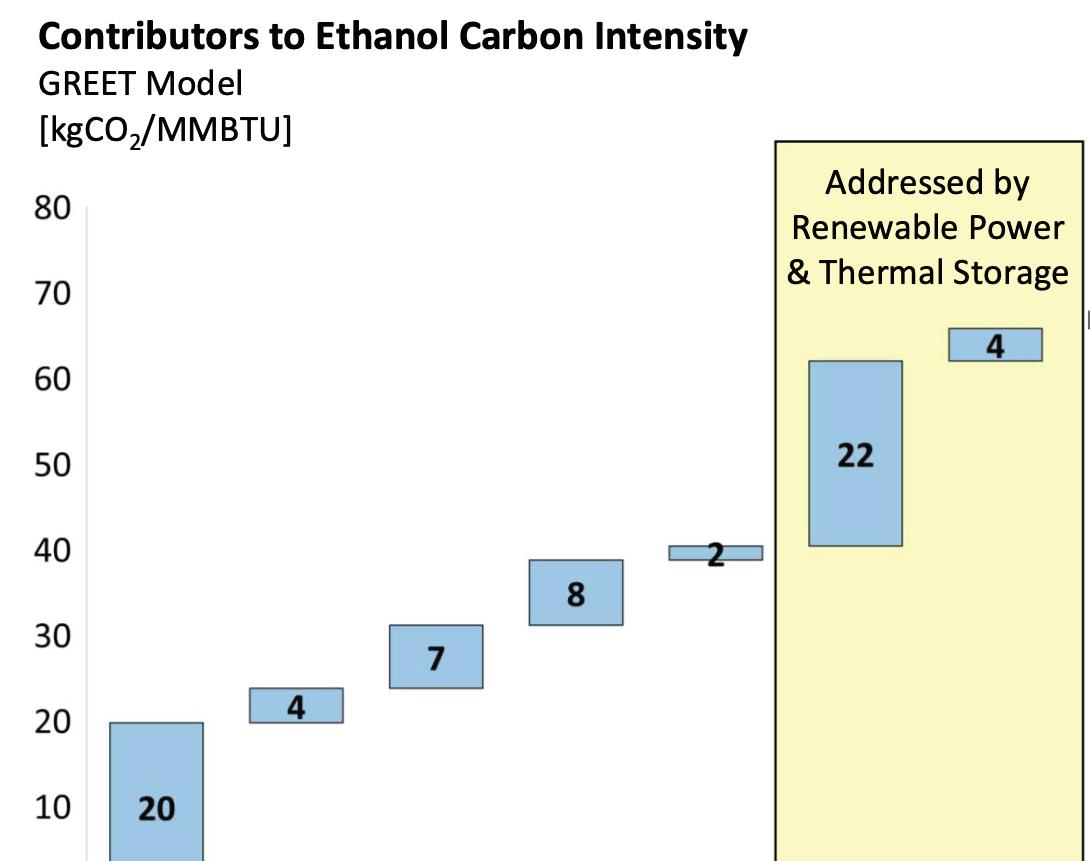

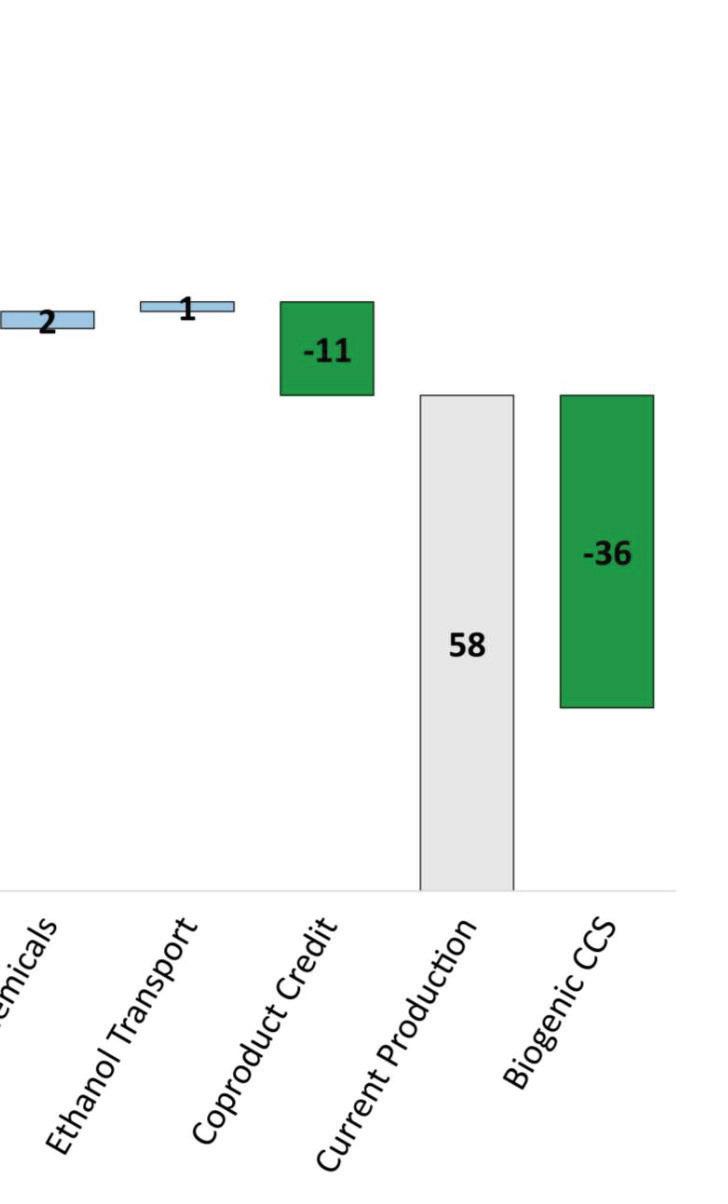

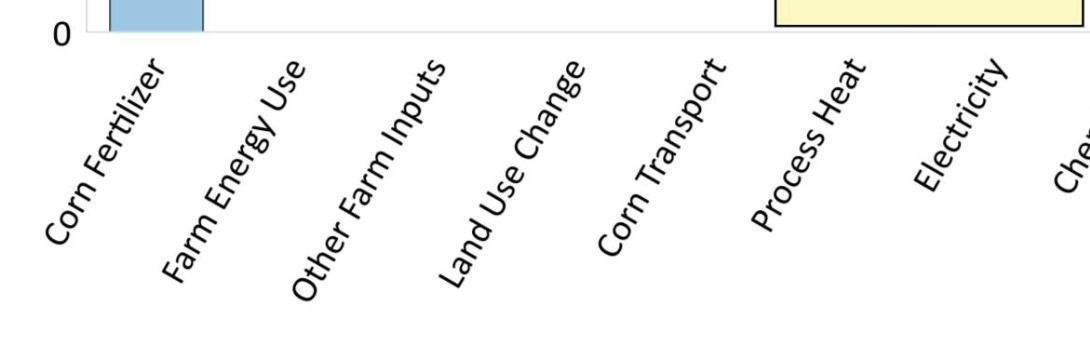

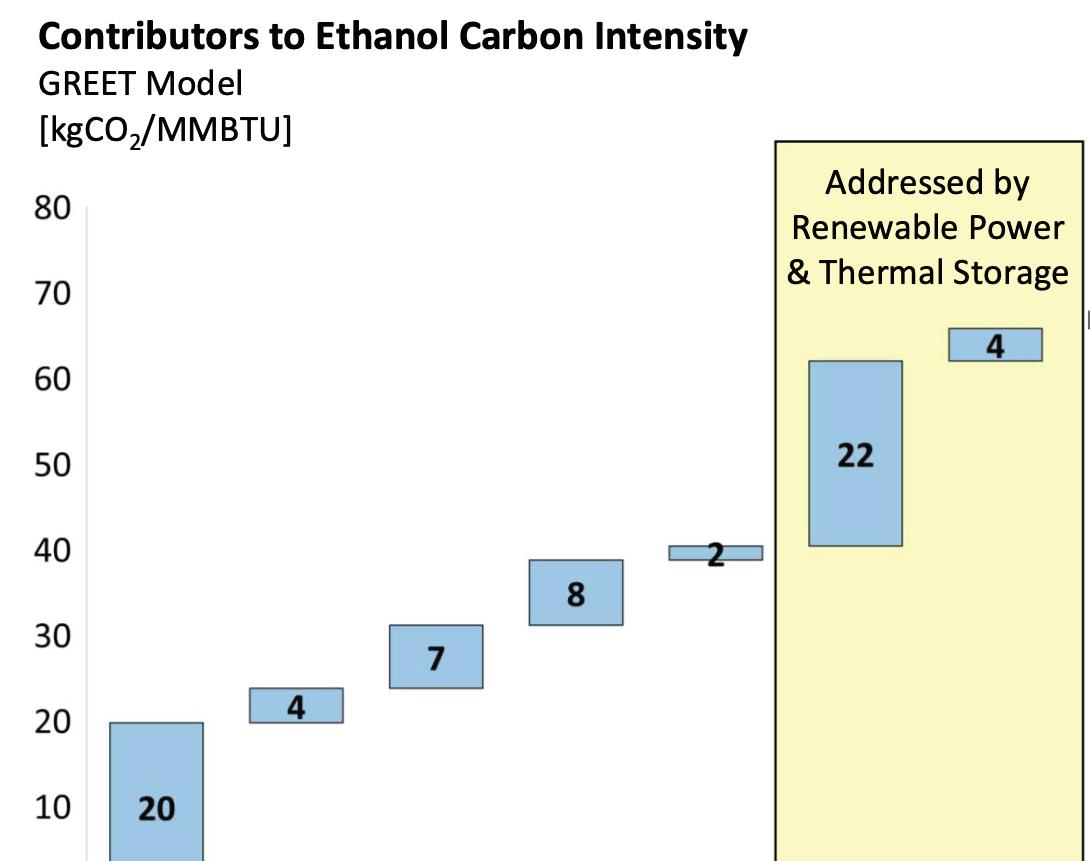

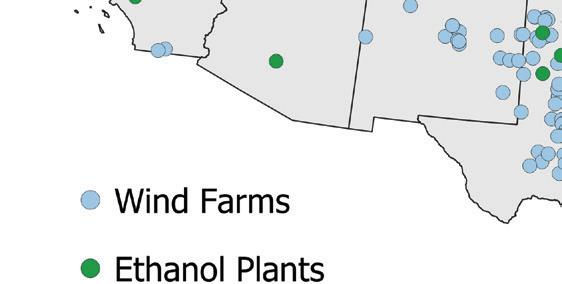

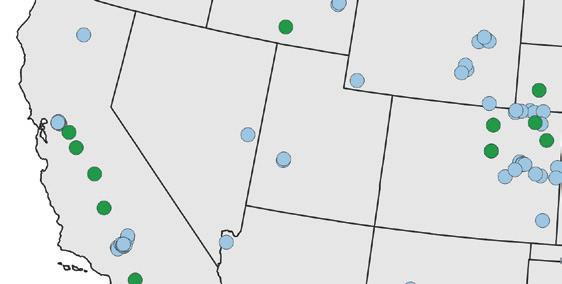

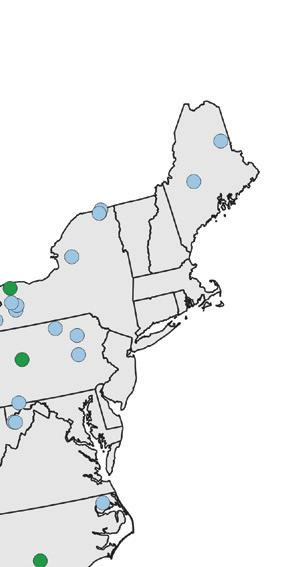

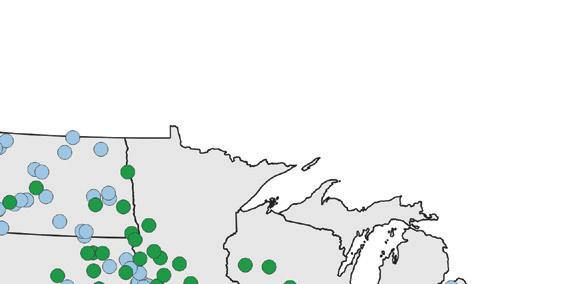

70 ENERGY Decarbonizing Process Heat: The Key to Capturing Once-In-A-Generation Incentives Thermal energy storage for on-site wind energy By Jordan Kearns

Will Stark

EDITORIAL

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor

Erin Voegele evoegele@bbiinternational.com

Staff Writer

Katie Schroeder katie.schroeder@bbiinternational.com

DESIGN

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

PUBLISHING & SALES

CEO

Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales

John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader

Chip Shereck cshereck@bbiinternational.com

Account Manager

Bob Brown bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe mdefoe@bbiinternational.com

EDITORIAL BOARD

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine

Front Range Energy Dan Sanders Jr.

Advertiser Index

Upcoming Events

2023 Int'l Fuel Ethanol Workshop & Expo

June 12-14, 2023

CHI Health Center, Omaha, NE (866) 746-8385 | FuelEthanolWorkshop.com

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

2023 Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel

June 12-14, 2023

CHI Health Center, Omaha, NE (866) 746-8385 | BiodieselSummit.com

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomassbased diesel sector beyond its current limitations.

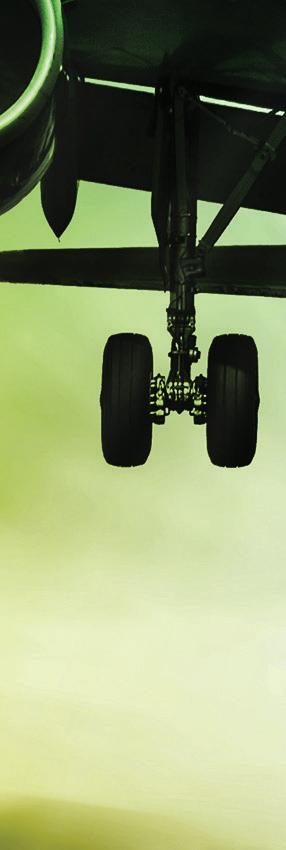

2023 North American SAF Conference & Expo

August 29-30, 2023

Minneapolis Convention Center, Minneapolis, MN (866) 746-8385 | www.safconference.com

The North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers.

2023 National Carbon Capture Conference & Expo

November 7-8, 2023

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@ bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

Please recycle this magazine and remove inserts or samples before recycling

Iowa Events Center | Des Moines, IA (866) 746-8385 | www.nationalcarboncaptureconference.com

The National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon dioxide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as directly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

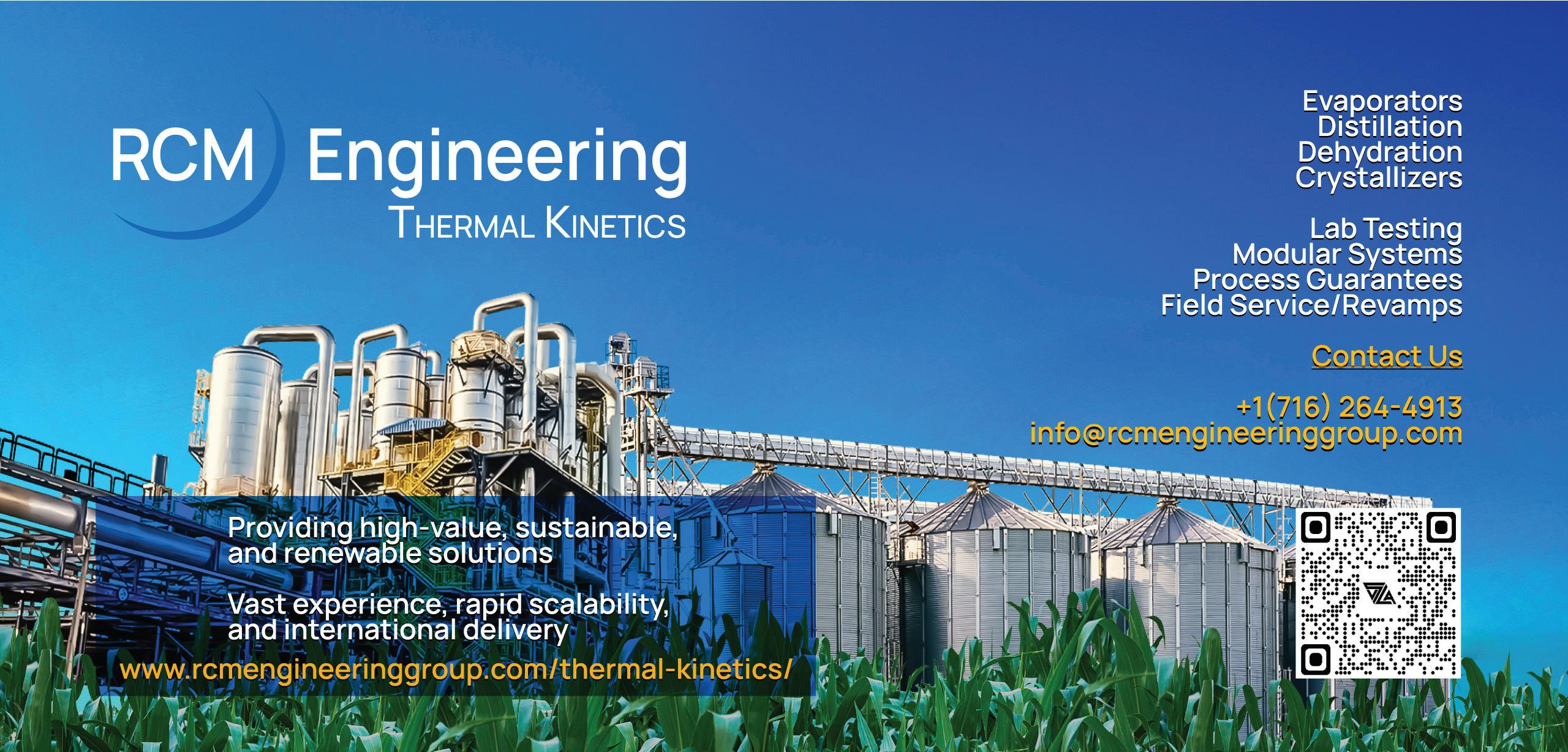

ETHANOLPRODUCER.COM | 5 2023 Int'l Fuel Ethanol Workshop & Expo 14-15 ACE American Coalition For Ethanol 69 Apache Stainless Equipment 38 Bepex International LLC 19 BetaTec Hop Products 76 Beyond (a Christianson Company) 23 Check-All Valve Mfg. Co. 40 CPM 72 D3MAX LLC 34-35 Ecolab 39 Fagen Inc. 28 Fluid Quip Mechanical 30 Fluid Quip Technologies 12 Growth Energy 13 Helle Engineering, LLC 29 Howden 18 Hydro-Thermal Corporation 50 ICM, Inc. 9 & 65 IFF, Inc. 59 Indeck Power Equipment Co. 42 Interra Global Corporation 48 Interstates, Inc. 64 J.C. Ramsdell Enviro Services, Inc. 67 Jacobs Corporation 57 KATZEN International, Inc. 46 Keit Spectrometers 22 Kemin Bio Solutions 41 Krieg & Fischer 55 Lallemand Biofuels & Distilled Spirits 11 Leaf by Lesaffre 73 Mason Manfacturing, LLC 54 McCormick Construction, Inc. 56 Midland Scientific Inc. 47 Mole Master Services Corporation 43 Natwick Associates Appraisal Services 31 NLB Corp. 68 North American SAF Conference & Expo 21 Phibro Ethanol 25 POET LLC 7 Premium Plant Services, Inc. 61 RCM Engineering-Thermal Kinetics 49 RPMG, Inc. 58 SAFFiRE Renewables 74 Salco Products, Inc. 3 Sukup Manufacturing Co. 2 The CCM Group 20 Trucent 32 Veolia 60 Victory Energy Operations, LLC. 33 WINBCO 51 Zeochem LLC 71

COPYRIGHT © 2023 by BBI International

CI Reduction at the Plant and On the Farm

Turning ethanol into an ultra-low carbon—someday, net-zero—biofuel calls for the powerful convergence of three things: continued efficiency gains at the facility level (perhaps including the future replacement of fossil energy); the widespread adoption of carbon capture systems (of all kinds); and the adoption of state and federal low-carbon fuel policies that reward climate-smart agriculture. All three legs of this strategy are necessary, and each shows up in the pages of this June edition.

It is ironic that the least talked about component of our net-zero quest is arguably the most vital and difficult to achieve. There’s a strong case for reducing the allocated carbon intensity of corn grown on farms that use low-carbon techniques like reduced tillage and cover cropping, along with shrewd nutrient management. But we seem to be miles away from real incentives. As we report in “Sequestration In the Field,” on page 16, current incentives for low-carbon biofuel—namely what’s offered by California’s LCFS—assign the same base-level carbon intensity rating to all corn, regardless of cultivation practices and soil management. Status quo programs don’t reward ethanol producers sourcing (or planning to source) low-carbon, soil-friendly feedstock from growers practicing regenerative agriculture. In turn, they fail to provide farmers with an incentive to change. Still, there is sizeable interest in climate-smart farming. Important pilot programs are underway, and there’s real hope for both state and federal legislation that would finally give both farmers and ethanol producers the credit they deserve.

Continued process efficiency gains are an important aspect of the industry’s net-zero quest, and our page-26 story on Little Sioux Corn Processors is a good example of how ethanol producers can grow dramatically, in stages, while maximizing efficiency and building new revenue streams. As you’ll discover while reading “Climbing Higher Over Time,” LSCP has done this while embracing the humble mantra of “doing more with less.” And, oh, are they doing more—of everything.

After hearing about multiple ethanol plants making headway with installations of ICM Inc.’s Advanced Processing Package, we asked the company to share its progress. We’re glad we did. The Kansas-based process technology company is staying busy with APP installations, and we catch up on their journey in our page-36 story, “Going for Gold.” ICM’s system, which allows ethanol plants to produce a yeast-enriched 50% protein, along with traditional DDGS or, alternatively, a high-energy animal feed, provides numerous tangential benefits (more ethanol, more corn oil and less energy use, to name a few). The multi-part package is easily integrated with existing equipment and can be adopted in stages or, if desired, all at once.

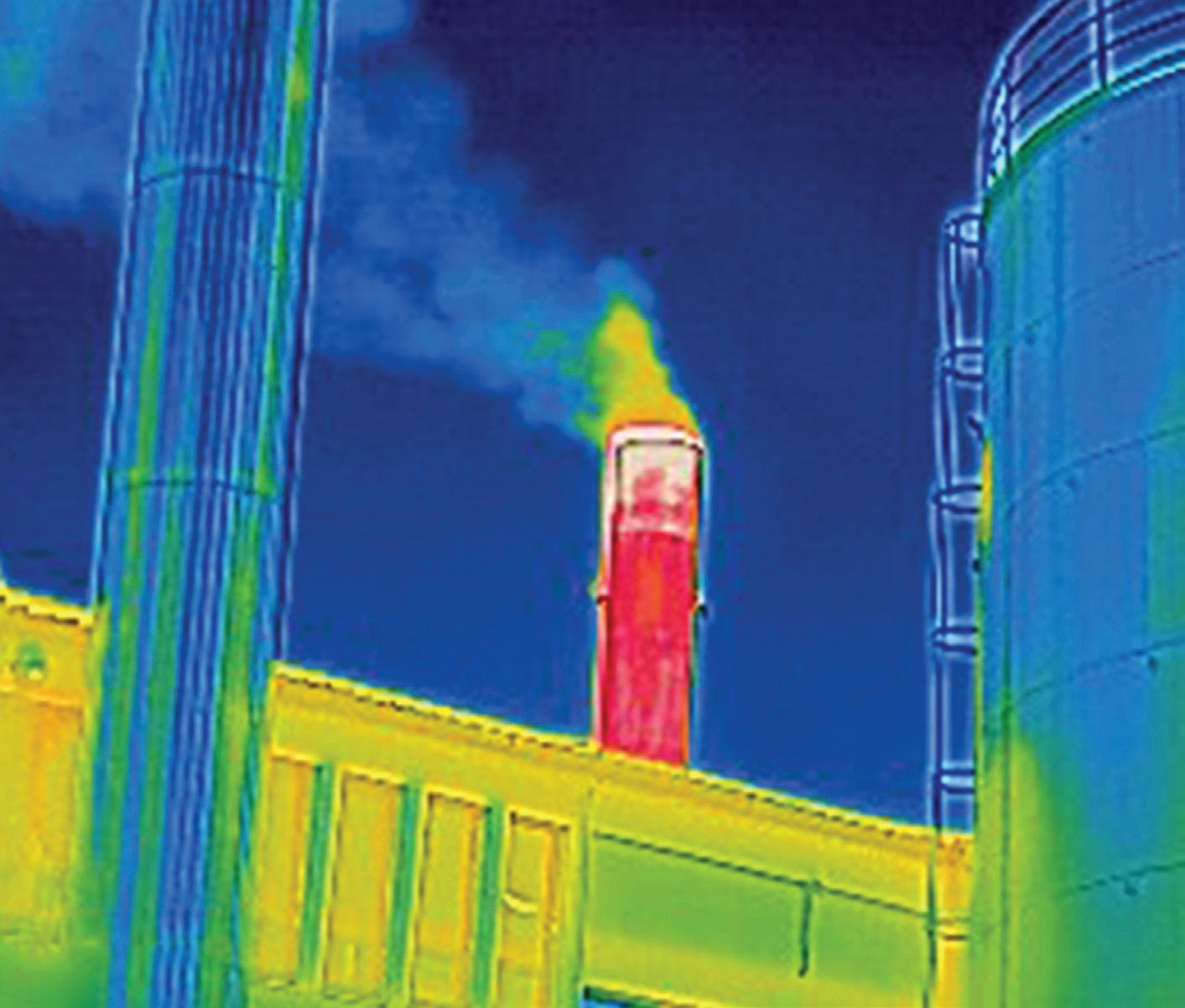

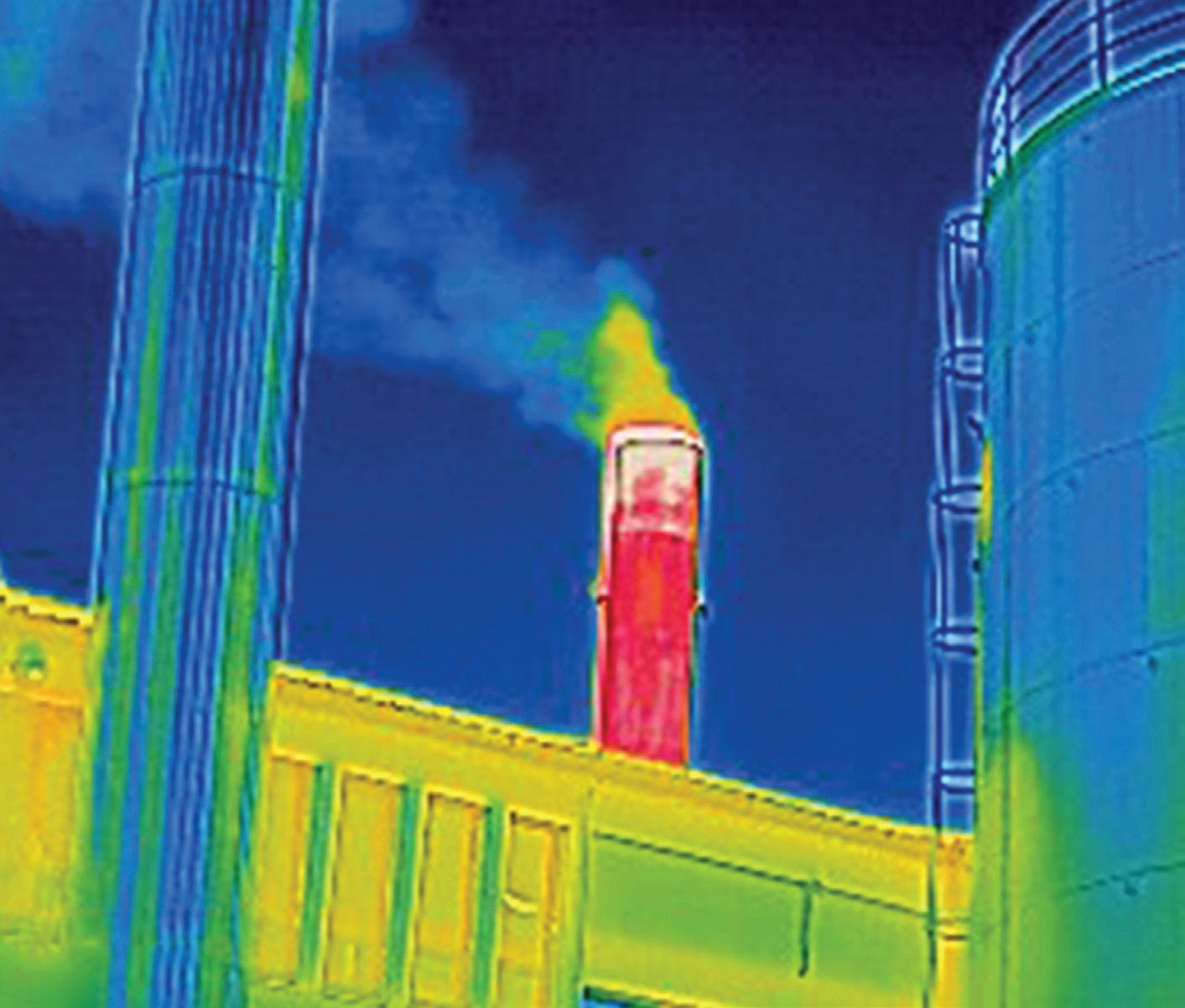

New technologies and plant expansions are exciting, but there are also sobering aspects to growth, compliance being one of them. In “Tighter LDAR Protocols,” on page 44, we look at the relatively stringent leak detection and repair procedural requirements ethanol producers must maintain and sometimes amend—especially when they make facility changes. With some frequency, regional and federal enforcement agencies have been auditing LDAR plans and stopping by ethanol plants to scan for leaks with infrared cameras. Fortunately, third-party contractors can help plants reduce their compliance stress with LDAR program management that helps them be audit-ready at all times.

Finally, be sure to check out our story on Comstock’s wood ethanol vision, on page 52, followed by three really good contributions—one from renowned builder Fagen Inc. that fits right into this month’s decarbonization theme.

Enjoy the read.

6 | ETHANOL PRODUCER MAGAZINE | JUNE 2023 FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US: TWITTER.COM/ETHANOLMAGAZINE Editor's Note

in rh ythm with natur e

gcooper@ethanolrfa.org

The Importance of the Next Generation Fuels Act

In April, the U.S. Environmental Protection Agency released a proposed regulation for what it calls “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles.” While that title sounds official and impressive, let’s call the proposed regulation what it really is: an electric vehicle mandate. Why? Because unless automakers dramatically increase their production of EVs in the years ahead, they’ll have no way of complying with EPA’s ambitious proposed standards. EPA itself expects that, under the regulations, “EVs could account for 67% of new light-duty vehicle sales” by 2032.

Indeed, John Bozzella, head of the national trade association representing automakers, called EPA’s proposal “aggressive by any measure” and labeled the agency’s EV goals as “very high.” Rather than plunging headlong into the EV abyss, Bozzella recommended that “EPA and the petroleum industry should act quickly to concurrently lower the carbon intensity of liquid fuels. This will produce higher and faster returns by reducing emissions from not only new gas vehicles (including plug-in hybrid EVs), but from the millions of light-duty gas vehicles currently on the road.”

We wholeheartedly agree.

And that’s why policymakers should be considering technology-neutral approaches for reducing carbon emissions instead of pursuing vehicle mandates that put all of our eggs into one basket. A smarter approach to carbon policy would be to set the emissions reduction goal, then let the marketplace determine the lowest-cost and most efficient ways of meeting that standard.

That’s exactly what the Next Generation Fuels Act would do.

This bipartisan legislation was introduced in the Senate in late March by Senators Chuck Grassley (R-IA), Amy Klobuchar (D-MN), Joni Ernst (R-IA) and Tammy Duckworth (D-IL), and the following week in the House by Reps. Mariannette Miller-Meeks (R-IA), Angie Craig (D-MN), Darin LaHood (RIL), Nikki Budzinski (D-IL) and 16 others.

If signed into law, this bill would require more efficient high-octane, lower-carbon fuels beginning in 2028. The bill doesn’t dictate how regulated parties must achieve the higher octane and lower carbon requirements; it doesn’t require the use of a specific fuel or vehicle. Rather, it simply sets the standard for high octane (95 RON ramping up to 98 RON) and low carbon (the source of the octane boost must reduce GHG emissions by 40% compared to today’s gasoline), opens the marketplace to a broad array of high-octane, low-carbon sources by removing arcane regulatory barriers, then lets the market work its magic.

The reintroduction of the Next Generation Fuels Act in both the House and Senate gives liquid fuels the opportunity to increase fuel efficiency while reducing tailpipe emissions, something that the Biden Administration is acutely focused on at this time. This bill would also keep our industry moving forward in pursuing our members’ commitment to a net-zero-carbon future and would demonstrate that there are alternatives to an all-EV future in the form of lower-cost, lower-emitting renewable liquid fuels that are ready to deploy in increased amounts today.

RFA strongly supports the Next Generation Fuels Act, and we thank the many visionary leaders in Congress who support this landmark legislation. We look forward to working with clean fuel supporters in both chambers of Congress—and both political parties—to turn this bold vision into a reality.

8 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Renewable Fuels

Geoff Cooper President and CEO

Association 202-289-3835

View from the Hill

U.S. Grains Council Celebrates Japanese Ethanol Ruling

U.S. Grains Council staff and representatives’ recent activity in Japan has contributed to a major breakthrough for U.S. ethanol, allowing domestic producers to access up to 100 percent of the Japanese biofuel market.

In the leadup to the landmark announcement, council staff and members of the Illinois Corn Marketing Board were accompanied by Illinois Sen. Tammy Duckworth to Tokyo to meet with Japanese auto manufacturers, the Department of Agriculture’s Foreign Agriculture Service (FAS) Tokyo, U.S. Ambassador to Japan Rahm Emanuel and Ministry of Economy, Trade and Industry (METI) officials to discuss Japan’s commitment to double ethanol consumption by 2030.

Japanese ethanol imports are in the form of ethyl tert-butyl ether (ETBE). The U.S. first achieved market access following a change in Japan’s policy in 2018, coinciding with its industry’s interest in U.S. ethanol’s low carbon properties. The USGC estimates U.S. ethanol in Japan totaled about 140 million gallons (utilized in the form of ETBE) during marketing year (MY) 2021/2022.

The current volume for Japanese bioethanol consumption remains at 217 million gallons (77 million bushels in corn equivalent) per year at an ethanol blend level of 1.9 percent ETBE.

Japan’s METI oversees Japan’s energy policy, which includes how ethanol is to be utilized in the country. The U.S. industry delegation discussed ways to further increase Japan’s ethanol consumption to comply with global environmental targets and domestic consumer initiatives by demonstrating infrastructure feasibility, supply availability and automobile compatibility to promote a direct blend of E3 in the near term.

In addition to creating market access for U.S. ethanol, the mission was also a time to discuss sustainable aviation fuel (SAF), the carbon reduction benefits of ethanol and the reliability of the U.S. ethanol supply. Representatives from Japan’s All Nippon Airways and Boeing were present at a biofuels panel hosted by the U.S. embassy to hear from ICMB and other industry representatives about ways to use corn ethanol-based SAF within their policies.

Just a month after the council’s meetings in Tokyo, METI released its final proposed rule for partial amendment of the Act on Sophisticated Methods of Energy Supply Structures—in place through 2028— that allows the country to further contribute to its climate targets through consumption of lower-carbon ethanol and, for the first time, will grant U.S. ethanol the ability to achieve full access to the Japanese biofuel market.

The act, which is reviewed every five years, featured timely and scientific updates regarding the lifecycle assessment of U.S. corn-based ethanol.

The council is delighted to have contributed to this new ruling through years of programs, meetings and other initiatives in Japan to provide U.S. ethanol producers with a new, high-volume market that will increase their profit and lower carbon emissions overseas.

10 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Mackenzie Boubin Director of Global Ethanol Export Development

U.S. Grains Council mboubin@grains.org

Global Scene

In Japan to discuss the country's commitment to double ethanol consumption by 2030, U.S. Grains Council staff and Illinois Corn Marketing Board members were joined by Illinois Sen. Tammy Duckworth (head of the table). The group met with auto manufacturers and government representatives while there, including U.S. Ambassador to Japan Rahm Emanuel (left of Sen. Duckworth)

PHOTO: USGC

MEET TODAY’S GOALS. ANSWER TOMORROW’S QUESTIONS. SOLUTIONS, DESIGNED BY LBDS.

We put Fermentation First™. You get yeast, yeast nutrition, enzymes and antimicrobial products, alongside the industry leading expertise of our Technical Service Team and education resources. Find the right solution for your ethanol business at LBDS.com.

© 2023 Lallemand Biofuels & Distilled Spirits

BUSINESS BRIEFS

Davis named vice president of New Energy Blue

New Energy Blue has hired Kelly Davis as vice president, a new position at the company. Davis will augment the company's technical, regulatory and operations expertise as it staffs up to build out a series of clean-tech biomass refineries, which aim to produce low-carbon biobased fuels and chemicals from corn stalks, wheat straw and, in the future, perennial grasses.

Davis joins New Energy Blue after a decade as vice president of technical and regulatory affairs with the Renewable

ClearFlame Engine Technologies raises $30 million in Series B funding

Chicago-based ClearFlame Engine Technologies has raised $30 million in Series B funding to bring to market innovative solutions that power heavyduty engines with clean, renewable fuels and create a viable business solution to reduce carbon and soot. The company’s patented technology runs on a range of renewable liquid fuels including ethanol.

The latest investments were led by Mercuria Energy Group, one of the world's largest privately held energy and commodities companies, with Mercuria

Fuels Association. A chemist by training, she brings three decades of biofuels experience in quality management, production and marketing. Davis will work with local farmers in Iowa, sourcing crop residue for conversion into second-generation fuels. She will also develop expanded uses for the clean lignin produced at New Energy Blue’s future biorefineries.

and Breakthrough Energy Ventures both making second investments. Other new investors were also announced.

“Federal Department of Energy funding moved us from concept to patent,” said BJ Johnson, ClearFlame CEO and company co-founder. “[And] series A funding propelled us from patent to pilot. This latest investment round can accelerate us from pilot to proven product in multiple markets, starting with longhaul trucks.”

The experts in transformative technology. ©2023. All rights reserved Fluid Quip Technologies , LLC. All trademarks are properties of their respective companies. Scan here to schedule a meeting today! Engineering solutions, providing insight and guidance on process improvements, optimization, and strategies.

PUT DECADES OF EXPERIENCE TO WORK IN YOUR FACILITY.

PEOPLE, PARTNERSHIPS

& PROJECTS

Kelly Davis

Ward returns to NCERC as project management engineer

The National Corn-to-Ethanol Research Center at Southern Illinois University Edwardsville (NCERC at SIUE) is pleased to welcome Steve Ward, PE, as its new project management engineer. In his new role, Ward will oversee research projects in NCERC’s pilot- and demonstration-scale research laboratories while working directly with clients from across the world that come to the center to perform scale-up of commercial-bound biotechnologies. In addition to his role on the

CHP Alliance urges Congress for support in FY 2024 budget

The Combined Heat and Power Alliance and more than 50 businesses, manufacturers, end-users, trade associations, non-profits and others sent a letter urging House and Senate leadership of the Energy and Water Development Appropriations Subcommittee to support robust funding for combined heat and power (CHP) programs in the fiscal year 2024 budget.

The letter requests funding for several programs within the Department of Energy’s Advanced Materials and Manufacturing Technologies Office and

research team, Steve will serve as a mentor for NCERC’s operations staff and those who participate in the workforce training programs at the center.

Ward brings over 15 years of experience in engineering and project management to the NCERC leadership team, including previous employment at the center, holding multiple roles there from 2004 to 2016.

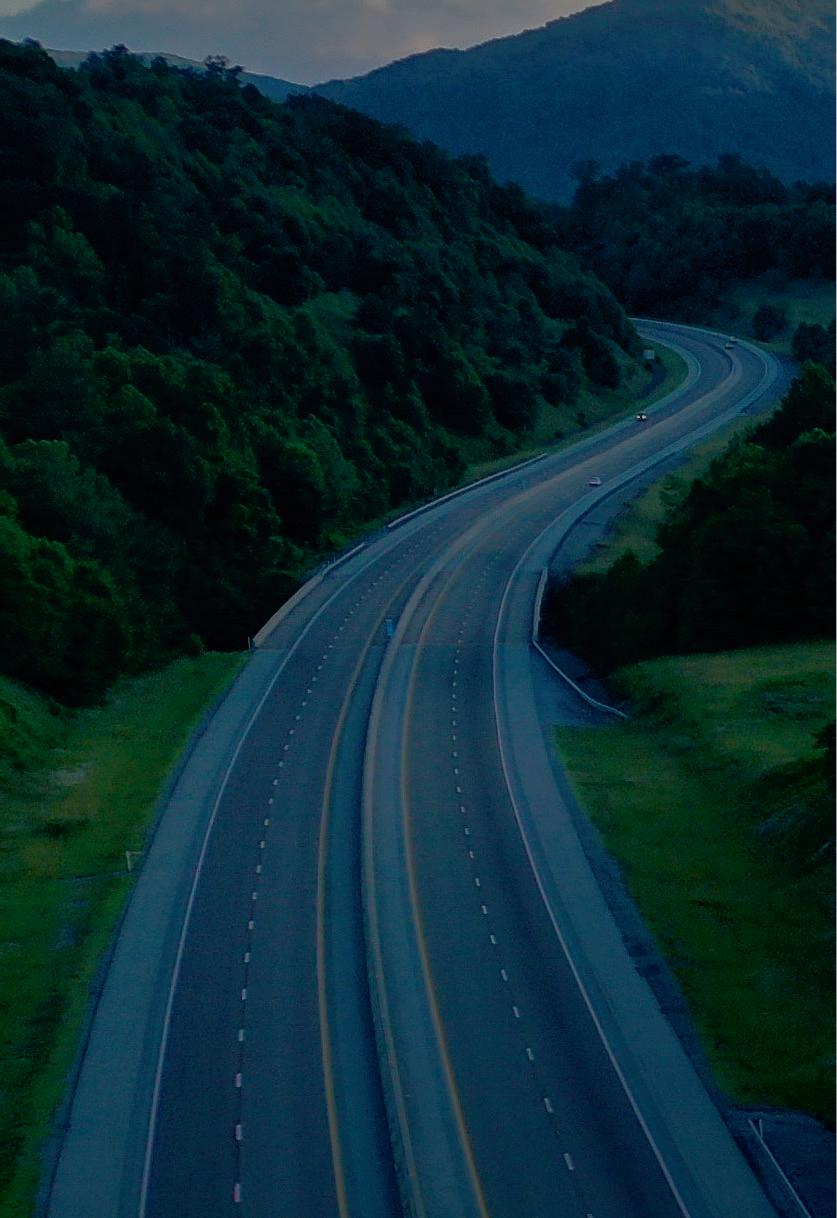

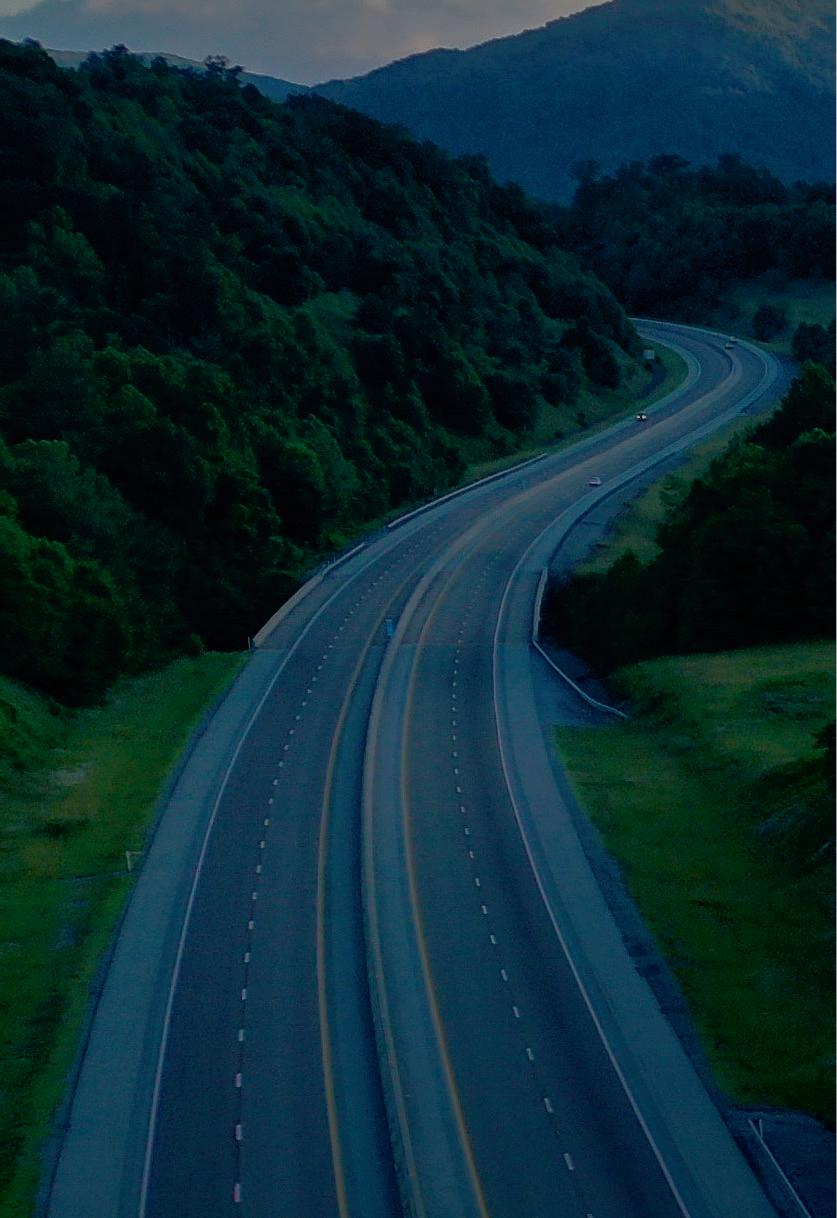

CLEANER ROAD TR IPS AWAIT

Industrial Efficiency & Decarbonization Office, including: $58 million in funding to help interested parties deploy CHP systems; $20 million in funding directed toward RD&D and technical assistance for renewable- and hydrogen-fueled CHP to be used in industry; and $35 million in funding to support economy-wide decarbonization efforts and fund research and development of materials with high thermal and/or electrical conductivity, including CHP systems and waste heat recovery.

We’ve put together some eco-friendly, perfect-for-spring itineraries with Get Biofuel stops and mustsee sights built in. Browse the itineraries &

learn more

at

Steve Ward

THANK YOU SPONSORS

THANK YOU SUPPORTING ORGANIZATIONS

THANK YOU MEDIA PARTNERS

ND C e North Dakota Ethanol Council european renewableethanol June 12-14, 2023 OMAHA, NE Sponsors & Exhibitors as of April 24, 2023

MA GAZINE

THANK YOU EXHIBITORS

4B Components, Ltd.

ABP Engineering

ADF Engineering, Inc

AGR A Industries, Inc

Aldon Company Inc

Alfa Laval, Inc

Alliance Technical Group

Allied Instrumentation

Allied Tank And Construction

Allied Valve, Inc

American Coalition for Ethanol

AmeriWater

AmertechTowerServices

Anderson Chemical Co

Angel Yeast Co., Ltd.

Antea Group

Apache Industrial Services, Inc

Apache Stainless Equipment Corp.

Apollo Water Services

Applied Material Solutions, Inc

Applied Products Thermal Products Group

Arktos Environmental

ArrowUP

ASI Industrial

Babcock & Wilcox

Barnhart Crane & Rigging

Baron Filtration Co., Inc

BASF Enzymes, LLC

Battelle

BE&E

Bepex International, LLC

BetaTec Hop Products, Inc

Beyond (a christianson company)

BG Peterson

BioFuels Automation

Bioleap, Inc

Bion Companies

Bison Engineering, Inc

Bluewater Energy Solutions

Boss RailCar Movers

Brown Tank, LLC

BRUKS SIWERTELL

Bulk Conveyors, Inc

Buresh Building Systems

Burns & McDonnell

Butterworth, Inc

Campbell-Sevey

Carbis Solutions Group, LLC

Carbon Sink, LLC

CCS Group

CEMTEK KBV-Enertec

Central States Group

Chase Nedrow Industries

ChemTreat, Inc

Christianson PLLP

Christy Catalytics, LLC

Clariant Corporation

Clear Air Enviro-Services

Clear Solutions USA, LLC

Cleaver-Brooks

Combustion Kinetics Corporation

CompuWeigh Corporation

Conveyor Engineering & Mfg. Co

Cooling Tower Depot, Inc

Corval Group

CORYS

CPM

Crown Americas-Crown Iron Works

CTE Global, Inc

C-TEC AG

D3MAX, LLC

Decker Electric, Inc

Diamond R Industries

Diemme Filtration Srl

Direct Companies

DMA/Streamtech Industrial

Dowco Valve Company

Durr Systems, Inc

DXP Enterprises

Eagle Services Corporation

Eco Industrial Services

EcoEngineers

Ecolab, Inc

EGM, Inc

Emerson Appleton Lighting

Emerson Measurement Energy Integration, Inc

Enertech Solutions, Inc

Entecco Filtration Technology, Inc

ENVEA, Inc

Enviro-Dyne Industrial Services

EnviroLogix, Inc

ESC Spectrum

Ethanol Producer Magazine

Evergreen Engineering, Inc

Evoqua Water Technologies, LLC

Fagen, Inc

Federal Appraisal, LLC

Federal Screen Products, Inc

Ferm Solutions, Inc

Filtration Technology Corporation

Flexitallic

Flottweg Separation Technology, Inc

Fluid Process Equipment, Inc

Fluid Quip Technologies, LLC

Foundation Analytical Laboratory, Inc

Franzenburg Centrifuge

G Tech USA

GEA North America

Genesis III

Gilbert Industries, Inc

Global Refractory Installers & Suppliers

Good Land Industrial

GP Strategies Corporation

GPM, Inc

Grace Consulting, Inc

Growth Energy

H2O Innovation

Hamilton Company

Harvesting Technology, LLC

Hayward Tyler, Inc

Helle Engineering

Hengye, Inc

High Plains Boiler and Mechanical

Hoffmann Inc. & Wolf Material Handling Systems

Howden

Hrvyst

HTH Companies

Hubbell Killark

Hupp Electric Motors

Hydrite Chemical Co

Hydro-Thermal Corporation

ICM, Inc

Industrial Contractors, Inc

Industrial Equipment & Parts

Innospec Fuel Specialties

Innovative Plant Solutions, Inc

Innovative Technologies

IntegroEnergy Group, Inc

Interra Global Corporation

Interstates, Inc

iRely, LLC

J&D Construction, Inc

J.C. Ramsdell Enviro Services, Inc

Jackson Industrial Construction

Jacobs Corporation

Jasper Engineering & Equipment Company

Johnson Screens

KATZEN International, Inc

Keit Industrial Analytics

Kemin Bio Solutions

KFI Engineers

Kiewit Energy Group

Kobelco EDTI Compressors

Koch Engineered Solutions

Komax Systems, Inc

Krieg & Fischer Ingenieure GmbH

Kubco Services, LLC

Kurita America

L&M Ethanol Maintenance Contracting, Inc

Laidig Systems, Inc

Lallemand Biofuels & Distilled Spirits

Lapis Energy

Leaf by Lesaffre

Lotus Mixers, Inc./LOTUS Process Group, LLC

Louisville Dryer Company

LucasE3 Engineering

Maas Companies, Inc

Malloy Electric

Mapcon Technologies, Inc

Mason Manufacturing, LLC

Master Packing & Rubber Company (MPRC)

McC, Inc

Mcgyan Biodiesel, LLC

Merjent, Inc

Metrohm USA

Midland Scienti c, Inc

Mid-States Millwright & Builders

Midwest Cooling Tower Services

Midwest Cooling Towers, Inc

Midwest Laboratories

Midwest Mobile Waterjet

Miller Mechanical Specialties, Inc

Minnesota Bio-Fuels Association, Inc

Modern Companies, Inc

MoistTech Corp.

Mole Master Services Corporation

Montrose Environmental Group, Inc

MRC Global

NABP

Nalco Water, an Ecolab Company

National Corn-to-Ethanol Research Center

Navigator CO2

Nebraska Department of Economic Development

Nelson Baker Biotech

Nestec, Inc

Neuman & Esser USA, Inc

NLB Corp.

Northern Horizons INC

Northern Plains Rail Services

Northwest Electric

Novaspect, Inc

Novozymes

Oxidizers, Inc

P&E Solutions, LLC

P1 Service, LLC

PAC LP

Paget Equipment Co

Painters USA

Pelican Energy Consultants

PerkinElmer, Inc

Phase Biolabs, Inc

Phibro Ethanol

Phoenix Contact USA, Inc

Piller TSC Blower Corporation

Pinion

Pinnacle Engineering, Inc

Pioneer Industrial Corporation

Pivot Clean Energy Co

Plaas Incorporated

Plasma Blue

Pneumat Systems, Inc

PRAJ Industries Limited

Precision Rotary Equipment

Premium Plant Services, Inc

Prentice

Pro ow Pumping Solutions

ProQuip, Inc

PROtect, LLC

Proteum Energy, LLC

Qi2 Elements

RailPros Inc

Rasmussen Mechanical Services

RCM Engineering-Thermal Kinetics

Refractory Service, Inc

Renewable Fuels Association

Renewal Service, Inc. (RSI)

Rentech Boiler Systems, Inc

Richard

RINAlliance, Inc

RMS Roller-Grinder

Robinson Fans, Inc

Rondo Energy, Inc

RTP Environmental Associates, Inc

Rudolph Research Analytical

RVI, Inc

Ryan & Associates, Inc

SafeRack, LLC

SAFFiRE Renewables

Salof Ltd., Inc

Saola Energy, LLC

Schimberg Company

Scott Equipment Company

SCS Engineers

SCS Global Services

SECSI

Sentinel Integrity Solutions, Inc

Sentrimax Centrifuges (USA), Inc

Separator Technology Solutions

SEPCO Sealing Equipment Products Co., Inc

SES, Inc. Superior Environmental Solutions

SGS North America, Inc

Shandong Longda Bio-products Co., Ltd.

Sherwin Williams

Shuttlewagon

Siemens Industry, Inc

Solar Turbines Incorporated

Solutions

SonicAire

4 Manufacturing

Southern Heat Exchanger

SPX Cooling Technologies, Inc

Standard Polymers

StoneAge Tools

Strobel Energy Group

Sukup Manufacturing Co

Sulzer Chemtech USA, Inc

Sulzer Pumps Solutions, Inc

Summit Carbon Solutions

Sunson Industry Group Co., Ltd.

Sys-Kool Cooling Towers

Teikoku USA, Inc

The CMM Group

The Lubrizol Corporation

The Walling Company

TMI Coatings Inc

TorcSill Foundations, LLC

Total Valve

Trace Environmental Systems, Inc

Tracerco

Trackmobile Railcar Movers

Tranter, Inc

Trident Automation, Inc

Trihydro Corporation

Trislot USA

Trucent

Twin City Fan Companies, Ltd.

Unison Energy, LLC

University of North Dakota-EERC

VAA, LLC

Valley Equipment Company, Inc

Vanguard Fire & Security, Inc

Veolia Water Technologies & Solutions

Victory Energy Operations, LLC

Viking Automatic Sprinkler Co

Vogelbusch USA, Inc

VSP Technologies

W.R. Grace & Co

Warrior Mfg., LLC

Water Tech, Inc

WCR Incorporated

WEG Electric Corp.

Weishaupt America, Inc. Midwest

Western Ag Enterprises, Inc

Westmor Industries, LLC

Whitefox Technologies Limited

Williams Refractory Services, Inc

WINBCO

Winger Companies

Wiss, Janney, Elstner Associates, Inc

World Kinect Energy Services

Woven Metal Products

Xylogenics, Inc

Yakima Chief Hops

Zachry Group

Zeeco, Inc

Zenviro Tech US, Inc

Zeochem, LLC

IFF

SEQUESTRATION IN THE FIELD

Carbon intensity scores determine, in part, the value producers get for each gallon of ethanol they produce. Today’s CI calculations don’t factor in low-carbon farming practices, but industry leaders like Brian Jennings are determined to change that.

By Katie Schroeder

Carbon reduction has been the buzzword for the U.S. ethanol industry over the last few years, particularly since mid2022 with the passage of the Inflation Reduction Act. However, one of the major components of cornbased ethanol’s carbon intensity score occurs—with unacknowledged but important variability—before an ethanol plant ever receives its feedstock, while the corn is be-

ing grown. Farming is a frequently overlooked element of the carbon reduction conversation in the ethanol space, while carbon capture and sequestration (CCS) is receiving an extraordinary amount of ethanol producer

attention and investment, largely due to enhanced tax credits for CCS and the possibility of CO2 aggregation pipelines. However, the potential impact of “climate-smart” farming practices is certainly not lost on industry leaders like Brian Jennings, CEO of the American Coalition for Ethanol. “The production of corn is responsible for about half of ethanol’s carbon footprint, and the other half of ethanol’s carbon footprint can be attributed to manufacturing of the ethanol and then

16 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Brian Jennings CEO, American Coalition for Ethanol

the use of the ethanol,” Jennings says. “A big chunk of the ethanol carbon footprint is what happens on the corn farm or what happens in the corn field.”

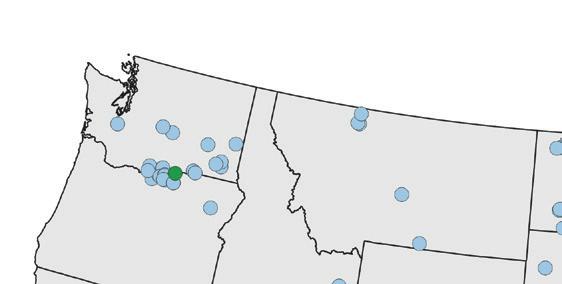

ACE Climate-Smart Farming Project

ACE received a grant from the U.S. Department of Agriculture to partner with South Dakota State University, the South Dakota Corn Growers Association, the U.S.

Department of Energy Sandia National Laboratory, and Dakota Ethanol LLC, a 100 MMgy ethanol plant in Wentworth, South Dakota, to compensate farmers in the surrounding seven counties for using regenerative or climate smart practices such as cover cropping, reduced or no tillage, and nutrient management.

The goal of the project is to get more farmers involved in these practices and gain data on how these practices impact soil health and carbon intensity. “We will

do baseline testing, as we want the soil data from these farmers engaging in these practices,” Jennings says. "What’s the carbon content of their soil before they begin the practice, [and] what’s the carbon content of the soil after they’ve adopted these practices for four or five years?” Jennings explains that ACE plans to provide this data to Congress, the California Air Resources Board and the U.S. Environmental Protection Agency, showing documentation of the impact these practices have on reducing

ETHANOLPRODUCER.COM | 17 Farm

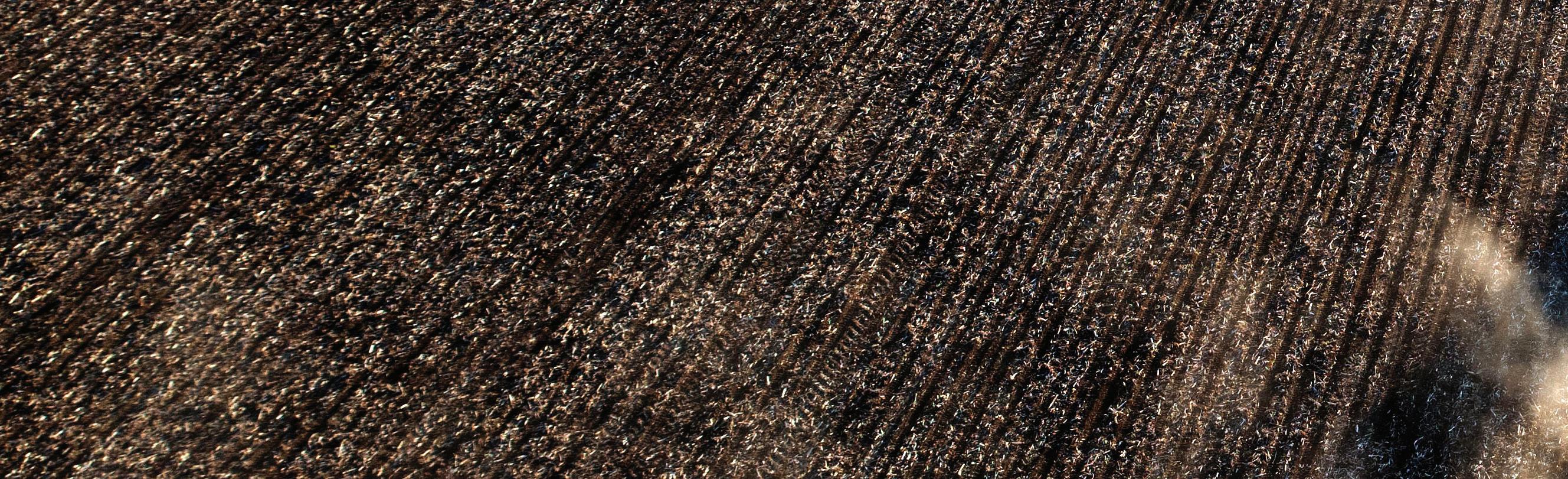

FEWER PASSES: Using reduced tillage technology, a farmer drills seed into a field that still has the previous corn crop's residue on its surface.

PHOTO: STOCK

nitrous oxide emissions and the increase in soil carbon sequestration.

Regenerative or climate-smart farming practices are nothing new. In fact, many farmers have already been using them for years. “The adoption rates are increasing. Maybe not at the pace that some would like to see but it’s not a small sliver of farmers that are engaged in sustainable and climatesmart practices,” Jennings says.

David Clay, past president of the American Society of Agronomy and distinguished professor of soil science at South Dakota State University, agrees that farmers are using these techniques already, explaining that the amount of carbon stored in the soil has been increasing over the past few decades as a result. “What we’ve been seeing is an increase in soil carbon levels,” he says. “That increase in soil carbon levels helps hold our soils together, reducing the risk of erosion and so we see the benefits of that.” Improved carbon levels and crop

genetics have also enabled farmers to rely less on fertilizers to achieve high yields. For example, in a drought year in 1974, South Dakota farmers harvested only 33 bushels per acre, while in 2012 farmers harvested around 100 bushels an acre statewide in similar drought conditions.

These practices have potential to significantly benefit farmers, and the program is gaining a lot of interest. “We ended up having a large list of people that wanted to participate, and we are working our way through developing projects with them to be involved with,” Clay says. “One of the things they’re most interested in at this point is [cover cropping].”

The practices ACE will incentivize include reduced tillage, nutrient management and cover cropping. Clay explains that some contracts will be signed for this summer, while others will start in the fall. The incentives will allow farmers to not have to shoulder the entire financial burden of

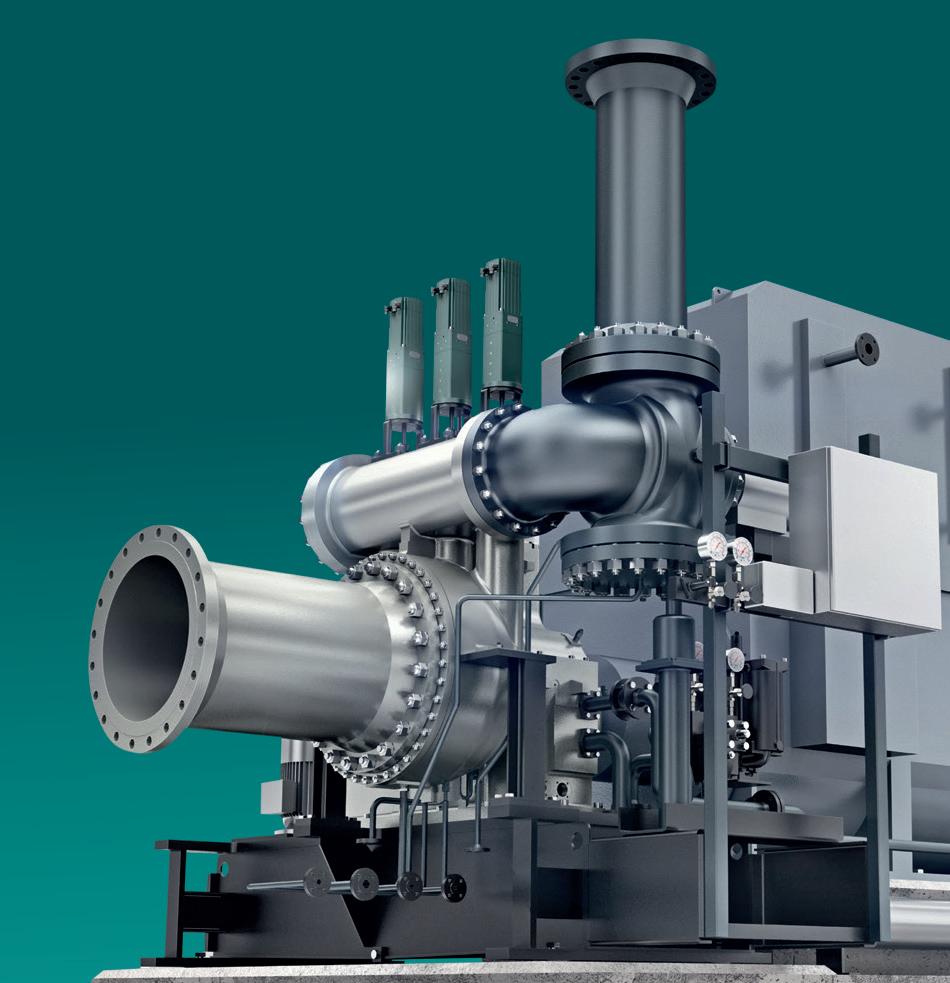

Improve your CI score with our back pressure steam turbines

Chart Industries Company, supports carbon intensity reduction,

you can reach your best CI score. Our

installed systems improve efficiencies and lower carbon intensity. · Highest CI improvement CHP method · Low maintenance without high LTSA premium operating costs · Quick delivery and simple, low-cost installation Experiencing high natural gas pressures at your site? Install our turbo expander and generate kW power with ZERO carbon emissions. Howden.cloud/FEW23 Discover the power of steam in FEW Booth 1400

As a leading equipment provider in the Ethanol industry, Howden, a

so

worldwide base of

Farm

transitioning to low-carbon farming practices. The project will compensate farmers for roughly 75 to 85 percent of the costs associated with implementing these practices, according to Jennings.

Switching to these practices will probably come with a learning curve for corn growers, because they are learning to do farming differently than the way their parents or grandparents did, according to Clay. To help aid in the transition, farmers will also have access to a learning community with other growers participating, including those with experience using reduced tillage or other regenerative agriculture practices.

SOIL SCIENCE: In addition to cover cropping, corn growers are practicing climate-smart farming by reducing tillage, which improves the long-term health of soil by reducing the mineralization rates of the carbon found in it.

Scan Here to learn more

PHOTO: STOCK

PHOTO: STOCK

Reduced Tillage

Switching to reduced or no tillage allows for carbon to remain sequestered in the soil, reducing the carbon intensity of the corn and improving the soil quality. “Instead of intensively going in after you’ve harvested your corn and discing up those stalks or plowing those corn stalks up and turning that field black, there are a wide variety of methods at your disposal as a farmer to reduce the number of tillage passes that you make on that land,” Jennings says. “And that in and of itself has a tremendous benefit in terms or retaining moisture in the soil, keeping the soil more intact to prevent wind and water erosion.”

Clay explains that reducing tillage im proves long-term soil health by reducing the mineralization rates of the carbon found in it, thereby reducing erosion.

Cover Crops

Cover crops are planted after the primary “cash crop” is harvested, Clay says. Jennings explains that in certain regions, cover crops improve nitrogen retention as well assisting in carbon retention. Some studies have shown that cover crops drastically reduce the CO2 equivalent emissions from roughly 500 kilograms per hectare without cover crops to negative 1,000 kilograms per hectare with cover crops.

Farmers in colder climates may dor-

primary crop to prevent them from becoming a weed problem and reducing yields.

Nutrient Management

Farmers manage application of nitrogen fertilizer using the “four Rs” of nutrient management: right place, right time, right form and right rate, according to Jennings. Nitrogen fertilizer is one of the major contributors to corn’s CI score. “Anything a farmer can do to reduce or more efficiently use nitrogen fertilizer that helps bring down the overall carbon intensity

20 | ETHANOL PRODUCER MAGAZINE

Farm

866-746-8385 | service@bbiinternational.com | #SAFC23 @saf_magazine Produced By THE INDUSTRY IS CHANGING In Collabor a tion With

Policy Progress and Industry Impacts

The ethanol industry has a lot to gain with the adoption of these practices, and a lot to lose without them. Since producers are selling to markets on the coasts and those markets are asking for low carbon intensity biofuel, Clay believes that looking for ways to meet those requirements will help insure those markets continue to be profitable. “A major goal of the American Coalition for Ethanol is to convince policymakers to change the way they implement those policies, to give credit to farmers and ethanol producers for reduced tillage or no-till or cover crops or nutrient management,” Jennings says.

Although the transition to low- or no-till farming is expensive, there are currently no credits provided to farmers who implement these practices. “Farmers and bioethanol producers are penalized by policies that make certain assumptions about what happens on the farm,” Jennings says. “For example, the nitrous oxide emissions are counted as part of ethanol’s carbon footprint, land use change is counted as part of ethanol’s carbon footprint, but ... policy does not yet give credit to farmers or ethanol producers for these regenerative or climate-smart practices.”

...so

why do you do that with your fermentation?

Real time, continuous, on-line measurement of liquefaction, fermentation and distillation. Sugars, acids, alcohols, FAN & PAN, and fusels all in real time Visit www.keit.co.uk for more information.

wouldn’t look at the road

You

only once every 8 hrs...

FERTILIZER FACTOR: A grower applies granular fertilizer to a field. Nitrogen fertilizer, which is applied in both liquid and solid form, becomes a source of nitrous oxide emissions, which contribute to the carbon intensity of corn.

Farm

PHOTO: STOCK

‘Whether we believe in global warming or not doesn’t really matter because the people buying our products do.’

- David Clay, Distinguished Professor of Soil Science South Dakota State University

Jennings explains that the ACE team has been vocal with lawmakers about the difficulties of transitioning to low-carbon farming. Legislation is in motion nationally and at the state level that would give farmers credits for implementing these practices. “In order to get the change that [policymakers] want to see in terms of [their] sustainability or carbon reduction goals, there are going to have to be incentives in place for farmers to adopt these,” Jennings says.

Midwestern states may be more aware of the need for these credits and ready to assist farmers he explains. In early March, the Clean Transportation Standard was introduced to Minnesota State legislators. While the bill had not yet passed at press time, it contains language that would give credits to farmers and ethanol producers for climate-smart practices. ACE has assisted with a similar potential bill in Nebraska, which has currently been postponed until 2024.

On the federal level, there was a hearing in mid-February to explore the concept of a national low-carbon fuel standard in the Senate Environment and Public Works Committee. ACE submitted testimony that climate-smart practices need to be a part of any future low-carbon fuel standard, Jennings says. He also sees the Farm Bill, which needs to be reauthorized by Congress in 2023, as an opportunity to “encourage a new policy that would reward farmers and ethanol producers.”

With the implementation of more lowcarbon fuel standards, the market for ethanol would grow, as higher ethanol blends are a quick way to reduce the carbon intensity of transportation fuel. If some of these policies pass and are implemented, it could mean millions of dollars for ethanol producers, Jennings explains. Farmers would also benefit, gaining credits around $200 an acre if they implemented all of these regenerative practices, according to an analysis

done by Jennings and his team based on LCFS credits over the past three years.

These credits, if implemented, would be key to accelerating the widespread adoption of climate-smart farming, which would help solidify ethanol’s place in low carbon markets. “How do we move to the future? Whether or not we believe in global warming doesn’t really matter because the people buying our products do,” Clay says. “And we need to provide the products that they want and are insisting.”

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

24 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

TURNING IT OVER: Conventional tillage, or discing, is still a necessary practice for most growers. Regional differences in soil quality, crop history and grower preferences weigh into a farmer's ability to practice reduced tillage.

PHOTO: STOCK

Farm

Climbing Higher Over Time

Little Sioux Corn Processors’ CEO and plant manager discuss the plant expansions, coproduct optimizations and debottlenecking successes behind the facility’s remarkable growth over two decades.

By Katie Schroeder

By Katie Schroeder

Production

26 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

PHOTO: LSCP

ETHANOLPRODUCER.COM | 27

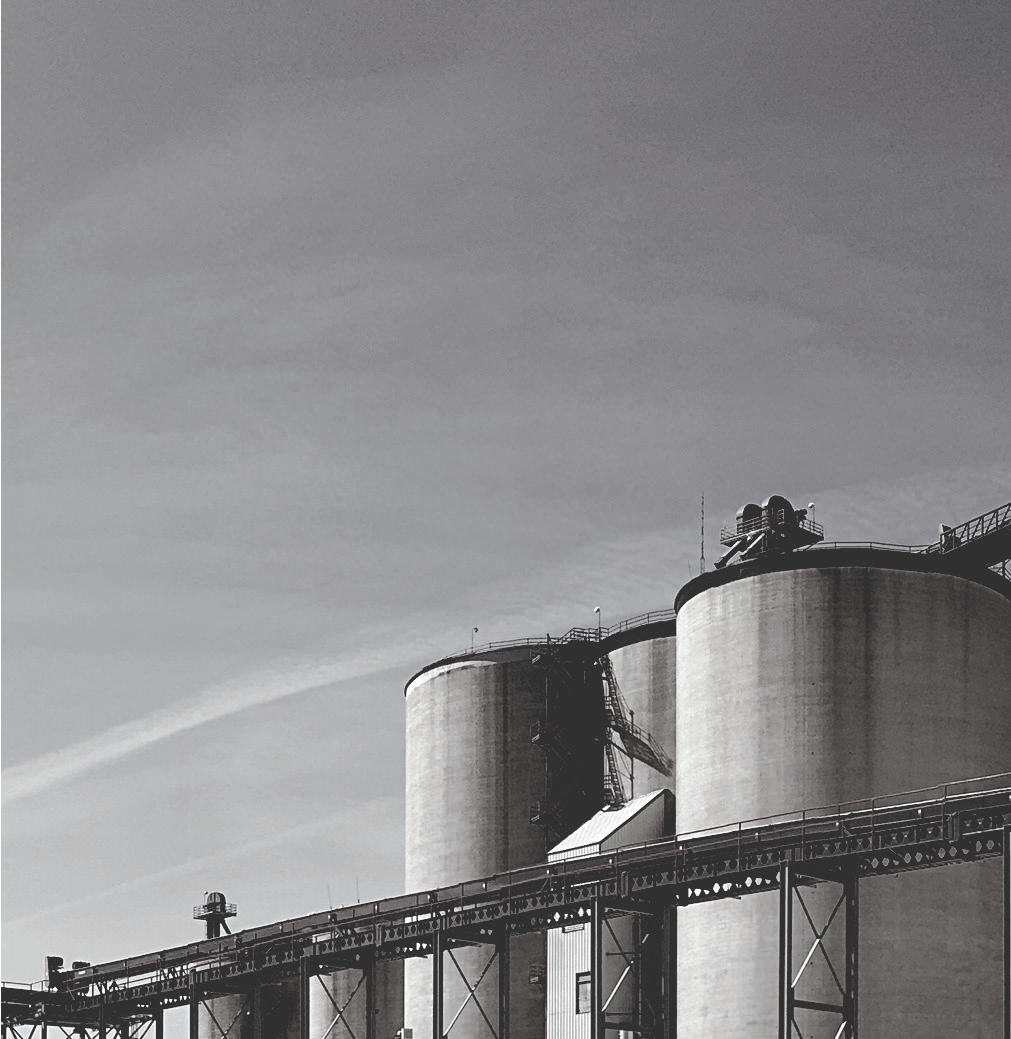

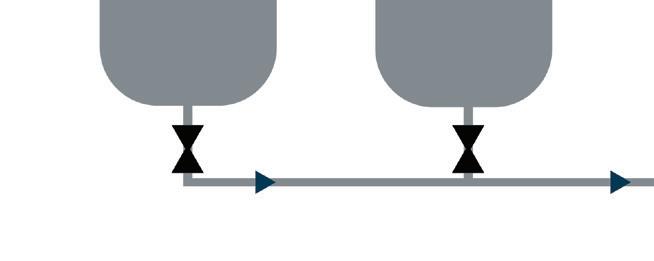

Little Sioux Corn Processors has grown steadily throughout its 20 years of production, expanding in stages while continuously seeking new ways to innovate and improve efficiency. Located in Marcus, Iowa, the plant opened with a 40 MMgy nameplate capacity in 2003 and has since quadrupled its output. The company’s CEO, Steve Roe, who has been with LSCP since its inception, tells Ethanol Producer Magazine that achieving benchmark-leading yields over the years has been a key measurement of success for the company, and a gratifying quest for its employees. “I think that’s something we should all be proud of here,” Roe says, reflecting on the plant’s journey of growth, past and present.

Throughout LSCP’s history, its production capacity expanded multiple times, Roe explains. The plant expanded to 52 MMgy in

2005, 92 MMgy in 2007, climbing to about 135 MMgy by 2015 before expanding to its current capacity of 165 MMgy in 2017. These expansions required LSCP to go from three fermenters and three whole stillage centrifuges up to 12 of each. Recently LSCP has started to pursue expanding even further, perhaps up to 190 MMgy. The LSCP board of directors, with assistance from the management team, hired an engineering firm to examine the plant’s flow to identify any bottlenecking issues and improve-

ments the capacity jump would require. The study was expected to be complete by May or June.

Roe anticipates the changes that will be required, including expansion of distillation and grain capacity. Distillation is completely maxed out, he explains, and in order to expand further LSCP would need to change column sizing. “Then you’ve just got to follow suit—it’s a never ending [process]—one fix leads to another,” Roe says.

28 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Production

The plant's grain capacity has also grown since LSCP started up, beginning with 200,000 bushels and expanding up to 2.9 million currently. The possibility of expanding to 190 MMgy would necessitate additional grain storage capacity to “back it up,” Roe says.

Further expansion would require innovation due to the limited space on the plant’s 37acre footprint, Roe explains. Space limitations will also create more steps for the expansion process and more capital cost per gallon than past expansions.

HUMBLE BEGINNINGS: Little Sioux Corn Processors started production in 2003 as a 40 MMgy ethanol plant, a typical nameplate capacity for the time. As can be seen in this aerial image from the early or mid-2000s, the plant had just four (and originally three) fermenters. Today. LSCP has 12 fermenters (see new plant photo on previous pages 26-27). That fermentation capacity expansion is illustrative of the plant's growth over two decades.

Innovating for New Opportunities

Since its inception, LSCP has been innovating and looking for ways to diversify. The plant was one of the first to install an oil centrifuge and sell distillers corn oil (DCO) into the market, currently selling DCO into the renewable diesel industry. Since that first centrifuge, the plant has added two more, and plans to add a fourth as soon as it is delivered. DCO has continued to be a key coproduct, reaching up to 70 cents or more per pound in recent months, Roe explains. “[Almost] 95 percent of it now is going into renewable diesel—nothing

into feed that I’m aware of—and there’s a little bit, time to time, that we’ll send to biodiesel,” Roe says.

When LSCP first installed a DCO centrifuge, the plant produced around 0.4 to 0.45 pounds of DCO per bushel of corn. Now the plant produces 1.1 to 1.15 pounds of DCO per bushel of corn. “There’s a learning curve on all this equipment, you know there always is,” Roe says. “We’ve got much, much better at knowing how to keep the machines clean and flushed and rebuilt when we’re supposed to, and all the other things that go with it.”

In 2021, LSCP installed Fluid Quip Technologies’ trademarked Maximum Stillage CoProducts (MSC) system, starting it up in May of that year. Throughout the past two years, they have been working to fully integrate it into their plant’s process. “We’ve been ramping it up,” Roe says, explaining that his team has recently been able to bring the MSC equipment up to its full capacity. “So, today we’re making approximately 210 tons per day in corn pro-

ETHANOLPRODUCER.COM | 29

PHOTO: LSCP

PLANT UPTIME IS IMPORTANT TO EVERYONE

Our full service team of experts have 20 years of ethanol plant maintenance reliability and uptime history 24/7 support and ready access to a full inventory and all Fluid Quip equipment parts, ensures that you maintain your plant’s uptime status.

Production

PHOTO: LSCP

ROAD TO GROWTH:

• OEM Parts Warehouse

• $1 million+ on-hand inventory

• Fully stocked trucks

• Overnight/hot shot shipping

EQUIPMENT SERVICE

• Factory Trained & Certified

• MSC™ Systems

• SGT™ Grind Systems

• FBP™ Fiber By-Pass Systems

• MZSA™ Screens

• Paddle Screens

• Grind Mills

• Centrifuges

tein,” he says. “And it’s being marketed—primarily going to local feeders and then into the eastern poultry market, and there is some that’s being exported to the Far East, Southeast Asia.”

Integrating the MSC system took time because of the complexity of integrating protein technology into the plant and operating it in a way that optimizes production. “It’s just as much an art as it is a science,” Roe says. Currently, LSCP’s dryer is the limiting factor in MSC’s production, which currently produces around 2.75 pounds per bushel of corn or 220 tons per day of AltioPro, the plant’s high protein coproduct. He explains that the MSC system would probably be able to give them 3.5 pounds per bushel of protein if they had the dryer capacity for it. “[We’re] bringing people in ... to look at the dryer and the burner management to see if we can increase our gas flows [in a way that brings] our corn pro-

tein production up, possibly up to 250 [tons per day],” Roe says. “Unless we add another dryer, that’s going to top it out.”

Debottlenecking

The first step to expanding the plant was a debottlenecking study done by engineering firm Nelson Baker Biotech, based out of Sioux Falls, South Dakota. The study involved gathering operational data such as flows and pressures from across the plant, and then feeding that data into a modeling program. Ultimately, Nelson Baker will be able to tell the LSCP team what capacity potential currently exists for the plant, and what it would take to expand the facility to 190 MMgy.

PARTS LSCP’s Production Volume Growth Over 20 Years 2003 40 MMgy 2005 52 MMgy 2007 92 MMgy 2015 135 MMgy 2017 165 MMgy Next 190 MMgy (Evaluating)

After running the program, the engineering firm gives a plan of action including which pieces of equipment are lacking or sufficient for current and future needs. This was a “complex endeavor” Roe explains, because

SIZING UP STORAGE: LSCP’s Grain Storage Capacity

2003 200,000 bushels

2023 2,900,000 bushels Next 3,000,000-plus bushels

of the plant’s multiple expansions and the MSC system for protein.

A key part of LSCP’s success is its experienced team, which makes running the plant optimally day-to-day, along with the implementation of new technologies, possible, explains LSCP Plant Manager Chris Williams. “We’ve got team members that have been here since day one,” he says. “That’s a big [help].”

He further explains that one of the biggest challenges is working a new piece of equipment into the plant process and figuring out what other adjustments need to be made. “There’s always something out there to [try make] more efficient; we’re always trying to be more efficient and trying to get better, but it takes time and you’ve got to have a flat stable plant to do it with,” Williams says.

Challenges and Triumphs

Looking back over the years, Roe has seen a lot of development in the ethanol industry. Yields have improved and the variety of coproducts has increased.

“Yields gradually have gotten better; the enzymes have gotten better, and our components, the yeast has gotten better conversion

rates,” Roe says. “And so, when we started out, [we were achieving] about 2.65 denatured gallons per [bushel], and now we’re right up next to 3 gallons on a denatured basis.”

He views these changes as vital developments that help the ethanol industry be competitive and maximize revenue. “But off those high yield times that, you know ... in the business, it’s a roller coaster. And if you can make more with less, it’s better to ride the storm, and then when it’s good, it’s really good,” Roe says.

Improving efficiency and diversifying revenue streams are important to LSCP’s future and the survival of the ethanol industry as a whole, according to Roe. “Be innovative enough to continue to change and find ways to make more with less. In other words, [find ways] to make more something with the same bushel,” he says.

The challenges LSCP has faced over the past 20 years include getting through the 2008 recession, which was a difficult time for many ethanol producers, as well as the more recent Covid pandemic. Roe explains that LSCP was able to run at half rate for about six weeks and work its way through it. The ripple effects of 2020, along with inflation,

ETHANOLPRODUCER.COM | 31

800-279-4757 701-793-2360 Callusforafree,no-obligation consultationtoday. Natwick Appraisals 1205 4th Ave. S., Fargo, ND 58103 www.natwickappraisal.com natwick@integra.net The Specialist in Biofuels Plant Appraisals • Valuation for nancing • Establishing an asking price • Partial interest valuation Few certi ed appraisers in the United States specialize in ethanol plant and related biofuels properties. Natwick Appraisals o ers more than 50 years of worldwide experience. Your appraisal will be completed by a certi ed general appraiser and conform to all state and federal appraisal standards. Our primary specialty in industrial appraisal work is with ethanol, biodiesel, and other types of biofuel facility appraisals, including cellulosic ethanol plants.

PHOTO: LSCP

has led to long-lasting supply chain issues. LSCP is experiencing an estimated 36-week wait time on receiving a new oil centrifuge which was ordered last summer. “It’s coming on nine months, pretty close and it’s still not here,” Roe says. “And it doesn’t appear that all the parts to make it operate like it’s supposed to are going to be here for a while yet. It might be a [whole] year since we ordered it.”

LSCP produced its one billionth gallon in 2015, followed by its two billionth gallon in 2021, two high points for the plant, according to Roe. The plant has also been able to return its investors’ original investments 13 times over throughout its history. Roe is also proud of the fact that LSCP has been able to increase the value of corn and help improve the economy in northwest Iowa.

Moving forward, Roe believes that finding ways to remain competitive, such as decarbonization through carbon capture and sequestration, is important to the industry’s success. “Hopefully, there’s a way we can find a solution that everybody can live with because ... that’s the way we’re going, and if we can’t

COPRODUCT QUESTS:

Production

Protein Yield Currently 2.75 lbs/bu. Goal 3.5 lbs/bu. Corn Oil Yield 2005 0.4/0.45 lbs/bu. 2023 1.1/1.15 lbs/bu.

PHOTOS: LSCP

CAPACITY AND YIELD:

Fermenters

2003 3 Tanks

2023 12 Tanks

Yield

2003 ~2.65 gal/bu. 2023 ~3.00 gal/bu.

participate and lower our CI scores and sequester our CO2, that’s going to put us at a competitive disadvantage,” Roe says.

LSCP has practiced the ideal of pursing innovation and “making more with less” for the last 20 years. Looking for new ways to make more out of the corn kernel is a hallmark of ethanol production, and LSCP has made it into an art.

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

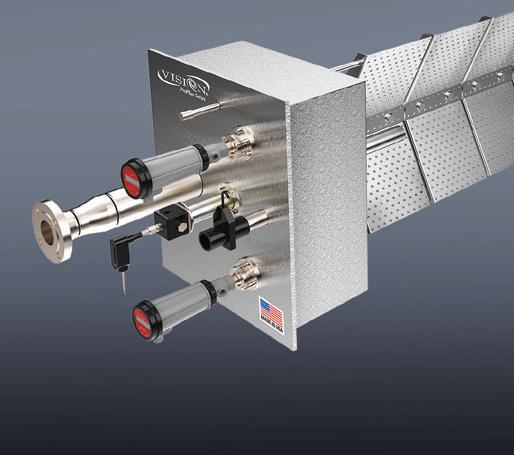

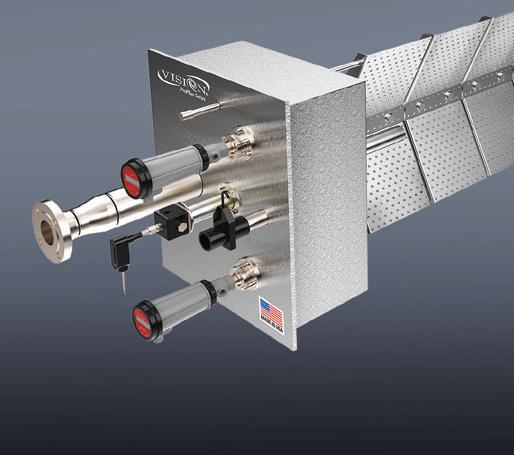

ETHANOL PRODUCER_HALF PG AD_VISION BURNERS_12-09-2022_PRINT.pdf 1 12/9/2022 4:41:49 PM

GOLD Going for

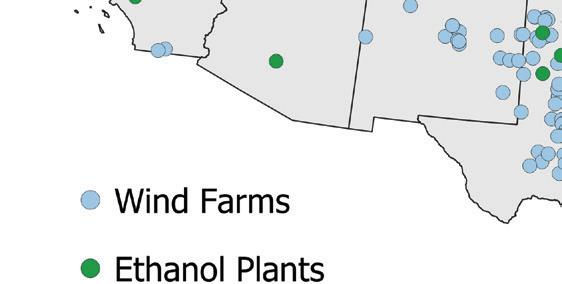

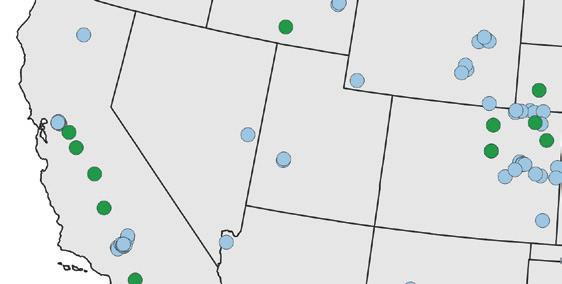

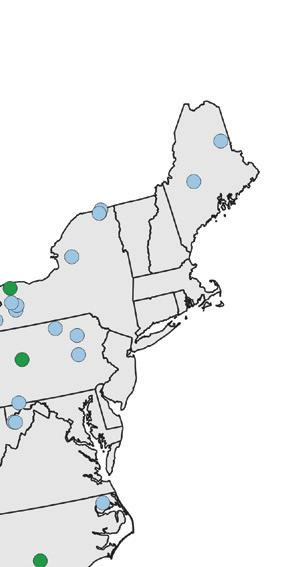

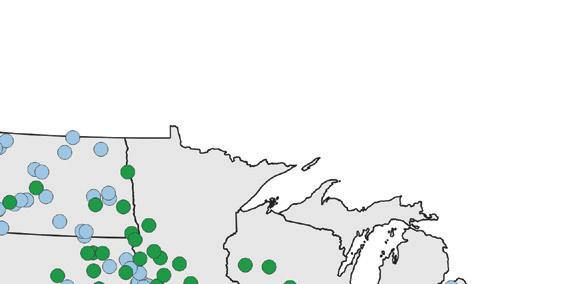

From CI-score reduction to back-end feed ROI, a growing number of ethanol plants are in pursuit of the multi-part benefits of ICM’s trademarked Advanced Processing Package.

By Luke Geiver

By Luke Geiver

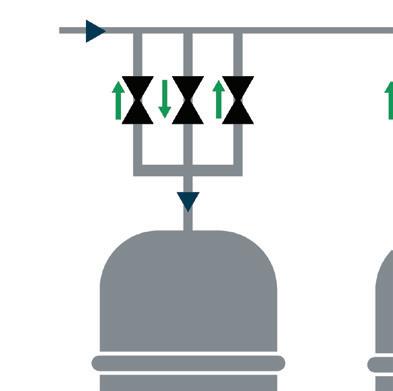

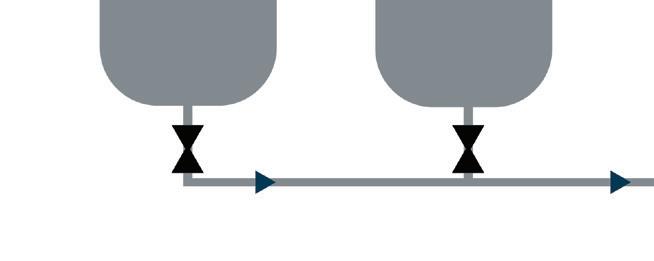

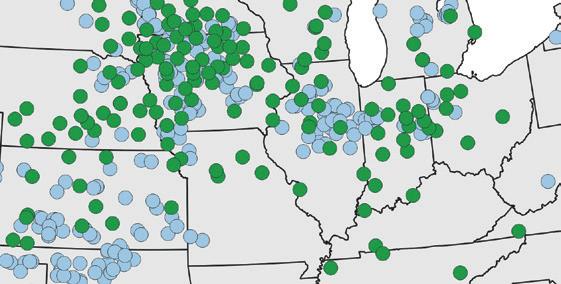

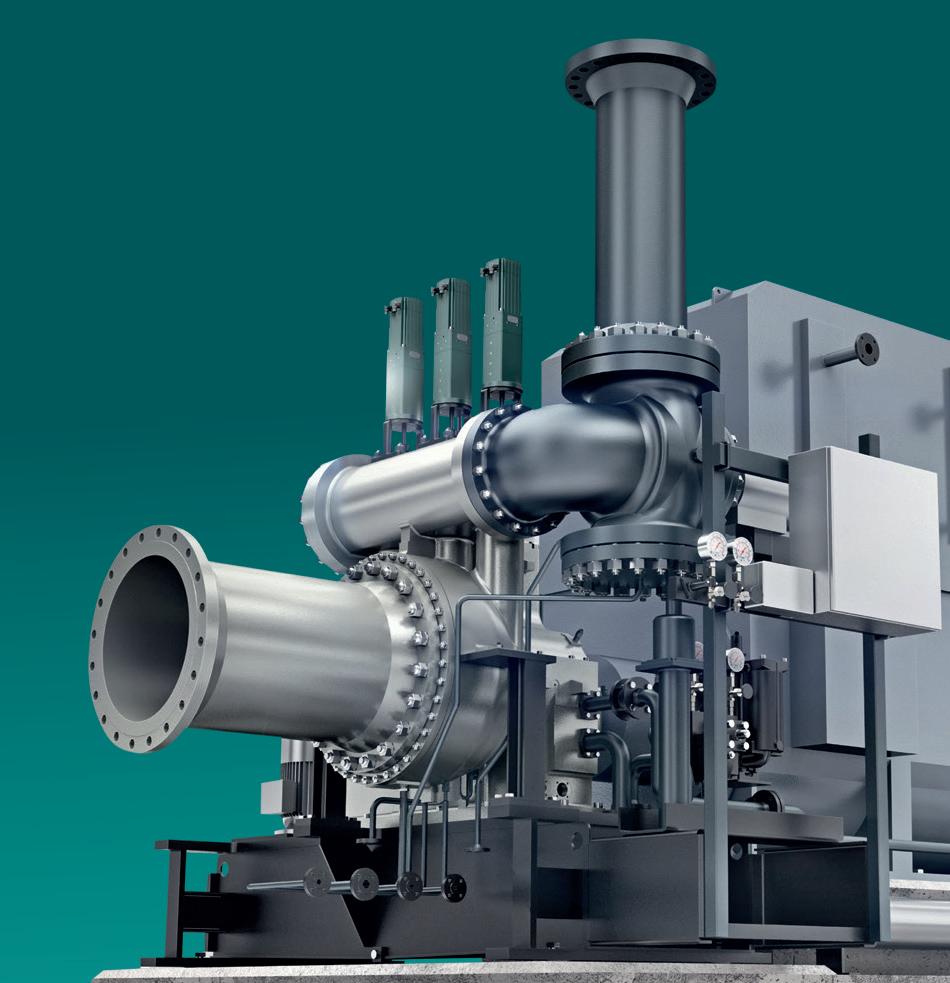

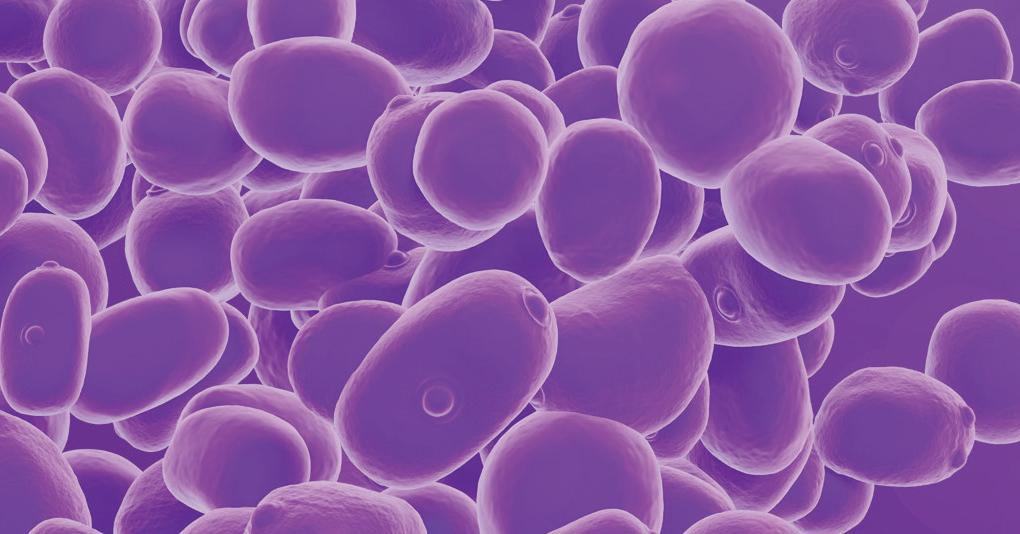

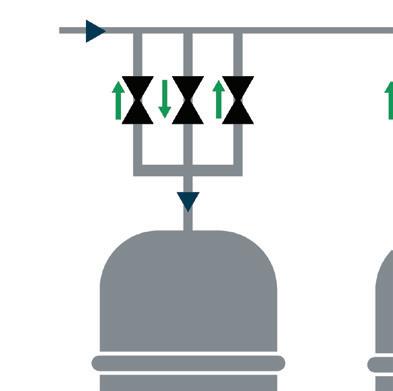

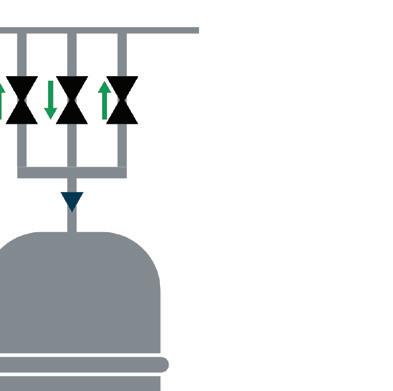

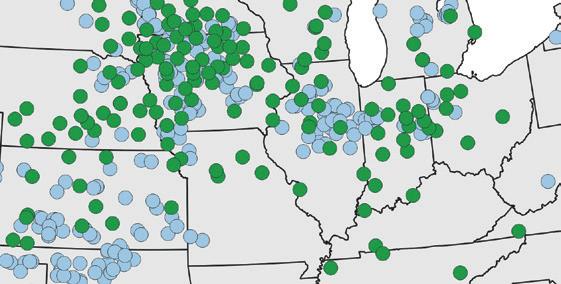

It should come as no surprise that ICM Inc. has made its Advanced Processing Package system—an innovative suite of bolt-on technology systems for ethanol plants looking to diversify revenue streams and lower carbon intensity (CI) scores—seem so simple. The Kansas-based ethanol process technology pioneer first unveiled its APP system in 2019. Since then, multiple ethanol plants have acquired APP and are currently in various stages of implementation.

Adam Anderson, director of sales at ICM, has played a major role in educating the industry on the system. When asked what he and his team have learned from ethanol clients since they’ve started to use or implement portions of it, his response was quick. “It’s a pretty simple answer. The system has gone over well,” he says. “Most are blown away by the simplicity of it. They are blown away by the robustness of the design.”

36 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Diversification

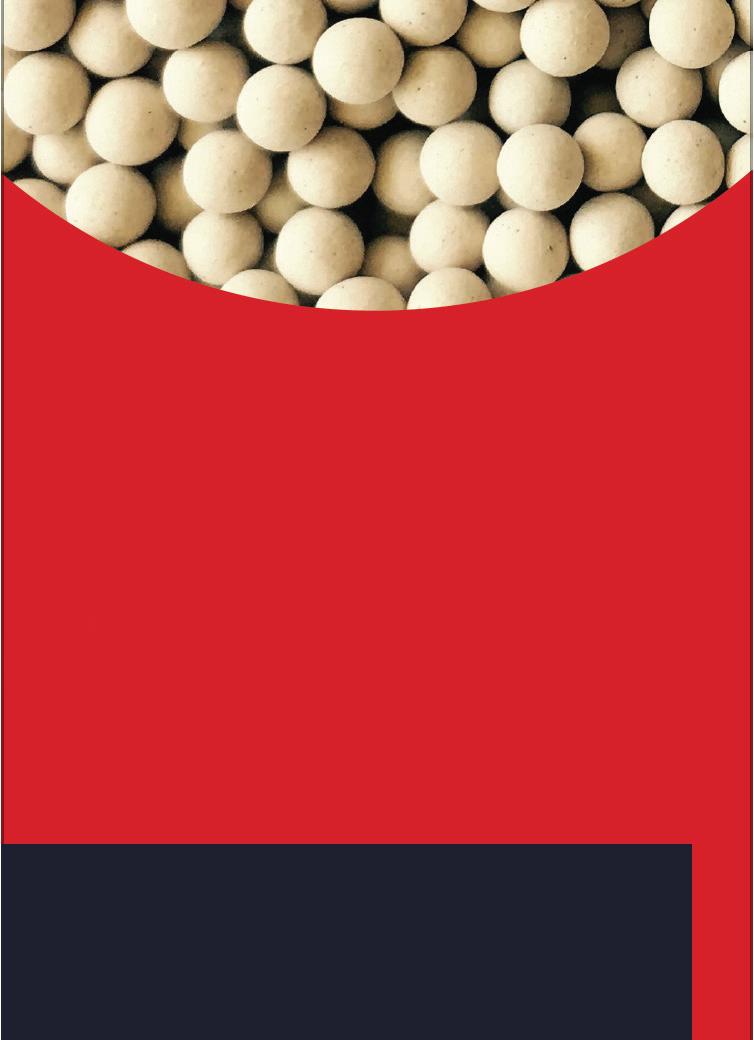

FLOWING INTO NEW MARKETS: The trademarked PROTOMAX yeast-enriched 50-percent protein feed produced through ICM's APP technology gives ethanol plants a lane into new markets. Because of its higher protein and lower fiber content, it can replace portions of soybean meal and corn in poultry and swine diets, and even be used in aquaculture and certain pet foods.

ETHANOLPRODUCER.COM | 37

PHOTO: ICM INC.

Advanced Technology, Flexible Investment

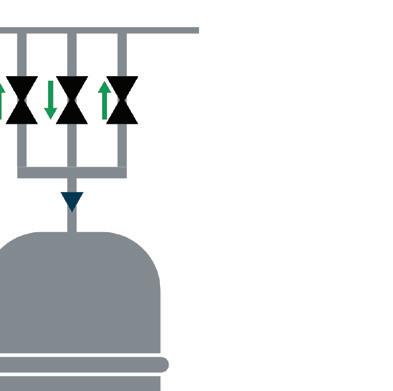

The trademarked APP system includes four patented and patent-pending technologies necessary to efficiently produce the trademarked PROTOMAX, a yeast-enriched 50-percent protein animal feed, and either traditional DDGS or SOLBRAN, a trademarked high-energy animal feed.

PROTOMAX gives ethanol plants an entrance into new markets. Because of its higher protein numbers and lower fiber content in proportion of protein to fat, it can actually replace portions of soybean meal and corn in poultry and swine diets. It can even be used in aquaculture (i.e., fish food) and some forms of pet food.

Chuck Gallop, director of innovation for ICM, says his team took a very focused look at the traditional ethanol plant and tried to optimize each step needed to produce the

CLEAN AND CUSTOMIZABLE: Ethanol plants with the full APP system installed can produce different product streams including PROTOMAX (50% protein, left), and DDGS or SOLBRAN (high-energy feed, right), which can be marketed on their own or combined in unique ways to design customized feed products.

advanced animal feed options. “We wanted to fractionate components out at each step,” he explains. In some instances, they wanted to reduce water requirements, or heat or grinding and milling techniques. The result of the team’s work is a system that not only creates various feed components, but diversified revenue streams as well. Through the process, an ethanol plant with the full system installed can produce fiber, protein, enhanced protein with yeast and solubles. The clean piles can be combined in many ways to design customized feed products for different animals.

The full system relies on four technology upgrades. First, the process uses ICM designed Selective Milling Technology, or SMT. The tech deploys additional frontend rollers to produce right-sized particles for easier downstream separation. Then, using its Fiber Separation Next Gen tech, the system removes fiber from the process

38 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

PHOTO: ICM INC.

Diversification

stream before fermentation, creating a clean pile of bran. With its Feed Optimization Tech, the next and third step, the process stream undergoes two phases of separation, resulting in a liquid stream and protein. Lastly, the liquid stream enters the Thin Stillage Solids Separation System, which separates solubles and enhanced protein with yeast.

After that, a custom-engineered conveyor system can be used to combine the separated feed components to make final products which can be dried using a plant’s existing rotary dryers.

The advanced system isn’t just about producing a unique animal feed stream. Gallop and his team focused on reducing

PROVIDING HOLISTIC SOLUTIONS THAT HELP YOU:

the amount of tech needed in the system and making sure everything was right-sized along the way. “We wanted the technologies to be familiar,” he says. “The more we can make it familiar, the easier it is to adapt to existing ethanol plants.”

To make an investment in APP easier on the balance sheet, ICM designed it so

MAXIMIZE YIELD

INCRE A SE PRODUCTIVIT Y

REDUCE TOTAL COST OF OPERATION

REDUCE RISK

ETHANOLPRODUCER.COM | 39

Ready to learn more? Find us at FE W: Booth 1237 visit: ecolab com call: 1-800-8 24-3027

certain portions of the system can be installed at different times. The “stepwise process intensification,” facilitates flexible investment management.

In addition to making the system easy to operate and easy to invest in, Gallop and his team wanted to make it easy to see the role APP can play in CI score reduction efforts. According to Anderson, the ethanol industry has become extremely focused on CI reduction. “In the environment we are in right now,” he says, “I don’t foresee the ethanol industry investing in something that hampers their CI score. So, the fact that we

are allowing diversification of the feed and reduction in CI score is huge.”

The combined efficiencies of the APP tech bunch can reduce natural gas usage by up to 12 percent. Using the solid-liquid separation tech, a reduction in the hydraulic load on dryers also happens.

Lowering operational costs and making the entire plant more efficient is also an attribute of the system, something that Gallop says comes standard with any ICM effort. Because the fiber is removed before fermentation, maintenance and chemical use goes down. And, protein production doesn’t

require downtime outside of a plant’s scheduled shutdown.

Advancing Your Ethanol Plant

Gallop and his team of innovators look at plants holistically. “We have to pay attention to every change we make, whether it’s mechanical or secondary. We also understand the base plant better than anyone else.”

The APP setup works for what Gallop describes as one of two options. Because there are roughly two different size plants (a

Mo re than a Check v alv e

40 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Order at: ww.check all.com Call us at 515-224-2301 or email us at: sales@checkall.com

50 MMgy base and a 100 MMgy base) that have most likely added some capacity, one APP setup is needed for a 70 to 80 MMgy plant capacity range. For plants over that, up to 160 MMgy, two APP set-ups are needed. “It is the same equipment,” Gallop says. “It’s just one versus two of them.”

In terms of timing, Anderson says the buildout of a system is roughly 12 months. In some cases that might be extended due to issues with steel supply or electrical equipment and automation parts. The footprint of a plant might change, but it depends on the design of the plant and the base technology already there.

“We do like to treat everyone and their individual system uniquely,” he says. His team does initial base engineering work to determine client needs and demands.

“The plant is going to change,” Anderson says. “It will become a more sophisticated plant.”

Part of that change comes from subtraction. Protease will be taken out and not needed. On the backend of the plant where the feed comes out, it will become a more advanced system that includes quality control for handling and storage.

Although the main markets for the feed product will typically be cattle and dairy, there are swine, poultry and now aquaculture buyers as well. Anderson says his team has been working with customers and their feed marketing groups to educate them on what the new feed options are, and where they can get top dollar for the product. “It allows our

customers to get the maximum value of the feed,” he says.

The strength of the entire system, apart from the CI score-reduction aspect, is that users can fractionate the distillers grain piles, Gallop says. “It allows you to put them back together as a feeder and use them best.”

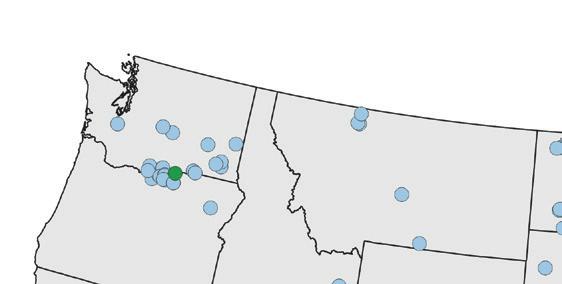

Plants Installing or Already Using APP

Since the system first rolled out in 2019, several ethanol facilities have began work to install the APP, in full or in part. Corn LP, a 72 MMgy plant in Goldfield, Iowa, is now working with ICM to install APP, which will allow the plant to produce high-protein feed (PROTOMAX 50%), along with increasing ethanol sales and lowering its operating costs. In its second-quarter company newsletter, the leadership team outlined its strategic decision to partner with ICM and install the APP system. “This project opens the door for feed sales, and Gold-Eagle, (Corn LP’s parent company), is already working with feed customers to market this new product.” Corn LP’s project should be operational in the first half of 2023.

ETHANOLPRODUCER.COM | 41 © Kemin Industries, Inc. and its group of companies 2023 All rights reserved. ® ™ Trademarks of Kemin Industries, Inc., U.S.A Kemin is proud to serve the biofuels industry with enzymes and antioxidants for improved production. kemin.com/biofuels ZyloPro™ Protease ZyloZyme™ AA alpha-Amylase FermSAVER™ ZyloCell™ Cellulase BF320™ Biodiesel Antioxidant

Diversification

POINT OF SEPARATION: ICM's APP tech deploys additional front-end rollers to produce right-sized particles for easier downstream separation. Then, using its Fiber Separation Next Gen tech (middle), the system removes fiber (right) from the process stream before fermentation, PHOTO: ICM INC.

42 | ETHANOL PRODUCER MAGAZINE | JUNE 2023 THE POWER BEHIND PROGRESS RENT • SALE • LEASE Stock Boilers HRSG Waste Heat Recover y Boilers High Temp Hot Water Custom Control Panels

FITTING RIGHT IN: Producers installing APP systems appreciate the ability to integrate their existing equipment with the package, including rotary dryers like this one, which play a role in finishing each individual product stream, or in drying customized blends to spec.

ICM

PHOTO:

INC.

Another plant, Cardinal Ethanol, in Union City, Indiana (140 MMgy), is also installing APP. The company broke ground in 2022. Jeremy Herlyn, plant manager of Cardinal Ethanol, toured an ICM facility to see the APP system in action. When the team signed an agreement with ICM to install the full system last February, Herlyn said that the system would allow Cardinal to utilize much of its own setup, including dryers, to produce high-protein feed. “The integration is more efficient, providing natural gas reduction and requiring less equipment compared to other options,” Herlyn said.

Jeff Painter, president and CEO of Cardinal, said the work with ICM would be a great opportunity to diversify products, enter new markets and get a new technology that has long-term viability.

Lincolnland Agri-Energy has also added the full capabilities of APP. The Illinois producer already had the SMT from ICM installed (since 2012). Eric Moseby, general manager of Lincolnland, also toured an ICM facility to see APP in action. “We knew the APP package was the best choice for us after experiencing firsthand the ease of operation and verifying the high quality of the feed products,” Moseby said.

The first installation of APP happened in Kansas in 2020 at the Prairie Horizon Agri-Energy LLC plant, now known as Amber Wave. The general manager of the plant at the time said that they recognized that diversifying the plant’s product offerings was key to revenue growth. The system gave them the chance to add higher-value animal feed to its product offerings and enter new markets.

Most APP users chose the system for its ROI on the feed, according to Anderson. But, when the team shows the payback and how the system works to produce more gallons, grind more corn, recover more corn oil and use less natural gas, there is a strong interest in those benefits as well, he says.

On the innovation side, Gallop and his team are looking at ways to account for more variation in the feedstock so they can really dial in the system. They are also looking at all the ways to reduce the use of natural gas or change certain sections to run on electricity. Much of what they are accomplishing on the feed side happens in conjunction with an eye towards CI score.

As for the feed, the main reason many plants install the system, results come quick. With the system installed, the feed pile can be altered at the speed of business. “We can move things and influence the end feed product composition,” Gallop says, “within a matter of hours [after installation].”

Author: Luke Geiver

Author: Luke Geiver

Contact: editor@bbiinternational.com

RA ISIN G TH E BAR IN GR AIN SILO CLEA NOUT

Experience

More than 35 years of tackling the most dif cult silo cleanout projects in 30+ countries worldwide.

Safety

Professional service technicians are MSHA and OSHA-certi ed and adhere to a rigorous continuing education program.

Capability

We conquer the most dif cult cleanout projects in the world with our proprietary silo cleaning technology

ETHANOLPRODUCER.COM | 43

10 /2 2 02 25 4

Diversification

Tighter LDAR Protocols

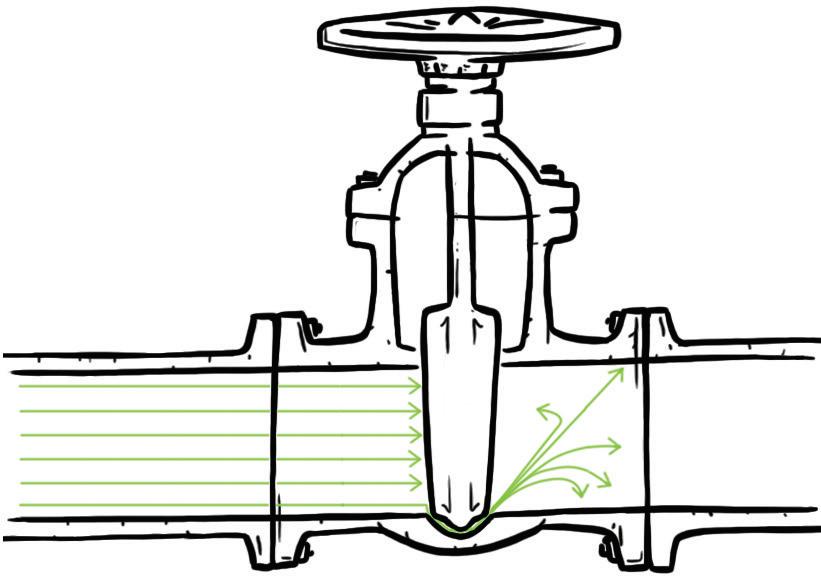

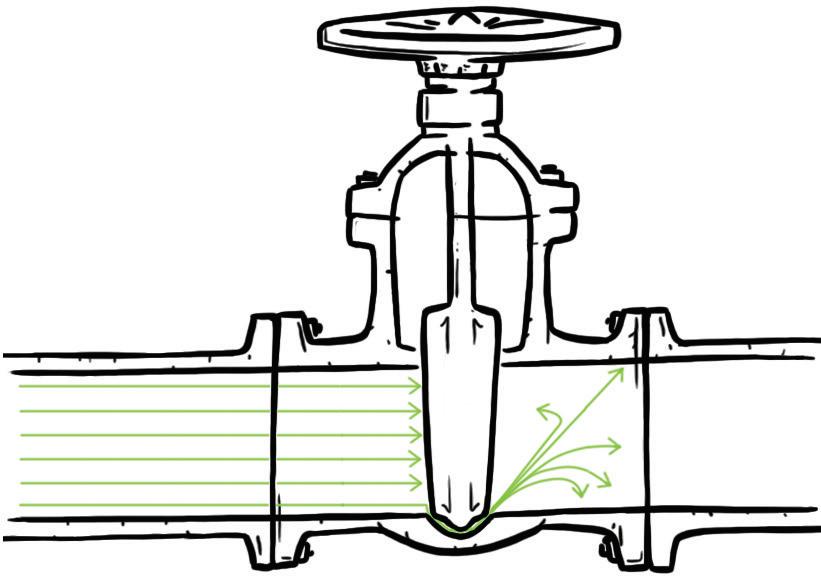

Sound leak detection and repair practices are essential to modern ethanol plant operations. Both procedural and high tech, LDAR is rooted in compliance, but closely tied to everyday maintenance and project planning.

By Luke Geiver

Experts in the leak detection and repair (LDAR) business believe ethanol plants need to focus on pressure relief valves at the tops of fermenters, along with open-ended lines, or OELs, and a list of other infrastructure components within the plant. “These areas tend to have the most noncompliance-related findings,” says Andrea Foglesong, senior EHS consultant for PROtect LLC, an environmentalfocused firm formed in 2020 though the merger of two long-established companies, ERI Solutions LLC and DBI Inc. Foglesong and other LDAR experts tell Ethanol Producer Magazine that the relevance of LDAR in ethanol production has never been higher. With new areas of focus, new strategies and updated best practices for compliance, producers are both compelled and obligated to stay up to date on LDAR.

44 | ETHANOL PRODUCER MAGAZINE | JUNE 2023

Environmental

ADAPTING YOUR PLAN: Even ethanol plants that already have successful LDAR programs in place might need to update their procedures periodically, especially if they expand, add new equipment or make other changes to the facility. Producers need to maintain documentation of evaluating whether a capital expenditure could result in moving from a less stringent regulation to a more stringent program.

ETHANOLPRODUCER.COM | 45

PHOTO: STOCK

The State of LDAR

Foglesong has been an environmental regulatory consultant in the ethanol industry for 22 years and she believes LDAR is being talked about more today than ever. “The value of a well-managed program can be seen in multiple areas of plant operational management,” she says. “New and improved technology is allowing facilities to decrease program costs, be more efficient in program implementation and improve the detection and monitoring of applicable components.”

A well-run LDAR strategy can keep a facility’s air permit in compliance, reduce product loss, reduce health and safety risk, lower air emissions and reduce exposure to fines or violations associated with noncompliance. In many cases, a successful LDAR program can also be used in the development of company-wide sustainability goals, she says.

Mike Ogden, project manager from Trihydro Corp., an engineering and environmental consulting firm, is another LDAR specialist focused on the goals of modern ethanol plants. Although the company has served the industry since 2004, Ogden and his team are currently assisting with permitting fugitive emissions calculations and actively engaged in assisting ethanol clients with carbon capture and sequestration projects. Most CCS projects are injection well projects that require fullspectrum environmental assessment and oversight, Ogden says.

Ethanol plants are required to implement an LDAR program because the facilities are subject to federal and state rules known as U.S. Environmental Protection Agency New Source Performance Standards Subpart VV and/or VVa. Therefore, regulatory policy drives the need for an LDAR program. EPA regulators play a

role because the rule is federally enforceable. EPA and state agency regulators will identify program areas for increased enforcement oversight, and will audit a facility’s LDAR program to determine compli-

46 | ETHANOL PRODUCER MAGAZINE | JUNE 2023 World

Collaboration is the process Bringing it to life is our passion katzen.com

class design begins with a vision

Environmental

ance with Subpart VV/VVa, according to Foglesong.

Plants that have a successful LDAR program or practice in place need to take note. Changes across the facility might re-

quire updates to the LDAR program, according to Ogden and Foglesong.

“Changes to the production process could mean the facility becomes applicable to different standards. For example, a facil-

ity that is managed under Subpart VV that goes under a large plant expansion may then have to implement Subpart VVa standards. Modifications affecting facility-applicable processes would require the plant

ETHANOLPRODUCER.COM | 47

DROP-IN VISITS: EPA and state agencies have had an increased presence in the ethanol industry over the past several years, sometimes with unannounced site visits utilizing optical gas imaging cameras to look for possible plant emissions leaks.

PHOTO: STOCK

to include those new or modified areas in the LDAR program, possibly requiring retagging, inventory update, and additional monitoring,” Foglesong says.

Sometimes it doesn’t have to be a change in production. Failure to implement an LDAR program that leads to enforcement action can include the need to implement higher-level standards, she adds.

EPA and state agencies have had an increased presence in the industry over the past several years with Clean Air Act section 114 requests for information or with unannounced site visits utilizing optical gas imaging cameras to observe possible emissions, Ogden says.