It’s easy to see all the bene ts that Vydate® C-LV insecticide/nematicide offers. In the soil, Vydate C-LV provides protection against damaging nematodes. Above ground, its foliar activity protects plants against numerous insects, such as aphids, lygus, Colorado potato beetle, potato psyllid and leafhoppers. Plus, Vydate C-LV delivers the “carbamate kick”, something you’ll observe as “green up” of plants, improved plant vigor/growth, reduced senescence and improved yields. To learn more about the eye-catching bene ts of Vydate C-LV, contact your crop consultant.

PO Box 333, Roberts, Idaho 83444

Telephone: (208) 520-6461

Circulation: (503) 724-3581

Potato c ountry.com

eDitor

Denise Keller editor@ColumbiaMediaGroup.com

oPerations manaGer, aDvertisinG

Brian Feist brian@ColumbiaMediaGroup.com

PUBlisHer, aDvertisinG

Dave alexander dave@ColumbiaMediaGroup.com

insect iDentiFication andy Jensen www.nwpotatoresearch.com

Disease iDentiFication

Jeff miller jeff@millerresearch.com

marKet rePort

Ben eborn napmn@napmn.com

Potato Growers oF wasHinGton Dale lathim dale@pgw.net

eDitorial inFormation

Potato Country is interested in newsworthy material related to potato production and marketing. Contributions from all segments of the industry are welcome. Submit news releases, new product submissions, stories and photos via email to: editor@ColumbiaMediaGroup.com.

aDvertisinG sales

For information about advertising rates, mechanics, deadlines, etc., call (208) 520-6461 or email dave@PotatoCountry.com.

U.S. $24 per year / Canada $40 per year / Foreign $80 per year Subscriptions can be entered online at: potatocountry.com/subscribe or call (503) 724-3581. Email address changes/corrections to: brian@ColumbiaMediaGroup.com or send to

Potato Country, PO Box 333, Roberts, ID 83444.

Potato Country magazine (ISSN 0886-4780), is published eight times per year and mailed under a standard rate mailing permit at Idaho Falls, Idaho and at additional mailing offices.

It is produced by:

Columbia Media Group, PO Box 333, Roberts, ID 83444

Copyright 2023. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, for any purpose without the express written permission of Columbia Media Group.

n Colorado potato beetle

n Potato psyllid

n Worms (loopers, armyworms)

n Thrips

Insecticide applications may target a single pest, but other pests likely reside in your elds. With Delegate® WG insecticide, you can control multiple pests at once, including Colorado potato beetle, potato psyllid, worms (loopers, armyworms) and thrips.

As a member of the spinosyn class of chemistry (IRAC Group 5), Delegate WG controls pests like no other class of chemistry used in potatoes. Yet, Delegate has low impact on populations of key bene cial insects and will not lead to secondary pest outbreaks.

By Kylie D. Swisher Grimm, USDA-ARS Christopher Gorman, David Crowder and Carrie Wohleb, Washington State University

By Kylie D. Swisher Grimm, USDA-ARS Christopher Gorman, David Crowder and Carrie Wohleb, Washington State University

Purpletop disease of potato has been a persistent problem in the Columbia River Basin region of Washington and Oregon since it was first observed in 2002. Potato plants that are infected with this disease show purpling and curling of upper leaf tissue, aerial tuber formation and plant decline, ultimately leading to decreased tuber yield (Fig. 1). The causal agent of this disease was identified as the beet leafhopper-transmitted virescence agent (BLTVA) phytoplasma, which is transmitted to potato and other crops by the beet leafhopper. In the Northwest, the beet leafhopper transmits at least two other pathogens to crops in the Columbia River Basin, including beet curly top virus (BCTV) and Spiroplasma citri. However, these two pathogens have not been a concern for potato growers.

Washington State University (WSU) extension scientist Carrie Wohleb has been conducting beet leafhopper monitoring near potato fields in the

Columbia Basin of Washington since 2009. In 2020, sticky cards were also placed near other vegetable and seed crops throughout the region to maximize beet leafhopper collection. In recent years, total beet leafhoppers captured during a season has ranged from 24,942 in 2020 (from 69 field locations) to as many as 55,968 in 2021 (from 67 field locations).

Weekly beet leafhopper population results are disseminated to growers and crop consultants via an e-newsletter called WSU Potato Alerts. In collaboration with David Crowder, beet leafhopper monitoring data are interpolated and displayed in the form of geographical contour maps that highlight areas of high to low beet leafhopper densities across the region to aid growers in their integrated pest management decisions. This data is displayed each week in WSU Potato Alerts but is also available at www.potatoes.decisionaid.systems.

Since purple top disease of potato continues to be an issue that growers in the Northwest must manage, researchers with the USDA Agricultural Research Service and Washington State University realized that weekly BLTVA pathogen prevalence data from captured beet leafhoppers could help growers make more informed pest management decisions. Currently, there are no BLTVAspecific treatments, so control of potato purple top disease is done through managing the beet leafhopper vector. Understanding the threat of BLTVA in beet leafhoppers captured throughout the region could enable growers to better time pesticide applications or even reduce the number of applications used each season. Funding from the USDA Office of National Programs Areawide Pest Management Program and the Washington State Department of Agriculture Specialty Crop Block

Figure 1. Symptoms of potato purple top include purpling and curling of leaves (left) and aerial tuber formation (right). Left photo courtesy Jim Crosslin, USDA, retired

Figure 1. Symptoms of potato purple top include purpling and curling of leaves (left) and aerial tuber formation (right). Left photo courtesy Jim Crosslin, USDA, retired

Grant Program allowed this work to be completed.

To obtain weekly BLTVA pathogen data, new insect extraction and molecular diagnostic methods were designed and validated in the laboratory to generate results in a timely manner. Despite attempts to determine pathogen prevalence data in 2020 and 2021, the improved molecular detection assays were not completed until the beginning of the 2022 season. As a result, data was only obtained from collections made in May and June in 2020 and 2021, but by 2022, season-long pathogen prevalence data became available on a near-weekly basis.

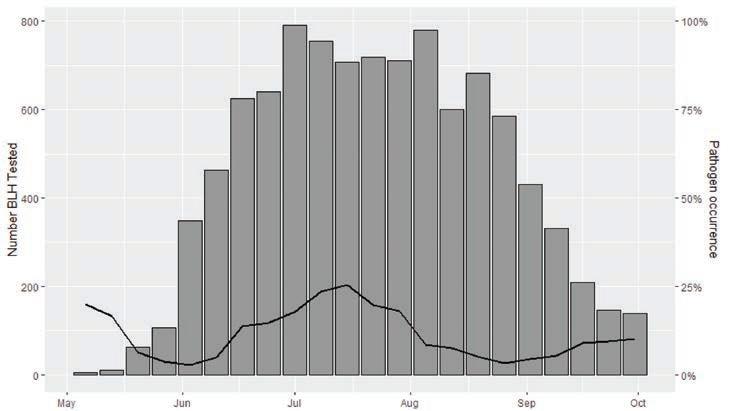

In 2020 and 2021, BLTVA pathogen prevalence increased at a steady rate over the months of May and June when testing of beet leafhoppers occurred. Pathogen occurrence reached 34.15 percent by the week of June 22 in 2020 and 22.32 percent by the week of June 18 in 2021. In 2022, initial BLTVA pathogen prevalence was high when testing began in the first week of May, which was followed by a drop until the beginning of June when pathogen prevalence steadily began increasing again (Fig. 2). Seasonlong data obtained in 2022 identified a peak in BLTVA pathogen prevalence at 25.35 percent by mid-July. The month of July also saw the highest number of beet leafhoppers collected and tested. Overall BLTVA pathogen levels were lower in 2022 than in 2020, even with the limited data available from the 2020 season, and this is likely true of the 2021 season as well.

Current efforts are focused on completing the testing of beet leafhoppers collected from the 2021 season to generate season-long pathogen prevalence data from two consecutive years, with the anticipation of identifying trends in beet leafhopper population and BLTVA pathogen prevalence.

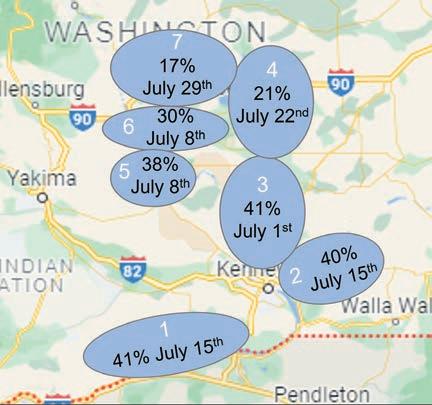

The Columbia River Basin of Washington encompasses a wide geographic range. The 2022 beet leafhopper collection locations were divided into seven distinct regions, many of which were defined by geographic landmarks, to assess differences

in pathogen prevalence based on geography. These regions were identified as the following: Paterson, Snake River, Basin City, Othello, Mattawa, Royal City and Quincy. While BLTVA pathogen prevalence peaked at different weeks in July across the region, the highest BLTVA rates (at 40-41 percent) were found in the southern regions, and these occurred early to mid-July (Fig. 3). The two northern-most regions of Quincy and Othello showed BLTVA rates that peaked later in July at just 17 and 21 percent, respectively. Results from this single year of data indicate that the BLTVA pathogen may be a higher threat to crops grown in the southern region of the Columbia Basin. Data from additional years will be used to validate these results and determine if this is a consistent trend or simply a unique finding in the 2022 season.

During the 2022 growing season, BLTVA pathogen occurrence in beet leafhoppers, as well as BCTV and S. citri pathogen prevalence, was incorporated into the WSU Potato Decision Aid System (www.potatoes.decisionaid.systems). On this website, heat maps depict weekly rates of pathogen prevalence broken down by region, and visitors can toggle between the weekly data to observe how pathogen prevalence changes over time. The goal is to have this information updated weekly throughout each growing season to help growers and

Figure 3. Beet leafhopper collection locations were divided into seven regions (1: Paterson, 2: Snake River, 3: Basin City, 4: Othello, 5: Mattawa, 6: Royal City and 7: Quincy), and the peak BLTVA pathogen prevalence (rate and collection date) is indicated. Geographical map originates from googlemaps.com.

crop consultants make more informed decisions about the timing and number of applications needed to control the beet leafhopper vector.

While BLTVA and potato purple top disease has been a persistent problem in the Columbia Basin for the past 20 years, improving the overall understanding of pathogen presence throughout the region could help reduce the economic impact of this disease on potato production.

Potato growers from across the country united as an industry to fulfill the National Potato Council (NPC) mission of “Standing Up for Potatoes on Capitol Hill.” The 2023 Washington Summit, held Feb. 27-March 3, provided a forum for potato industry members to discuss, define and advocate for the policy priorities impacting their businesses and protecting their ability to farm. Attendees met with lawmakers to discuss industry policy priorities such as keeping potatoes in federal nutrition programs, promoting free and fair trade agreements, and protecting tax policies that support the long-term health of family-owned farming operations.

Secretary of Agriculture Tom Vilsack praised potato growers for their significant contribution in providing America with nutritious, delicious potatoes, while supporting rural communities and the U.S. economy.

During the summit, the NPC also elected its new Executive Committee. RJ Andrus of Idaho Falls, Idaho, will serve as the 2023 NPC president. Andrus is a third-generation farmer and an owner of TBR Farms in Hamer, Idaho. He has served on the Executive Committee since 2019 in roles including vice president of Grower Outreach and Industry Research, and, most recently, vice president of Legislative Affairs. Andrus is also vicechairman of the Potato Leadership, Education, and Advancement Foundation (Potato LEAF) board.

Andrus will lead the NPC Executive Committee, which also includes Bob Mattive, Colorado, first vice president and vice president, Environmental Affairs; Dean Gibson, Idaho, vice president, Legislative Affairs; TJ Hall, North Dakota, vice president, Grower Outreach and Industry Research; Ben Sklarczyk, Michigan, vice president, Finance; Ted Tschirky, Washington, vice president, Trade Affairs; and Jared Balcom, Washington, immediate past president.

Can biologicals work in large-scale agriculture? This question has been increasingly posed in the agricultural community. With the EPA and states removing chemistries from the market, resistance increasing in pests, and increased regulations on active ingredient (AI) units applied to cropping systems, the biological crop protection route is looking more and more appealing.

In this article, we look at the reasonableness of using biologicals for pest control, its benefits and its shortcomings. And we look at how biologicals compare to the synthetic pesticides currently on the market.

Most farmers know the power of a good synthetic pesticide. When applied

correctly, synthetic pesticides will achieve the desired control quickly and at low rates. However, the current market for new AIs is slowing down as many “simple synthetics” have been discovered, and what’s left takes a lot of research to find and develop. For instance, it takes an average of 10 years and $250 million to produce a new AI, according to CropLife International. That’s a big investment from a crop protection manufacturer, especially when the return isn’t guaranteed. This, paired with the fact that more and more states are restricting AI loads and specific AIs, along with the growing resistance to AIs, leads to fewer tools in the farmer’s toolbox to combat disease and insect pressure.

Farmers may be asking themselves right now, if AIs are being reduced and not replaced at the same rate, meaning we will eventually run out of AIs, what options will be left? Many researchers would answer that biologicals are the key to continued pest control – or at least part of it.

So, why aren’t biologicals taking over all the ag markets – organic and conventional? There are a few reasons: efficacy, ease of use and pest control. There are many biologicals that solve one of these issues, but to find products that can meet all three product requirements is challenging. If producers have used a biological, they may have experienced any of the following “normal” issues with application: refrigeration requirements, oily texture, plugged nozzles, high spray volume, microbial growth in spray tanks and smell.

To find a product that eliminates the hardships of application, has a decent shelf life and is also efficient is unique. Luckily, there are several companies dedicated to finding this balance.

A potato fungicide trial completed by Miller Research in 2022 tested 14 products including a biological fungicide treatment that was half Azoxystrobin and half Reynoutria extract, a biological. The results speak for themselves (Fig. 1). By combining the ease of use with a dual mode of action fungicide, the product called AZterknot provided consistent disease control and had the highest marketable yield in the study. While AZterknot is only a half biological product, it shows the potential for biological products to fit in large-scale operations without sacrificing efficacy or yield to reduce AI load (Fig. 2). And this is just one biological product on the market out of hundreds.

There is a long road ahead before biologicals are as mainstream as synthetics, but with the advancements being made by companies and the research going into these AIs, I believe that in the future, American farmers will apply biological crop protection products with the same frequency as they apply synthetics today. But to answer the question posed by this article: can biologicals work in large-scale ag? It appears that there are already biologicals on the market that can meet the demands of large-scale farmers. Now the question to pose is: will farmers choose to use them?

By Carl Rosen, Professor, University of Minnesota

By Carl Rosen, Professor, University of Minnesota

Phosphorus (P) is a macronutrient essential for all forms of life. A deficiency of P in potatoes is associated with delayed vegetative growth, poor tuber set and bulking, and reduced yields. Excess P seldom affects plant growth, but it can increase eutrophication if it moves offsite into surface water. Phosphorus management is, therefore, an important consideration from both production and environmental standpoints.

Phosphorus fertilizer recommendations for potatoes are often based on soil test P and yield goal, but numerous studies have shown that economic responses can sometimes occur even on high P testing soils. For this reason, some P fertilizer is usually recommended for potatoes even when soil test P is high. However, a P response is not always guaranteed even on lower P testing soils.

Phosphorus in soil exists in both inorganic and organic forms. It is considered a very immobile soil nutrient with availability of inorganic forms primarily controlled by soil pH. In acid soils, P binds tightly to soil particles by forming insoluble iron and aluminum compounds, and in alkaline soils, it forms insoluble

calcium compounds. The optimal soil pH for P availability is generally between 6 and 7. Placement of P fertilizer in a band near the root system is one way of increasing P availability.

The reasons why potatoes often respond to phosphorus even under high soil P conditions are not entirely known but could be related to several factors. For example, potatoes naturally have a limited root system and the practice of hilling limits that root system even further. Because P is immobile in soil, plant roots depend on an increased root surface area to increase the probability of intercepting soil P in areas that have not yet been depleted. As plant roots take up P, the amount available for further uptake decreases; therefore, growing into areas of higher soil P is an important adaptation to increase P supply to the plant.

Soil pH may also be a factor that limits P uptake. As previously mentioned, fixation by iron and aluminum in acid soils and calcium in alkaline soils reduces P availability. For some varieties, soils are maintained at a pH below 5.5 to control common scab. While this practice can improve tuber

quality, it may also result in lower P availability.

Another reason for variable P response may be due to soilborne diseases such as Verticillium and pathogenic nematodes, which can further limit root growth. To control soil-borne diseases, fumigation is used, but this practice is not specific to disease organisms and may also reduce beneficial microbes such as mycorrhizae. Mycorrhizae are naturally occurring symbiotic fungi that form a symbiotic relationship with plant roots to increase root surface area and, therefore, improve phosphorus uptake.

Finally, there could be distinct varietal differences in P uptake due to differences in root structure and surface area. Some varieties may be more efficient in P acquisition and uptake than others due to root adaptations to solubilize fixed P or breakdown organic P.

To explore some of these factors in more detail, a twoyear experiment was conducted at the Sand Plain Research Farm in Becker, Minnesota, with an overall goal of improving predictability of potato response to P fertilizer. Specific objectives were to 1) compare P response of two potato varieties in fumigated and non-fumigated soils, 2) determine the effect of mycorrhizal inoculation on P response, and 3) evaluate broadcast vs. banding of P fertilizer on tuber yields.

The soil at the experimental sites had a pH that ranged

Proven for use in: Reds, Russets, Round Whites, Gold Rush and more

Potato Sizing Video Now Available: www.kerian.com

GENTLE: Separates without damaging potatoes

ACCURATE: Precisely grades potatoes of all shapes and varieties

FAST: Thirteen standard models custom-designed to meet your needs sort from 1000 lb/hr to 80,000 lb/hr

SIMPLE: Effective but simple design provides a rugged, low cost, low maintenance machine at a high value to our customers. It can even be used in the field!

from 6.4 to 6.9 and a Bray P soil test that ranged from 95 to 126 ppm. The pH was in the range for optimum P availability, and soil test P was in the very high range, indicating the probability of P response to applied fertilizer for most crops would be low. Treatments for this study included, with and without fumigation, two varieties, Russet Burbank and Ivory Russet, and nine P treatments replicated four times for a total of 144 plots. The nine P treatments were: 0, 75 150, 300 and 450 lbs P2O5/acre as triple super phosphate broadcast applied and incorporated in the spring before planting, mycorrhizae inoculation without P fertilizer and with mycorrhizae with 150 lbs P2O5 broadcast applied, banded P fertilizer at 75 and 150 lb P2O5/acre. Fumigated plots received 40 gallons of Vapam the first year and 50 gallons the second year. MycoGold was used as the mycorrhizae inoculant and applied at the labeled rate in furrow at planting.

P rate and fumigation response: Total yield increased with increasing P rate in both years of the study for Ivory Russet under both fumigated and non-fumigated conditions (Fig. 1a, 1b). In contrast, the P response for Russet Burbank in the first year of the study was not significant (Fig 1c). However, in the second year of the study, Russet Burbank yields increased with an increasing P rate in both fumigated and non-fumigated conditions (Fig 1d). At equivalent P rates, yields for both varieties were higher under fumigated conditions than nonfumigated conditions.

Mycorrhizae inoculation: Over the two years of the study, mycorrhizal inoculation had no effect on yield of either variety when applied at planting at 0 and 150 lb P2O5/acre under non-fumigated or fumigated conditions (Table 1). These results suggest the P response in these soils is not related to lack of mycorrhizal associations.

Banding vs. broadcast-applied P: Mixed effects were found for P placement over the two years. In the first year, banding at equivalent rates to broadcast had no effect on yields for Russet Burbank in either fumigated or non-fumigated conditions. There was an unexpected decrease in Ivory Russet yields when banding was used under fumigated conditions and no effect of placement under non-fumigated conditions. In the second year of the study, results were more consistent, with banded P applications tending to increase yields of both varieties when compared to broadcast applications at equivalent P rates, although the effect was statistically significant at only the 75 lb P2O5/acre rate under fumigation (Table 2).

1709 Hwy 81 S, PO Box 311, Grafton, ND USA 58237

701-352-0480 • sales@kerian.com

Fax 701-352-3776

Phosphorus fertilizer economics: Phosphorus fertilizer prices have more than doubled over the past two years with a current cost of $1.02/lb P2O5. The yield increase of 0.127 cwt would be required to pay for each extra pound of P2O5 applied assuming a value of $8/cwt. Based on a cost analysis for the second year of the study, adding P fertilizer at current prices would only have been cost effective when potatoes were grown under fumigated conditions. This suggests that root growth under non-fumigated

“A more gentle way to size your potatoes quickly and accurately.”

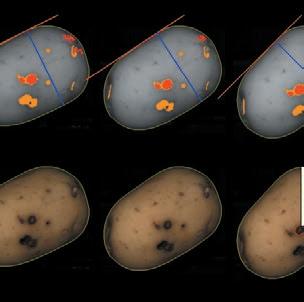

You want the best of both worlds. Speed to deliver maximum capacity and accurate defect detection to maintain consistent quality. Inspect the entire surface and look inside each potato to get the best out of every batch.

More info?

Please contact John Albert (206)915-4962

john.albert@ellips.com www.ellips.com

table 1.

Averaged over variety, fumigation, and year

conditions was not sufficient to take advantage of the extra P fertilizer applied when P fertilizer costs are high and would result in a loss. If the cost of P fertilizer decreased to pre-2020 levels, P fertilizer addition would be cost effective. These results suggest that under fumigated conditions, it is important to optimize other inputs to realize the full effect of fumigation.

The reason why potatoes sometimes respond to P fertilizer in high P testing soils continues to be puzzling. However, based on this research, it is unlikely due to lack of mycorrhizal associations. Ivory Russet was more responsive to P the first year of the study than Russet Burbank, but both varieties responded to P fertilizer the second year. Phosphorus response

PLANTERS

2020 Checchi Magli 4 row used, like new

2005 Lockwood 6 row pick planter 6 row 36”

2003 Kverneland 3300 cup 6 row 34” pull hitch

2012 Miedema 6 row planter 36” pull hitch

rear steer

2013 Spudnik 8069 bed planter

9 units in 6 row pull Type

2008 Spudnik 8080 Pull type cup, 8 row 36”

2008 Spudnik 8060 Cup 6 row 36”

Semi Mount

2004 Spudnik 8060 Cup 6 row 36”

Semi Mount

PLANTER FILLER PILERS

New Logan 36” Telescopic Planter Filler One left for spring

SEED CUTTERS

Better Built Model 448 single phase 220 volt 48”

Milestone 48” 220 volt 1ph, Hyd adjust, elev. Drive, wheel drive

TREATERS

2016 Excel 10” liquid and dry treater 230 V 3ph

2002 Better Built 12” Cannon Duster

1991 Better Built CDT10- 8”

Cannon Duster

2008 Milestone 36” Barrel Duster

PILERS

2000 Double L 813 31”BC x 49’ Tel Bm 1ph

1985 Double L 813 31”BC x 49’ Tel Bm 1ph

1998 Milestone 36” 480 volt 3ph remote all belt

1998 Spudnik 560 36”BC x 48’ Tel Bm 480 Volt 3ph

1982 Spudnik 450 36”BC x 45’ Tel Bm 230 Volt 3ph

SCOOPERS

1997 Spudnik model 150 30” Rec. Like new

1992 Spudnik model 150 30”

1990 Spudnik 100 24” 3ph

1982 Spudnik 100 24” 3ph

POTATO TRUCK

1995 Ford LTL9000 CAT- 3176, 13 spd, Chalmers susp., 318,000 miles, Spudnik 22’ bed

1982 IH 2500 Cummins NTC300, Auto Trans., Hendrickson Susp., 325,000 miles Spudnik 22’ bed

2004 Kenworth W900 M11 Cum 350hp 15 speed Tran. Spudnik 26’ bed

1997 Peterbilt 377 Cummins diesel, 18spd 20’ bed frame

BULK BEDS/BOXES/ SELF-UNLOADING

1991 Logan 20’ 90-Series Electric

1985 Logan 20B Electric 20’

1999 Spudnik 2100 Elec 20’

1997 Spudnik 2100 Elec 20’

1992 Spudnik 2100 Elec 20’

1990 Spudnik 2100 Elec 20’

1986 Spudnik 2000 Elec 20’

CROSSOVERS/WINDROWERS

2018 Allan 6 row

2015 Double L 6560 6 row

2009 Double L 951 4row

1996 Double L 851 4 row

2012 Lockwood 554 4 row

1984 Logan 2 row RH BC

2008 Spudnik 6160 6 row R&L discharge

2007 Spudnik 6140 4 row

2001 Spudnik 5140 4 row

1997 Spudnik 5140 4 row

HARVESTERS

2017 Allan 3 row Electric w/ VFD controls

2018 Double L 7340 4 row

2004 Double L 859 2 row 69”

2003 Grimme SE 75-30

2012 Lockwood 474H 4 row

2012 Spudnik 6640 4 row

2009 Spudnik 6400 4 row

2008 Spudnik 6200 2 row multi sep

2001 Spudnik 5625 2row 69”

table

Means within a row followed by the same letter are not significantly different at p=0.10.

was observed under both fumigated and non-fumigated conditions, but there seemed to be a greater response to P with fumigation. Banding was effective in one of the two years and may reduce the need for higher P application rates. While potatoes can respond to P fertilizer in high P testing soils, yield increases may not be sufficient to offset the current high cost of P fertilizer, especially if soil-borne diseases are prevalent.

CROP CARTS

2020 Allan AEC 35T, Scott Table

WATER DAMMERS

2019 Logan 6 row Yield Pro 36” Dammer

2014 Logan 8 row Yield Pro 36” folding wings Water Dammer

STINGERS

2015 Double L 832 36” BC with fingers

2007 Double L 833 30” Belt Chain only

2014 Logan Trac Pro 30” belt only

1994 Spudnik 2230 36” belt only

CONVEYORS TELESCOPIC

1989 Double L 810 Tel. conv. 30” x 50’ 3ph

2012 Logan Trac Pro 30” x 65’ 230 V 3ph

2021 Spudnik 1250 42”/48”x 85’ TC 480V 3ph

1997 STI 30” x 70’ 3ph Tel. Conv.

CONVEYORS STRAIGHT

Double L 809’s 30” x 40’ 3ph x 6 Mayo 48” x 20’ side shift with 2 – Belt Stingers 36”

Spudnik 1200 30” x 40’ 3ph

Spudnik 1205 30” x 30’ 3ph

SIZER ONLY

2016 Spudnik 925 84” 230 volt 3phase

1998 Spudnik Model 910 72” acorn rolls 230 volt 3phase, spring adjustable

DIRT ELIMINATOR W/SIZER

1997 Double 807 Dirt Elim. 62” BC 3ph Stingers 72” Sizer

2013 Milestone Model MSDS 96 BC Elev Sizer clod drum split picking table

2010 Milestone 60” sizing table only w/ acorns quick adjust arms

1994 Milestone 72” Dirt Elim. Sizer, 2 – 24” x 12’ stingers

2011 Spudnik 96” 990 BC Elev. Reverse roll table, sizing table, split picking, cross out conv.

2004 Spudnik 995 DES 72” Q A dirt & Size roll tables, split picking 230 volt 3ph

2002 Spudnik 72” DE belt elev

DIRT ELIMINATOR ONLY

2017 Milestone 96” 480 3phase

1998 Double L Model 806 BC, fingers, belt table, 2- pups 230 volt 3ph

2006 Spudnik 995 72”Finger rollers, ellis table, Belt Chain table 230 Volt 3 phase

1990 Spudnik 950 72” 230 volt 3phase

ROCK/CLOD/AIR ELIMINATORS

2013 Harriston 4240 Clod Hopper 3ph

2013 Harriston 3240 Clod Hopper 3ph

2011 Harriston 3240 Clod Hopper 3ph

1999 Harriston 240 Clod Hopper 3ph

2003 Harriston 200 Clod Hopper 3ph 480 volt Ellis table

EVEN FLOWS/ SURGE

HOPPER

New Logan Surge Pro Hoppers 60” 72”

DIRT TARE PILER

New Logan Dirt Tare Pro 30” 36”

MISC.

Ace Roll over Hyd. Reset Plow 5 bottom

2020 Logan Barrel Washer for little potatoes

Belly Dump Unloader Attachment for Scooper

Evenflows: 1200 cwt, 900 cwt, 400 cwt

Greentronics Scale

Kerian 72” sizer

Mayo 60” flat washer belt chain elevator

Tri Steel 60” felt dryer

Flumes, pumps, rolling tables

By Chris Voigt, Executive Director, Washington State Potato Commission

By Chris Voigt, Executive Director, Washington State Potato Commission

15 years ago, food manufacturers were caught flat footed when a group of researchers determined that foods cooked at high temperatures generated a natural chemical reaction between the sugars and an amino acid present in the food. This natural chemical reaction produced a potential carcinogenic called acrylamide. Acrylamide is present in about 50 percent of the food we eat. You can find it in most foods that are cooked at high temperatures. It is present in roasted coffee beans, crackers, bread, cereal, cakes, cookies, grilled meat, fries and chips. The highest acrylamide levels

Aboutwere found in sweet potato fries. Even though we’ve been eating acrylamides since our ancestors started cooking over a fire, the FDA was very interested in lowering the risk of acrylamide by lowering the amount in our diets.

The potato industry went to work. Potato processors and grower organizations quickly determined the best approach to lower acrylamide levels was through the breeding process. Develop new varieties that were low in sugar and/or low in the amino acid, asparagine. This industry consortium of processors and growers came together to fast track new variety development of potatoes that were low in acrylamide. The focus was finding new varieties that were low in sugars and low in asparagine

and to trial those new varieties in six different growing regions in the U.S. Testing the potatoes coming out of storage was also important to make sure they maintained their low acrylamide levels throughout the year. The National Frozen Processing Trials (NFPT) was incredibly successful in lowering acrylamide levels and avoiding regulation by the FDA.

Today, the NFPT is still functioning, but its mission has changed. Acrylamide is still important, but now we use the NFPT as the primary screening tool looking for the next great French fry potato. The NFPT is a three-year process. Collectively in the U.S., we produce about 500,000 new clones each year. We take the 50 best clones and enter them into the first

year of the NFPT. We focus on things like yield, gravities, sugars, fry color, shape, length/width ratios, storability, pest and disease resistance, and other quality features. If they survive this process, they graduate to year two for another round of trials. If they still look good after two years of trials in six different locations across the U.S., they qualify for another year of screening which includes important taste and texture trials. We don’t want to keep a variety around if it’s not going to meet the taste and texture requirements of our customers.

The NFPT members know that our focus has to be on finding varieties that our customers are going to love, but we also need to find varieties that produce more food using fewer inputs. The pipeline of new varieties looks great! I’m confident we can continue to meet the food needs of our growing population.

The Washington State Potato Commission is one of the 10 founding members of the NFPT. The work of the NFPT has been able to shave off several years required to bring a new variety to market. It has also saved the industry millions of dollars by eliminating poorly performing varieties earlier in the new

variety development process, and it gets customer acceptance much sooner in the process. Most folks don’t know much about the NFPT, but it shows how successful we can be when we put our competitive differences aside and work together on solving industry issues.

www.agri-stor.com/crop-protection/

Agri-Stor Company’s storage disinfecting and crop protection solutions address seed, process and fresh market growers’ needs for superior product quality. Multiple modes of application are available, including cold and thermal fogging, AANE and misting.

Solutions include peracetic acid (PAA), chlorine dioxide and other effective options to protect storage and crops against various diseases and micro-organisms.

www.greentronics.com

RiteWeight In-line Conveyor Scale

Greentronics offers an easy and accurate method for tracking loads and weights by date, field, variety, temperature and cellar. New features added to Greentronics’ RiteWeight in-line conveyor scale are designed to automate harvest and storage data recording. Data are uploaded via an Android phone or tablet to the Greentronics cloud server for processing and reporting in near real-time. Maps and reports can be viewed, downloaded, shared or printed from anywhere. A range of reports detail how much crop is stored and where it was grown. 2-D maps show where crop is stored by date, field and variety. By including a crop temperature sensor with the scale, maps will provide a temperature profile for each cellar. Maps allow growers to easily complete traceability reports. Harvest and storage progress can be monitored remotely. Reports show inventory levels.

www.harriston-mayo.com

Speed clean with Harriston’s belted chain elevator and Evolution dirt table. This compact, portable machine features some big tare-eliminating components, starting with the belted chain elevator. The belted chain elevator gets rid of loose dirt before feeding into the Evolution table. The second component is the highly adjustable Evolution table that can be set for a wide variety of conditions. With reversible rollers and frequency drives for every pair of rollers, users can set it to be as aggressive or gentle as needed.

www.lockwoodmfg.com

Designed with today’s higher-level harvesting capacities in mind, the new 700 series harvesters can handle more volume with a wider rear cross and side elevator. Included is a new 10-inch customizable touchscreen control system with joystick control. The 774 harvester’s full swing truck boom allows for truck loading efficiency. It is complete with numerous side elevator and full-width cleaning table options, as well as optional wheel drive and vine chopper to fit each user’s needs. Like all of Lockwood’s harvesters, it comes equipped with dual high-efficiency fans for increased airflow and also offers excellent visibility for the operator.

www.loganpotato.com/listing/load-pro

Logan’s Load Pro Truck Bed is designed and constructed for years of excellent performance. With its 100-inch-wide body, providing the largest capacity from 20 to 30 feet in length, and its construction of standard carbon steel and complete stainless steel, the Logan Truck Bed is capable of meeting all a grower’s needs.

Main components such as the side door, non-door and main frame rails are one piece, providing strength and longevity. Important structural members are bolted into place, allowing twisting and torsion to happen without cracking.

The beds are feature rich and have unique advantages such as large 3-inch carry up rollers, heavy side support ribs spaced close together, upper rear hydraulic doors and turnbuckle ratchet take-ups. All Logan Equipment is sandblasted, primed and painted with a high-gloss polyurethane paint that is very durable, providing years of attractive quality.

www.mayomfg.com

The Mayo Web Belt Sizer is best for accurate sizing of round potatoes, separating one or more undersize profiles. The key is the unique rubber belt web screen that is durable and doesn’t stretch. These machines are designed for portable use or to be integrated into a grading and sizing facility. The unit is available with built-in standard or stainless steel and in a variety of sizes. Options typically included are cross conveyors for small sizes and discharge conveyors.

www.rietveldequipment.com

The Allround Polisher TD 350-18 has 18 rolls of brushes with an estimated capacity of 25 tons per hour. Three smaller models are also available. The polishers are available in stainless steel and feature a hydraulic lift for easy cleanout, variable speed control, a water recirculation system and water cleaning system. The machine also offers easy brush removal for changing the brushes, as well as several different types of brushes for each application.

Allround builds all of the machines required in a washing/grading line, and the machines are running in over 80 countries worldwide.

Rietveld Equipment offers free 2D and 3D drawings of full lines, or drawings of the available machines in users’ existing lines.

Parts and machines are in stock at the company’s Midwest facility, and service and support from certified technicians is available 24 hours a day, seven days a week.

www.trinitytrailer.com

Since its invention in 1975, the Trinity EagleBridge has hauled potatoes and farm commodities longer than any other self-unloading trailer. It transports heavy loads over rough country roads year after year and flexes over uneven terrain.

Another well-known Trinity product in the potato industry is the EagleBed. With its 102-inch-wide stainlesssteel body, fold-down side door and time-tested design, customers can be sure it will hold up to wear and tear and perform when they need it most.

Trinity Capital offers in-house financing for customers’ equipment needs to keep financing flexible. With 47 years of proven success, Trinity’s reputation speaks for itself.

The EPA has approved Bayer’s Luna Pro, a premium premix fungicide formulated to provide both foliar and soil-borne disease control in potatoes. The newest addition to the Bayer potato portfolio utilizes prothioconazole, a DMI foliar fungicide, and fluopyram, an SDHI fungicide. DMIs work by hindering the growth of certain fungi on a cellular level, which helps to improve overall plant health and increase yield potential. Luna Pro is the first DMI-containing foliar fungicide offered by Bayer for potatoes.

The combination of two proven active ingredients, fluopyram (FRAC group 7) and prothioconazole (FRAC group 3), offers a strong defense against early blight, white mold and other key potato diseases, according to Bayer. The addition of prothioconazole provides a second mode of action with rotational flexibility and increased resistance management.

Visit www.lunapro.us.

RUSSET VARIETIES:

Russet Norkotah S3

Russet Norkotah S8

Rocky Mountain Russet

Silverton Russet

Rio Grande Russet

Canela Russet

Mesa Russet

Mercury Russet

Fortress Russet

Crimson King

COLORED VARIETIES:

Columbine Gold

Colorado Rose

Rio Colorado

Red Luna

Purple Majesty

Masquerade

Mountain Rose

Vista Gold

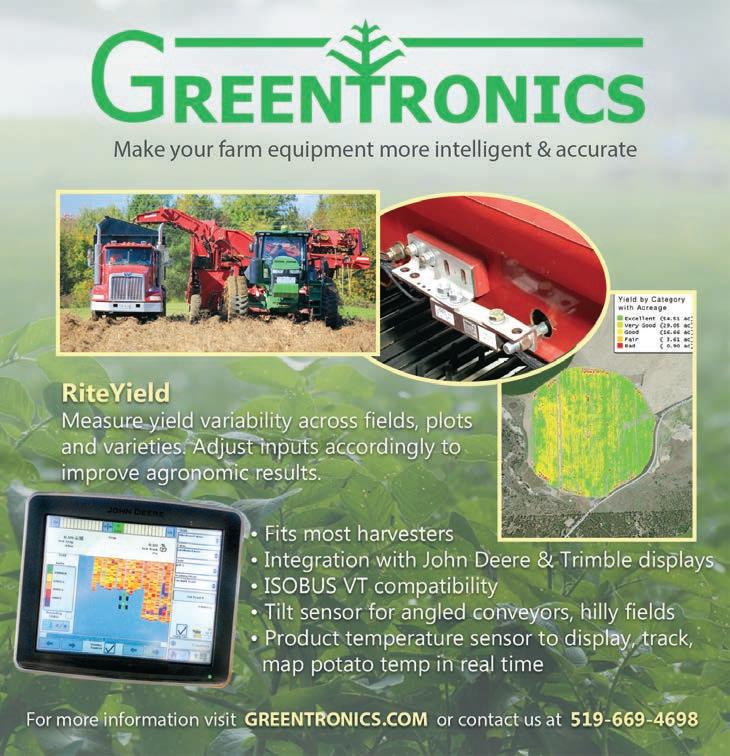

Root and vegetable crop farmers have a new yield mapping solution available for the 2023 harvest season. The Greentronics RiteYield monitor works with FieldView, a digital tool to collect, store and analyze data. Users can quickly and easily create spatial yield maps from the field directly in the FieldView Cab App. According to the company, FieldView is backed by data-driven recommendations, giving users the insights needed to make more informed decisions and maximize return.

Visit www.greentronics.com or www.fieldview.com.

Zapata Seed Company

Worley Family Farms

SLV Research Center

San Acacio Seed

Salazar Farms

Rockey Farms, LLC

Pro Seed

Price Farms Certified Seed, LLC

Palmgren Farms, LLC

Martinez Farms

La Rue Farms

H&H Farms

G&G Farms

Bothell Seed

Allied Potato

“Quality as High as our Mountains”Sample Potato Yield Map

et’s face it. The world of nutrition can be confusing, and the ongoing debate about ultra-processed foods (UPF) is no exception. Despite the lack of consensus among U.S. nutritionists about the definition of a UPF, the buzz around this topic continues. More frustrating is that even though most chips and fries do not meet the widely used definition of UPF, they are often mentioned in a story or shown in an image alongside articles about UPF. It is possible to correct this misinformation when armed with an understanding of the definition of UPF and the argument as to why chips and fries should not be the “poster child” for

While numerous definitions of UPF float around the nutrition community, the one that gets the most attention is the NOVA food classification system designed at the University of Sao Paulo, Brazil, at the Center for Epidemiological Studies in Health and Nutrition, School of Public Health. NOVA was developed in 2010 to help people “group foods according to the extent and purpose of the processing they undergo.” Food processing identified by NOVA involves physical, biological and chemical processes that occur after foods are separated from nature and before they are eaten or used in preparing dishes and meals. From those considerations, foods are grouped into four categories:

Group 1: Unprocessed or Minimally Processed

• Unprocessed or “natural” foods come directly from plants or animals and are not altered before they are eaten.

• Minimally processed foods have been cleaned, ground, dried, fermented, pasteurized or frozen.

• Examples include “natural, packaged, cut, chilled or frozen vegetables, fruits, potatoes, and other roots and tubers.”

Group 2: Oils, Fat, Salt and Sugar

(aka Processed Culinary Ingredients)

• These are food ingredients made from Group 1 “natural foods” by pressing, grinding, crushing, pulverizing or refining.

Sponsored

NOVA acknowledges that these are used in homes and restaurants to season and cook food to create varied and delicious dishes and meals.

• Examples include butter, oil and salt.

• Processed foods are manufactured by using salt, sugar, oil or other substances (Group 2) added to natural or minimally processed foods (Group 1) to preserve or make them more palatable. Most processed foods have two or three ingredients.

• Examples include canned or bottled legumes or vegetables preserved in salt (brine) or vinegar; fruits in sugar syrup; freshly made cheeses; freshly made (unpackaged) bread made of wheat flour, yeast, water and salt.

Group 4: Ultra-Processed Foods (UPF)

• Ultra-processed foods are “industrial formulations made entirely

or mostly from substances extracted from foods (oils, fats, sugar, starch and proteins), derived from food constituents (hydrogenated fats and modified starch), or synthesized in laboratories from food substrates or other organic sources (flavor enhancers, colors and several food additives used to make the product hyper-palatable). Manufacturing techniques include extrusion, molding and preprocessing by frying. Beverages may be ultraprocessed. Group 1 foods are a small proportion of, or are even absent from, ultra-processed products.”

• Examples include fatty, sweet, savory or salty packaged snacks; ice creams; carbonated soft drinks; sweetened and flavored yogurts; and chocolate milk.

Unfortunately, the NOVA system contradicts itself in more than one example. For instance, “fatty, sweet,

savory or salty packaged snacks” can be interpreted to include potato chips; however, many unflavored varieties include only three simple ingredients: potatoes, oil and salt, which meets the definition of Group 3. Moreover, potatoes (Group 1) are a significant proportion of chips and fries, which contradicts the definition of UPF. In some cases, examples of UPF like ice cream, chocolate milk and flavored yogurts also meet the definition of Group 3 as they only contain three ingredients and a significant proportion of Group 1 foods.

With this information, writers and editors who mention or use images of chips and fries in stories about UPF can be asked to correct the content. If you see misinformation or would like more information about media corrections, please get in touch with Bonnie Johnson at bonnie@potatoesusa.com.

The National Potato Council (NPC) has released a new analysis of the national economic contribution of potatoes. According to the report, “Measuring the Economic Significance of the U.S. Potato Industry,” authored by economists from Michigan State University, the potato supply chain drove $100.9 billion in U.S. economic activity in 2021. This includes $10.8 billion in agriculture production and agribusiness services; $49.1 billion in processing, wholesaling and retail; and $41 billion in food service industries and household consumption. In addition, the report estimates that the U.S. potato sector generated 714,000 domestic jobs and provided wages of $34.1 billion annually to those employed along its supply chain.

The U.S. is the world’s fifth largest producer of potatoes, with approximately 20 percent of all potatoes grown or processed in the U.S. exported to Canada, Mexico, Japan, South Korea and other trading partners. In 2021, the value of all potato-related exports (fresh, processed and dehydrated) topped $1.88 billion in sales.

For more highlights and a link to download the full report, visit www.nationalpotatocouncil.org/spudnation.

The Idaho Potato Commission (IPC) has partnered with Van Leeuwen, a New Yorkbased brand of madefrom-scratch dairy and vegan ice creams, to create a limited edition ice cream representing Idaho potato French fries and milkshakes. The launch of this new flavor comes after a national survey identified French fries and milkshakes as the most popular “unusual food combination.”

The toasty caramel-flavored ice cream features bites of French fry pieces, which were created by Van Leeuwen’s pastry team using Idaho potato flakes. Pints of Malted Milkshake & Fries ice cream are available at www. vanleeuwenicecream.com while supplies last. Van Leeuwen scoop shops in New York and Los Angeles are also serving the limited edition flavor.

Netherlands-based potato variety development company HZPC has hired Dustin Wageman as a new product manager. He will serve as HZPC’s technical liaison and collaborate directly with the company’s breeders in the Netherlands to trial and introduce new potato varieties bred specifically to help growers achieve the next level of success in the North American potato industry.

Wageman grew up on a potato farm in Idaho and has over 10 years of experience in chemical sales and business management in the Pacific Northwest.

The Idaho Potato Commission (IPC) and the American Diabetes Association (ADA) have announced a multi-year partnership, making fresh Idaho potatoes the first vegetable to participate in the ADA’s Better Choices for Life program. The purpose of the partnership is to help educate Americans on ways they can add Idaho potatoes to their meal plan and to debunk myths about potatoes and diabetes.

The Better Choices for Life program uses the ADA’s evidence-based guidelines and perspective to help consumers make informed choices about the products they purchase. Participating products prominently display the Better Choices for Life mark on their packaging, now including select 5- and 10-pound bags of Idaho potatoes.

The performance of individual organic produce categories ranged widely last year, according to the State of Organic Produce 2022, a report released by the Organic Produce Network. The 72-page report provides an overall view of organic produce retail performance in 2022, as well as specific insights into the top 20 organic produce categories.

In terms of year-over-year sales increases, potatoes came in third on the list, with a gain of 10.7 percent, edged out by onions (15.4 percent) and cucumbers (11.3 percent), while the worst performers were lettuce (−3.1 percent), celery (−2.3 percent) and bell peppers (−2.1 percent).

Total organic produce sales increased by 3 percent and volume decreased by −3.7 percent year over year. Looking at total retail sales, berries took the lead in 2022, edging out packaged salads. Bananas remained the top volume mover, with nearly 509 million pounds sold at retail in 2022.

June 6

ag world Golf classic

Canyon Lakes Golf Course

Kennewick, Wash.

www.agworldgolf.com

June 8

ag world Golf classic

The Links at Moses Pointe

Moses Lake, Wash.

www.agworldgolf.com

June 11-13

washington Potato and onion association

summer convention

Campbell’s Resort

Lake Chelan, Wash.

www.wapotatoonion.com

June 21

osU Potato Field Day

OSU HAREC, 2121 S. 1st St. Hermiston, Ore.

Lora Sharkey, (541) 567-8321

June 22

wsU Potato Field Day

WSU Othello Research Unit

Othello, Wash.

Mark Pavek, (509) 335-6861 or mjpavek@wsu.edu

June 27-29

nPc summer meeting

Hyatt Regency Lake Tahoe Resort

Incline Village, Nev.

www.nationalpotatocouncil.org

July 23-27

Potato association of america annual meeting

Delta Hotel by Marriott

Charlottetown, Prince Edward Island, Canada www.paaevents.org

Editor’s note: To have your event listed, please email Denise Keller at editor@columbiamediagroup.com. Please send your information 90 days in advance.

Heath Webber has joined Black Gold Farms as the new chief financial officer (CFO). Webber brings more than 30 years of finance experience and a history of executive experience with local potato processing plants.

Webber replaces Bob Hoffert, who retired after 30 years with Black Gold Farms. Headquartered in Grand Forks, North Dakota, with a network of farm locations throughout the U.S., Black Gold Farms is a grower, shipper and marketer of Irish potatoes, sweet potatoes and other commodities.

Maximizes plant health and provides systemic, broad-spectrum control of key diseases.

Added biological activates the plant’s natural defenses and improves stress tolerance.

Better resistance management with two active ingredients (P5 + Group 11).

AZterknot trial results consistently show enhanced root and plant growth and increased disease control. 2022. Aberdeen, ID.

AZterknot delivers long-lasting disease protection and increases crop health for maximum tuber development and ROI.

vivecrop.com/azterknot

Major exporting countries shipped a record 9.959 billion pounds of French fries and other frozen potato products to countries outside of their local trading zones during the year ending Jan. 31, 2023. That is 629 million pounds more than year-earlier shipments, a 6.7 percent increase. Limited raw-product supplies held back offshore sales growth for U.S. fryers. Despite similar challenges in the EU, offshore exports climbed 5.8 percent above the year-earlier sales volume. In addition, smaller exporters such as Canada, Turkey and China appear to be taking advantage of the situation. Their combined external frozen product sales climbed 46 percent during the year ending Jan. 31. Frozen product exports from Argentina and New Zealand were relatively stable during the period. In this article, we explore global French fry trade by major exporter as well as the trade outlook for the next 12 months.

European fryers exported a record 6.509 billion pounds of French fries and other frozen potato products to customers outside the EU during the year ending Jan. 31. Exports to external customers exceeded year-earlier sales by 356 million pounds, a 5.8 percent increase. All but three of the EU’s major external customers increased their purchases of French fries and other frozen product during the year ending

Jan. 31. The largest volume increases came in sales to the United Kingdom (+160 million pounds), the United States (+95 million pounds), Japan (+74 million pounds) and Saudi Arabia (+69 million pounds). Brazil, the fourth largest importer of EU French fries, reduced its purchases by 7 percent relative to a year earlier. Chile reduced its imports by 20.1 percent during that timeframe. EU processors captured 65.4 percent of the global market. That is down from 66 percent in 2021-22 and 65.5 percent in 2020-21.

North American fryers shipped 2.428 billion pounds of frozen potato products to offshore markets during the year ending Jan. 31. That exceeded yearearlier shipments by 72 million pounds, a 3.1 percent increase. U.S. frozen product exports increased by 1.2 percent, while Canadian offshore exports climbed 14.6 percent during the year ending Jan. 31. Nevertheless, North American offshore sales fell 86 million pounds, or 3.4 percent, short of the 2019-20 sales volume.

Japan, the largest customer, took 648 million pounds of product during the period, 21 million pounds, or 3.3 percent, more than year-earlier purchases. The largest sales decline came in Mexico, which reduced its purchases by 10.4 percent, to 543 million pounds. Exports to South Korea increased by 31 million pounds, to 213 million pounds. Sales to the Philippines and Taiwan rose 6.3 percent and 4.2 percent above yearearlier exports, respectively. Frozen product exports to the remaining 65 customers increased by 10.2 percent, relative to year-earlier levels.

Raw-product supply constraints and strong domestic demand have held back export growth this year. North American fryers captured 24.4 percent of the global market, which is down from 25.3 percent in both 2021-22 and 2020-21.

Argentina exported 488 million pounds of French fries during the year ending Jan. 31. That is 1 million pounds less than year-earlier sales, a 0.3 percent decline. Argentina’s global market share was 4.9 percent, down from 5.2 percent a year earlier. Brazil is Argentina’s main customer.

China ramped up French fry exports during the year ending Jan. 31, to 217 million pounds. That is 115 million pounds more than year-earlier sales, a 114.8 percent increase. Exports have nearly tripled during the past two years. China is becoming a major player in the global French fry export trade. China has a 2.2 percent share of the global French fry market, up from 1.1 percent a year earlier. China’s major customers include the Philippines, Japan, Thailand, Indonesia and South Korea.

Turkey also has become a major French fry exporter during the past several years. The country exported a record 196 million pounds of frozen potato products during the year ending Jan. 31. That is 85.1 million pounds more than yearearlier sales. Turkey captured 2 percent of the global French fry business during the period, up from 1.2 percent a year earlier. Turkey’s major customers include Russia, Iraq and China.

New Zealand exported 122 million pounds of French fries during the year ending Jan. 31. That is 3 million pounds more than year-earlier sales, a 2.2 percent increase. New Zealand captured 1.2 percent of the global market during 2021-22, down from 1.3 percent a year earlier. Most of New Zealand’s French fry exports go to Australia and Thailand.

On a side note, December and January trade data are not yet available for Egypt, though the country has become a major player in the frozen product export market. The country exported 193 million pounds of frozen product during the year ending Jan. 31, 2022. That is 69.7 percent more than 2020-21 exports.

will Global French Fry trade continue to Grow over the next 12 months?

Global French fry exports grew by an average of 6.9 percent per year during the 10 years preceding the pandemic (2011-2020). Sales have bounced back from 2020-21 levels, though they have not quite returned to the pre-pandemic growth path. Domestic demand also has been strong both in North America and in the European countries. That has limited the product available for offshore sales. The data suggest that expansion of global French fry demand is likely to continue; however, raw-product supply constraints have held back export growth. Rawproduct supply constraints will limit processing use until at least July. Supply conditions will likely improve after that.

Planting is underway in parts of North America and Europe. Fryers are counting on early potatoes to cover their endof-season supply gaps. Once new-crop potatoes become available, processors will ramp up production to fill their processing capacity. North American processors may be able to re-capture some of their lost market share beginning in July when the new crop becomes available.

By Ben Eborn, Publisher, North American Potato Market News

• major exporting countries shipped a record volume of French fries and other frozen potato products to countries outside their local trading zones during the year ending Jan. 31, 2023.

• raw-product supply constraints have held back offshore sales for U.s. fryers. canada’s offshore sales were the strongest since 2011.

• european fryers posted strong external sales growth during the year ending Jan. 31, despite limited rawproduct supplies. canada, turkey and china have ramped up export sales during the period.

• Domestic and export demand appears to be strong for French fries and other frozen potato products.

• north american processors may be able to re-capture some of their lost market share when the new crop becomes available.

From time to time, everyone tends to take a person or a segment of their life for granted, assuming they will always be there no matter what. The same can happen in an industry, as well. In the potato industry, I believe we have taken the seed segment for granted.

For the nearly three decades I have been fortunate enough to be a part of the potato industry, it has been stated repeatedly that seed would never be a limiting factor on planted acres. The frozen potato products markets have grown over the years, and production capacity, water availability and weather

have all impacted the volume of potato products produced. As we kick off the 2023 crop year, it now appears that for the first time, seed will, in fact, be the limiting factor.

Why is that? In simple terms, since we are planting actual tubers and not seeds, the seed potatoes we are planting

that both processors and commercial growers think will be the next big thing don’t pan out in the long run if they are not approved by major QSR chains. Once that variety is no longer the bright, shiny star, it goes by the wayside and the seed grower is left to shoulder the financial loss.

Milestone ...........................18

Montana Seed ....................21

Oro-Agri .............................32

Redox .................................19

Rietveld ..............................31

Rivers West Auctions ..........25

Skone Irrigation ..................28

SpudEquip.com ..................16

Stukenholtz ........................29

The Potato Podcast

Sponsored by Vive ..............24

Teton West .........................12

TKI ........................................3

Trinity Trailer ........................9 Verbruggen.........................11 Vive ....................................27

this year were impacted by the weather last year. The weather stress in the seed growing areas resulted in lower yields. This alone would have tightened up the supply, but the reason it is so short and we are having to plant less than desirable seed lots goes much further and started many years ago.

As processors shrank the profit margins in potato contracts so substantially in the past decade, potato growers had control over very few inputs in terms of price. In general, agricultural producers are price takers, not setters. One of the few inputs growers had a major say in was their seed potatoes. As commercial production margins shrank, potato growers pushed back on their seed growers as much as possible to help maintain their own profitability. This resulted in many seed growers having their margins drop to unprecedented levels. Some decided enough was enough and left the seed business. Others cut as many corners as possible to hang on.

Besides the lower price, seed growers are also subject to whims of the market. Since they have to grow varieties that commercial growers are going to want in future years, they have to take some risks on what varieties they grow, especially when it comes to new varieties. Unfortunately, some of the new varieties

So, shame on us as an industry for not recognizing this sooner. This year, with the assistance of the strongest open market prices for potatoes in history, the entire industry was forced to raise seed prices to levels that should have been already in place. The market correction that has occurred on potato seed should stay with us for the foreseeable future and should be a stark reminder of how important good seed is. Very few, if any, crops have been above average in yield and/or quality after starting out with questionable seed. With the number of oversized tubers and the rot and virus levels that had to be planted this year due to the short seed supply, we can only hope the situation will not bite the industry in the proverbial butt at harvest time.

Next time you are talking to your seed supplier, say thank you for riding out the downturn, and remember to keep them whole going forward as that is one of the ways this great industry will continue to grow.

"very few, if any, crops have been above average in yield and/or quality after starting out with questionable seed."