A MAN WITH A PLAN

MALTA’S FINTECH BOOM AND ITS EMERGENCIES

FTX WAS EVERYTHING THAT CRYPTO IS NOT

ISSUE 75 BUSINESS | LIFESTYLE | DESIGN THE FINANCE EDITION

Chris Meilak / 32

2023

Joshua Ellul / 26

ECONOMIC OUTLOOK

Adrian Galea / 22

Kenneth Farrugia / 08

Liquidity Management Accounts - giving you the power

Overnight

Our suite of services are geared to support our customers with their banking requirements allowing access to world markets, interest rates and foreign exchange services - a personalised service through one relationship.

Speak

T:

E: PrivateBanking@sparkasse-bank-malta.com

Sparkasse Bank Malta plc, 101 Townsquare, Ix-Xatt ta’ Qui-si-Sana, Sliema SLM3112, Malta.

Sparkasse Bank Malta plc is a public limited liability company registered in Malta with registration number C27152 and registered office at 101 Townsquare, Ix-Xatt ta’ Qui-si-Sana, Sliema SLM3112, Malta. Sparkasse Bank Malta plc is licensed by the Malta Financial Services Authority to carry out the business of banking in terms of the Banking Act (Cap. 371 of the Laws of Malta), and to provide investment services and custody and depositary services in terms of the Investment Services Act (Cap. 370 of the Laws of Malta).

to manage your liquidity.

an advisor today.

to

our

to

you in optimising

deposits for professional customers -

goal is

support

your returns.

Banking | Custody | Investments Banking Investments - a personalised service through one relationship.

Although this is the finance edition of the magazine, you will notice that the omnipresent subject of sustainability is threaded throughout the interviews and articles because it has become an ingrained topic with most business issues.

While you’re reading this magazine, the annual World Economic Forum (WEF) meeting held in Davos, Switzerland, would have taken place as heads of state and government, cabinet ministers, and business leaders gathered to discuss the most pressing issues facing the world today, under the theme “Cooperation in a fragmented world.”

This group of influential people will be discussing topics such as the cost of living crisis, the ongoing war in Ukraine, climate change and the threats that it brings, and the infiltration of technology into our everyday lives, leading to what many call the “Fourth Industrial Revolution.”

On a local scale, Vanessa Macdonald’s interview with BOV CEO Kenneth Farrugia touches upon some of these topics, with the CEO stating that the bank’s ethos revolves around innovation to help the customer while keeping ESGs at the forefront of their initiatives.

On an academic level, a lot is being done in the research areas of renewable energy, sustainability, and artificial intelligence, according to Wilfred Kenely of the Research, Innovation, and Development Trust (RIDT). But once again, the word “sustainability” marks its territory as an important part of talk and action.

Business leaders know their companies’ impact on the earth, especially those that operate at the corporation level, emitting high emissions through technology usage, operations and supply chains, and even their human resources.

Therefore, they must reduce their environmental impact and promote sustainability. As a result, we see companies transition to renewable energy sources, implement energy-efficient measures, and reduce waste overall. The longerterm solution is to develop and implement new technologies and products to help mitigate climate change.

You cannot speak about finance without talking about cryptocurrency. The rise and fall of FTX, once dubbed “one of the safest buildings in crypto”, and the decline in the cryptocurrency market cap have people speculating about the future and stability of the digital exchange.

We get the point of view of Ken Goodwin, an adjunct professor on the Economics of Digital Assets, about “the cryptocurrency rollercoaster”, a topic that was also on the Davos agenda as the crypto companies made their presence known,

although in a more subdued manner to their past appearances. Possibly due to the FTX fiasco.

On page 26, Professor Joshua Ellul also has his say about the FTX saga, pointing out that regulation and blockchain offer a solution to situations where people are lacking in the trust game. Cryptocurrencies have blended into the fintech space, slowly losing their garish influence and taking on a more sombre and serious role.

On this note, the fintech industry in Malta remains prevalent (despite the Blockchain Island flop), with the regulator seeking measures to attract fintech companies to Malta – based on solid regulatory procedures. While Adrian Galea elaborates on this point, Jordan Portelli questions whether Malta’s attractiveness is at risk. Meanwhile, industry veteran Chris Meilak focuses on Malta’s 2023 economic outlook, which mirrors the issues discussed in Davos.

With a whole host of issues plaguing 2023 from its onset, we need to take note of the impact that we create in the world and its repercussions – and do something positive about it… because sustainability is the keyword that’s going to be around for a while longer.

Wishing you all an awesome year ahead!

MONEY is hand-delivered to Malta’s businesses, including managers and directors of the country’s top bluechip companies, iGaming companies, all 5-star hotels, including their business centres, executive lounges and rooms (where allowed), all foreign embassies and Maltese embassies abroad (the UK, Rome, Brussels and Moscow). All government ministries and entities.

For information regarding promotion and advertising: [bemags.com/money-pitch] · [hello@bemags.com]

All rights reserved. Reproduction in whole or in part is strictly prohibited without written permission. Opinions expressed in Money are not necessarily those of the editor or publisher. All reasonable care is taken to ensure truth and accuracy, but the editor and publishers cannot be held responsible for errors or omissions in articles, advertising, photographs or illustrations. Unsolicited manuscripts are welcome but cannot be returned without a stamped, self-addressed envelope. The editor is not responsible for material submitted for consideration.

ISSUE 75 MONEY 04 WELCOME

Money is published by Be Communications Ltd, No. 81, Howard Street, Sliema, Malta SLM 1754 FACEBOOK-SQUARE LINKEDIN · [becommunications.com]

PRINTING Print It DESIGN BeCommunications DISTRIBUTION JD Distributors

EDITOR Anthony P. Bernard

BUSINESS ENERGY FINANCE NO INTEREST FOR THE FIRST 3 YEARS All loans are subject to normal bank lending criteria, credit approval by the Bank and a credit agreement. Further terms and conditions are available from www.bov.com. Issued by Bank of Valletta p.l.c., 58, Triq San Żakkarija, Il-Belt Valletta VLT 1130. Bank of Valletta p.l.c. is a public limited company regulated by the MFSA and is licensed to carry out the business of banking in terms of the Banking Act (Cap. 371 of the Laws of Malta). EERE Malta is co-financed by the Republic of Malta, the European Union under the European Regional Development Fund. SWITCH NOW, GO ECOO Get in touch | bov.com/businessenergy | @bovofficial

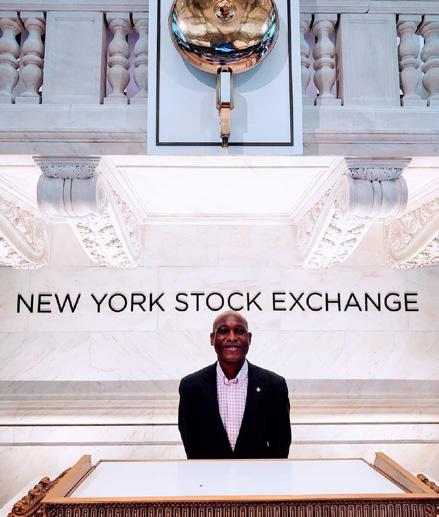

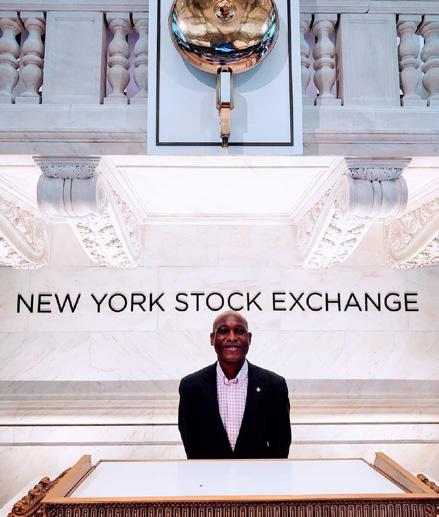

A man with a plan

Kenneth Farrugia was appointed chief executive officer of Bank of Valletta in mid-October 2022. He spoke with Vanessa Macdonald about focusing on the channels through which services are delivered to customers.

The crypto-currency rollercoaster

At the time of writing, the global cryptocurrency market cap stands at $835 billion, down from a high of $3 trillion in November 2021. Lea Hogg asks Ken Goodwin, a TEDxTALKS speaker, U.S. White House Business Council/Forward member, and an adjunct professor on the Economics of Digital Assets if it is time to get on board or head for the exit.

Malta’s 2023 economic outlook

In the history of humanity, 2022 was another average year. From our own experiences, however, it felt like quite an extraordinary year, especially at the tail end of the pandemic. So many are, inevitably, eagerly looking to turn the page and start a new year with renewed optimism and hope for better days. Chris Meilak continues.

How asking what if...? can lead to break-throughs

Companies had little appetite for funding research during the uncertainty of COVID-19, but the university’s Research, Innovation, and Development Trust sees renewed interest. CEO Wilfred Kenely discussed some of the projects currently underway with Vanessa Macdonald

Malta’s fintech boom and its emergencies

The official website of Finance Malta, the country’s primary marketing arm for luring foreign direct investment to Malta, fintech businesses have been lured to the island because of the abundance of expertise in technology and finance. Venture capital and portfolio management professional Adrian Galea elaborates.

need for a national payments (r)evolution

Payment systems are often taken for granted and underestimated. Credit cards, debit cards, online payments, mobile phone payments, contactless payments, and other new payment methods have become popular in the past few decades. Payment services underpin main streets, the wheels of industry, markets, and government operations. No other banking activity is as essential to either society or business as payments. JP Fabri continues.

The next financial frontier

Banks have long recognised that if they can grab their clients’ attention while they are young, they will most likely keep them for life. As a result, they have always been fast to capitalise on new and developing trends, and today’s hot tech potato, the metaverse, is no different. MONEY examines.

Joshua Ellul, associate professor and director of the University of Malta’s DLT centre, discusses the FTX story and the ripple effects it created.

Malta has become one of the best places in the world for foreign investors to do business. As a result, Malta has been among the top five European countries with the highest real GDP growth for the past decade. ABut as time passes, the things most important to our economic success are losing steam, so Malta’s attractiveness as a jurisdiction might soon be called into question. Jordan Portelli explains.

ISSUE 75 MONEY 06 CONTENTS

The

FTX was everything that crypto is not

Wake up! Malta’s attractiveness is at risk.

08 22 36 26 40 18 32 16 12

Are 60/40 portfolios still relevant?

The traditional 60/40 portfolio, in which 60% is invested in stocks and the remaining 40% is invested in bonds, has been the go-to strategy for many investors over the past decades. Paul Rostkowski and Daniel Galea explain.

10 lessons about running a business that I learned from running a marathon

COVID-19 was an extremely tough time for Richard Muscat Azzopardi. However, with time on his hands, he decided to run a marathon. Here is what he learned.

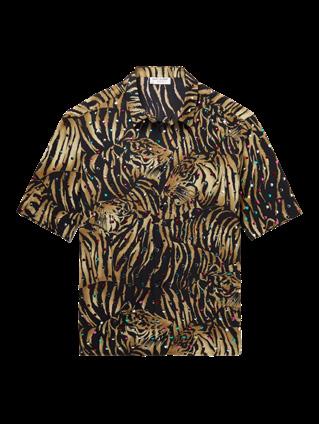

A beautiful year

MONEY spells out your new year’s resolutions in luxury and style.

42 44 54 56

There’s no business like snow business

MONEY’s pick will help you milk a powder day.

Adrian Galea is a venture capital and portfolio management professional for earlystage start-up investors. He also manages a Facebook group called Malta Startup Space that inspires start-up culture in Malta. For more information, www.clutchplayadvisors.com. FINTECH / 22

Chris Meilak is an economist and leads EY Malta’s economic advisory and sustainability services. ECONOMY / 32

JP is a founding partner at Seed, a multi-disciplinary advisory practice. FINANCE / 36

Jordan is an economist and CIO / portfolio manager for a local financial services company. ATTRACTIVENESS / 40

Joshua is an associate professor and director of the centre for DLT at the University of Malta, which runs a multidisciplinary Master’s programme in blockchain and DLT. MARKETS / 26

Lea produces and hosts a popular current affairs TV show. She provides multimedia content, analysis, forecasting and assessment reporting for a number of international corporates. CRYPTO / 18

Richard is the CEO of Switch — Digital & Brand, a marketing agency that forms part of ICOM, the world’s largest network of independent agencies. GOALS / 44

Vanessa had every intention of retiring but so far has been caught up by exciting freelance projects and voluntary work. BANKING / 08 INNOVATION / 12

MONEY THE FINANCE EDITION 07 CONTENTS

A MAN WITH A PLAN

Kenneth Farrugia was appointed chief executive officer of Bank of Valletta in mid-October 2022. He spoke with Vanessa Macdonald about focusing on the channels through which services are delivered to customers.

Over a decade ago, Bank of Valletta organised an internal workshop to discuss the future of the retail banking network. It was thoughtprovoking stuff, especially when Malta was still struggling with the large amount of cash in circulation, the high number of cheque payments, challenges concerning electronic payments in retail outlets, and the reluctance to use cards to get credit. The list was endless.

At that time, the bank was already almost 40 years old, having overcome the teething pains of puberty, and growing into a role that was already quite significant in terms of its impact on the economy.

The arrival of HSBC Malta just over a decade before had shaken it out of the complacency that comes from a status quo, and BOV had – albeit

ISSUE 75 MONEY 08

BANKING

with some grumbling – risen to the challenge. First, it introduced telebanking, which was radical at the time, and then internet banking before moving into mobile banking. And Farrugia, who joined the bank in 1985, is determined that there is still more to be done.

“Now we are taking it to the next level,” he said, stressing that digital will remain part of the bank’s strategy for the future.

The bank will be celebrating its 50th anniversary in 2024. It is getting close to the end of the last year of its current 3-year strategy, and it still plans to keep a “bold balance” in the ways it serves customers. Indeed, as had been discussed in detail at that workshop, the retail network evolved, and it was never part of the bank’s ethos to close significant numbers of branches.

That does not mean things have stayed the same. For example, BOV had just under 80 cashiers across its branch network a few years ago. It now employs 40 people.

This has meant career opportunities for these staff, who were reskilled and upskilled to do more complicated, productive, and responsible work. This may have been BOV’s plan all along, but there is no doubt that the restrictions imposed by the COVID-19 measures made people overcome their resistance to change when it came to other ways of banking. As a result, foot traffic in branches has fallen, more people have switched to direct debits, and more transactions have been shifted online.

“Three years ago, we processed 350,000 cheques in January. Last month, we processed 120,000, which means that the footfall in branches, when it comes to cashing cheques, is shifting,” Farrugia said.

“People have started getting used to paying digitally through our mobile banking app. But there is more: the ability to apply for a loan online or to block a card and refresh your PIN. Do you want to open your card for international transactions or just local ones?” he explained. The bank wants to empower its 365,000 customers by giving them various options to choose between—what Farrugia referred to as the “omnichannel environment”. This means retaining a “reasonable presence” in the community for those who prefer to go to the bank in person but building up functionality for those who prefer to do things online, with hybrid solutions for those who want a digital channel but still want assistance.

He also wants to ensure that its customers are comfortable with the extent and pace of change. So it is actively measuring transaction and promoter scores through customer satisfaction surveys. It also recently held a “customer experience week” to understand customer expectations and extend opening hours.

“The feedback was very positive,” he confirmed. Technology and behavioural changes have also affected the layout of branches. For example, fewer cashiers mean more space dedicated to areas providing privacy for customers who want to discuss complex or confidential issues.

The use of technology does not only refer to customer interactions. On the operational front, many processes can be robotised, with chairman

Gordon Cordina saying in the last annual report that the bank would “continue with our digital transformation, which will help this year focus on the revision of customer and internal processes.”

The report listed “enhanced investment processes, a new credit underwriting tool, and soon-to-be-delivered digital-based home lending and customer onboarding processes,” which are given considerable importance by Farrugia. The bank has created what it calls “digital factories”, assisted by experts, to challenge outdated processes. It is also working to improve its data quality, which will help the customer in the long run by giving faster responses or allowing digital transactions.

All this will free up resources and allow the bank to focus on the growing need for skills in risk and compliance, not to mention ESG (environmental, social, and governance) factors and sustainable finance.

BOV is taking quite a proactive stance. For example, the bank adopted the United Nations Environmental Programme Finance Initiative’s Impact Analysis Tool in 2021 to qualitatively assess whether its credit portfolio is aligned with the Paris Climate Agreement and the United Nations Sustainable Development Goals. It was also one of the 13 founding members of the Malta ESG Alliance, which was set up last July.

ESG will be a common thread across all the initiatives across the bank.

In addition, it has developed a “taxonomy”—or classification—of climate and environmental-related risks and even finalised its own internal Climate Stress Testing model.

“Banks are being pushed to provide sustainable investment opportunities. A lot needs to be done in this space, in some sectors more than others. The big operators already realise the role that ESG has to play today. Sustainability has become a matter of competitive advantage,” he said.

The company incorporated elements of sustainability into the existing BOV Sales Policy and will steer its investment recommendations towards socially and environmentally responsible decisions. For example, its investment advice or portfolio management will consider the ESG rating, aiming for companies or funds that invest in companies with “satisfactory relative ESG performance and a moderate degree of transparency in reporting material ESG data publicly”.

“ESG will be a common thread across all the initiatives across the bank,” Farrugia vowed.

MONEY THE FINANCE EDITION 09

BANKING

POWERED BY

a springboard for local tech companies

Techmag assists Tech.mt in taking the local tech industry to new heights by capitalising on its strengths and helping tech companies succeed by promoting their products and services in Malta and worldwide.

NEXT EDITION

MARCH 2023

Interested in advertising?

hello@bemags.com

In association with

READ ONLINE

HOW ASKING WHAT IF…? CAN LEAD TO BREAKTHROUGHS

Companies had little appetite for funding research during the uncertainty of COVID-19, but the university’s Research, Innovation, and Development Trust sees renewed interest. CEO Wilfred Kenely discussed some of the projects currently underway with Vanessa Macdonald.

ISSUE 75 MONEY 12

INNOVATION

Wilfred Kenely is not the type to throw around hyperbole. So when he starts to talk about one of RIDT’s latest projects with more than a bit of enthusiasm, you know this is serious.

Let’s put this in context: RIDT has already been involved with sending an experiment into space (more on that later), so this new project is worth attention for generating such a reaction.

The project went through all the agonies you would expect, with applications turned down until the RIDT got the team in the Electromagnetics Research Group in touch with Evolve. This company provided three donation tranches of €25,000 – with no strings attached. Its only condition: is that the money goes to this particular research team. It started with a “what if…?” RIDT had already helped Prof. Charles Sammut and Gordon Caruana Dingli to investigate the use of microwaves to treat breast cancer (one of several cancer-related projects). What if microwaves could be used for other things?

Years later, the result is a pinprick blood test using a hand-held device that uses microwave technology to analyse three different metrics. The €2 test would replace some 850,000 tests done at Mater Dei every year at €30 each, and the pinprick would not only replace the need for blood to be drawn but would also give the first results in minutes.

For hundreds of years, the University of Malta focussed on teaching. Still, in the past few decades, it started looking at research, partly to play a part in the development of the community and also to “provide solutions to today’s challenges so that tomorrow will be a little better”, he explained.

The trust was set up in 2011 and has financed over 60 projects. It has a dual role: filter through the various funding applications and source companies or individuals willing to donate money.

Research is carried out in various areas, from medicine and engineering to economics and information technology, from social studies to archaeology, the arts, and education.

“The medical and technological ones are perhaps more visible and more tangible. But there is also a lot being done in renewable »

MONEY THE FINANCE EDITION 13 INNOVATION

energy and sustainability and artificial intelligence,” he said.

The trust is involved in the crucial early stages of research projects: It supports the seed funds that projects require at the initial stages, without which they could not get anything moving. “You start with a proof of concept: it might work, but you must try it out. You need money to do that, which is where RIDT can help. Once you prove that the concept is feasible, you will need more money to work on the prototype, but unless you clear the first hurdle, you cannot move on to the second,” he said.

For example, the blood test project needed the original grant from Evolve. Still, the team later applied for €300,000 in Malta Council for Science and Technology funds, enough for

The proof of concept was a success, they developed a prototype through MCST funding, and FLASC is now being commercialised by a company that has spun off from the university.

Another project driven by curiosity was led by Prof. Joe Borg, whose team wondered what would happen if diabetic cells were exposed to microgravity and the harsh space environment.

“It was quite a long shot as taking cells to the International Space Station was costly and involved several entities, but Prof. Borg managed to do it, not once but twice, since the first attempt provided enough evidence to justify the continuation of the experiment and to try new things,” Kenely said.

RIDT found several local and one foreign

University research is driven by curiosity.

them to develop a prototype—an essential step towards commercialisation.

The university helps along the way, starting with due diligence on the provenance of the donated funds, which its Legal Office carries out. To enable researchers to focus on their work, the support unit assigns an officer to each project to look after administrative issues such as budgets, procurement, and reporting. And if the project is commercially viable, the Knowledge Transfer Office of the University will help them file for a patent.

Kenely ran through some examples of successful projects, stressing that even research that was not successful was necessary as results are published and shared with the global scientific community, directing efforts in new directions and away from deadends.

Thankfully, RIDT has seen some tremendous breakthroughs. Seven years ago, it provided €8,000 to a team considering ways to use compressed air to store renewable energy.

company, as well as government support, for the space project. As a result, the scientific community is now waiting for the results to be published with bated breath.

He stressed that the research outcome is not always positive; however, that does not mean it has no use. “It is difficult to be cool about negative results as they are usually not as exciting. But when it comes to research, a negative result says that an approach has been tried but did not work. That is why results are published so the broader global scientific community knows that a particular approach is not worth pursuing and they can try something else.”

What motivates companies to donate to research, especially if they have their own R&D units?

“Industry research is usually triggered by the need to solve a problem, for example, to improve a product or to develop a new one. On the other hand, University research is driven by curiosity.

“More and more companies realise that they have a role to play in corporate social responsibility and do not necessarily donate because they will benefit directly. Companies or entities can opt to be associated with a particular project, or they can leave it up to us,” he explained. For example, the Alive Foundation has raised over €500,000 over nine years for cancer research, which went to various projects and researchers, including the microwave technology that led to the blood test mentioned earlier.

“Some companies fund projects that have nothing to do with their line of work as pure philanthropy,” he added.

“And more companies realise that supporting research pays because it provides a better quality of life for the future. For example, RIDT persuaded many companies to donate serious amounts of money to preserve a mural at the Grandmasters Palace. They will get nothing back. They appreciate that investing in conservation will safeguard our heritage.”

ISSUE 75 MONEY 14 INNOVATION

The value of a dependable banking partner goes beyond the delivery of financial solutions. We strive to provide a high-quality banking experience to our customers, by building relationships and offering products and services designed to enable their business to achieve sustainable growth. Trade Finance - Corporate Banking - Real Estate Finance Factoring - Forfaiting - Treasury Services

FIMBank plc is regulated by the Malta Financial Services Authority and is listed on the Malta Stock Exchange. The Bank’s registered address is Mercury Tower, The Exchange Financial and Business Centre, Elia Zammit Street, St Julian’s STJ 3155, Malta. The Bank is licensed to undertake the business of banking in terms of the Banking Act 1994 (Cap. 371). Terms and conditions apply and are available on request. +356 2132 2100 info@fimbank.com www.fimbank.com

Your trade nance and corporate banking partner

FINANCIAL

Banks have long recognised that if they can grab their clients’ attention while they are young, they will most likely keep them for life. As a result, they have always been fast to capitalise on new and developing trends, and today’s hot tech potato, the metaverse, is no different. MONEY examines.

However, the metaverse—permanent, immersive digital worlds that may offer everything we need to live our lives digitally under one roof—opens new avenues for businesses to engage with customers. Banks, as usual, have been eager to capitalise.

Let’s examine how banks and other financial service providers are making their mark:

ISSUE 75 MONEY 16 METAVERSE

Customers from Generation Z are born and raised with technology, so shopping online for goods and services is their default option.

Virtual reception areas

In retail banks, one of the most apparent uses of the metaverse is to build “virtual branches” where they may offer banking products to a new breed of digitally native Gen Z consumers or give customer support to existing clients.

Every month, hundreds of thousands of people visit new metaverse sites such as The Sandbox and Decentraland. On the other hand, established gaming platforms with metaverse-like capabilities, such as Roblox

or Fortnite, may draw millions of users. Their customers are digital natives who want to do business with firms that understand and enjoy virtual worlds and gaming-style environments.

HSBC was among the first to establish virtual stores, having bought property in The Sandbox early this year and intending to use it to connect with online sports fans and e-sports lovers. Suresh Balaji, the company’s chief marketing officer for the Asia-Pacific region, said, “At HSBC, we see a lot of potential in developing new experiences through new platforms. This will give our current and future clients and the communities we serve a whole new world of opportunities.” Siam Commercial Bank of Thailand also operates a virtual branch on the Sandbox platform.

JP Morgan Chase is another global financial giant that has already established a presence on the Decentraland platform. For example, it set up the Onyx lounge in the Metajuku virtual mall, where people can learn about blockchain and other tech-based projects the bank is working on. It also has a tiger and a photograph of Jamie Dimon, the company’s CEO.

This tendency, however, is more recent than it appears. Second Life, which has been running since 2003 and is made by Linden Labs, is often thought of as one of the first metaverse settings. A few years later, in 2007, the Danish investment bank Saxo opened an office on the platform. It included many features that today’s metaverse bankers are working on, like the ability to use avatars to interact and talk to each other.

Bridging the divide between virtual and real economies

With metaverse spending anticipated to reach $5 trillion by 2030, it’s a huge business. Banks are already planning for their profits by transferring money and maybe other assets between the digital and physical worlds.

Metaverse platforms enable users to purchase virtual items like Nike footwear and Gucci clothing to personalise their avatars and virtual residences. Money may also be gained by playing online play-to-earn games like Axie Infinity and the Meta Cricket League. This mainly entails dealing in cryptocurrencies and other unique digital assets, such as NFTs.

This money is transferred into the real world by trading it for actual currencies, which are paid into a bank account.

Start-up Zelf, called the “bank of the metaverse,” lets users move money between virtual worlds and the real world and safely sell valuable in-game items to each other.

It’s all about appearances

Banks and financial services firms are interested in establishing a reputation as techsavvy, cutting-edge, high-tech corporations. With new technologies like artificial intelligence (AI), automation, virtual reality (VR), and the internet of things (IoT) changing so many parts of our lives, banks need to make sure they are seen as cutting-edge. One reason is to keep attracting top talent, which would otherwise go to tech giants like Google, Facebook, or Apple in search of the most exciting and profitable jobs.

There has been a lot written and said about businesses’ lack of skills when trying to use the most powerful and potentially gamechanging technology. Making sure they have a strong presence in the metaverse, banks, and financial institutions helps to ensure that they are seen as top destinations for the best and brightest graduates and job seekers—the people who hold the keys to breakthrough innovations.

What is the future of banking?

So, is metaverse banking another fad that will fade when customers lose interest? With real bank branches disappearing at an unprecedented rate, financial organisations may look to the metaverse and virtual worlds to preserve client connections and offer basic banking services.

It’s also clear that virtual economies and the exchange of virtual goods and services are on the rise. For example, when today’s younger generation of customers matures, they want to bank and seek financial advice where they feel at ease. Virtual environments will offer them a familiar platform to do so.

It is still unknown precisely what the metaverse is, let alone what it will look like in five or ten years. However, the banking and financial industries believe it will be an essential part of our lives and want to be a part of it.

MONEY THE FINANCE EDITION 17 METAVERSE

At the time of writing, the global cryptocurrency market cap stands at $835 billion, down from a high of $3 trillion in November 2021. Lea Hogg asks Ken Goodwin, a TEDxTALKS speaker, U.S. White House Business Council/Forward member, and an adjunct professor on the Economics of

Ken attributes part of the decline in value to moving money out of crypto to gold and cash as investors weigh in on the global macroeconomic impact of high inflation. “Bitcoin has traditionally experienced a 4-year cycle - it has a downward pressure in pricing despite fewer bitcoins being minted. This usually occurs from December until the 1st week of January. Additionally, Ethereum had a merge, resulting in more centralisation, causing a greater pullback,” Ken explains.

Bitcoin started taking losses in Q4 2021 and continued to weaken, rocked by the economy’s headwinds, rising inflation and interest rates, lack of investor confidence and the war in Ukraine. Will the recent collapse of industry giant FTX make its fall even steeper and have a knock-on effect on other crypto exchanges? »

MONEY THE FINANCE EDITION 19 CRYPTO

Digital Assets if it is time to get on board or head for the exit.

Simply put, the price of a bitcoin depends on the general sentiment at a point in time.

FTX, the world’s second-largest exchange, filed for bankruptcy after its finances were revealed to be unstable, and founder Sam Bankman-Fried is now in custody. US regulators accuse him of building “a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto”.

Preceding the FTX scandal was the collapse in May 2022 of two digital coins that caused $400bn to be wiped from the value of the crypto ecosystem. Hacking has also exploited crypto company vulnerabilities, with the Ronin Network losing $600m alone. Scammers are believed to be responsible for over $10m in losses daily, and Spanish bank Santander reports its customers lose $1.2m monthly in crypto fraud.

Regulation and lack of it have also influenced cryptocurrency volatility. For example, in 2021, China made all cryptocurrency transactions illegal, stating that cryptocurrency “seriously endangers the safety of people’s assets”. The same year the FCA banned the sale of complex derivatives that speculate on cryptocurrency movements, and in July 2022, President Putin banned paying for domestic goods and services with cryptocurrency.

Regulators are concerned. What started in 2009 as a forum for a few anti-establishment believers quickly grew with promoters helping Bitcoin become recognised and sought after. In May 2021, three state-backed organisations announced there would be no consumer protection if they lost any money from crypto trading. The following month, banks and payment platforms were told to stop facilitating transactions while bans were issued on crypto “mining.”

Ken argues that crypto will survive, suggesting that “major traditional exchanges will migrate to being custodians and the exchanges that are registered such as Coinbase and Paxos have distinguished advantages. So I would not be surprised to see NYSE, NASDAQ and other major exchanges start to trade registered Cryptos.”

Bitcoin still holds the top position with a market cap of $321bn at the end of 2022. Despite the fall in value, bitcoin’s previous performance might give some investors confidence in a full recovery. For example,

in 2013, one bitcoin was worth $112. At its peak in November 2021, its value had risen to $69,000. But by May 2022, it was worth less than half of that and now hovers around the $17,000 mark. So, if you bought early, you are likely still ahead. However, if you bought near the 2021 high, your losses could be as much as 70%. That said, Ruffer, the UK investment management firm, added bitcoin to its portfolios and sold five months later with a $1.1bn profit.

When examining the way institutions select crypto, Ken notes that “institutions are choosing crypto with utility use cases while allowing others to fail. They are using stablecoin investments more as these are better use cases to participate in the blockchain network. In addition, large financial institutions are exploring tokenisation across asset classes as an option and a way to provide more liquidity to assigned underline assets (i.e. Blackrock, Fidelity, State Street).”

ISSUE 75 MONEY 20 CRYPTO

Crypto is valued by supply/ demand economics and influenced by social events, thus making it a volatile asset class.

Celebrity promotion of cryptocurrencies and reports of people making millions attracted individual investors. According to the UK Government, one in ten British adults own a crypto asset, and the Pew Research Center reports that 16% of Americans have invested in, traded, or used cryptocurrency.

Fundamentally, bitcoin and other cryptocurrencies are digital assets used like regular currency. But there, the similarity ends. The coins do not exist physically but use blockchain technology to send data in cyberspace using the peer-to-peer payment to cut out bank fees. Surprisingly, many individual investors need help understanding what they are investing in but are afraid of missing out.

Bitcoins have a finite issue limit of 21 million coins that can be mined. Therefore, their value is based on speculation, making them volatile. Simply put, the price of a bitcoin depends on the general sentiment at a point in time. Commenting on the price of cryptocurrencies, the investment manager at Sparrows Capital, Mark Northway, said, “any intrinsic value does not underpin it. It is determined by one thing: confidence”.

Analysts advise that it’s best to consider cryptocurrency as a long-term investment rather than a short-term bet. Extreme volatility and substantial risk make cryptocurrency investment not for the fainthearted. Those who take the plunge should do so wisely, never investing more than they can afford to lose.

Speculation determines coin value, whereas a company’s share price moves in line with actual or anticipated performance. But are there safer ways to invest in cryptocurrency, Hargreaves Lansdown, one of the UK’s largest share trading platforms, believes so. You can buy shares in bitcoin-related companies, invest in cryptocurrency exchanges, buy shares in companies accepting Bitcoin, or invest in a bitcoin exchange-traded fund ETF which allows you to buy into the fund without buying bitcoin. Some investment companies are also launching bitcoin funds, making it easier to sell off an investment. Other funds offer some exposure to Bitcoin as well as shares and bonds.

Irrespective of bankruptcy lawyers describing the FTX failure as “one of the most abrupt and difficult collapses in the history of

corporate America”, companies like Visa, PayPal and Mastercard are adopting Bitcoin. In addition, there is speculation that Amazon is considering accepting bitcoin as payment, and rumours continue to circulate that Apple may invest in the coin.

Dubbed as ‘britcoin,’ the Bank of England is looking at its own central bank-backed digital currency, and the Federal Reserve is on the same track. In addition, in 2020, the world’s largest asset manager, BlackRock, offered two funds to invest in bitcoin futures; the same year, S&P Dow Jones announced it would add 550 of the top traded cryptocurrencies to its indices.

The involvement of large institutional investors will likely help calm the crypto asset market. While some banks remain cautious, most major UK banks now let you move money between a regulated crypto exchange and your bank account.

Prof Omid Malekan of Columbia Business School says crypto remains primarily a technology, and in that regard, he says, “It is doing just fine, in some ways better than ever.” For example, the technology improves lives in developing countries with no reliable financial infrastructure. It is also being used by charities to get funds into territories where traditional banking is made impossible due to conflict or repression. He also argues that the latest scandals are “a chance to purge the scammers and grifters” out of crypto.

In Ken’s view, “one must distinguish between crypto and blockchain technology. Blockchain technology has improved somewhat due to better use cases and DeFi applications. Both traditional and non-traditional blockchainbased firms are finding ways to apply the technology and create better solutions. In regards to crypto being the legal tender in certain countries, it remains to be seen whether this would substantially impact both central bank and household balance sheets and help central banks need to manage their foreign reserves with other nations. On the other hand, stablecoins are a separate issue and could sustain a long-term positive impact on society”.

Carol Alexander, professor of finance and leader of the Quantitative FinTech (QFIN) research group, believes “Crypto is just a

concise word for the future of the digital global economy” and cites the use of crypto technology in building metaverse environments which some think will be the future of work and life.

Ken concurs, describing crypto as “just a tool for the world to move towards a digitally transformed society whereby a global digital ID policy will be used to implement a global CBDC to track, monitor and record the actions of global citizens”.

So can cryptocurrency be a wise long-term investment? According to banks, hedge and pension funds, the answer is positive, with more of them investing in cryptocurrency than ever before. However, a BBC article published in December 2022 argued that crypto relies on having a strong and diverse pool of exchanges to survive. Without a credible and trusted place to exchange safely, the BBC report that crypto is unlikely to return to the highs of Nov 2021. Proceed with caution is Ken’s sage advice, “Crypto is a volatile asset class without any insurance or collateral, and as such, one could lose everything. Individuals should always do due diligence and research when investing in crypto. Crypto is valued by supply/demand economics and influenced by social events, thus making it a volatile asset class. Stablecoins are backed by currencies and commodities and offer some stability in pricing. Tokenising tangible assets will create a better price discovery for tokenised assets that could be more efficient.”

Is crypto a safe investment for the long term?

Ken says, “I would not invest in Bitcoin as part of a child’s education investment account. I would create a separate investment account for other purposes”.

About

Ken Goodwin is the Managing Partner of Jeanensis Ventures, a digital venture capital advisory firm targeting seed to Series A digital transformation firms within Blockchain Applications, FinTech, AgriTech, RegTech, EduTech, AI and Web 3.0. He is also the Blockchain/Digital Assets Contributor to FinTech TV on the floor of NYSE. Aspen Institute Nakasone and Mike and Maureen Mansfield Fellow, PhD Project Member, Ronald E. McNair Scholar and Harvard Model Congress Member.

MONEY THE FINANCE EDITION 21 CRYPTO

MALTA’S FINTECH BOOM and its emergencies

The official website of Finance Malta, the country’s primary marketing arm for luring foreign direct investment to Malta, fintech businesses have been lured to the island because of the abundance of expertise in technology and finance. Venture capital and portfolio management professional Adrian Galea elaborates.

ISSUE 75 MONEY 22 FINTECH

The local labour pool is deep enough to meet the needs of ICT employers across the range of technical and creative skills. At the same time, specialist knowledge can easily be sourced from overseas due to an incentive programme for foreign workers. Companies are also using Malta as a springboard to nearby markets, particularly those in Africa, which is increasingly becoming a testing ground for new financial technologies. Some of the key strengths of the cluster are the banking and payment providers, AML/ KYC compliance platforms, risk and asset management platforms, insurtech platforms, digital identity management platforms, and more.

Malta seeks to be a pioneer in regulating emerging technologies, with an interest in capturing a regulatory first-mover advantage and creating a cluster of economic activity. The model is employed with great success in the iGaming industry, with further successes in the captive insurance and securitisation markets, to name a few. Was the “Blockchain Island” strategy a success? It appears that the best response depends on who you ask. While some believe, the strategy failed to flatter, Malta does include prominent players in the fintech community, such as FalconX. Additionally, Malta has seen the emergence and growth of a couple of fintech start-up stories, Finaro, a Malta-based payment company, was acquired for over €500 million by a leading US firm, and embedded finance start-up Weavr, born here in Malta, recently raised $40 million to expand its global operations.

Through the enactment of the Virtual Financial Assets Act, regulatory innovation has expanded to distributed ledger technologies and cryptocurrencies. Whether Malta’s legislatures can keep up with the ebb and flow of the market and keep in tune with new ideas and technologies as they emerge is yet to be seen. To do this, the regulators of all financial services in Malta, the Malta Digital Innovation Authority and the Malta Financial Services Authority, have been given a clear fintech strategy. The authority is committed to creating the right conditions for fintech start-ups and scale-ups, tech firms, and traditional

financial services firms to create fintech products that have the power and potential to define the next generation of finance. The MFSA has set up a Fintech Regulatory Sandbox, which gives companies providing financial services with a safe place to try out new products and services. The main goal of the regulation is to bring law and order to a market that has been primarily unregulated up until now. This will protect consumers and keep the market honest. AI and IoT technologies are next on the country’s agenda. Globally and locally, most fintech companies are already using AI, and according to Finance Malta, the technology is expected to dominate the market by 2025.

So how is the emergent class of Malta’s start-up ecosystem dealing with the current fintech landscape in Malta? And what strategies do they intend to implement to scale to internationally relevant markets?

Andaria is a fintech start-up that aims to make business banking more accessible and usable. Its CEO, Nirav Patel, shared with us his belief that its product offering will help shake up the traditional notion that business banking needs to be expensive and requires prior industry knowledge. “We want to create a mentality shift in how businesses look at their payments flow, as not simply a means of collecting funds, but as part of their whole offering.”

Nirav is an accomplished and high-achieving payment and banking executive who continues to challenge the status quo by diving into nascent industries and accelerating companies through technology and innovation to achieve growth and profitability. Nirav was named CEO of Andaria Financial Services Limited in November 2020. Since then, »

MONEY THE FINANCE EDITION 23 FINTECH

Nirav Patel

he has overseen the company’s strategic vision and goals to become a leader in embedded finance. Andaria wants its “embedded finance” service to support big and small businesses in improving their customers’ experiences with payment services that add value.

What major paradigm shifts in the market, technology, or regulatory pillars affecting the fintech industry have affected start-up opportunities?

Shifts are happening across the board, and it is tough to pinpoint which one affects the fintech industry the most. From geopolitical unrest in various parts of the world to rising living costs, from Open Banking adoption by the traditional banking community to developments in the crypto space from both a regulatory and economic standpoint (the recent FTX saga speaks volumes in this

regard), the fintech industry is now so synonymous with all of the above that opportunities abound. Moreover, the start-ups in this space can help alleviate parts of or even, at times, find solutions to problems that, at first glance, seem too tough to crack.

It is encouraging for us to see start-ups in the fintech space taking all shapes and forms and tackling a wide range of issues across the globe. Companies like Revolut and N26 in Europe provide full digital consumer banking. Klarna and Zilch have actively pursued consumer lending, while C2FO and Wayflyer have focused on business lending. Other companies, like Comply Advantage, a partner of Andaria, have focused on specific issues like fraud prevention. There are also companies like Andaria that are taking financial technology one step further by allowing it to be seamlessly integrated into the client’s ecosystem.

We tackle issues that B2B businesses have faced for a very long time:

» Disjointed customer experiences when it comes to payments.

» Heavy dependency on human resources regarding

reconciliation, treasury, and accounting.

» Overall cost reductions when moving funds both locally and cross-borders.

Start-up opportunities in the fintech space are plenty, with the regulatory environment improving to make such businesses more scalable and secure for their clients.

What are the primary strategic comparative advantages that your start-up is attempting to capitalise on? How does Malta enable such strategies to develop?

Malta is an excellent testing ground for fintech companies. A sound regulatory regime, strengthened by a regulator that is an enabler for such companies to develop, a plethora of businesses that are increasingly conscious of the customer experience their customers are getting, as well as a stable economy that helps predict the financial needs of clients, give Malta and start-ups within the ecosystem a definite advantage vis-à-vis other jurisdictions. While the fintech space on the island is still relatively new, which means access to trained resources can be limited at times,

ISSUE 75 MONEY 24 FINTECH

Every company, in the not-so-distant future, will become a fintech company.

the otherwise favourable economic conditions make a strong case for Malta to be considered a clear choice for fintech start-ups to thrive.

Have you used any regulatory tools that Malta offers, like the regulatory sandbox or the MDIA?

While we have not used such tools, we are in discussions with the MFSA to learn how we can benefit from and, more importantly, contribute to such tools, not only for Andaria’s growth but also for the overall growth of the Malta Fintech start-up community. Engaging with such tools and bringing together the fintech community on the island will only help more fintech start-ups flourish in the space.

What are the main headwinds and threats facing your business? What resources do you have at your disposal to solve them?

The challenges are always plentiful as a start-up, and ours are no different from any other start-up’s. We need to utilise our funds most appropriately, recruit in a very fast-paced and competitive environment, keep abreast of the constant technological developments, and at the same time, remain true to our mission. We believe our resources lie mainly with our people, in the belief that we share a common vision for

where we want to be, both from a technology perspective and in terms of what we want to deliver to our clients, as well as what our brand stands for now and in the years to come.

What is the vision for your start-up within the next five years?

Andaria will become a leader in the B2B embedded payments space. We want to be a household name for any company that wants to enter the industry but is unsure how or what it will gain from doing so. True to our mission, we want to take this global while expanding the local business.

When “fintech” emerged as a term, it was initially applied to the technology employed at the back-end systems of established financial institutions. In the early 2010s, “software was eating the world,” and the financial industry was no exception to the rule. Since then, however, there has been a shift toward more consumer-oriented services and, therefore, a more consumer-oriented definition, as illustrated by Andaria, a Malta-based start-up tackling the challenges of this emergent field in finance. Fintech includes sectors and industries such as education, retail banking, fundraising and nonprofits, and investment

management. To borrow a phrase from Nirav, “every company, in the not-so-distant future, will become a fintech company.” As technology becomes more seamless in our daily operations, the lines between finance and retail will blur.

Malta’s mission is to establish the right conditions for fintech start-ups. If it is successful, start-up companies like Andaria may grow up to employ a highly skilled workforce and develop the common and shared know-how with the local ecosystem that will empower our communities and help us answer the challenges that the economies and technologies of tomorrow have in store for us.

MONEY THE FINANCE EDITION 25 FINTECH

FTX WAS EVERYTHING THAT CRYPTO IS NOT

Joshua Ellul, associate professor and director of the University of Malta’s DLT centre, discusses the FTX story and the ripple effects it created.

ISSUE 75 MONEY 26 MARKETS

First off, let’s clarify what FTX is. FTX and similar centrally-run exchanges provide the following services:

1. They allow users to buy different cryptocurrencies in exchange for debit/ credit card or bank transactions.

2. They allow for the trading, buying, and selling of cryptocurrencies and different forms of investments, speculation, or betting on whether the market price of a cryptocurrency will go up or down.

3. They allow users to withdraw their funds, which could take place by withdrawing crypto directly to a user’s cryptocurrency wallet (which is in no way connected to the exchange) or fiat currency (e.g. USD or EUR) to their debit or credit card or their bank.

There used to be similar ways to buy gold, silver, and other commodities, as well as stocks, shares, and other assets.

When you buy cryptocurrency, stocks, gold, or any other asset at one of these exchanges, you trust that the exchange has already purchased or has control of the asset and has set it aside for you in their system. So, that you can claim your assets whenever you want, you can request that your investment be withdrawn or sent to you.

If such services ensure that users’ requests for withdrawals are processed, everything will seem fine. However, once such a service provider does not have in its custody enough funds to cover the assets they are managing or is unable to process withdrawals for other reasons, users may begin to worry that the service provider is insolvent, i.e., the service provider is claiming to have more funds or assets than they are managing for their users. For example, imagine that you and I are the only users of a particular exchange, and I have €50 worth of cryptocurrency in the exchange, and you have €100 worth. Yet, in reality, the exchange only owns €25 worth of cryptocurrency, meaning they would have spent our clients’ money elsewhere. Because of this problem, clients could lose their money due to carelessness, lousy management, fraud, etc.

For the problem described above, whether the above service provider is a cryptocurrency exchange, a gold or commodities exchange, or any other stock or investment exchange is

not the issue. The issue is that we trusted a company to buy and hold certain assets for us, and they have yet to do so. When it comes to traditional financial assets, there is usually a regulatory framework and a regulator to ensure that companies treat their clients’ money well and don’t lose or mismanage it. Yet, it is essential to note that as a client, user, or citizen, we trust that such regulatory frameworks and regulators do their jobs (to the best of their abilities), yet this is not a 100% guarantee that it will stop such bad actors. However, if a good regulatory framework was in place and a regulator was doing its job, this would reduce risk in such jurisdictions for such cases, but it is not a panacea.

Also, there are good and bad regulators, and without getting into the details of the FTX case, media reports say it was regulated in a particular jurisdiction or jurisdictions. Indeed, this raises many questions. For example, where were their operations regulated? Did the regulator do their job? In addition, the process involved several affiliated companies operating in different jurisdictions; was there a particular jurisdiction that made it easier for this to happen?

Now, crypto-naysayers blame cryptocurrencies for this, but as discussed above, this has nothing to do with cryptocurrencies but with bad centralised actors. Blaming cryptocurrencies would be like blaming money for the various Ponzi schemes and scams we’ve seen over the past decades in the traditional finance world (e.g., Madoff’s Ponzi scheme). Scams, fraud, and illegal activities have been around for a long time and will continue to do so. They are drawn to new areas that are growing and attracting investment. Also, because there needs to be more regulation, it’s easier for them to do business since (i) regulators may not be able to step in and (ii) consumers may need to be told about better operators and jurisdictions. In fact, this is why Malta and other jurisdictions put in place regulatory frameworks for precisely these types of service providers. When you think about it, this is not a huge step in innovation when it comes to regulation. We’ve been regulating securities, commodities, and other types of assets similarly for decades.

Cryptocurrencies provide a solution to the problem described above, i.e., the problem of »

MONEY THE FINANCE EDITION 27 MARKETS

having to trust centralised actors and allowing them to cheat. Cryptocurrencies can be thought of as digital “money” (we’ll leave out the exact definition of “money” for the sake of making our point). But the digital “money” system can’t be changed or manipulated in a way that goes against the rules written into it. Being built on blockchain, which is one type of Distributed Ledger Technology (DLT), they provide a transparent means of keeping track of who owns what in a manner that guarantees that the rules encoded into the system cannot be broken (not even by the cryptocurrency system creators themselves). Decentralised exchanges (DEXs) can then be built on DLT to support the same types of exchange services provided by FTX (and others) without requiring an exchange service provider. If there is no exchange service provider, they cannot run away with clients’ investments. A pillar of the cryptocurrency sector is decentralisation: the ability for digital systems (owned by no one) to automate and provide digital services in a tamper-proof manner. The public should learn from this mess that cryptocurrencies and blockchain (DLT) offer a way out of situations where certain companies, entities, or people can’t be trusted.

Yet, the sector is still nascent, the technology is still developing, and regulators are still trying to figure out how to protect society, the market, and consumers while wrapping their heads around new types of decentralised entities. So people should be careful when investing their money, even though technology can change society.

When it comes to speculating about the price of particular cryptocurrencies, there is the general cryptocurrency market trend and individual cryptocurrency fluctuations based on the specifics of the cryptocurrency or token. The crypto market trend tends to affect

the price of all cryptocurrencies. E.g., if the price of bitcoin increases or decreases, all others follow; if an exchange like FTX crashes, the perception is that something went wrong in the whole crypto market because the entire market is still seen as a single whole. Over time, individual actors (cryptos or tokens) will have less of an effect on how the whole market is seen, just like in other markets. E.g., if a particular stock fails, it may not necessarily bring all stocks down (unless the other stocks were somehow linked to it, of course). Again, regulation will also help in this regard. Many say that the crypto market is too volatile, and indeed, it is the most volatile. Yet like any market, the speculative price that the market is willing to pay for an asset can be swayed quickly and by significant amounts. A single tweet about a company, a new CEO, the firing of staff, or whatever can cause the instant value of the market to drop or increase. We’ve seen this over the past months in the tech sector. It is just the way markets work. Over time, with regulation, the crypto market will become less volatile, like other markets.

Now, in the aftermath of what began with FTX, we are seeing ripple effects that have rendered other exchanges insolvent. In the 2008 financial crisis, something similar happened to Lehman Brothers. Because of the extent of other entities’ exposure to it, they were brought down with it, which resulted in a ripple effect. However, this should not be interpreted as having anything to do with technology or cryptocurrencies in general—instead, it has to do with the “unregulated cryptocurrency market” as a whole.

The main takeaways:

1. This is similar to a centrally managed investment platform. The differences are in the levels of regulatory requirements that were applied.

2. This has nothing to do with decentralisation, blockchain, or, for that matter, cryptocurrencies. It would be like blaming the general concept of stocks when an investment platform becomes insolvent. Cryptocurrencies and decentralised technology provide a solution to such situations.

3. This is why regulation was implemented, highlighting the need to regulate such centrally controlled platforms.

4. Speculation is speculation, irrespective of the market (though regulation helps).

ISSUE 75 MONEY 28 MARKETS

So people should be careful when investing their money...

Your Technology Solutions Partner go.com.mt/business With GO Business, your team can make a success of every opportunity. Find out more about our solutions at

WE DO NOT PROVIDE JOBS, WE OFFER CAREERS!

Lyndsey Grima talks to Martin Spiteri, operations manager at M Recruitment, about equal opportunities and bringing the right talent on board.

Operating successfully for the past ten years, M Recruitment is responsible for two types of recruitment: direct and outsourcing. With the former, clients approach them as a recruiting company to look for suitable candidates for the job. With outsourcing, M Recruitment employs staff on a full-time basis, which they then outsource to clients, also on a full-time basis.

“Outsourcing is a big part of our business,” says Martin. “It’s

most common in the hospitality, catering, care, and retail industries. We ensure that our staff is limited to a few hundred, not more, so it is manageable, and we can assist and support clients the same way as if the employees were on our premises.”

Like other agencies, M Recruitment attracts several third-country nationals, mainly from Dubai, Abu Dhabi, and Qatar, to name a few. The difference with this agency is that it works hard

to find the right people for the right jobs.

Martin explains that all candidates go through an online interview process. “Once we see that the candidate in question fits in with what our various clients want, then we give a job offer. We use several criteria to select a candidate that is right for that job role. We also invite the client to do an online interview with the candidate. If the interview goes well, we inform the candidate

that they have been chosen. The individual then begins a process in which we apply for their work permit. Once this is approved, the person applies for a visa, usually hands in their resignation from the job that they are working at, and then begins travelling to Malta.”

The process does not stop there. The staff at M Recruitment also guides candidates on where to look for accommodation to make it more convenient for them

ISSUE 75 MONEY 30 PROMO

to settle in. They also send all chosen employees a relocation checklist to make their journey as smooth as possible. Once they arrive on the island, individuals are given a full orientation session at the agency’s office to finalise the remaining details.

“As opposed to many stories we’re hearing, M Recruitment does not charge anyone any money for finding a job through our agency,” claims Martin. “It is illegal to do so. Our service to candidates is free, both through direct recruitment and outsourcing. The clients pay our fees. The same goes for the subcontracted work—we do not charge any fees. In addition, any third-country nationals we bring to the island are not charged any money for this service. We charge a minimal processing fee to settle their work permit and visa.”

Martin explains how there have been countless sad stories of people coming from countries like Dubai who have been charged up to €5,000 by companies to get a job on the island.

“This is white slavery, and it is

completely unfair. These people are coming here for a better future and starting immediately on the wrong foot. We completely CONDEMN this sort of abuse. We bring over people based on the right attributes and personalities, irrespective of race, ethnicity, and gender.”

Martin also highlights the fact that this brings about another obstacle. If an individual can afford to pay €5,000 to come to Malta for work, you are simply bringing in people who can afford it and not basing the individual on talent. “We are faced with employees who do not possess the characteristics that the industry needs. The industry is flooded with inexperienced people simply because they can afford the fees. “M Recruitment hires people based on their talent, experience, knowledge, and capabilities.”

Being an ethical employer, M Recruitment does its best to find the right talent for the local market. “We hear a lot of complaints, from locals,

especially on social media, that we are seeing fewer and fewer locals and Europeans working, especially in the catering industry. People don’t realise, though, that Maltese and Europeans are losing interest in the industry for various reasons. Unfortunately, the wages being paid in the industry are not competitive when compared to other markets in Europe, but it is not the case that the industry wants cheap labour. The margins are minimal, and with the current salary structure on the island, restaurants and hotels cannot afford to go above that structure, meaning that they cannot attract good European talent.”

M Recruitment does its best to find the best talent to serve its clients. “Most of the people we get have experience in the fourand five-star hotel industry or upmarket restaurants and cafes. They have already been exposed to a Western culture, which makes it much easier for them to integrate and be happy here. Our main aim is to help people find a career in Malta, not just a job, so that they can be happy here.”

M Recruitment aims to prioritise its employees’ mental and physical health. “We care for all our staff equally, and we have made wellness our priority this year regarding our office staff. A weekly gym session is being organised in collaboration with

I&J Fitness Team Gym and Team Sport to allow the whole team to train together, making a healthier lifestyle accessible for everyone. In addition, for all our outsourced staff, we give them a birthday card and a voucher to dine at one of our clients’ establishments, thus supporting our clients further.”

M Recruitment ‘s role as an agency continues even after the contract expires. Martin explains that when the staff contracts are close to ending, the agency either speaks to the client to see if they are happy with the candidate and will ask for a salary increase for them, or they see if the client would like to take them on directly as their employees, which generally means a promotion and career growth for the employee.

“We are proud to say that when we walk into our clients’ establishments today, their supervisors, managers, sous chefs, and head chefs are people we brought in in junior positions. We help them build their careers here. These little things might not seem significant, but they can change people’s lives. We are not here to offer people a job for a year. On average, 70% of our staff each year works with our clients directly. We give them careers that give them pride, and we take pride in that. It’s one of our biggest achievements.”

MONEY THE FINANCE EDITION 31 PROMO

M Recruitment hires people based on their talent, experience, knowledge, and capabilities.

A weekly gym session with I&J Fitness Team Gym and Team Sport for team training.

MALTA’S 2023

ECONOMIC OUTLOOK

ISSUE 75 MONEY 32 ECONOMY

In the history of humanity, 2022 was another average year: conflict between neighbouring countries, obstacles to trade, natural occurrences worldwide causing fatalities and damage, and government intervention needed to manage economic conditions. From our own experiences, however, it felt like quite an extraordinary year (including a World Cup in December), especially at the tail end of the pandemic. So many are, inevitably, eagerly looking to turn the page and start a new year with renewed optimism and hope for better days. Chris Meilak continues.

MONEY THE FINANCE EDITION 33 ECONOMY

However, 2023 will also pose several economic challenges—here is a list of four.

The big divide

Inequality is increasing at all levels and in all directions—income inequality, the digital divide, health, culture, opportunities, and other aspects of life. This is because economic growth has come at the expense of economic development, and redistribution systems are not working well. According to the United Nations, “inequality in its various forms is an issue that will define our time.” While income inequality between countries has declined in the last 25 years (meaning average incomes in developing countries are increasing faster), income inequality within countries (and societies) has risen—this is the form of inequality people feel daily. The UN says that 71% of the world’s population lives in countries

processes and outcomes. Several factors, such as economic and financial crises, natural

understand its effects and gain their buy-in, assessing the organisation’s readiness for change and the human impact, educating leaders on how to manage and monitor the transition effectively, monitoring the progress of individuals as they go through the different stages of the transition; and helping individuals understand how they can positively contribute to the change and the importance of their role in the organisation. By taking these steps, organisations can effectively manage the transition and ensure a smooth and successful outcome.

Grappling with inflation

Inflation will likely be one of the most important things affecting the world economy in the coming year. Higher inflation can have several impacts on businesses and the economy.

where inequality has grown. These include many developed and middle-income countries.

In 2023, we are likely to see increased efforts by international institutions and governments to promote inclusive, equitable, and sustainable growth to ensure a balance among the economic, social, and environmental dimensions of sustainable development, ensuring that “no one is left behind.” But because inequality comes in many forms and is very different from one country to the next, a one-size-fits-all approach is not a good idea.

Managing the transition

Aside from the damage it did to people’s health, the pandemic caused economic chaos and uncertainty, but it did not slow down the pace of change. While our societies, firms, and economies are constantly evolving, the last few years have brought about a call to transform and transition to better

disasters, and political upheaval, have caused this need for change. In addition, technological advances and better ways to connect and communicate have sped up the pace of change.

To many, this transition can have a different meaning – whether it’s embracing technological upgrades, restructuring towards more efficient or social models, adapting to climate change, prioritising environmental protection and the better use of resources (natural, artificial, human), embedding circular economy principles, shifting to a long-term focus to drive long-term value and long-term planning and looking beyond GDP…

Organisations must apply robust transition management processes to manage such transitions successfully. These include proper communication within the organisation about the need for change, gathering input from those impacted by the transition to

One potential impact of inflation is increased costs for businesses. As prices rise, companies may face higher expenses for raw materials, labour, and other inputs, affecting their profitability and competitiveness. To mitigate this impact, businesses may need to adjust their pricing strategies, find ways to reduce costs or explore new revenue streams.

Inflation can also make it harder for people to buy things, which lowers the demand for goods and services. This can impact businesses by reducing sales and revenue. To stop this from happening, companies might have to change their products or services to better meet customers’ needs and budgets.

Central banks have also responded to higher inflation by raising interest rates to stabilise prices. However, this can impact borrowing costs and economic activity, potentially slowing growth. As a result, businesses may need to consider the potential impacts of

ISSUE 75 MONEY 34 ECONOMY

It is not the strongest that survive, but the ones most responsive to change.

higher interest rates on their financing and investment decisions.

Overall, keeping an eye on how inflation affects the economy and businesses in the coming year will be essential. Companies can set themselves up for success in an uncertain world by carefully watching and reacting to economic changes.

Changing geopolitics

In the EY CEO Survey 2022, CEOs said that geopolitical tensions were the biggest threat to their plans for future growth. Since economic growth is slowing, inflation is rising, and geopolitical tensions are still high, the pressure will only worsen in 2023. To help CEOs revise their strategies for turbulent times, EY teams analysed geopolitical conditions to identify the four most likely globalisation scenarios [1]. Though these relate to global policy environments for international business, the Maltese economy’s openness and EU membership imply that the following could be relevant.

1. Self-reliance reigns – fraying alliances create a volatile geopolitical environment; economic and security rationales are conflated; nationalism and populism are ascendents, and many national leaders turn away from partnerships. Isolationist policies disrupt trade, creating a subdued growth outlook—nationalist policies, including trade barriers and price controls, further fuel inflation. Protectionism—and the lack of global coordination of climate change—makes cross-border supply chains costlier and more complex.

2. Cold War II –the hardening of alliances and ideological competition created a world order defined by two distinct blocs—one comprised of the U.S. and its allies, the other led by China. There is also a third bloc of largely non-aligned countries. Geopolitical tensions are high. The division of the global economy into blocs constrains private sector innovation and growth opportunities. Companies adjust their trade and supply chain relationships to operate within their home country’s bloc, leading to increased costs.

3. Friends first – a novel geostrategic environment, where complex alliances

and affinity groupings characterise geopolitics, sometimes institutionalised by trade and investment agreements. Governments prioritise strategic supply chains within their partnerships, but there are few restrictions on cross-border trade. Companies shift toward “friendshoring” critical operations and supplies. Technological hubs support productivity growth within regional hubs, but trade barriers limit gains.

4. Globalisation lite –Low levels of geopolitical friction create a more stable and predictable global operating environment. Ideological blocs fade in significance as trade-driven partnerships become more important. International relations and problem-solving for global issues such as climate change have

become more multilateral. More robust globalisation reduces trade barriers and revives technological progress, lowering inflation. Liberalisation raises investment and productivity growth and improves living standards.

All four of the scenarios above—and, of course, many others—are plausible within five years. So, businesses must build flexibility into their operations and strategies to be ready for any situation. CEOs should assess which strategic actions would create the most agility and robustness across all four scenarios. They should then prioritise and implement those actions immediately.

As Charles Darwin once said, “It is not the strongest that survive, but the ones most responsive to change.”

MONEY THE FINANCE EDITION 35 ECONOMY

THE NEED FOR A NATIONAL PAYMENTS (R)EVOLUTION