Trends in pump sealing technology

Carbon capture and storage: pumping carbon underground

What’s in store for the industry in 2021?

ISSUE 34 SUMMER 2021

pumpindustry

Global Water Solutions is the world’s premier manufacturer of high-quality pressure tanks for water well, pressure boosting and irrigation applications. For more than twenty years we have supplied the Australian market with industry-leading maintenance-free diaphragm tanks, and our products can be found in a wide variety of installations ranging from vineyards to mining sites to high-end residential and commercial properties nationwide.

Global Water Solutions pressure tanks are recognised as a critical component for extending pump lifetime, reducing energy usage and operating costs, and optimising overall system performance.

Global Water Solutions also o ers a wide range of filter housings, filters and other water treatment products.

info@globalwatersolutions.com | sales@southernpumping.com.au

www.globalwatersolutions.com | www.southernpumping.com.au

ACS Approved Find Out More About Our Anti-Legionella Technology

Our heavy-duty Power Generators have been designed specifically to suit our region’s unique environment.

They feature the trademark DEUTZ world-class quality, performance and reliability, and our renowned fuel efficiency will ensure the best possible overall cost.

The canopy is made of galvanised sheet metal and can withstand exposure to the elements. Best of all, our units feature an environmentally friendly fuel tank retention basin.

Discover more – visit www.deutz.com.au/gensets or contact your local Dealer.

Stay powered with DEUTZ DEUTZ Australia | www.deutz.com.au | deutzoz@deutz.com The engine company.

President’s welcome

Hello all and welcome to the Summer Edition of Pump Industry Magazine. On November 17, PIA held its first ever virtual AGM for which there were 45 registrations representing over 30 organisations. Our thanks to Monkey Media and Laura Harvey for hosting the meeting where we farewelled Louise Black, Mike Bauer and Hem Prakash; I take this opportunity to thank them for their contributions to PIA.

Pump Industry Australia Incorporated

C/-340, Stuarts Point Road Yarrahapinni NSW 2441 Australia Ph/Fax: (02) 6569 0160 pumpsaustralia@bigpond.com www.pumps.org.au

PIA Executive Council 2020

John Inkster – President Brown Brothers Engineers

James Blannin – Vice President Stevco Pumps & Seals

Kevin Wilson – Treasurer/Secretary Executive Officer

Alan Rowan – Councillor Executive Officer – Publications and Training, Life Member

Ken Kugler Executive Officer – Standards, Life Member

Geoff Harvey – Councillor Irrigation Australia Limited

Anant Yuvarajah – Councillor ASC Water Tanks

Joel Neideck – Councillor TDA Pumps

Matt Arnett – Councillor Ebara Pumps Australia

Michael Woolley – Councillor Tsurumi Australia

Steve Bosner – Councillor Pioneer Pumps

Billie Tan – Councillor Regent Pumps

At the same time, we welcomed Matt Arnett from Ebara Pumps, Michael Woolley from Tsurumi Australia and Billie Tan from Regent Pumps to Council. I also welcome back James Blannin as Vice President, Geoff Harvey, Joel Neideck, Steve Bosnar and Anant Yuvarajah who were all re-elected. Our Standards Officer Ken Kugler was also re-elected as was Alan Rowan as Publications & Training Officer. Kevin Wilson was reelected as Secretary.

A highlight of the AGM was the address by guest speaker Kylie Kinsella, Managing Director of Regent Pumps, whose topic was ‘Women in the Pump Industry’. Kylie said she had been in or around the pump industry for the last 15 years involved in a sales or management capacity, with her first leadership role being in 2009. Her presentation was very insightful in what is a maledominated industry. I trust her address may encourage other women to join our industry and for those women within the industry to aspire to management roles.

Well what can we say about the year that was; it’s behind us now, the borders reopened for Christmas, which meant I could join my family in Melbourne, and there is a promise of a vaccine coming soon – the best news of all. I for one will be lining up for the jab, having never had a flu jab.

Despite being a COVID year and the challenges that presented, I believe we achieved some milestones, including a revamped website, release of the 5th Edition Pipe Friction Handbook, a Flow Technology virtual seminar, and our own first ever Pumps & Systems Training Course, as well as keeping you all informed about our status as an essential industry once the declaration of the Coronavirus as a global pandemic was announced.

I would like to touch on the Pumps & Systems Training Course held in June, which was very successful. For the first time, PIA is offering Australian pump professionals a four-day nationally recognised competencybased training course. The course provides one Cert III competency and two Cert IV competencies. The content of the course is centred around pump theory, selecting pumps and understanding hydraulics. The June course was held virtually. Upon completion participants are presented a “Statement of Attainment” for the three competencies. Your Council would like to run two or three of these courses in 2021 and I ask that you all give consideration to supporting and sending staff to them; they will be easier to run this year as hopefully the borders will remain open enabling the one-day practical to be completed in person.

A pleasing aspect for the year was the continued growth in membership from 73 in 2017/18 to 86 in 2018/19 to 98 in 2019/20, so thanks to those who worked very hard to achieve this – we should see our membership grow to over 100 this year. With increased membership we are better positioned to hold Breakfast and Technical Meetings, enabling companies to showcase their products and capabilities, and at the same time enable PIA to expand its role as a value-adding resource to members and providing a forum for the exchange of industry information, promotion and education.

Once again I put a hand out to the larger organisations to participate fully in PIA activities as this gives more legitimacy to the organisation which strives to be the peak body of the pump industry; we need everyone's support.

I am sure you, like me, look forward to a better year in 2021, not that COVID-19 will be gone, but we are all learning how to live with it. Finally, I would like to thank all the Executive for their efforts in 2020 and extend a warm welcome to the new Councillors plus special thanks to our Executive Officers and to Kevin Wilson our Secretary.

I wish you all a prosperous 2021.

John Inkster President

2 pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au PUMP INDUSTRY

Premium Couplings from Global Leaders

CMD Winex

Winex DG Grid Couplings

Bore capacity 360mm

Torque range 52Nm > 186,000Nm

Chrome

Replaceable tooth rings from size DG15(1150T10)

Winex T & S Series Grid Couplings

Bore capacity up to 390mm

High torque range 90Nm > 800,000Nm

Chrome vanadium, heat treated & shot peened grids

Replaceable Tooth Rings T series from size 28 and the complete range in S Series

+61 (0) 3 9796 4800 Melbourne Perth info@drivesystems com au 8/32 Melverton Dve, Hallam, VIC 3803 drivesystems.com.au TECHNICAL EXCELLENCE & INDUSTRY EXPERIENCE

Rexnord

vanadium, heat treated & shot peened grids

+61 (0) 455 320 552 2/64 Baile Rd, Canning Vale, WA 6155

ABN: 36 426 734 954

204/23–25 Gipps St

Collingwood VIC 3066

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au info@monkeymedia.com.au pumpindustry.com.au magazine@pumpindustry.com.au

Editor: Lauren Cella

Assistant Editor: Eliza Booth

Journalist: Imogen Hartmann

Marketing Assistant: Stephanie Di Paola

Business Development Manager: Rima Munafo

Design Manager: Alejandro Molano

Designers: Jacqueline Buckmaster, Danielle Harris

Publisher: Chris Bland

Managing Editor: Laura Harvey

ISSN: 2201-0270

PIA

PIA MEMBER

CONTENTS This magazine is published by Monkey Media in cooperation with the Pump Industry Australia Inc. (PIA). The views contained herein are not necessarily the views of either the publisher or the PIA. Neither the publisher nor the PIA takes responsibility for any claims made by advertisers. All communication should be directed to the publisher. The publisher welcomes contributions to the magazine. All contributions must comply with the publisher’s editorial policy which follows. By providing content to the publisher, you authorise the publisher to reproduce that content either in its original form, or edited, or combined with other content in any of its publications and in any format at the publisher's discretion. NEWS Grundfos sales restructure cuts 600 jobs worldwide 6 Contractor named for Southern Downs water infrastructure condition assessment ........................................................ 8 Bunbury to benefit from new $11.9 million water recycling scheme 10 Weir Group receives offer on Oil & Gas division 12 Seqwater undertakes $11 million waterworks package 14 3D printing a miniature magnetic pump .................................................. 15 State-of-the-art pump supplies Yorke Peninsula ................................... 16

PIA AGM: overcoming the challenges and looking positively towards 2021 18

NEWS

NEWS New range of EN733 pumps: world-leading performance 20 Deep water pumping to 300 metres ........................................................ 22 System flexibility 25 Franklin Electric: the story so far 26 WOMA – Australasia’s leading high-pressure water supplier ................. 27 Moving s#!t: the advantages of the new FX range from DAB 28

a pumping capacity of more than 100L/s. ISSUE 34 SUMMER 2021 pumpindustry What’s in store for the industry in 2021? Carbon capture and storage: pumping carbon underground Trends in pump sealing technology Published by Monkey Media Enterprises

Cover image shows the new booster pump station at Kainton Corner in SA. The pump station houses three pumps, each with

5 www.pumpindustry.com.au pump industry | Summer 2021 | Issue 34 pumpindustry INDUSTRY NEWS EASYWELL: maximum reliability in extreme environments at a competitive price 30 Merger a disruptive force in the fluid sealing market .. 32 Volvo Penta: the right power for high pressure 34 The layflat solution to your temporary and emergency water transport problems ................. 36 STATE OF THE INDUSTRY State of the Industry 2021: finding opportunities in an uncertain time 38 WASTEWATER Modern and innovative: upgrading the 80 year old Dungog Wastewater Treatment Plant ..................... 50 Taking a Brisbane sewage pump station underground ..................................................... 54 Condition monitoring for submersible wastewater pumps with Smartobserver ..................... 56 VALVES Style and size considerations when selecting a control valve 58 POWER GENERATION Carbon capture and storage: the re-emergence of a critical technology 60 RECYCLING Vacuum pressure at the centre of Australia’s first automated waste collection system 64 TECHNICAL Trends in pump sealing technology 66 Successful project management (Part 1) 70 Regulars : President’s welcome 2

an expert: The role of PCPs in the wastewater industry and how they can aid in resource saving. 72 Pump school: What is a peristaltic pump and what are the benefits? 74 Editorial schedule .......................................................... 76 Advertisers’ index ......................................................... 76

Ask

GRUNDFOS SALES RESTRUCTURE

CUTS 600 JOBS WORLDWIDE

Global water technology company Grundfos underwent a reorganisation of its sales, marketing, technology and operations functions in late 2020, which involved cutting 600 jobs worldwide.

The change was designed to create a more customer centric structure, where the whole value chain is focused on meeting customers’ unique needs by focusing on four different customer segments: Water Utility, Commercial Building Services, Domestic Building Services, and Industry.

It came in response to trends in changing customer needs by reorganising for simplicity and speed, and by investing significantly into innovation and digital capabilities.

Even though the COVID-19 pandemic had a significant impact on markets globally in the first half of 2020, Grundfos said it made these changes from a position of strength.

Jens Moberg, Chairman of the Holding Board of Directors, said, “Our strong performance allows us to make these changes from a position of strength.

“Now is the right time for us to make the changes to put our strategy into action.”

The transformation resulted in a reduction of approximately 600 employees worldwide, but Grundfos said the employees would be treated with the utmost respect and provide them with support.

“It will be very sad to see some of our colleagues leave us at this pivotal time, and I would like to thank everyone for their hard work and loyalty,” Mr Moberg said.

“We will make sure to care for them as they have cared for us and our customers during their time with Grundfos.

“I am proud of the company we are today, built by Grundfos people on the firm foundations of the Poul Due Jensen family.

“Since the birth of the business back in 1945 we have changed many times to ensure our success.

“Now is no different, we are taking these important moves to proactively put our strategy into action and better fulfil our purpose.”

Layne Bowler vertical turbine and submersible pumps have a proven record under the most demanding and toughest of conditions.

VERTICAL TURBINE PUMPS

• Flows to 7,500 L/Sec

• Heads to 500 m

• Power to 1000+ kW

• Temperatures to 150°C

• Bowls Diameter up to 45 inch

Applications

• Irrigation

• Water supply

• Process water

• Geothermal

• Cooling towers

• Fire protection

• Marine

• Water treatment

• Dewatering

SUBMERSIBLE PUMPS

• Flows to 140 L/Sec

• Heads to 200 m

• Power to 110 kW

• Bowls Diameter in sizes 6”, 7”, 8” and 10”

Applications

• Irrigation

• Deep well water supply

• Inline booster

• Service water

• Dewatering

Brown Brothers Engineers have innovative solutions whatever your application. Contact us today about your requirements.

NEWS pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 6

DELIVERING PUMPING SOLUTIONS Ph: 1300 4 BBENG www.brownbros.com.au 11/20

CONTRACTOR NAMED FOR SOUTHERN DOWNS WATER INFRASTRUCTURE CONDITION ASSESSMENT

The Southern Downs Regional Council in Queensland has awarded a contract for the condition assessment of critical water and sewerage infrastructure, including pump stations.

Council-owned reservoirs, tanks and sewerage pump stations have been identified as the next priority due to the critical role they play in providing water and sewerage services to the community.

The condition assessment will be performed by external contractor Hunter H2O with funding received from the Queensland Government Local Government Grants and Subsidies Program.

Councillor Stephen Tancred said Council had a multipronged approach to securing the region’s future water supply.

“As part of our Water Contingency Plan, we are exploring short, medium and long-term strategies for our current and future water supply,” Mr Tancred said.

“The condition assessment of these critical water assets will provide vital information for Council to better maintain infrastructure and replace or upgrade where necessary.

“This will facilitate long-term financial planning for water operations throughout the region and enable Council to make informed decisions with confidence.

“Despite some recent rains, our region has not fully exited this current drought, and it’s important we prepare for the next drought.

“Council continues to investigate all avenues to secure a sustainable water supply for the region.”

The condition assessment will test 25 reservoirs and tanks, and 34 sewage pumps across the region. The contractor will also make a number of recommendations and develop a tenyear capital works program and routine maintenance schedule.

Council will prioritise replacements and upgrades as appropriate and according to budget constraints.

“It’s important to keep our critical infrastructure running and in good shape,” Mr Tancred said.

The assessment is expected to be completed by the end of April 2021.

A contract for the condition assessment of Council’s water and sewerage treatment plants was awarded in November 2019 under the same funding stream.

KELAIR - FIRE PUMPS

Containerised Fire Protection Pumpsets

Kelair Pumps Building & Fire Division is one of the most technically-competent suppliers in Australia. We can provide a complete range of fire sprinkler pumpsets for all applications, fully compliant to technical specificiations.

Benefits of containerised fire pump units:

- Purpose built to individual requirements

- Compact, pre-fabricated, complete packaged solution

- Simple to mobilise and transport

- Fully tested to AS2941/ISO9906 and pre-commissioned

- Wall insulation keeps operational noise to a minimum

- Turnkey installation saves time and labour costs

We know the importance of choosing the right equipment to match your process. With our extensive range of pumps, first class customer service and ongoing comprehensive support, Kelair Pumps are second to none when it comes to your pumping requirements.

NEWS pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 8 WHEN PUMP KNOWLEDGE MATTERS Rely on Kelair Find out more today 1300 789 466 www.kelairpumps.com.au

11/20

Hygienic Pumps & Mixers.

At Inoxpa, our focus is on ensuring the quality and suitability of our products (mixing skids, CIP skids, product recovery systems, pasteurizers, manifolds, process automation, pumps, agitators, blenders, mixers, valves and fittings) for each industry.

Stainless steel, sanitary centrifugal, rotary lobe and progressive cavity pumps, hygenic agitators and mixers for:

Dairy

Food and beverage

Chemical

Cosmetic

Pharmaceutical

Experience. Innovation. Quality. Reliability.

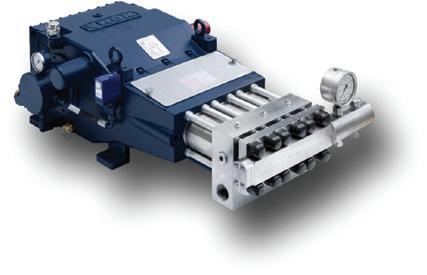

At Hammelmann Australia, our primary focus is on delivering customer-specific solutions for pumping high pressure liquids and gases in diverse applications and industries:

Offshore platforms

HPUs

FPSOs

Mining and minerals

Chemical Petrochemical

Ship cleaning

Construction

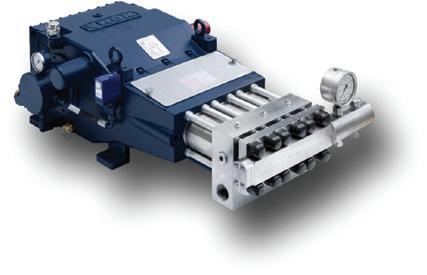

Our positive displacement high pressure process pumps are used for a variety of industrial uses:

Chemical injection

Sea water reinjection

Flowline services

Dosing

BUNBURY TO BENEFIT FROM NEW $11.9 MILLION WATER RECYCLING SCHEME

Bunbury is set to benefit from the construction of a new $11.9 million water recycling facility and pipeline alongside the Bunbury Wastewater Treatment Plant in Dalyellup, to supply water for use on major infrastructure projects and irrigation of public open spaces.

Climate change has particularly impacted the South West region of Western Australia, resulting in reduced rainfall, streamflow and recharge into its groundwater resources.

The use of treated recycled water to meet Bunbury’s nonpotable water requirements for infrastructure projects and irrigation will alleviate the need to use high-quality potable water from the Yarragadee Aquifer, while reducing the amount of treated wastewater discharged out to sea.

The project will support local jobs by contracting local companies during construction.

The project is an initiative led by Aqwest, which will build and operate the new facility, and source water for the scheme from Water Corporation’s Bunbury Wastewater Treatment Plant.

This facility will join around 80 other water recycling schemes in operation in Western Australia providing climate resilient, fit-for-purpose water to communities and industry.

Water Minister, Dave Kelly, said that the new water recycling

facility will help address water supply issues and improve livability for the Bunbury community.

“This initiative helps to address the impact climate change is having on our water supplies by ensuring the sustainability of the Yarragadee Aquifer and the future supply of potable water to homes in Bunbury,” Mr Kelly said.

“The fit-for-purpose, recycled water generated will provide a much needed water resource for industry and irrigation, and deliver far reaching benefits to the City of Bunbury community by greening the environment and improving liveability.”

Bunbury MLA, Don Punch, said that the project will help meet the needs of the community while supporting and creating local job opportunities.

“Already our local water supply is constrained, with a number of local parks going without reticulation so a project that will recycle water, protect our environment and allow for the watering of public open space to improve our suburbs is a fantastic outcome for our community,” Mr Punch said.

“This project shows we have the capacity to be innovative and develop new and sustainable ways of meeting the ongoing needs of our community, all while supporting jobs for local people.”

INCREASED

Smart Conveying Technology (SCT) provides quick maintenance, significantly reduced life cycle costs and the shortest downtime. SEEPEX pumps with SCT are successfully used in virtually all industries and applications.

y Increased energy savings due to very low energy consumption

y Adjustable stator segments extend stator life by up to 200%

y Retensioning of stator restores pump efficiency

y Reduced maintenance time by up to 85%

y Reliable and durable technology for long-life operation

y Easy retrofit onto your existing SEEPEX pumps

NEWS pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 10

EFFICIENCY SMART CONVEYING TECHNOLOGY

SEEPEX Australia Pty. Ltd. T +61 2 43554500 info.au@seepex.com www.seepex.com

Reducing material cost through waterjet technology

BUILDING AND CONSTRUCTION PARTS

STRUCTURAL COMPONENTS DECORATIVE FACADES

Waterjet technology

Waterjet cutting is a process of precision cutting that utilises high pressure water.

We can process a wide array of materials. Heavy gauge plate, thin sheet stock and composite materials (i.e. carbon fibre, phenolics etc.). It is not uncommon for 6+ inch aluminium and titanium to be cut on waterjets to near final shapes. Edge quality of the parts can vary depending on customer requirements.

We can process anything from a very rough cut for hog-outs, to a very fine edge for precision, finished parts:

Cut up to 6 m x 3 m (20 ft x 10 ft)

Thickness up to 254 mm (10 in)

Improved yield and less waste material

Supplied close to net shape reducing customer machine time

Shorter lead times

Zero heat effected zone

Processing of customer supplied materials

Contac t th yssenk ru pp Mater ials Austr ali a Pt y Lt d Unit 2, 7−10 Denoci Cl os e We th erill Pa rk , NS W 2164, Austr ali a T: +61 2 9757 7777 F: +61 2 9757 7700 sales.tk mater ials.au@ th yssenk ru pp.c om www.t hyssen kr up p- mater ials -a us tr alia.co m Materials Services

Weir Group receives offer on Oil & Gas division

The Weir Group has entered into an agreement to sell its entire Oil & Gas division for an all-cash US$405 million to Caterpillar Inc.

This follows the announcement in February 2020 that Weir would seek to maximise value from its Oil & Gas division as it continued its strategic transformation into a premium mining technology pure play.

Delivering transformation of Weir into a premium mining technology pure play

• Focused on attractive markets underpinned by global demographic trends, the transition to a low carbon society and adoption of new technologies in the mining industry

• Differentiated aftermarket, service and technology offering with proven earnings stability and strong cash generation through the cycle

• Strategic intent to build on leading mission-critical positions in the mining supply chain from extraction to concentration and tailings management

• Strengthened balance sheet to provide enhanced flexibility to invest in future growth opportunities

Transaction highlights: a strong outcome for all stakeholders

• Agreement to sell Oil & Gas division to Caterpillar Inc. for an Enterprise Value of US$405 million (£314 million)

• Net proceeds to reduce the group’s leverage; pro forma Net Debt/ EBITDA at 30 June 2020 of 1.9x

• Transaction facilitates a $70 million US cash tax benefit for Weir to be realised over the medium term

• Transaction subject to Weir shareholder approval; Class 1 Circular to be published in due course

• Completion expected by the end of 2020, assuming normal regulatory clearances

Jon Stanton, Weir Group Chief Executive Officer, said, “We are pleased to have reached this agreement that delivers a great home for the Oil & Gas division and maximises value for our stakeholders.

“Alongside the previous sale of the Flow Control division and the acquisition of ESCO, it is a major milestone in transforming the group into a focused, premium mining technology business.

“It means Weir is ideally positioned to benefit from long-term structural

demographic trends and climate change actions which will increase demand for essential metals that must also be produced more sustainably and efficiently.

“This will require the innovative engineering and close customer partnerships that define Weir, and it is why we are so excited about the future.”

Joe Creed, Vice President of Caterpillar’s Oil & Gas and Marine division, said, “Combining Weir Oil & Gas’ established pressure pumping and pressure control portfolio with Cat’s engines and transmissions enables us to create additional value for customers.

“This acquisition will expand our offerings to one of the broadest product lines in the well service industry.”

As a Class 1 Transaction, the sale is conditional upon the approval of Weir shareholders with a Circular to be posted in due course, including a timetable for a General Meeting.

The Oil & Gas division will now be classified as held for sale and will be reported in discontinued operations.

NEWS pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 12

Locked on Protection.

For more than 35 years, Rexnord Tollok® products have led the industry in Locking Assemblies. Our robust product offering features a wide range of options from simple and compact designs to advanced features such as corrosion resistant coatings, special bolting options, and high-speed applications to help companies maximise operable time. Our full range of locking assemblies can be tailored to fit our customers’ ever-changing application needs, and are ideal for use in heavy-duty and specially engineered environments. We offer a broad range of reliable, cost effective internal locking assemblies, shrink discs and rigid couplings to fit a diverse array of industrial applications that are dimensionally interchangeable with most of today’s industry standard units.

Additionally, Rexnord Tollok Locking Assemblies are a great alternative to a shaft/ hub connection such as key, splined, press fit, QD or taper-lock bushings. Customers benefit from reduced maintenance costs and plant downtime and are rewarded with increased productivity and plant efficiencies.

• Quick Installation time

• Equipment protection

• Increased life of system components

• Up to 3,389,550Nm capacity

Contact Rexnord today to see which coupling is right for your application. sales.australia@rexnord.com or Tel 02 4677 6000 © Rexnord Corporation. All Rights Reserved. www.rexnord.com

Seqwater is undertaking an $11 million waterworks package, which is set to deliver up to 50 per cent more drinking water for suburbs north of Brisbane and the Sunshine Coast, and support up to 30 jobs during construction.

Queensland Natural Resources Minister, Dr Anthony Lynham, said the two-year program of works by Seqwater includes upgrades to two reservoirs, two pump stations and new pressurereducing valves.

“Queensland has an economic plan for recovery and that includes building more water infrastructure,” Dr Lynham said.

“We’re starting to deliver on that plan, with a $50 billion infrastructure guarantee to support communities and jobs across Queensland.

“This investment will increase capacity in the northern section of the

Seqwater undertakes $11 million waterworks package

SEQ Water Grid, help meet demand, and support continued growth and jobs.

“Investing in this section of the SEQ Water Grid will benefit Moreton Bay and Sunshine Coast, allowing more drinking water to be transported in times of peak demand and help to reduce pressure on our Sunshine Coast dams.”

The works include:

• Major bypass pipework at Sparkes Hill Reservoir

• Upgraded pumps at Lloyd Street Pump Station in Enoggera

• Upgraded infrastructure at Kitchener Road, Stafford Heights

• A new water quality facility at Aspley Member for Aspley, Bart Mellish, said the new water quality facility at Aspley Reservoir will boost water disinfection for his electorate.

“Clean and safe drinking water is important for all Queenslanders and this

upgrade will ensure more than 177,000 residents in Aspley and the northern regions continue to have that,” Mr Mellish said.

The works will also allow Seqwater to move up to 125 million litres of water a day – the equivalent of 50 Olympicsized swimming pools – north from the Mt Crosby Water Treatment Plant to suburbs north of Brisbane and the Sunshine Coast.

That will be an increase of more than 50 per cent compared to the current capacity of 80 million litres per day.

Seqwater Chief Executive Officer, Neil Brennan, said the package was one of the largest upgrades to the SEQ Water Grid in the past two years.

“It is critical we continue to invest in the network which provides our region with one of the most secure water supplies in Australia,” Mr Brennan said.

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 14 NEWS

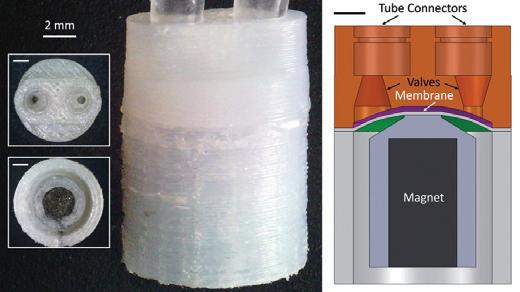

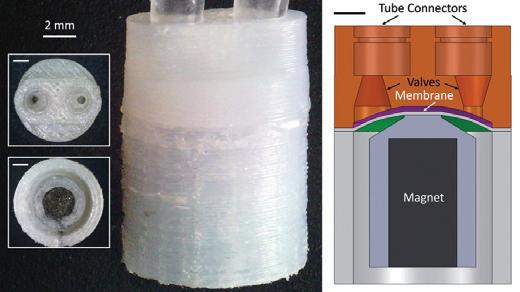

3D PRINTING A MINIATURE MAGNETIC PUMP

Anew miniature pump – compact, valveless and operated magnetically – demonstrates the broad capabilities of devices manufactured by 3D printing.

Measuring only 1cm in volume, the pump was fabricated in 75 minutes in a single process using multiple materials that cost less than $3.89 per unit. It can move both liquids and gases using less power and experiencing less clogging than standard manufactured pumps of its size. One of the pump designs is the first demonstration of a magnetic, multimaterial pump 3D printed monolithically – all in one piece.

Luis Fernando Velásquez-García, principal research scientist at MIT’s Microsystems Technology Laboratories (MTL), led the team that built the pump. He said the efficient and portable pump could be used in applications “from fuel cells to power generation to heat exchangers” that cool computer chips.

Additive manufacturing offers a way to craft miniaturised devices that contain multiple materials with new capabilities, and that are designed on demand for more personalised applications, he suggested.

Mr Velásquez-García said he hopes that the proof-of-principle pump will inspire others to look more closely at the potential of layer-by-layer, computeraided additive manufacturing, compared to the “cleanroom” mass-production style set by the semiconductor industry.

pumps, for instance, which need to be physically coupled to an outside source of pressurised fluid.

Fourteen million cycles later, the new pumps showed no signs of leaking, and their performance surpassed that of state-of-the-art 3D-printed miniature liquid pumps and compared well with miniature commercial vacuum pumps, the researchers concluded.

“Not about copy-and-pasting”

Although the pump wasn’t designed with any specific applications in mind, Mr Velásquez-García said the device demonstrates the opportunities available through monolithic, multi-material 3D printing.

While researchers have been trying to emulate that industry’s successes to develop new miniature devices, “you come to the conclusion that, in some cases, the manufacturing methods cannot be the same, the materials cannot be the same, and the specific embodiments of the solutions are very different”, he said.

Mr Velásquez-García, along with MTL postdoc Javier Izquierdo Reyes, sponsored by the Monterrey Tec-MIT Nanotechnology program, and Anthony Taylor at Edwards Vacuum, describe the new pump in the August 27 issue of the Journal of Physics D: Applied Physics.

Portable and powerful

The pumps, each slightly less than the diameter of a dime, are shaped as small cylinders crowned by a membrane. On top of the membrane is the fluid chamber, with two valveless ports at the top to attach tubes. The researchers printed the pump in two ways, using Nylon 12 as the structural material in both. In the first pump, a magnet is press-fitted into the structure of the enclosing piston. With the second monolithic pump, the researchers used Nylon 12 embedded with neodymium magnet (NdFeB) microparticles to create the pump’s magnetic core.

Mr Velásquez-García said Nylon 12 is an excellent structural material that can easily absorb large amounts of the magnetic particles, and is sturdy enough to hold still the NdFeB microparticles during the initial magnetisation, which makes possible to create strong permanent magnets.

“In a softer material, the particles would wobble, resulting in no net magnetisation of the magnetic composite.”

The pump is driven by an outside rotating magnet, which interacts with the internal magnet to move the piston and deform the membrane, propelling the liquid or gas from one port to the other. The piston is only constrained by the membrane, so it can move in multiple ways at the same time when activated by the external magnet. Since it is magnetically driven, the new device is more portable than pneumatic

For instance, the researchers were able to increase the new pump’s stroke capacity beyond that of a pump classically manufactured in silicon by altering printing methods to make a more deformable membrane while keeping a more rigid piston body – all using the same Nylon 12 material.

“It’s not about copy-and-pasting what people have done before, it’s really exploiting the advantages of printing,” said Mr Velásquez-García. “I think there is a real opportunity to make a difference if we revisit problems that we couldn’t quite solve before and now we can because of this umbrella of additive manufacturing.”

Albert Folch, a professor of bioengineering at the University of Washington who was not involved in the MIT study, said the new magnetic pump “is a very clever implementation of the principle that ‘complexity is free’ in digital and additive manufacturing”.

“Because these pumps are made of several components of different materials and complex shapes, traditional manufacturing and assembly tends to be expensive.”

Mr Velásquez-García agreed, saying, “The possibilities of how to process energy and information are far greater if you can monolithically create devices that are made of a plurality of materials.”

As a next step, Mr Velásquez-García and his colleagues may use lessons learned from the pump to monolithically build a miniature electrical motor. But he hopes that people around the world will be inspired by the pump to design and manufacture their own devices, especially since they can be created using relatively inexpensive and widely available printers.

“Maybe this can play a part in democratising technology,” he said.

15 www.pumpindustry.com.au pump industry | Summer 2021 | Issue 34 NEWS

Monolithic, fully 3D-printed magnetic pumps are shown next to a US dime. The fluidic ports are visible in the pumps on the left and centre, while the piston with embedded magnet is visible in the pump on the right.

Photo: Luis Fernando Velásquez-García.

Left: Fluidic ports (top) and the piston with embedded magnet (bottom). Centre: A side view of one of the pumps. Right: A crosssection of a monolithic, fully 3D-printed magnetic pump.

Photo: Luis Fernando Velásquez-García.

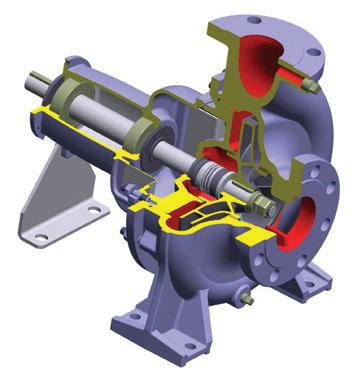

State-of-the-art pump supplies

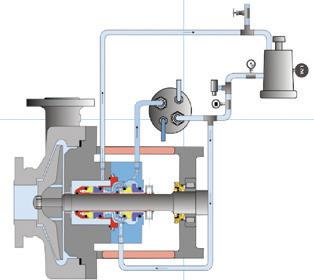

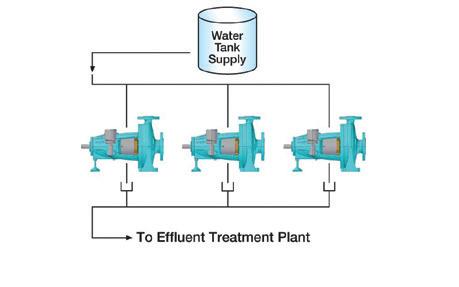

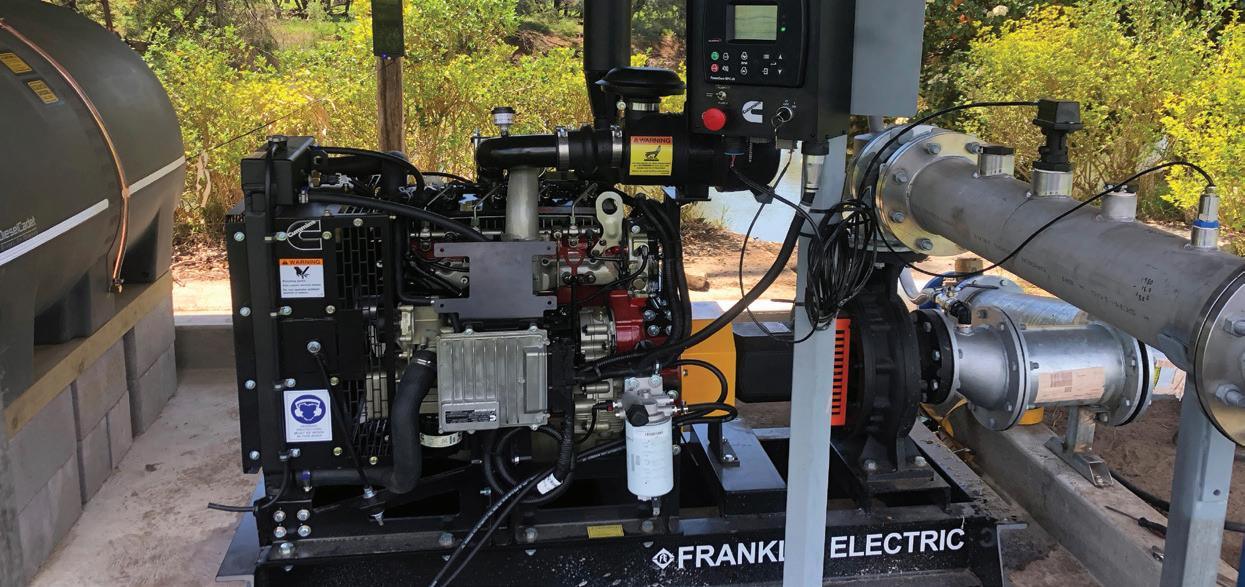

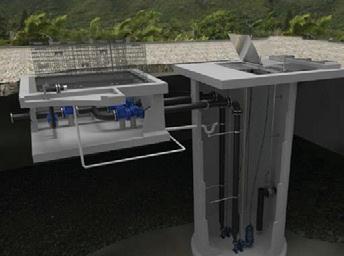

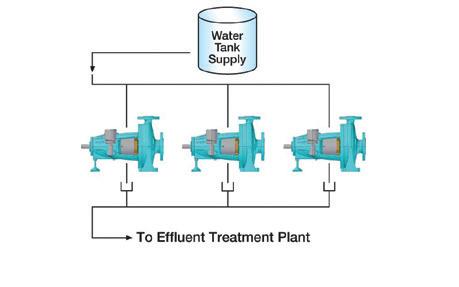

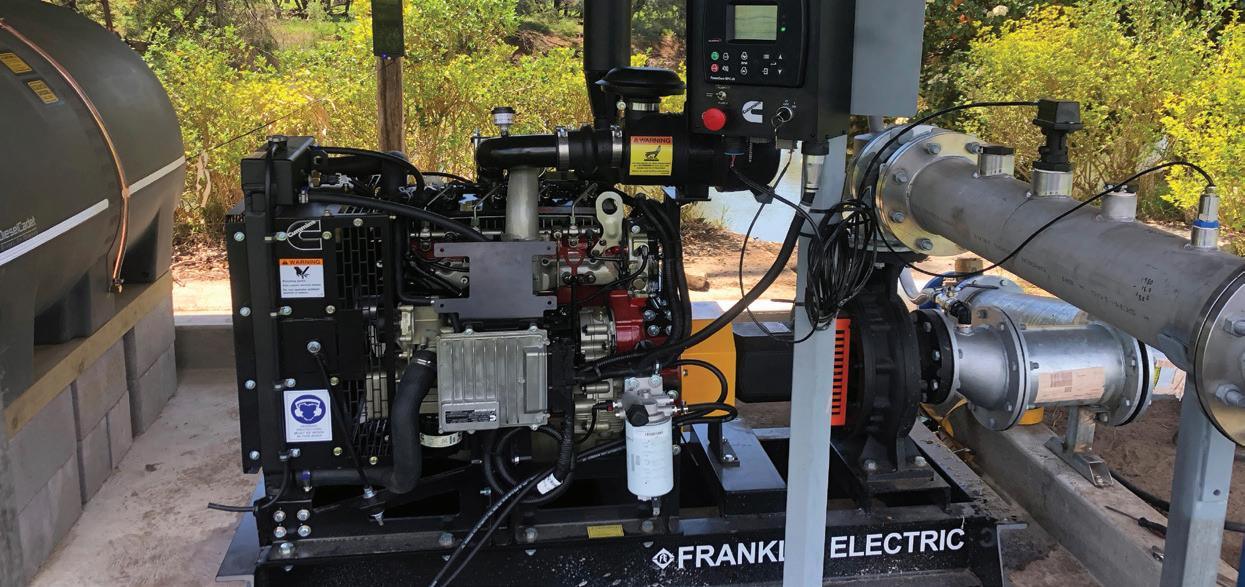

At Kainton Corner, the booster pump station – in-line with the Upper Paskeville water treatment and water pump station –feeds the entire water distribution network to the south of Yorke Peninsula in South Australia via the Arthurton water storage tanks located some 20km away.

The challenge

Having delivered great performance for decades, the asset had reached the end of its life with civil and structural elements in poor condition, and electrical and mechanical infrastructure in need of upgrade.

In late-2019, Water Engineering Technologies was charged with delivering a turnkey pump station solution to replace the aged asset. The scope of works spanned the specification for the new plant; all electrical, mechanical and control works; and construction, operation and maintenance of this essential asset.

The Kainton Corner pump station housed three pumps, each with a phenomenal pumping capacity of more than 100L/s, that provided a flow of approximately 235L/s to the Arthurton water storage tanks (2 x 9.09ML and 1 x 32.5ML).

The new pump station design had to meet demanding hydraulic requirements, and all relevant work health and safety requirements, design standards, operator requirements for access and maintenance, stakeholder considerations, and environmental responsibilities.

Supplying water to most of the Yorke Peninsula, commissioning the asset with minimal interruption to supply was critical and so carefully staged to minimise interruptions for our customers and manage any risks.

The project scope included demolition and decommissioning of the existing asset.

The solution

This project was delivered on time and within the $2.7 million budget by Water Engineering Technologies’ highlyskilled team of more than 200 people from sought after trades to mechanical and electrical engineers plus project managers.

The team at Water Engineering Technologies’ Crystal Brook workshop designed, constructed and now maintain the asset, as part of the services they provide SA Water’s water and wastewater infrastructure that exists within a huge service area ranging from Marla in South Australia’s far North to Warooka in the south, Burra in the east and Whyalla in the west.

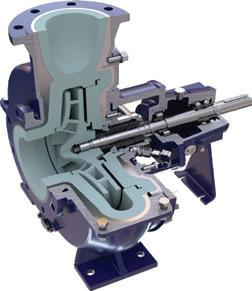

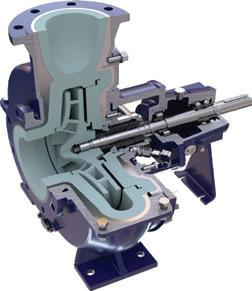

Three 150kW Flowserve 6HPX12C end suction pumps with variable speed drives (VSD) were selected for use at the new

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au

16 NEWS

supplies Yorke Peninsula

pump station. These were connected to stainless steel and MSCL suction and discharge pipes fabricated at the Crystal Brook workshop.

All electrical works associated with controls, instrumentation, power and communications telemetry were conducted by the team.

Plant and pumping infrastructure assembly was planned and performed by Water Engineering Technologies’ mechanical tradespersons Luke Seymour and Jay Avery, among others.

Control architecture

If you think of the pumps as the heart of the station, its electrical controls are its nervous system and programmable logic controller (PLC) its brain.

Peter Hombsch, Senior Electrical Tradesperson, ensured that the performance of the new main switchboard, including Motor Control Centre and PLC, met all required safety performance, maintenance standards, asset reliability, ease of programming and rapid process fault diagnosis, and whole of lifecycle cost.

Mr Hombsch developed the electrical drawings together with SA Water electrical engineers over a five week period and performed all electrical wiring works on the switchboard over an additional three weeks. A record time for a project of this size.

The field wiring at the pump station is hard wired to the PLC and is used to transmit power, pump pressure and water flow data to the program used to control the pumps. All site information is then transmitted to Arthurton tank where it is captured and sent through to SCADA for remote monitoring and control.

These controls enable the three pumps at the Kainton Corner, located between the Paskeville pumping station and the Arthurton tank, to run sequences in synchrony with the Paskeville pump station.

Joel Gale, Senior Electrical Tradesperson, said that the team also designed and set up a radio network to transmit control and monitoring signals to be sent between the integrated assets located at Arthurton, Paskeville and Kainton Corner.

Nima Gorjian Jolfaei, Senior Manager Water Engineering Technologies, said that he was delighted in his team’s performance.

“The delivery of this complex project on time and within budget without any interruption in water supply services is a great achievement. It demanded excellent project management skills and the close coordination of specialist resources within our electrical and mechanical engineering teams,” he said.

17 www.pumpindustry.com.au pump industry | Summer 2021 | Issue 34 NEWS

59 Export Dr, Brooklyn VIC 3012 Email: sales@wellcross.com.au wellcross.com.au 130 0 656 276 AUSTRALIA’S TRUSTED DIESEL POWER AUSTRALIA’S TRUSTED DIESEL POWER Adelaide | Brisbane | Melbourne | Perth | Sydney | Townsville Australian owned and operated since 1926. Manufactured in Australia. FOR YOUR PUMPING & IRRIGATION NEEDS ▶ Diesel Engines up to 800hp ▶ Diesel Generators up to 860 kVA ▶ Diesel Generators for prime, standby, sub pumps & centre pivot power

PIA AGM:

OVERCOMING THE CHALLENGES AND LOOKING POSITIVELY TOWARDS 2021

Against the backdrop of COVID-19 and various travel and live event restrictions, the PIA took its AGM online in November, allowing all its Members to attend from the comfort of their home or office. During the meeting members heard about the association’s achievements and activities across the year, as well as plans for 2021, with the hopes that in-person events and training will be able to resume.

The PIA reported that despite the challenges of COVID, it still had a successful year engaging with the industry and working behind the scenes with government and other organisations.

Engaging with the industry and others

COVID-19 meant that in-person events and training were cancelled for most of the year, with various restrictions limiting travel and in-person meetings. PIA rose to this challenge and was able to adapt to bring Members together.

Before the initial lockdown in late March, PIA was able to successfully hold a Breakfast Meeting in February at Cummins South Pacific in Scoresby, Melbourne, which saw approximately 36 pump professionals hear about engines, controls, panels and associated equipment for pumping systems.

PIA was then able to go digital, working with Pump Industry magazine and its publisher Monkey Media, to bring the Flow Technology Virtual Conference to over 200 delegates in June.

One of the major activities that had been scheduled for 2020 was the new Pumps and Systems Training Course, a nationally recognised, competency-based training program facilitated by Irrigation Australia, a PIA Member and Registered Training Organisation.

Initially slated to be a four-day in-person program, PIA organised for the initial three-day theory component to be completed online, with the final practical component to be completed at a later date at each attendees main city when restrictions allowed.

PIA reported the response to the new training was good, with 14 people registering and undertaking the course, and a number of others expressing their interest in participating in future ones.

PIA has also continued engaging industry and other organisations through other avenues.

When COVID restrictions were first introduced, PIA wrote to State and Federal Ministers to clarify the status of the industry as an essential service, allowing Members peace of mind that they were able to keep operating as long as health and safety precautions were put in place. This engagement ensured the industry was able to keep operating throughout the various state and territory restrictions and lockdowns.

Engaging with standards

While activity was quiet over 2020, PIA has continued to engage with Australian and international standards organisations to review and provide expert comment on related standards.

There were three main committees PIA took part in:

• FP-008 Fire Pump Committee

» Committee currently inactive and AS2941 is now seven years old, however no organisation has proposed its revision

» Miscellaneous ISO fire standards had been issued for review but none requiring input by the PIA

» AS2118.2 Automatic fire sprinkler systems, Part 2: Drencher systems reviewed with no commentary necessary

• ME-030 Pump Committee

» AS ISO ASME14414:2020 Pump system energy assessment published in April

» Various ISO standards reviewed with comments as applicable, including ISO 13709:2009, ISO 14847:1999, ISO 5198:1987 and ISO 16330:2003

» Draft Australian Plumbing Standards reviewed and comments submitted as applicable, including DR AS NZS 3500.0, DR AS/NZS 3500.1:2020, DR AS/NZS 3500.2:2020, DR AS/NZS3500.3 and DR AS/NZS 3500.4:2020

• EL-58 Energy Efficiency for Swimming Pool pumps Committee

» AS 5102:2019 Performance of household electrical appliances — swimming pool pump units, Part 1: Measurement of energy consumption and performance was published in late November 2019

» Draft AS 5352 Swimming Pool and Spa Heat Pump Systems is currently being written. The PIA resolved to remain on the committee as an Observing Committee Member, but will not provide technical input. PIA expects to review and comment if and where appropriate

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 18 PIA NEWS

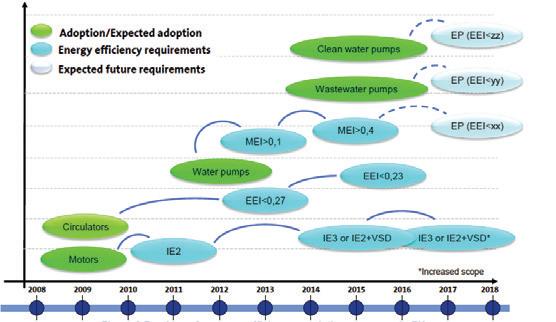

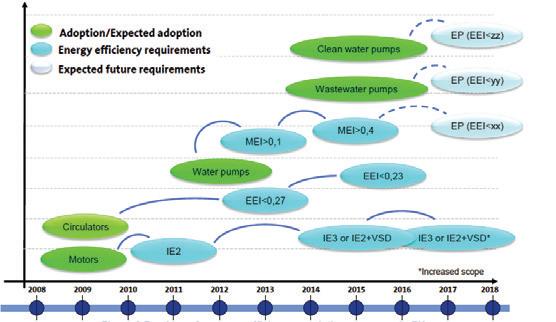

PIA has also been working with the Australian Government E3 Energy Efficiency Equipment (E3) Program in the Technical Working Group, providing input into the discussion paper for industrial pump MEPs. Activity with this program came to a stop in March, however in November the E3 released technical papers addressing industrial pumps, compressors and boilers for industry to provide comment.

Updated publications released and being worked on Work on PIA publications has also continued. Updates to the fifth edition of the Pipe Friction Handbook was completed and it was published in April to a good response, with an additional two print runs needed since.

An update of the Pump Technical Handbook has also been taking place and is expected to be completed by the end of Q1 2021, with publication in Q2.

These updates would not be possible without the help of a number of volunteers lending their expertise, and the PIA thanks them for their time.

An expanding membership

PIA was pleased to report membership has continued to grow throughout the year. In the 2017/18 period, membership stood at 73 with an increase to 86 in 2018/19, and in 2019/20 this increased to 98, a 14 per cent rise.

The association is hoping to continue this growth trend in 2021 and see membership increase to over 100.

A resolution was also put forward to Members for the acceptance of a third category of membership (Group Membership), following expressions of interest by franchisers –that have a number of franchisees – to become a PIA Member. This resolution was passed, helping the PIA membership to continue to expand in future years.

Planning for 2021

PIA acknowledged that while the situation is looking up for Australia, 2021 is still very uncertain. The association is hoping circumstances will allow in-person social events to be held again and is currently planning to hold six Breakfast Meetings and 2-3 Pump Systems Training Courses across the year in various states.

A dinner is also planned for 2021 to take place at the AGM as has happened in previous years. However, if the situation remains uncertain, PIA will instead look to hosting smaller social events throughout the year across multiple locations in its place to ensure all Members will be able to participate.

Women in the pump industry

To end the AGM, Kyle Kinsella, Managing Director of Regent Pumps, provided attendees with an interesting and thoughtproving presentation on women in the pump industry.

Kylie has a background in pneumatic equipment and first got into the industry as a product manager for pumps, meters and reciprocating compressors. Having never seen a pump at this stage of her career, she was fortunate to have three mentors in the company and was provided the opportunity to travel overseas for training at manufacturer facilities, allowing her to learn about various pumps and their applications.

As her career progressed, she undertook an Advanced Diploma in Business Management to solidify the skills and knowledge she had gained as she moved into management and sought new roles. At this stage she was the only woman in a similar role in the industry.

Kylie recalled interesting stories about how she was perceived in the early days, mentioning at one particular conference she attended where she was the only woman, she said she thought the other attendees were convinced she was there to serve tea and coffee. In other instances, there were potential customers who would speak to any men first, even though she was the manager.

In 2006, she was recruited by Roger Withers as the first female manager for Matthew Davis, part of Regent Holdings, and 18 months later she was working behind the scenes on all the businesses in the group.

Kylie said while she was proud that more females were now employed in key management roles at Regent Pumps and other companies, overall the perception of women in the industry hasn’t changed a lot – there are still very few women, but this is slowly changing.

She said her general feeling was that women needed to prove themselves, work harder, and justify how they can juggle home life with a career and possibly children. Another issue is that the pump industry is still perceived as male dominated and is closely related to other industries such as building services, mining, water and wastewater, and oil and gas that are also seen as male dominated.

She said with almost 60 per cent of students enrolled domestically at universities or other institutions being women, the pump industry needs to create ideas on how to capture this growing representation of women to realise the benefits that they can provide. In 2019 studies by the Business Council of Australia and the Workplace Gender Equality, showed businesses who employed women in key management roles were producing higher profits and getting better results.

Kylie said women in management can bring a diverse business approach to the team, as well as their talents and management skills to the pump industry in other various roles such as mechanical engineering, business, HR, sales and accounting. She believes the way to get more women in the industry is through:

• Training and opportunities, and helping to facilitate that by not overlooking them

• Improving recruitment practices to not use wording that shows gender bias

• Have leaders recognise and develop talented women within their organisations

• Developing a mentor program that women can access

There is a strong case to create change, and the industry needs to support and develop rising women. She said it only took one managing director to get her career started in the industry, and the current leaders have the opportunity to replicate that for other women. For women already in the industry she encourages them to challenge themselves, be proactive, do things for themselves, continue learning, be bold and know they are good enough.

19 www.pumpindustry.com.au pump industry | Summer 2021 | Issue 34 PIA NEWS

The virtual PIA AGM was facilitated by Pump Industry magazine publisher Monkey Media and hosted by Monkey Media Managing Editor, Laura Harvey.

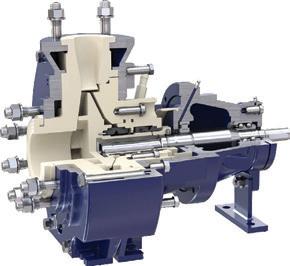

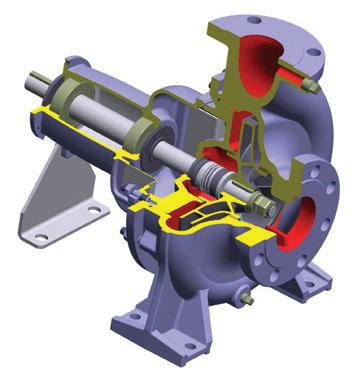

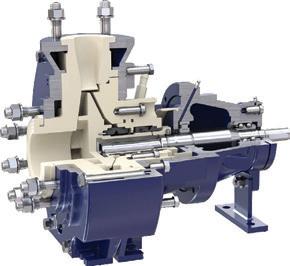

NEW RANGE OF EN733 PUMPS: WORLD-LEADING PERFORMANCE

Ebara Corporation (Japan) has recently released its new global range of EN733 standard end suction centrifugal pumps.

Utilising the most advanced hydraulic computer design software available, Ebara engineers in Japan have been able to improve and increase the pump efficiencies of the new GS range above most other available pumps of similar design and standard on the global market.

As a major manufacturer of industrial pumps to JIS and API610 standards, Ebara Corporation has embarked on a globalisation of its range of pumps for the world market. This includes the introduction of a range of industrial pumps to European EN733 standards and a new range of vertical multistage pumps.

The new Ebara GS range of EN733 standard pumps are manufactured in component form at Ebara Corporation Japan owned and managed factories in the Asia Pacific region with final assembly of market range models undertaken by skilled tradesmen at Ebara Pumps Australia’s Melbourne facility.

The new GS series are 16 bar rated pumps, with a close coupled version (GSD) offered as well. Both the GS bareshaft pump and GSD are now available in Australia.

About Ebara Corporation

Ebara Corporation was founded in Japan in 1912 as a manufacturer of pumps. Today, as a group, it consists of more than 70 companies in six

continents with a workforce of more 11,000 people and with company owned and Japanese managed factories in eight countries covering four continents.

The huge scale of production and distribution is matched by a constant commitment to research, development and design of new products and the modern technologies for manufacturing them. Ebara products have gained a worldwide reputation for their technology and quality.

Contact your local Ebara dealer or Ebara Pumps Australia for more information.

Two of the more popular models that are stocked in Australia are both solids handling pumps. For more details contact us at Ebara Pumps Australia or visit our website.

Stamped stainless steel pumps with open impeller

Maximum 19mm passage size

50mm discharge

1.1 to 1.5kW - 1 phase

1.1 to 3.0kW - 3 phase

Cast iron submersible pumps with semi vortex impeller

32 to 56mm passage size

(Depending on model)

50 and 80mm discharge

0.4 to 0.75kW - 1 phase

0.75 to 3.7kW - 3 phase

Manual or automatic

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 20 PIA MEMBER NEWS | PARTNER SOLUTIONS

MODEL DWO

MODEL DVS

New hydraulic design - World leading performance

Combining over 100 years of experience with the latest computer aided design, EBARA has developed the new GS series of pumps that offer world leading performance and efficiencies.

End suction single stage centrifugal pumps

Pumps to EN733 dimensions

16 Bar rated. PN16 flanges (24 Bar hydrostatic test pressure)

High efficiencies. MEI ³0.6 (Minimum Efficiency Index)

Mechanical seals to EN12756

Protectors to ISO13852

O’ Ring seal for casing

Cast iron components ED painted (Electro deposition painting)

Model GS

Model GSD

www ebara com au EBARA PUMPS AUSTRALIA PTY. LTD. 7 Holloway Drive Bayswater, VIC. 3153 P h : 0 3 9 7 6 1 3 0 3 3 sales@ebara com au

Looking ahead, going beyond expectations

Available

now

2900 rpm 1450 rpm GSD range GS range GS range - 41 pump sizes from 32-125 to 200-500 GSD motor pump versions available from 1.1 kW up to 75 kW (4 pole) and 110 kW (2 pole)

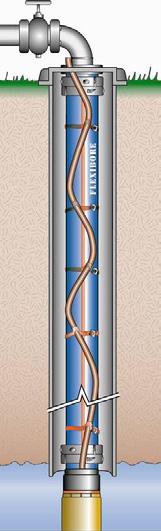

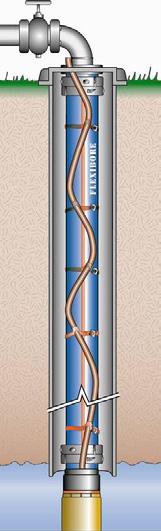

DEEP WATER PUMPING TO 300 METRES

The town of Collie is situated 200km south-east of Perth within Western Australia’s only coalfield, which boasts two large coal mines. These coal mines are the main source of energy for the local power station, offering a reliable supply of electricity to the region. Following a breakthrough by Crusader Hose in the manufacture of a high pressure flexible hose for mine dewatering at depths up to 300m, Premier Coal, the largest of the two mines, chose to replace the fibreglass pipe connecting its deepest bore to the dewatering system with Flexibore® 300.

Premier Coal was previously owned by Wesfarmers Coal, but is now part of Yancoal Australia. In 2008, a major pipeline was installed at the open cut mine to lower the water table. A large 600mm diameter ring main was installed around the perimeter, and 40 deep bores were drilled inside and around the pit. These bores are all between 199-245m deep – except one, which is 252m deep – and connected to the ring main to help keep the water table low.

Test pumping was carried out on all bores to measure the drawdown level, and the Perth-based consultant designing the system specified 150kW submersible pumps and flexible hose.

Mark Sanders of Think Water Bunbury was then selected as the prime contractor for this dewatering project.

Using his 40-plus years of pumping experience and expertise with other Premier Coal mine projects to make his recommendations, Mark combined Grundfos Pumps with Flexibore® 250 rising main from Crusader Hose for 39 of the 40 bores.

A high performance hose

Flexibore® was chosen as the preferred hose for the dewatering system due to its ease of installation and excellent hydraulic performance.

“Flexibore® can swell up to 15 per cent under pressure and this dilation eliminates any build-up of iron bacteria or internal scaling,” Francois Steverlynck, Managing Director of Crusader Hose, said.

To assist Mark carry out the first installation, Francois flew to WA. Installing the flexible hose

To install the hose, it was rolled out, the pump connected and the power cable attached along its length, with Think Water able to install the pumps at a rate of one per day. Only one bore – the deepest bore at 252m – was not

suitable for using flexible hose as the depth exceeded the safety margin of Flexibore® 250. Fibreglass pipe was used instead, which required more labour and took three days to install due to the complexity of handling 6m sections of rigid pipe.

“That one pump for which Flexibore® could not be used really challenged me as I was unable to supply hose for the large submersible pump installed over 250m deep,” Francois said.

“Because of this, I set the Engineering Team a challenge to fabricate a hose that could go down to 300m into a bore.”

A breakthrough flexible hose design for high pressure environments

Crusader Hose is an innovative company with a strong culture of continuous improvement and its Engineering Team has had a recent breakthrough – the ultra-high-pressure Flexibore® 300 series hose, which is the highest pressure layflat hose in the world for mine dewatering, with a burst pressure of 900m.

Mark re-entered into discussions with the dewatering supervisors at the mine about this new capability.

“They were pleased to hear about this development and were impressed by the perseverance at Crusader Hose. They were also pleased that all their original Flexibore® risers were still working well after more than 12 years of continuous pumping. Based on this, we secured an order for a 252m length of the new Flexibore® 300 to replace the fibreglass column,” Mark said.

Francois said the Flexibore® 300 is truly a pioneering achievement in the history of Crusader Hose.

“This development will hopefully be keenly adopted by many Australian mining companies and enable them to keep at the forefront of productivity and continuous improvement,” Francois said.

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 22 PIA MEMBER NEWS | PARTNER SOLUTIONS

Grundfos submersible pump.

Flexibore installation over a roller.

Flexibore ready for installation.

FLEXIBORE FLEXIBORE

Flexibore Coupling Flexibore Hose Power Cable Power Cable Strap Borehole Pump PUMPING EFFICIENCY & COST SAVING EASY STORAGE, HANDLING & TRANSPORT QUICK AND EASY INSTALLATION & RETRIEVAL Customised Layflat Hose Systems ON CRANE OVER A ROLLER WALK IN THE SYSTEM OF CHOICE FOR GROUND WATER PUMPING THE SYSTEM OF CHOICE FOR GROUND WATER PUMPING If it’s a bore, think FLEXIBORE!

Transforming energy into solutions.

Motors | Automation | Energy | Transmission & Distribution | Service

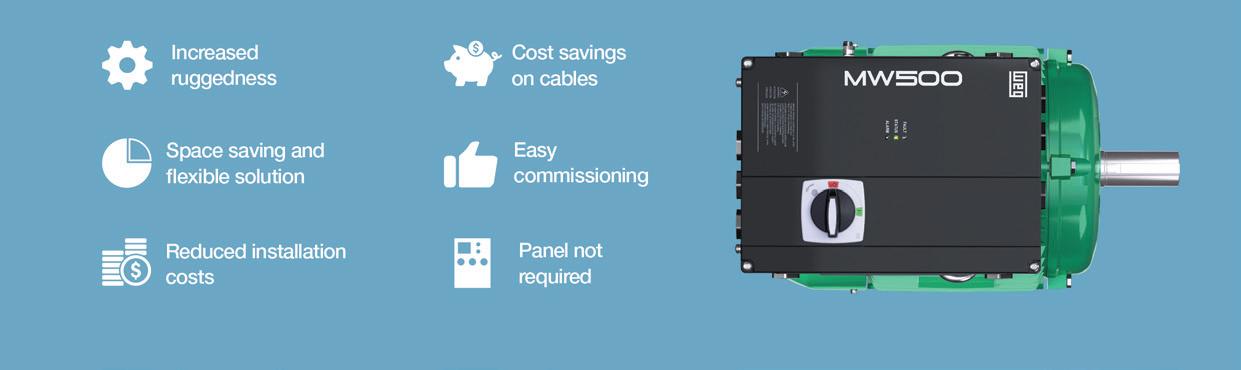

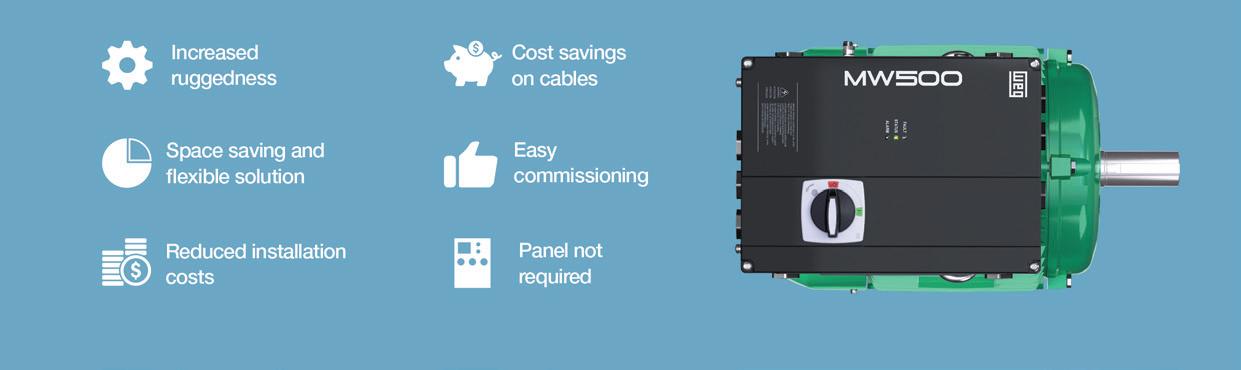

MW500 DECENTRALIZED VSD

System flexibility

The MW500 is a high-performance VSD dedicated for induction motor control, with embedded features and a high protection degree of IP66 which allow decentralised installation directly on the motor. Designed exclusively for industrial or professional use, the decentralised WEG VSD adds a great deal of flexibility, allowing users to install it near onto the controlled motor, thus eliminating the necessity of long cables and panels.

The MW500 performance level can be scaled to match the application requirements by selecting WEG vector control (VVW) or scalar control (V/F). It also includes built-in SoftPLC capability with free WLP programming software for custom tailored control schemes without additional hardware. A variety of plug-in option modules may be added for additional I/O and communications protocols, providing extended capabilities and making the MW500 a flexible and cost-effective solution for your variable speed requirements.

PIA MEMBER NEWS | PARTNER SOLUTIONS

25

Franklin Electric: the story so far

Commencing back in 1962 in Dandenong, Victoria, close by to its present site, Franklin Electric began importing and distributing 4” submersible products. Soon after, local manufacturing commenced with specialised imported parts to offer the Australian water industry Franklin’s world-leading 4” submersible motors.

Over the decades, Franklin Electric motor products were designed and evolved to provide the industry with the highest quality 4”, 6”, 8”, 10” and 12” submersible motor products available.

Quality, reliability and performance

The main benefit that the Australian industry has come to rely on from Franklin is its quality, reliability and performance. Franklin demonstrates these every day to its customers through its Five Key Factors for Success: quality, availability, service, innovation and cost.

Franklin submersible motor products became Australia’s leading submersible motor and indeed the world’s most installed submersible electric motors.

Franklin had been partnering with pump manufacturers for decades and had developed a deep understanding of the market. When the industry started to consolidate around the world in the late 1990s and early 2000s, Franklin had some serious decisions to make.

Entering the global water pump industry

In 2004, Franklin Electric announced the purchase of JBD (the former Jacuzzi industrial range), and that it was entering the pumping industry by launching Franklin Pumping Systems, now known as FPS. Starting from a very low share, FPS is now leading the US market.

As the pumping industry is global, similar issues applied in Australia. In late 2007, Franklin Electric Australia, after three years of evaluating the market, entered the main water pump industry by launching and distributing its FPS range of submersible pumps and above ground pumps, motors, drives and controls direct to its own Australian dealer network.

In 2005, Franklin Electric purchased a 35 per cent stake of Pioneer Pump Inc, situated in Canby, Portland, Oregon. Pioneer manufactures a large range of centrifugal pumps and automatic self-priming pumps, as well as solids handling selfpriming pumps. Outside of the US, Pioneer Pump has factories for fabrication, and assembly and warehousing facilities operational in South Africa, England and Australia.

In 2011, Franklin Electric agreed to purchase the remaining 65 per cent of Pioneer. In 2020, Franklin Electric decided to consolidate its water business group globally under one Franklin Electric company.

Today, Franklin Electric Australia and Pioneer Pump Holdings Australia are one company, Franklin Electric Australia New Zealand Pty Ltd, with two facilities operating: the warehouse and assembly facility in Dandenong South, Victoria; and the fabrication assembly and test facility in Sunshine West, Victoria, which includes a logistic warehouse in Ravenhall, Victoria. Along with the consolidation of the businesses comes the staff and the years of pump experience, the company has 100s of years of experience to assist every person who needs help with a pump or application.

An expanding range

Today, the range of products have expanded to:

• A full range of surface mount pumps, ISO, split case, multistage, small and large centrifugal motor pumps, progressive cavity (MONO TYPE) and self-priming ranges, small volume low head, to extreme high volumes (2500 LPS) and discharge heads exceeding 300m

• Solar pumps and pumping equipment

• A huge range of below ground pumps: submersible turbine, line shaft, bore hole and dewatering

Truly one of the largest and most comprehensive ranges of pumping and associated products supplied by a single company globally.

“Moving Water Moving Forward”.

PIA MEMBER NEWS | PARTNER SOLUTIONS

26

WOMA – Australasia’s leading high-pressure water supplier

WOMA – a leading provider of water jetting, vacuum extraction and explosion protection technologies has recently introduced a stable of robust, reliable and technically advanced industrial water jetters to the market. Engineered and manufactured to exacting standards, their units are purpose-built to suit the demands of the oil & gas, mining, construction and similar heavy industrial markets.

The WOMA ‘WaterJet’ offers cold, hot and steam capabilities with the provision for venturifed additive. It’s ideal for quarantine applications for the effective destruction of pathogens and bacteria as often required in heavy duty industrial environments or for the cleaning and maintenance of facilities and infrastructure with oil-based residues.

Innovative and versatile

WOMA’s new modular VersaJet system is available in numerous pressure and flow variations enabling application across varied industrial environments, principally dictated by the client or as required by the task at hand. ATEX or IECex Zone variants with optional EN 12079 or DNV 2.7.1 Certification are also available for hazardous environments. All units are AS 4233 compliant and ready for work.

As manufacturers strive for sustainable innovation and excellence,

WOMA’s initiatives continue to introduce agile and efficient practices to facilitate its manufacturing strategy whilst concurrently reducing cost and risk.

WOMA understands that “time is money” and that project management principles stress the interdependence of the triangle consisting of scope, time and cost. In light of this, WOMA is based upon a simple philosophy whereby customer solutions are realised by emerging technologies, amplified by enabled human ingenuity, ensuring that customers are in receipt of the very best in performance and reliability.

WOMA WaterJet 5000psi 350Bar 20lm Cold Hot Steam.

ENGINEERED INDUSTRIAL PUMPING SOLUTIONS

PIA MEMBER NEWS | PARTNER SOLUTIONS

www.pumpindustry.com.au pump industry | Summer 2021 | Issue 34 27

UHP • HP • VAC • ACCESSORIES • ROBOTICS • EXPLOSION PROTECTION www.woma.com.au | hpwater@woma.com.au | +61 8 9434 6622

WOMA VersaJet Electric Ex or Exd Cold Water Jetter.

WOMA VersaJet Electric Cold Water Jetter.

MOVING S#!T:

THE ADVANTAGES OF THE NEW FX RANGE FROM DAB

The new FX range by DAB includes four distinct models for various wastewater applications.

The range includes:

DRENAG FX: Draining pumps with rubber coverings that limit wear due to the presence of sand or abrasive particles. Suitable for draining environments prone to flooding where high head is necessary.

FXC: Pumps with an anti-clogging channel impeller. Suitable for drainage and the transfer of effluent and sewage water, containing solids up to 50mm with reduced long fibre content.

cross

1. Compact motors with high starting torques to reduce clogging 2. Double mechanical seal in the oil chamber completely protected from the pumped liquid

3. Anti-leakage resin sealed cable gland with fast connections

4. Delivery port, both threaded and flanged, to increase the flexibility of installation

5. Easy to access condenser compartment for inspection and maintenance

6. Anti-corrosion stainless steel motor shaft AISI 304

7. Cataphoresis and two-component coating to guarantee high resistance

8. Rubber disc for increasing stability of the pump in mobile installations

DFXV: Pumps with a patented super vortex impeller. Increased performance without compromising the ability to work in the presence of large solids and long fibres guarantees a completely free passage.

GRINDER FX: Pumps with a high resistance stainless steel grinder system and suitable for the transfer of sewage water at high pressure or when narrow piping is needed to keep system installation costs down.

esign was carried out with absolute reliability and strength in mind. The double silicon carbide mechanical seals are entirely enclosed in the oil chamber to avoid direct contact with the pumped liquid. The high standards of construction, including the motor shaft in anti-corrosion stainless steel AISI 304, the external cataphoresis, and two-component coating and the resin sealed cable gland, guarantee the long life of the range. The new FX range also comes with new motors that are more compact than ever. Sized to guarantee high resistance to clogging and consistent performance.

The new, compact motors are designed to increase the starting torque and reduce the risk of clogging. Now more efficient than ever, they allow the FX pumps to run even when not fully submerged to permit complete emptying of the tanks.

The pumps in the FX range have a structure with three levels for quick access to all the main components, greatly facilitating maintenance. The spare parts have also been unified and made universal for the entire range.

A focus on efficiency

The FX range tackles the issue of efficiency from every point of view. Advanced research into computational fluid dynamic analysis (CFD) has allowed DAB to improve performance in terms of efficiency and increase the capacity to manage sewage water. The FX range comes with high energy efficient motors that permit lower power ratings, guaranteeing the same performance as a more powerful pump.

The new Super Vortex impeller, patented by DAB, is an important development. Completely redesigned on the basis of research into computational fluid dynamics, the new impeller improves on the performance of the FEKA FXV pumps under all conditions, reducing motor consumption while still offering the benefit of a free passage the same size as the pump's delivery port (50 and 65mm).

The new FX range is available with accessories to make the replacement of old models and system upgrades as easy as possible. The reduced overall size, complete with threaded flange connection, makes installation even simpler.

Thanks to its production capacity and its service network, DAB can guarantee the availability of the FX range worldwide.

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 28 PIA MEMBER NEWS | PARTNER SOLUTIONS

FX

section:

THE TEAM THAT ALWAYS SCORES. Four completely innovative solutions for waste water; four answers to your needs. V C DABPUMPS.COM.AU

EASYWELL: maximum reliability in extreme environments at a competitive price

Caprari further expands its range of EASYWELL (MPC) submersible motors with improved options and configurations, cementing its position as a world-leading manufacturer.

Important new developments include:

• 100 per cent anti-corrosion in extreme applications: EASYWELL is now available in full AISI 316 stainless steel, allowing them to be used in even more extreme applications. When combined with Caprari’s international patented DEFENDER®, a standard device on all Caprari wet ends, the life of the electric pump is extended, even in the presence of seawater

• Suitable for high temperatures: thanks to the dual layer insulation windings, EASYWELL submersible motors are suitable for high temperature water applications without any decrease in performance

• 100 per cent reliability: the EASYWELL range has always guaranteed exceptional resistance to wear due to its silicon carbide mechanical seal and robust design which allows it to be used in difficult operating conditions. Furthermore, the range is equipped with a thrust bearing that is generously oversized compared to the axial loads generated by the wet end and has line bearings made of self-lubricating composite material based on graphite, guaranteeing durability

The EASYWELL range encompasses motor powers up to 125HP in size 8” and 200HP in size 10” for both the standard version and the new stainless steel version.

The EASYWELL range provides increased power outputs, reduced energy consumption all at competitive prices.

For more information, visit caprari.com.

SUBMERSIBLE MOTORS RANGE EXTENSION

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au RELIABILITY OUTSTANDING

HIGH CORROSION PROOF HIGH RESISTANCE TO OVERHEATING 30 INDUSTRY NEWS | PARTNER SOLUTIONS

The right choice for high concentration of solids and sand up to 450 g/m3 The new 4” and 6” submersible pumps for small and medium size wells are Caprari’s answer to the need for high performance plus long life in extremely heavy duty conditions. Compact and made of stainless steel, they combine power and reliability thanks to their re-engineered construction and the quality of the materials. www.caprari.com BREAKTHROUGH DESIGN NEW LINE FOR BOREHOLE PUMPS

Merger a disruptive force in the

FLUID SEALING MARKET

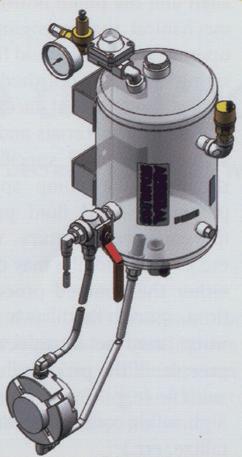

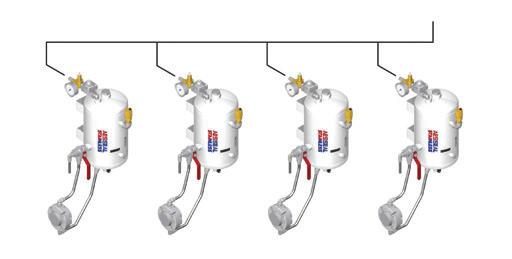

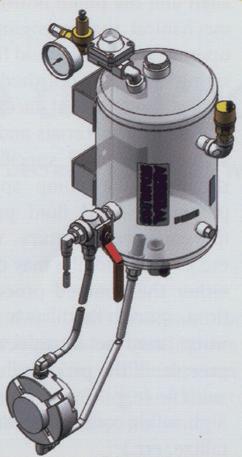

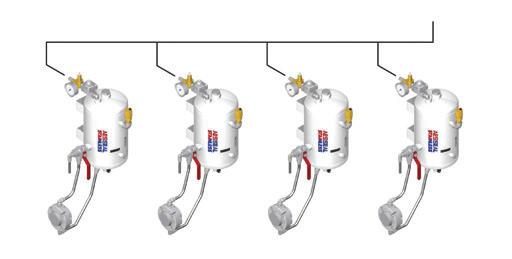

Flex-A-Seal and Momentum Engineered Systems have announced their planned merger, providing a unified mechanical seal and systems approach to the fluid sealing market. The merged company is now operating under the new name, Flexaseal Engineered Seals and Systems (FAS-ESS).

Both Flex-A-Seal and Momentum are distinguished by their commitment to ‘Made in the USA’ with a solid reputation for producing quality products. The merger now vertically integrates and supplies Flex-A-Seal and Momentum products under one entity, providing a complete sealing package to customers.

The new company’s point of difference focuses on manufacturing custom mechanical seal and rotating equipment support systems in half the standard industry lead time. All FASESS support systems for applications involving rotating equipment are designed, manufactured and tested in the US, with delivery of standard products in as little as four weeks.

Hank Slauson, former President of Flex-A-Seal and now Chairman of Flexaseal Engineered Seals and Systems, said, “I am proud to announce this merger as the next step in our path to increasing our share of the sealing market. This merged company has the rare combination of strong technology and a customer-centric business ethic. It is a timely opportunity to integrate our unique company culture with another forward-thinking force in the fluid handling market.”

Global leaders in fluid sealing

Flex-A-Seal, founded in 1983, known globally as a leader in the manufacture of welded metal bellows and fully split cartridge mechanical seals, offers engineered solutions for virtually any sealing application. Flex-A-Seal has customers in over 50 countries worldwide.

Momentum Engineered Systems, founded in 2013, disrupted the poorly served seal support and lubrication markets through innovative customer service. Momentum Engineered Systems is currently the largest independent seal systems manufacturer in the US.

Trey Maxwell, former CEO of Momentum Engineered Systems and now CEO of Flexaseal Engineered Seals and Systems, said, “Our customers are looking for a change, our goal is to bring service back. Our American manufacturing and dedicated professionals will be a disruptive force.”

The new company maintains its operations in Williston, VT; Houston, TX; and Gonzales, LA, with the corporate headquarters in Williston, VT, and continues to distribute its products in Australia through their trusted sales partner, IndustriTech.

pump industry | Summer 2021 | Issue 34 www.pumpindustry.com.au 32 INDUSTRY NEWS | PARTNER SOLUTIONS

For all Australian enquiries, contact IndustriTech – Industrial Process Solutions at www.industritech.com.au.

protection valves designed and manufactured in Germany. Exclusively distributed in Australia by:

| sales@industritech.com.au UNDER PRESSURE.

Pump

www.industritech.com.au

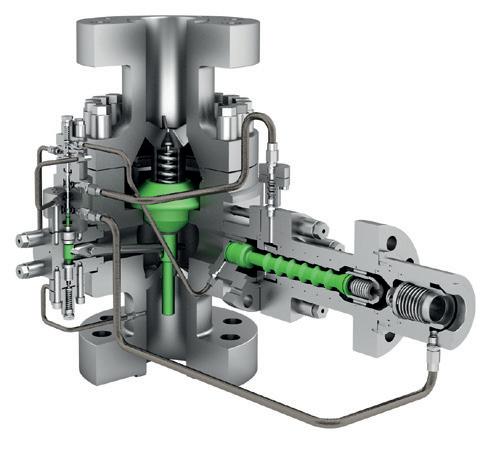

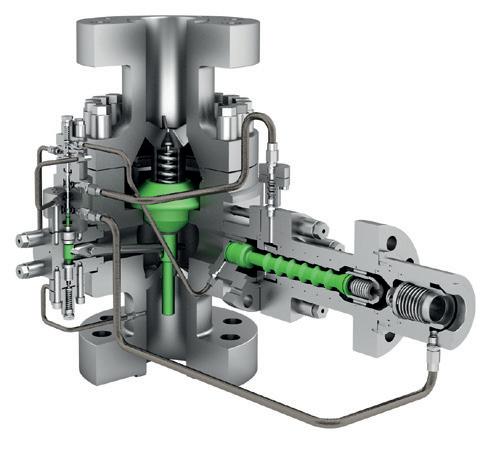

The Schroeder automatic recirculation valve for all pressures and all load conditions.

VOLVO PENTA: THE RIGHT POWER FOR HIGH PRESSURE

Volvo Penta’s engine range is characterised by high performance, reliability, fuel efficiency and low emission levels. Built to be versatile, their low weight, compact designs, easy installation and optional equipment packages make them perfect for numerous machine and equipment applications in a variety of industries.

As part of the Volvo Group, Volvo Penta is a premium supplier of engines for the pumping industry.

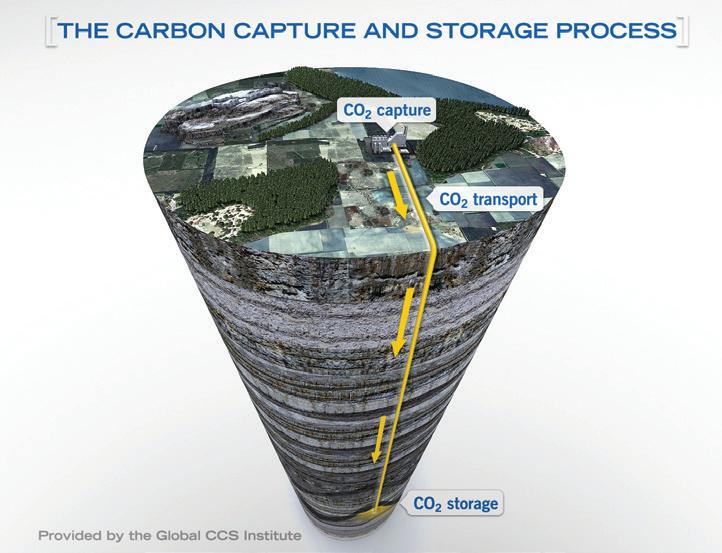

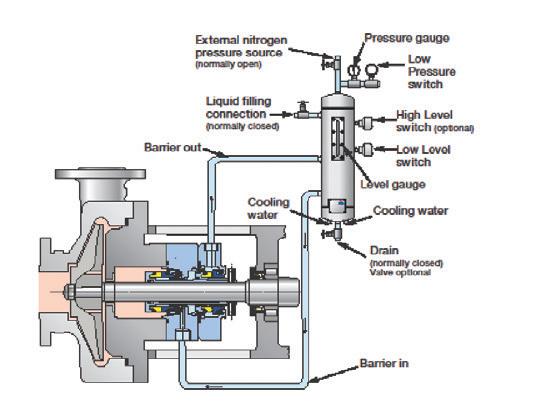

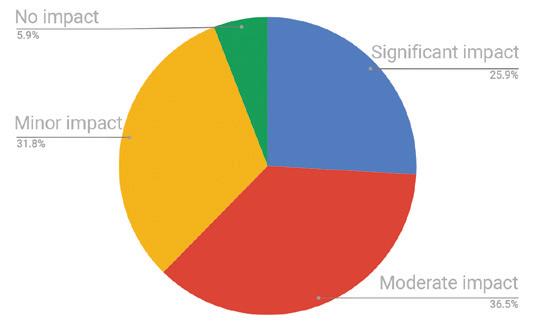

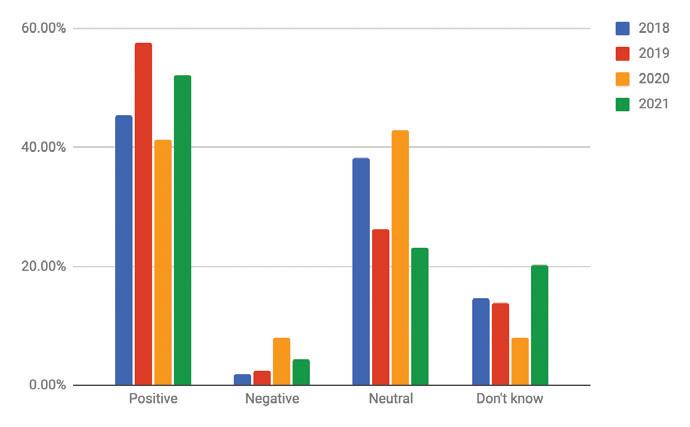

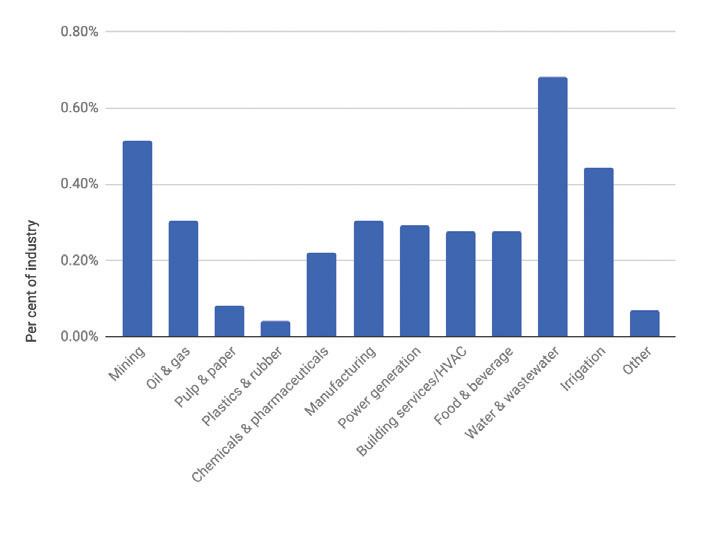

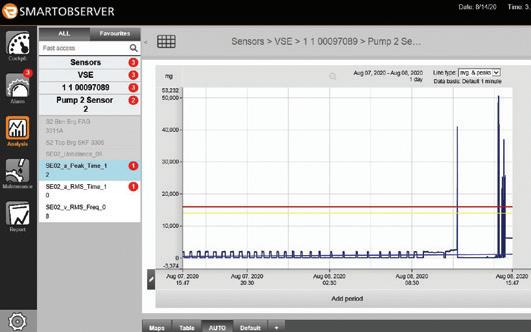

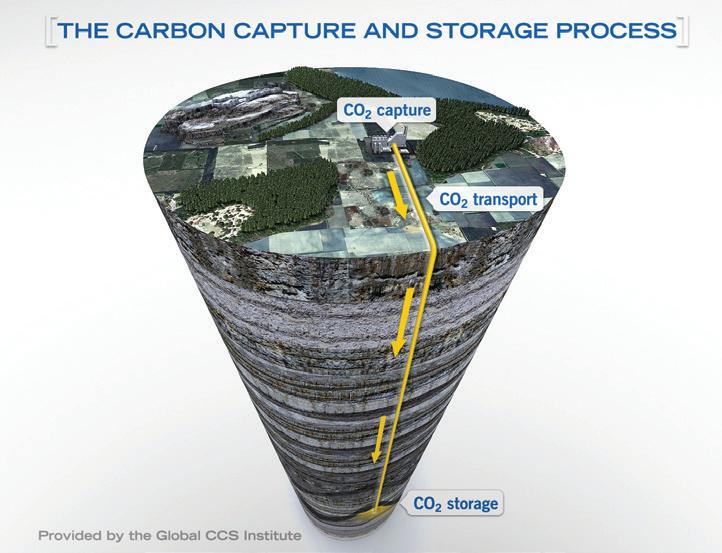

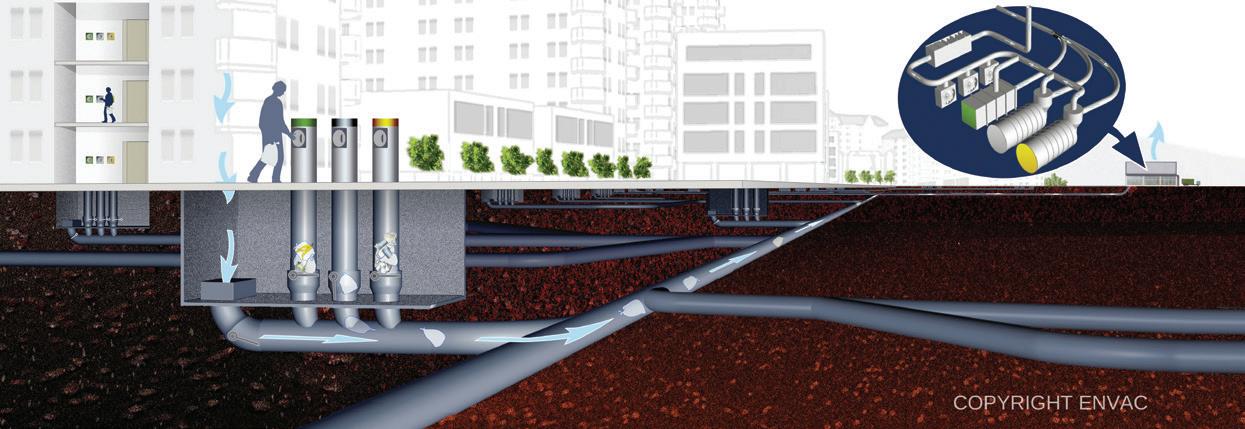

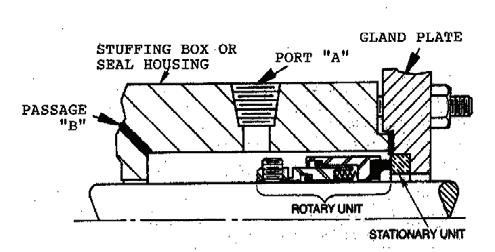

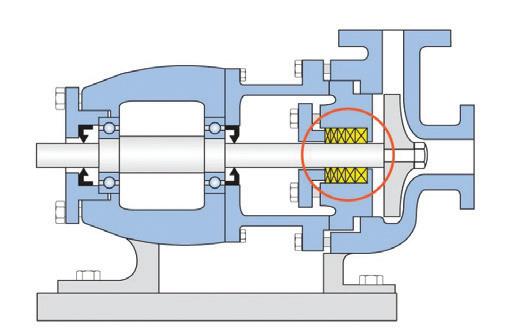

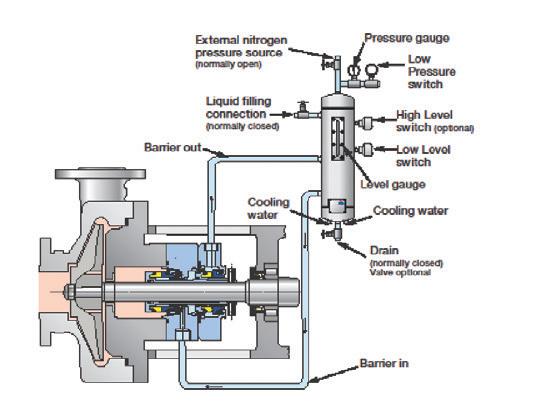

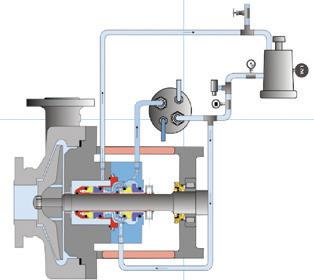

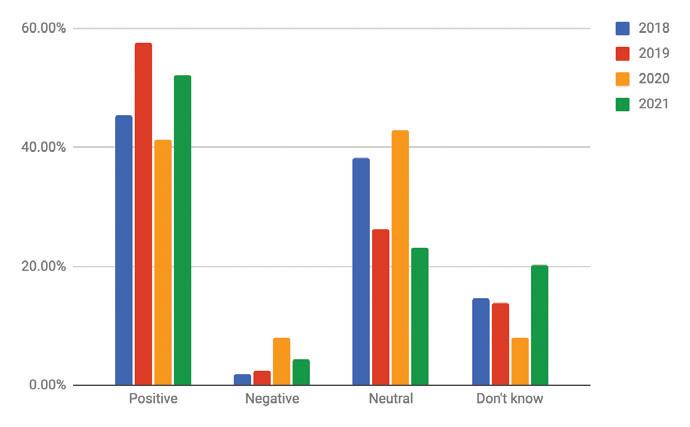

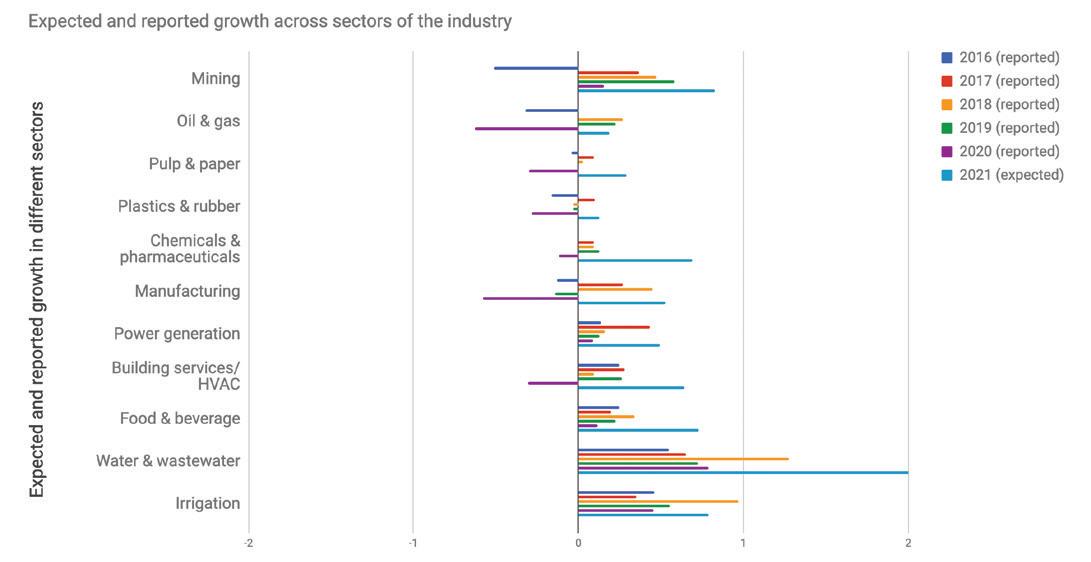

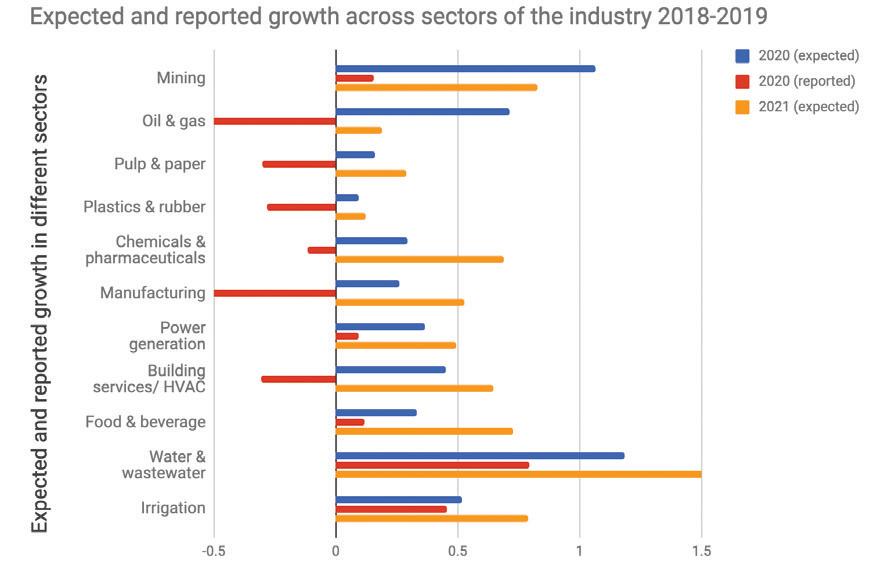

Martin Skoglund, Head of Volvo Penta Oceania, said, “We continuously work towards sustainable solutions and provide both OEMs and operators with state-of-theart engines and technology based on over 100 years of engineering experience. Our engines power various industrial applications all over the world – contributing to the overall productivity of the operations, through excellent performance and minimised total cost of ownership.”