ISSUE#27 FROM SAAS TO SPEEDBOATS... THE BEST STRATEGIES IN A ‘PERMACRISIS’ MORE BOOM! LESS DOOM, Mobiquity ● Auriga ● BBD ● McKinsey ● CBI ● G+D ● Bitstamp ● Vitesse Volante ● Mambu ● HSBC ● Netcetera ● Digiseq ● Tink ● Visa ● Resilience ● FIS Worldpay INSIGHTS FROM THE RULE OF ENGAGEMENT FSCOM ON THE UK’S NEW CONSUMER DUTY LAW BUILDING A BANK FOR SME s MAMBU ASKS: WHAT DO THEY WANT? READY TO PLAY WHY IT’S GAME-ON FOR BARCLAYS CONTINENTAL SHIFT HOW AFRICA FLEXED ITS FINTECH POWER

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

FINTECH FOCUS

32 Wake-up calls

Mobiquity’s VP of global digital banking Peter-Jan Van de Venn and the fintech futurist and author Brett King explore where banks should focus their IT investment in an uncertain year

40

Beating the digital drum

African fintechs are ‘doing it for themselves’. We asked three leading members of its fintech ecosystem –Matthew Barnard, Gwera Kiwana and Matteo Rizzi – what that means for them… and the rest of the world

64 Game-on!

Elaine Dowman explains why Barclays is banking on the UK’s video game industry

OPEN FINANCE

6

Unlocking the new economy

With their customers facing, not one but two, existential threats, banks need to seize the open banking moment and drive real change in 2023, says Tink’s Tasha Chouhan

11 A slice of the action

As European regulators begin shaping a new era of API-driven open finance, Italy’s CBI is already positioning itself and its clients to reap the benefits. Head of Banking and Financial Market, Alessio Castelli, outlines the menu of options

PAYMENTS

14 Short cuts, fast growth

The Visa B2B Connect network for high-value business payments is making good on its promise to shake up correspondent banking, says Ben Ellis, SVP and Global Head of Visa B2B Connect at Visa Business Solutions

THEFINTECHVIEW

It was John F. Kennedy who pointed out that, when written in Chinese, the word crisis is composed of two characters – one that represents danger, and the other opportunity.

Logically, then – since we are now in an era of permanent crisis, according to lexicogaphers at Collins, who made permacrisis their fave word at the end of 2022 – we are also in an era of heightened opportunity.

That’s not the impression one gets from the drip, drip of depressing headlines, announcing another staff layoff, down-valuation or VCs snapping the wallet shut (with perhaps the noble exception of fintech champion Sequoia Capital, which poured money into 100 of them last year). In uncharacteristically downbeat mood, finfluencer Leda Glyptis even describes the outlook for H1 2023 as ‘grim’ on page 74.

The macroeconomic environment affecting FSPs – and both their retail and business customers – combined with an even more active regulatory one (check out the FSCom discussion on page 44), is making life more difficult than usual. No one in this issue is pretending otherwise.

ISSUE #27 | 2023

The danger is that the cautious will stop investing in innovation at just the moment when they must hold their nerve – or lose out to more opportunistic businesses… At least, that’s the situation in the Global North. There, many now mature fintechs grew up in a time of plenty, have no experience of recession and are having to come to terms with leaner models and nervous investors.

Look across the world to Africa (page 40), though, and you’ll find a different and much more positive outlook. They’re no longer looking to the Global North for inspiration nor investment – and are even exporting solutions that can teach the rest of the world a thing or two about delivering what customers really want with minimum resources.

The good news is that Leda cheers up in H2 2023. So, if you’re reading this at Finnovate Europe on March 15, look on this Ides of March not as a day doom, but as a signpost to impending opportunity. Our last issue’s spine tingler, “Perhaps we make too much of what is wrong and too little of what is right”, was a quote from HRH

Queen

Elizabeth II Sue Scott, Editor

CONTENTS

Issue 27 | TheFintechMagazine 3 40 64

19 No time like the real-time

The US payments landscape is being driven by a unique set of circumstances that will have deep and lasting impact on how business gets done. Volante’s Rachel Hunt says banks must move fast – in more ways than one

22 A token of our esteem

Are we falling out of love with cards?

If anything, our relationship is proving remarkably resilient, agree Alex Page from FIS Worldpay, G+D’s Alex Gatiragas and Kurt Schmid from Netcetera. Here, they discuss how tokenisation, click-to-pay and secure customer authentication are all helping to keep the spark alive

26 Mission critical

Payments provider Vitesse is helping a new wave of parametric insurers deliver funds where they’re needed, when they’re needed

30 Getting closer

Terrie Smith, Co-founder and Global Ambassador at wearable tech pioneer DIGISEQ, on why issuers should open their eyes to a new dawn in wearable payments

PARTNERSHIPS

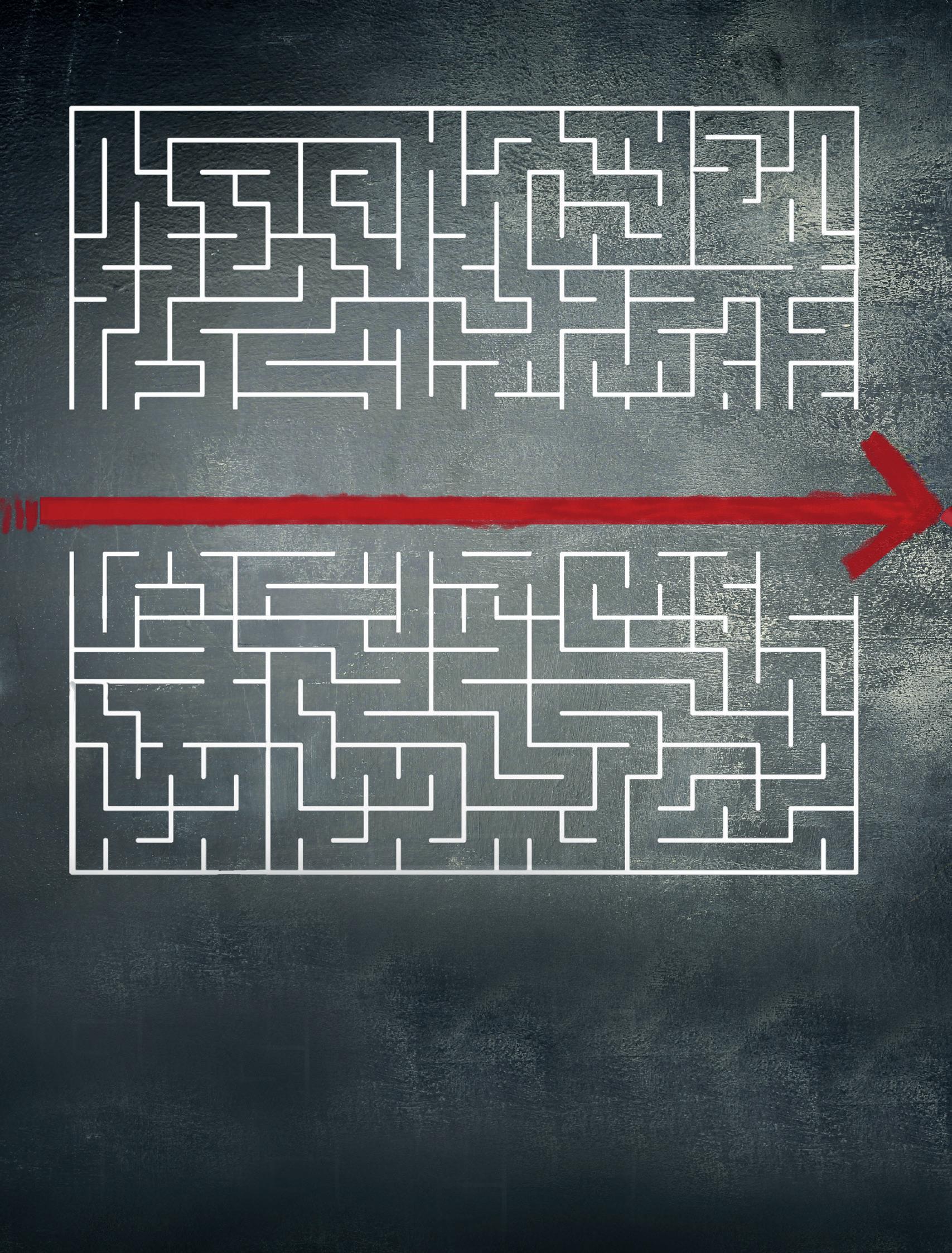

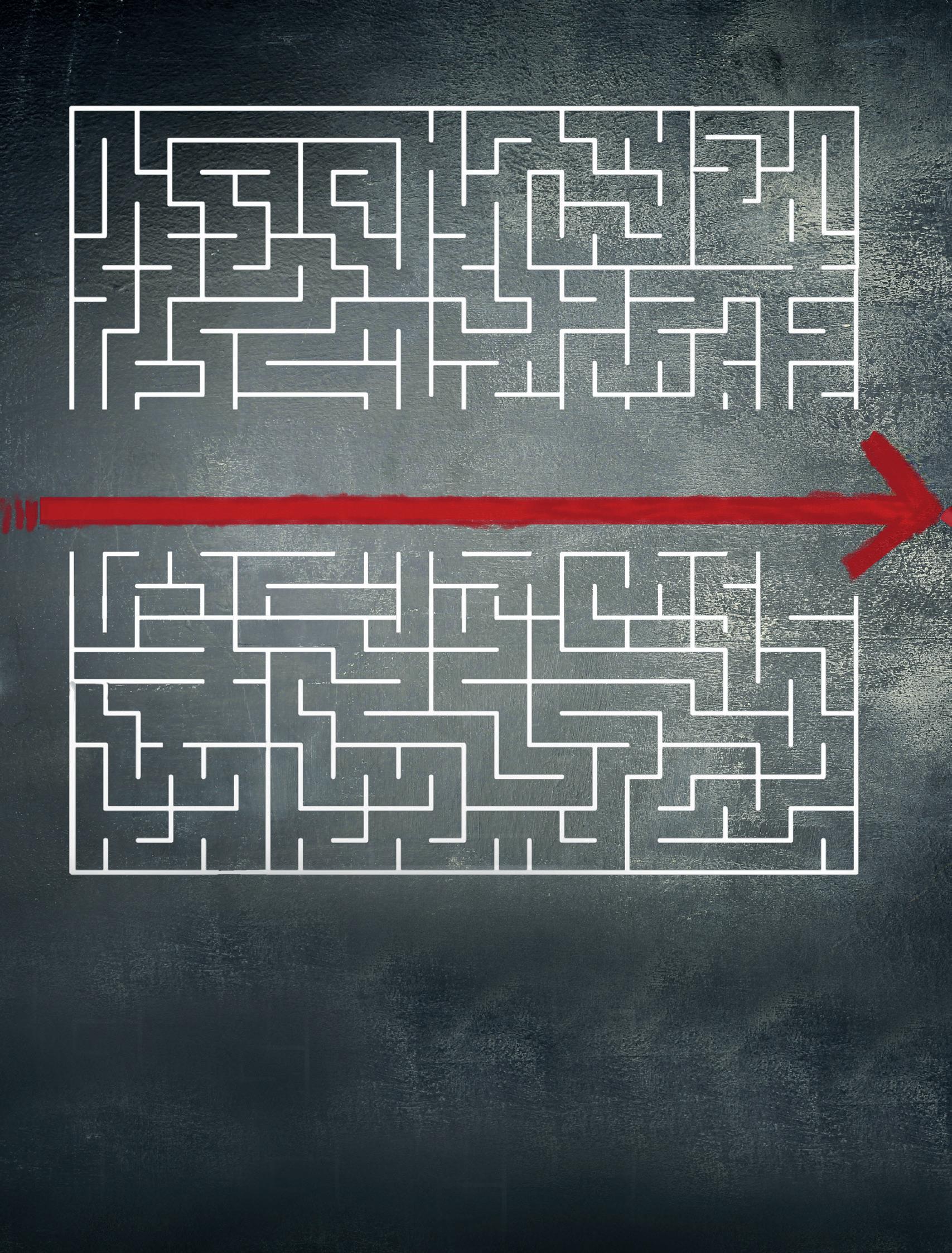

36 Piloting bigger banks to safety

Kunal Galav from Mambu, and McKinsey analyst Henning Soller discuss how incumbents mired in complexity can compete in shifting seas

SECURITY & COMPLIANCE

44 Prepare for scrutiny

fscom’s recent Regulatory Outlook 2023 event covered a wide variety of issues impacting financial services companies in the UK and the FCA’s evolving approach

49 Ground zero ATMs and assisted self-service machines are vulnerable assets, says Juan Ramon Aramendia, Head of Cybersecurity Product Engineering at Auriga. But there is a solution

HOW TO BUILD A BANK

52 Winning the hearts, minds and finances of SMEs

Mambu and friends look at the state of banking for the majority of the world’s businesses and finds them hungry for better support

ARTIFICIAL INTELLIGENCE

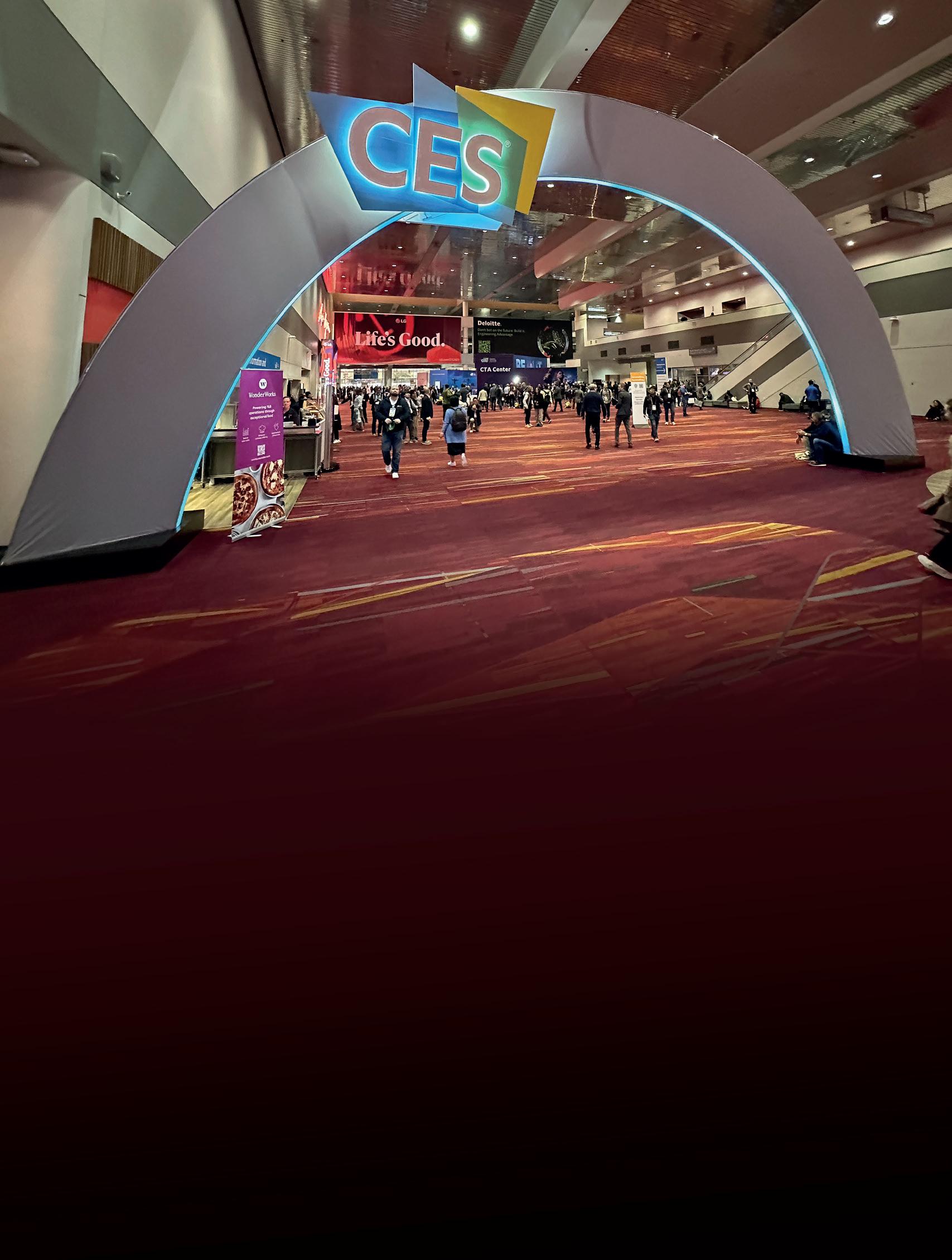

58 Where were you fintech?

Stuart Thompson roams the aisles of the world’s biggest consumer electronics show in search of an industry that really should be taking notice

61 Truth, accuracy and AI

HSBC’s Ash Booth on the possibilities and perils in a new generation of generative artificial intelligence

ALTERNATIVE ASSETS

67 Alternative realities Ron Delnevo asks if central bank digital currencies are less about fending oºff competition from cryptos and more about advancing a political – and cashless – agenda

70 The knowledge exchange

In a tumultuous year for the crypto industry, Bitstamp set out to restore faith by tackling the biggest obstacle to adoption… ignorance

LAST WORDS

74 How will 2023 unfold?

Predictions from Ram Gopal, Leda Glyptis, Brett King, Tom Eggleston and Igor Tomych

4

THE GOOD SHIP BANKING THE GOOD SHIP BANKING

CONTENTS 52 36

CHALLENGER CHALLENGER

67

TheFintechMagazine | Issue 27 ffnews.com All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott PRODUCTION Taylor Griffin HEAD OF CONTENT Douglas Mackenzie HEAD OF MARKETING Ben McKenna CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Joshua Hackett FEATURE WRITERS David Firth l Tracy Fletcher Tim Goodfellow Martin Heminway Natalie Marchant Martin Morris l John Reynolds James Tall l Frank Tennyson Stuart Thomas l Sue Scott Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP ACCOUNTS TEAM Jacob Bruce Tom Dickinson Nicole Efthymiou Emillie Snelgrove VIDEO TEAM Lewis Averillo-Singh Alexander Craddock Max Burton IMAGES BY www.istock.com PRINTED BY Print it 24 seven "PROUDLY NOT ABC AUDITED" THEFINTECHMAGAZINE 2023 ISSUE #27

the new economy Unlocking

the globe, from droughts and wildfires to devastating floods.

Those twin fears – around the rising cost of living and the impacts of climate change – are challenging consumers across Europe and beyond, according to Tasha Chouhan, UK and Ireland banking and lending director at Tink, Europe’s biggest open banking platform.

The world is caught between a rock and a hard place. Facing a global economic slowdown as well as rapidly accelerating climate change, we need to alter the way we think and act to avoid worsening the situation further.

Largely in response to the soaring energy prices that were driving inflation, central banks in the US, UK and Europe have raised base rates multiple times in less than a year. In the UK, higher repayments are contributing to an overall 12 per cent cut in real incomes for a typical mortgaged household between 2020 and 2024, the think tank the Resolution Foundation forecasts.

Meanwhile, in January 2023, winter climate records were smashed across many countries in Europe, with Bilbao in Spain seeing temperatures reach summer levels of 25°C. At the same time, parts of North America suffered one of the coldest snaps ever recorded with historic snowfalls. The year also saw a host of climate-related catastrophes across

Chouhan highlights this as a tipping point at which Tink is ready to step in.

Open banking empowers banks and financial service providers to help consumers adapt to ever-changing economic and environmental conditions.

To do this, Tink is focussing on three areas of development: lending, payments and personalised banking services – including sustainability tools.

Tink’s September 2022 report, Lending Unlocked: A New Era Of Credit, for which pollsters YouGov spoke to 380 financial executives across Europe, revealed that 58 per cent of lenders had tightened their consumer lending criteria, including for mortgages, while 54 per cent are more careful when considering business loans.

“Forcefully restricting lines of credit will have a further negative impact on an already turbulent economy,” the report points out. “While it’s vital to protect vulnerable consumers from taking out loans they can’t afford, it’s of equal importance that those who can afford them are given a fair assessment. This means using the best tools available to

prevent anyone from financial trouble, either by borrowing more than they can afford or being forced to turn to less mainstream – and less regulated – forms of credit.”

Tink believes that using open banking to provide information about credit applicants’ financial circumstances will have a transformative impact for both consumers and lenders.

“From this report, we’ve been able to understand there are a number of key factors that are really driving the need for change in the current economic climate – the cost-of-living crisis that everybody’s feeling in Europe, but particularly in the UK,” says Chouhan. “The rise of inflation and the mortgage crisis, also in the UK, really show the need for more investment into the lending models that we have.

“Some of the lending models available today don’t take into account the fact that applicants’ circumstances are changing on an ongoing basis. Accurate and up-to-date information is needed for decisionmaking, and this is something that the traditional manual processes don’t always offer today.

“We’re looking at how open banking and real-time information can improve risk profiling. How a credit applicant’s transaction history, with real-time insights into their incomings and outgoings, can help lenders assess their affordability and creditworthiness.”

Tink’s own research underlines the vast

6 OPEN BANKING: EMPOWERING CUSTOMERS

TheFintechMagazine | Issue 27 ffnews.com

With their customers facing not one but two existential threats, banks need to seize the open banking moment and drive real change in 2023, says Tink’s Tasha Chouhan

Tink-ing outside the box: Open banking data helps address more than one pressing issue

potential offered by open banking and establishes a clear need for its services among lenders.

When asked what the most common reasons for being unable to assess applicants’ creditworthiness were,

responses ranged from the biggest barrier being ‘unable to verify assets or collateral’ (31.8 per cent), to being ‘unable to access payment history’ (23.7 per cent).

In addition, half of lenders are still not using data-driven technology to generate a credit score for loan applicants, while more than a third (35 per cent) are not using bank account data to get a clear picture of an applicant’s expenses and their overall affordability for a loan.

That said, many of the respondents indicated they were planning to use open banking to improve those stats. So far, the main obstacle for lenders has been the inability to evaluate applicants in real time – without impacting conversion rates by adding too much friction.

7

ffnews.com Issue 27 | TheFintechMagazine

Some of the lending models available today don’t take into account the fact that applicants’ positions are changing on an ongoing basis. Accurate and up-to-date information is needed for decisionmaking, and this is something that the traditional manual processes don’t always offer today

“With the economic crisis showing no sign of slowing, better decisions on lending are needed to protect and support consumers and businesses who might be struggling with affordability in the year ahead,” says Chouhan. “The good news is that there is a growing appetite to embrace open banking-powered technologies, with 41 per cent of lenders planning to adopt digital solutions for data-driven credit scoring.

“Traditional credit checks are often limited, requiring a lot of manual input from both the applicant and the lender. This often leads to an outdated view of their creditworthiness.”

Tink is extending its partnerships with fintechs to layer on additional services for its banks’ customers.

One of these fintechs is the technology platform Youtility, which provides UK retail banks with embedded subscription and money management tools. Through up-to-date transaction data, the app allows customers to set budgeting goals and achieve savings on household bills, such as energy, broadband, phones and TV subscription services.

“Providing proactive money management insights – through data that shows consumers where their money is going and how they can save – demonstrates the real-world value of open banking,” explains Chouhan. “In helping consumers navigate the very serious challenges presented by the cost-of-living crisis, our collaboration is showcasing the significant benefits that open banking technology has enabled.”

Of course, when it comes to climate change, the world faces a far harder and longer journey, but financial prudence during a cost-of-living crisis could have a positive impact on the planet, too. A better understanding of a household’s energy costs and how to reduce them, would, for example, lower emissions. And Tink’s research shows a growing demand among customers for tools that enable them to do their bit.

“A clear majority (62 per cent) of 18 to 34-year-olds want more information about their carbon footprint, and more than half expect their financial services provider to do more to help them reduce it,” says Chouhan, quoting from research commissioned in early 2022 during which Tink surveyed 2,000 UK consumers, asking them about the importance of cutting their own carbon footprint.

fail to give full, transparent visibility over their environmental impact and carbon footprint may be at risk of alienating a key segment of their customers.”

It’s a warning that Tink, itself, is pushing hard to address, again by forging alliances with banks and fintechs. For instance, it has teamed up with sustainability-as-a-service provider Ecolytiq, to use open banking data to allow customers to have a deeper understanding of how consumption habits impact the environment, empowering them to make climate-positive changes.

Berlin-based Ecolytiq is also part of the Visa Fintech Partner Connect Programme where, for example, in Canada it is linking with co-op credit union Vancity to create a banking web application called Carbon Counter. It allows every Vancity Visa credit cardholder to be able to track the estimated carbon emissions of their credit card purchases.

Chouhan emphasises that Tink is committed to enabling services that can help people both better manage their money and to safeguard the planet.

“Tink’s Money Manager technology is designed to help banks deliver tools that help people improve their finances by creating personalised insights with seamless actions that drive meaningful change,” she says.

“Nearly half (43 per cent) said they would switch to a new financial provider which allowed them to see the environmental impact of their purchases. As the climate crisis worsens, it’s clear that consumer expectations for financial institutions are rising. Banks that

“Both the climate crisis and rising cost of living are defining issues for consumers, which is why we are building an ecosystem of partnerships, including Youtility and Ecolytiq, to provide the clarity needed for people to make meaningful decisions on how they manage their finances and reduce their footprint.”

OPEN BANKING: EMPOWERING CUSTOMERS 8 The ffnews.com

Driving green behaviours: Open banking can help address customers’ environmental concerns

As the climate crisis worsens, it’s clear that expectations of financial institutions are rising. Banks that fail to give full visibility over environmental impact risk alienating a key segment of their customers

Keep your digital banking experience relevant for your customers

Customers’ expectations are changing and they are demanding more from banks than ever before. Discover what is globally available in digital banking app features and how to stand out from competition while delighting your customers with a frictionless digital banking experience.

Mobiquity helps clients to create and deliver customer-centric digital products, that maximise revenue and orchestrate effortless digital banking user experiences.

Set your bank apart from the competition!

www.mobiquity.com

M Stand out in a crowded marketplace

M Adopt latest technologies and innovations

M Enhance your customers banking experience

M Maximise revenue

INTERACTIVE GLOBAL BANKING FEATURES RADAR OPEN ACCOUNT MANAGEACCOUNT MANAGE FINANCES SAVEMONEY INVEST MONEY PAYOTHERPEOPLE GET PAID LOANMONEY C TCENNO & TCAPMI SGNIHTYUB & YAP B I L L S DIFFERENTIATORS DELIGHTERS MUSTS MUSTS DELIGHTERS DIFFERENTIATORS

DOWNLOAD RADAR

A slice of the action

If you imagine the EU’s second Payment Services Directive (PSD2) as a simple-but-classic margherita pizza, could the next iteration be a meat-feast-stuffed crust of possibilities beyond payments?

The Italian payment providers’ community and infrastructure provider CBI is preparing for just such a future, and is determined to guarantee itself and its clients a significant slice of it.

It has seen API adoption and traffic across its CBI Globe open banking platform explode since PSD2 came into full effect in 2019, thanks to the directive’s success in boosting innovation by opening up the payments market to new entrants.

While it introduced the concept of open banking, it limited data sharing to payments information. Now, the EU is actively considering the introduction of a ‘PSD3’ to create truly open finance.

To pave the way, the Commission carried out an open finance framework consultation last summer, and is gearing up to present a legislative proposal for an open finance framework in Q2 of 2023 for an update/review of the PSD2. Similarly, CBI will make a case for the introduction of open finance in its Global Finance Report, which will be released on 23 March.

Head of banking and financial market, Alessio Castelli, says: “The report will look

at the evolution of open banking and open finance over the last two years, and present the best-in-class use cases, new companies and innovations developed by financial institutions, in Italy and across Europe, showing triple-digit growth in open banking services.”

Whatever PSD3 looks like, it is widely acknowledged that regulators will need to ensure any new rules provide a level playing field for incumbents, neos and fintechs alike, while protecting customers through better supervision.

Castelli explains: “Open finance is a new paradigm within the finance landscape, an evolution of open banking aiming to allow end-users, corporate and retail, to utilise innovative services that better meet their needs through functionalities with wider scope than typical banking products, like personal financial management or wealth management.

“It also gives financial companies the opportunity for new commercial strategies, with upselling and cross-selling opportunities utilising financial data.”

Castelli says several factors are driving the open finance uptake, which is contributing to such hockey-stick growth.

“The first element of open finance is regulatory, where market players must respect the mandatory rules defined by the authorities, as in Europe with PSD2 forcing traditional banks to open their systems to third parties,” he explains.

“The second is market-driven, where players drive different behaviours among end-users by selling new products offering great user experience and wide interoperability,” he adds.

The European Commission’s efforts to facilitate open finance include its 2020 Digital Finance Package aimed at boosting market competitiveness for operators within the European Economic Area by prioritising digitisation in finance.

“In Italy, we also have the national competent authority, the Bank of Italy, which is offering support to market innovators through channels including Milano Hub and the Regulatory Sandbox,” adds Castelli. But regulation must be balanced with freedom to innovate, to realise the full potential.

“Market operators need to understand the rules well, while regulators need to understand the market’s needs and how the technologies are being produced,” he says.

“CBI was selected, a few months ago, to join the Bank of Italy’s regulatory sandbox, initiated by the Italian Ministry of Finance, with a project called Invoice Control Database, which aims to become a central solution in Italy for invoice financing security.

“This is a huge opportunity for us, and the Italian market, to show all innovators how it’s possible to have strong conversations with our national competent authorities.”

Democratising finance: PSD2 allowed open banking to flourish

11 OPEN FINANCE: EUROPE

ffnews.com Issue 27 | TheFintechMagazine

As European regulators begin shaping a new era of API-driven open finance, Italy’s CBI is already positioning itself and its clients to reap the benefits. Head of Banking and Financial Market, Alessio Castelli, outlines the menu of options

In many ways, then, the move towards open finance is transforming the world of finance into the kind of collaborative ecosystem where players can contribute their specialist offerings to what becomes a layered solution. And third-party providers are becoming increasingly critical to making this happen.

Castelli says: “CBI could be seen as an industry utility, helping financial institutions, European payment service providers, corporates, fintechs, IT providers, and public administrations to respond more promptly and effectively to market challenges in the digital payments landscape.

“We develop frameworks, technical guidelines and collaborative infrastructure around digital services, to help companies innovate from a B2B2C perspective.”

And it is having to adapt fast to ensure its place at the table, particularly given current macroeconomic challenges and business behaviour, including operating beyond its own borders.

“CBI has to embrace new business models and collaborate more to increase its competitiveness,” continues Castelli.

“Our main accomplishment has been creating a strong ecosystem of innovative players, collaborating to develop new services on a new technical platform. We’re also working hard to define technical and implementation guidelines, to allow wide interoperability.

“We are also developing and offering microservices, mostly through REST API technologies which can be easily integrated with wider products or processes, allowing them to offer new functionalities with low effort and good time-to-market.”

With this ready-built ecosystem facilitating API connections between banks – both challengers and incumbents – and third-party providers, inside and outside Italy, CBI stands ready to extend its community. It aims to capitalise on the effect PSD2 has had so far in opening up the market, and has the appetite to do more.

Castelli adds: “Our Italian activities are focussed on the payment industry, and we have a strong role in supporting the companies involved, but we’re also being challenged to support businesses across Europe, and attracting interest from companies all over the world, including the United States.

“This is why we’re involved in developing new services like Name Check,

a confirmation of payee (CoP) service, which will be widely adopted in the next few years,” says Castelli.

“This is in addition to our Invoice Control Database, and we’re also drafting the new generation of corporate banking in Italy. And we also have an active role in the European working groups, shaping the future of open finance, through innovative use cases and digital services.”

More than 80 per cent of the Italian banking industry uses CBI‘s Globe platform, and 200-plus payment service providers have processed over 300 million API calls through it.

Some 10 million citizens have used its CBILL service to pay 200 million bills and pagoPA payment notices, while its open finance ecosystem reaches ‘100 per cent of domestic current accounts and leading international platforms’.

on the success of PSD2 was initiated by financial services commissioner in May 2022. The commissioner wants to determine if the directive is achieving its objectives of opening up banking by forcing banks to allow their competitors access to customer data, reducing fraud with the introduction of new security measures, and cutting card transaction fees through a ban on additional surcharges for debit and credit card payments.

Hundreds of trade associations, businesses and individuals have so far responded, including the European Banking Authority (EBA), which said the benefits of PSD2 are starting to materialise, writing in its submission that ‘the security requirements – in particular, SCA – are having the desired effect of reducing fraud’, with instances three times higher for payments authenticated without SCA.

Notwithstanding any teething problems that may have occurred, it’s widely recognised that PSD2 heralded a payments revolution. It increased competition and innovation in payments, and more than 2,700 new payment and electronic money institutions have been registered since it came into effect.

The EBA has acknowledged that any future iteration should encompass pensions, insurance and investments.

It also supports 400 payment service providers; around three million Italian companies use its payment processing standards and ‘seven central public administrations have simplified access to the Italian financial industry.‘

A PAYMENTS REVOLUTION

CBI’s involvement in the national regulatory sandbox aims to eradicate the risk and cost associated with fraudulent invoices in the B2B2B space. Selected intermediaries and other third parties are also involved in the operational workflow, which is open to welcome new players.

They are carrying out various operations in real time to see how these could be protected against mistakes and fraud, through REST API interfaces, with data flows protected by advanced encryption and using CBI’s technologies to create a centralised database of information related to advanced bills, from a multi-bank and multi-channel perspective.

Ahead of its successor’s introduction, a 12-month, industry-wide EU consultation

So, what finance functions have made up the largest proportion of CBI’s increase in API numbers over the past two years?

“Our analysis showed a 35 per cent year-on-year increase in the number of APIs offered by fintechs, the majority with commercial rather than mandatory applications,” says Castelli. “Ninety-five per cent of APIs have informative functionalities like account aggregation, with the other five per cent addressing payment initiations.

“And these APIs, of course, could be integrated within other fintech applications – for instance, personal financial management and savings management.”

The report highlights a 93 per cent growth in the number of third-party providers operating within SEPA and a 130 per cent API growth in the last few months, with a strong increase in the adoption of the informative services.

“So we are working on all these activities,” says Castelli, “to offer to our clients the best solution, the highest interoperability, and the best user experience.”

12 OPEN FINANCE: EUROPE TheFintechMagazine | Issue 27 ffnews.com

Our main accomplishment has been creating a strong ecosystem of innovative players, collaborating to develop new services on a common technical platform

Securing Everyday Digital Payments

Giesecke+Devrient’s future-proofed payment technology is securing billions of people on a daily basis globally: Our tokenized payment solutions are repeatedly awarded as best-in-class, and our worldwide customer base of renowned brands leverage on our proven track-record in securing everyday digital payments.

With our secure digital payment solutions you will enjoy increased customer satisfaction thanks to frictionless payments – ready for you to customize and gain competitive advantages.

Digital Payments your Customers will Love! #futurebanking

Follow us on:

14 PAYMENTS: INFRASTRUCTURE SHORT CUTS FAST GROWTH TheFintechMagazine | Issue 27 ffnews.com Now entering its fourth year, the Visa B2B Connect network for high-value business payments is making good on its promise to shake up correspondent banking, says Ben Ellis, SVP and Global Head of Visa B2B Connect at Visa Business Solutions

Disrupting the 130-year-old correspondent banking network, to which more than $100trillion in global cross-border B2B payments are entrusted each year, is a monumental task.

And even a world leader in digital payments like Visa doesn’t expect to displace the complex relationships that have built up between correspondents overnight. However, there’s a ‘$10 trillion opportunity’ in cross-border transactions to compete for by using an alternative network, as Visa’s Executive Chairman Al Kelly described it.

That service is Visa B2B Connect, a bank-to-bank money movement network for high-value, cross-border transfers. It forms a key part of the company’s

points for a long period of time,” he says. “We know this because we’ve done the surveys, we’ve talked to the banks and the corporates, and we’ve asked them ‘what are the challenges?’.”

Solutions to those challenges – for high-value payments at least – have not been as easy to find as those that address the lower-value B2B and consumer markets.

“Because, if you’re going to solve it,” says Ellis, “what it takes is a company that knows how to build and operate a network at scale – from a technology perspective, from a rules and regulation perspective, from a compliance and security perspective and from the perspective of how you service a large number of financial institutions in the right way.

“That’s what Visa does and has been doing for decades in our traditional business.”

The service was informed by a survey conducted for Visa in 2019 that showed nearly 70 per cent of corporates across 20 countries had experienced systemic issues in cross-border payments, ranging from speed to cost and visibility into the transaction journey, as well as limited ability to send information alongside the payment to assist with reconciliation.

The aim with Visa B2B Connect was to dramatically simplify the journey by facilitating transactions between the bank

financial institutions with a faster (within the same business day, depending on when the payment is sent), cheaper and fully transparent cross-border payments experience for the user. Last year, for example, the network added banks in Tanzania, Uganda and Angola.

“The quest to deliver fast global business transfers is taking on greater precedence, with clients eager to adopt more visible and efficient payment processes,” says Ellis. “What banks are getting by using Visa B2B Connect is the trusted expertise and capabilities that help enhance the payments experience for their customers: innovation at a global scale from one of the most trusted brands is a true differentiator.”

One of the advantages of Visa B2B Connect for banks is that it gives them a set of options, says Ellis. As the world recovers from the 30 per cent slump in global trade that put a dampener on international B2B transaction flows following the pandemic, anything Visa B2B Connect can do to facilitate global trade by giving banks and corporates a fast-track to growth, it will, says Ellis.

“We’re seeing more and more businesses increasingly operate across borders, and the rise of B2B e-commerce and online marketplaces is driving

‘network of networks’ strategy. Visa B2B Connect is another way to grow out a robust Visa infrastructure, which adds more endpoints and attracts more clients.

There is no doubt that there is demand among financial institutions and their corporate customers for such an alternative to traditional correspondent banking corridors, according to Ben Ellis, SVP and global head of Visa B2B Connect at Visa Business Solutions.

“Cross-border payments for businesses paying other businesses has been an issue with a lot of pain

of origin, directly to the beneficiary bank with no stops in between.

“So, we built a multilateral banking network for high-value B2B payments where banks can sign on to the network and send directly through Visa B2B Connect, to anyone else on that network,” explains Ellis. “You can deliver payments with full value, full predictability, and full knowledge of what the fees and costs are going to be.”

Visa B2B Connect is currently available in more than 100 countries and territories where it’s accessed by more than 60

more cross-border transactions,” he says.

“But several factors complicate cross-border commercial payments –payment infrastructures vary by country; the landscape of regulations governing cross-border transactions is fragmented by geography; providers are plagued by complex internal business processes and operations… the list goes on.

“Visa is committed to helping merchants, fintech clients, corporate partners and individuals alike move money around the world, and at scale.”

15 ffnews.com Issue 27 | TheFintechMagazine

Several factors complicate cross-border commercial payments – payment infrastructures vary by country; regulations governing cross-border transactions are fragmented by geography; providers are plagued by complex internal business processes and operations… the list goes on

parisfintechforum.com EARLY BIRD 20% OFF until 31/03/2023 PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PARTICIPANTS 40 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PARTICIPANTS 40 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PARTICIPANTS 40 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PARTICIPANTS 40 COUNTRIES PARIS ∞ NETWORKING 10 0 SPEAKERS 50 0 PARTICIPANTS 40 COUNTRIES

THEY WILL BE ON STAGE

JM. CAMPA European Banking Authority (FR) Chair

C. CHICHE Lydia (FR) CEO A. DALMASSO Satispay (IT) CEO L. DAVID BNP Paribas (FR) Deputy CEO / COO C. HOGG Visa Europe (UK) CEO

I. DIMITROVA OpenPayd (UK) CEO

N. DUFOURCQ Bpifrance (FR) CEO

P. GAUTHIER Ledger (FR) CEO G. GRAPINET Worldline (FR) CEO E. GUEZ Papaya Global (IL) CEO J. JANARDANA Zopa (UK) CEO J. LAMBERT Mastercard (US) Chief Digital Officer JP. MAZOYER Crédit Agricole (FR) Deputy CEO P. NANU Nium (SG) CEO A. PROT Qonto (FR) CEO

F. TRAVELLA Novicap (ES) Executive Chairman

A. SHTILMAN Rapyd (IL) CEO D. KJELLEN Tink (SE) CEO T. GEORGADZE Raisin (DE) CEO E. ROSSIELLO AZA Finance (UK) CEO

M. KNECHT Billie (DE) Co-CEO JC. SAMUELIAN Alan (FR) CEO F. VILLEROY DE GALHAU Banque de France (FR) Governor

M. WEIMERT EPI Company (BE) CEO

S. BOUJNAH Euronext (NL) CEO

2023 SPONSORS INCLUDE: 2023 SPONSORS INCLUDE:

PRINCIPAL SPONSORS

SPONSORS

Gary Collier Gary Collier CTO of Man Alpha CTO of Man Alpha Technology Man Group Man Group

Rafa Lopez-Espinosa Rafa Lopez-Espinosa COO of International COO of International Business Business Point 72 Point

Romain Boscher Romain Boscher Chairman of the Board, Chairman of the Board, Senior Advisor Senior Advisor Fidelity Investments Fidelity Investments

Cathy Gibson Cathy Gibson Global Head of Trading Global Head of Trading Ninety One Ninety One

Jane Buchan Jane CEO CEO Martlet Asset Martlet Asset Management Management

George Patterson George Patterson Chief Investment Officer Chief Investment Officer PGIM Quantitative PGIM Quantitative Solutions Solutions

Yannig Loyer Yannig Global Head of Trading Global Head of Trading AXA Investment AXA Investment Managers Managers

Marc Wyatt Marc Wyatt Global Head of Trading Global Head of Trading T. Rowe Price T. Rowe Price

Alison Hollingshead Hollingshead COO of Investments COO of Jupiter Asset Jupiter Asset Management Management

Mike Steliaros Mike Global Head of Equity Global Head of Equity Portfolio Engineering Portfolio Engineering and Trading and Trading ADIA ADIA

Shamik Dhar Shamik Dhar Chief Economist Chief BNY Mellon Investment BNY Mellon Investment Management Management

Jon Glennie Jon CTO of Trading CTO of Trading Technologies Technologies JP Morgan Asset JP Morgan Asset Management Management

Palais des Congrès de Paris Palais des Congrès de Paris

Gary Collier Gary Collier CTO of Man Alpha CTO of Man Alpha Technology Man Group Man Group

Rafa Lopez-Espinosa Rafa Lopez-Espinosa COO of International COO of International Business Business Point 72 Point

Romain Boscher Romain Boscher Chairman of the Board, Chairman of the Board, Senior Advisor Senior Advisor Fidelity Investments Fidelity Investments

Cathy Gibson Cathy Gibson Global Head of Trading Global Head of Trading Ninety One Ninety One

Jane Buchan Jane CEO CEO Martlet Asset Martlet Asset Management Management

George Patterson George Patterson Chief Investment Officer Chief Investment Officer PGIM Quantitative PGIM Quantitative Solutions Solutions

Yannig Loyer Yannig Global Head of Trading Global Head of Trading AXA Investment AXA Investment Managers Managers

Marc Wyatt Marc Wyatt Global Head of Trading Global Head of Trading T. Rowe Price T. Rowe Price

Alison Hollingshead Hollingshead COO of Investments COO of Jupiter Asset Jupiter Asset Management Management

Mike Steliaros Mike Global Head of Equity Global Head of Equity Portfolio Engineering Portfolio Engineering and Trading and Trading ADIA ADIA

Shamik Dhar Shamik Dhar Chief Economist Chief BNY Mellon Investment BNY Mellon Investment Management Management

Jon Glennie Jon CTO of Trading CTO of Trading Technologies Technologies JP Morgan Asset JP Morgan Asset Management Management

Palais des Congrès de Paris Palais des Congrès de Paris

No time like the real-time

Back in 2019, Helmut Wacket, head of division at the European Central Bank, told a gathering of payments leaders in Germany that the business case for banks to adopt real-time payments was simple: “The business case for banks is to stay in business!” he said.

Notwithstanding the challenges of legacy technology, banks heeded Wacket’s implicit warning and have adapted and adopted real-time rails. It’s still a work in progress: the European Commission has a vision to create an interoperable network of instant payment schemes cross-border and it’s not satisfied with current levels of service. In October last year it put forward a proposal that would compel all payment service providers (both inside and outside the EU) that offer transfers in euros to be available 24 hours a day, 365 days a year. The Commission hopes that such a move will also drive open banking adoption.

In the United States, there's still all to play for when it comes to real-time, although here much of the innovation around instant payments is being driven by the market, not legislators.

There are a lot of moving parts to keep track of in the US payments space right

now, not least the institutional duopoly of The Clearing House and the Federal Reserve locked in a race to provide instant domestic and instant cross-border services. The Federal Reserve Banks’ FedNow Service to facilitate nationwide, round-the-clock reach of instant payment services by financial institutions is scheduled to go live between May and July 2023. Then there is Swift’s transition to ISO 20022 to consider, which all providers in the US will have to comply with by 2025. And there are signs that the US is finally loosening its grip on paper-based cheques (both B2C and B2B) – a move accelerated by the pandemic.

Volante, a Cloud-based, low-code payments-as-a-service provider, aimed at established institutions looking to engage with what it calls ’payments modernisation 2.0’, is right at the heart of this evolution.

Operating across not just North America, but also LATAM and EMEA, it enables customers, including many mid-tier banks with limited resources, to rapidly bring new payments products and services built on top of instant payment rails to market, fast. Once that real-time door is open, the value-added solutions it unlocks for customers are limitless, says Rachel Hunt, VP for strategy and growth at Volante.

“Instant payments introduces a complete business change in the way that the banks interact with their customers. It’s not just the introduction of a new method of payments; it has a fundamental impact on the way that you run your business, and how you service your customers.

“It’s always a journey towards instant payments, because there are so many parts of the organisation that are going to be touched on: it’s the people, the processes, and the systems you have in place,” she adds. “And what’s really exciting in the US right now is that we’ve reached a hockey-stick moment.

"The pandemic clearly showed that we had to be digital, that it was important to have real-time information and real-time payments to navigate everything we’ve gone through, and make sure organisations could continue to operate. If you want to keep up with all the change that’s going on in the US, or even globally, then you have to think about real-time.”

Following the pandemic, same-day automatic clearing house payments – once seen as a good enough proposition by banks – were no longer viewed as such by their corporate customers.

19 PAYMENTS: INSTANT PAYMENTS USA

ffnews.com Issue 27 | TheFintechMagazine

The US payments landscape is being driven by a unique set of circumstances that will have deep and lasting impact on how business gets done. Volante’s Rachel Hunt says banks must move fast – in more ways than one!

“One, there’s a fee, so there’s a cost to that proposition. That isn't right,” says Hunt. “And second, it’s not real real-time, which is important for a number of reasons, not least liquidity management. Instant payments (mean) you have the visibility to be able to manage your liquidity better.”

In the last couple of years, there has been an uplift in the number of federally insured US depository institutions using The Clearing House’s Real-Time Payments Platform (TCH RTP). Banks joining the scheme are now beginning to think more about the use cases and the value-added services they can build on top.

“We’ve been a key player in that market, and, with some of our customers, have processed some of the first TCH RTP transactions in the US,“ says Hunt.

“Although there are more than 100 participants in TCH RTP, with FedNow we’re talking about instant payments reaching scale in the next few years in the US. There’s a real opportunity to bring real-time payments to tier 2, 3, and 4 organisations.”

For her, the billion dollar question going forward is how can scalability of real-time payments be achieved with accuracy and security across all institutions, but especially among those mid-tier banks, which face challenges on a number of fronts, she says.

“One is the skills available in the market. We’re in an incredibly tight environment, in terms of skill sets and people. And then many of these banks are asking ‘can I really spend this investment building my own teams, building the scalability, the resilience – all of these things that you have to have with real-time payments – in house or should I partner with a vendor?”

Hunt would argue the latter for a number of reasons, not least that by choosing to build themselves they often end up settling for the minimum viable solution which does not allow the organisation to fully benefit from the kind of transformation that real-time payments systems represent. Indeed, many have come to the same conclusion; Hunt says that as-a-service, is now where the majority (80 per cent) of organisations are focussing their strategies as they receive and consume payments software.

“When we talk about SaaS, or PaaS, people always mention cost first. (Yet) there are economies of scale that come with such a service: the vendor invests in that environment, it’s secure, it’s tested, it

complies to the regulation,” says Hunt. “It’s already built for scale, for resilience, for availability, and the right partner is going to bring you the next set of innovation requirements that are going to happen.Because we’re no longer in a world where the new methods of payments happen once every 20 years. The new rails are one thing, but then there’s the valueadded services like Request for Pay/ Request to Pay and questions around how you are going to embed that offering within the broader payments value chain.”

She uses Request to Pay in Europe as an example of how a payments service processed on a real-time rail can have a big impact on both a bank’s corporate and retail customers.

“If you think about your electricity, gas or water bill and you had your utility provider saying, ’I understand it’s difficult times, your bill is $100, but actually we’re sending you a Request to Pay $50, $70, $80, whatever you can afford to pay at this particular time,’ then, from a consumer perspective, you think, ’OK, that’s really nice’. It’s about understanding what your core service offering is to your customer base – can you offer a better customer experience to the end end customer?”

that experience, offer different opportunities and services in the bill pay, if you start attaching APIs and instant payments.”

The emergence of the as-a-service as an alternative to a licensing model (based upon a set contract) coincides with ‘a huge amount of convergence happening in payments’, says Hunt. She urges companies to think about how their payment flows will evolve over time. For instance, you might continue to receive some payments through ACH bulk files, ‘but the best way is to send them through the real-time rails,’. This is especially true of contractors, and individuals operating in the gig economy, for example, where swift payment resolution is a basic requirement.

“There’s going to be some convergence between wires, ACH, and instant payments,“ Hunt observes “and it’s really going to be driven by your customers’ preferences.“

It all comes down to smart routing.

“As individuals, or as corporates, we really don’t care which rail the payment is being used, so long as my payment is going to go through, I have visibility, and it’s based on my own risk preferences, or time requirements,“ she says.

Hunt is particularly excited about the possibilities of adding value in the B2B payments space and how banks can use it to enhance their relationships with corporate customers.

Hunt also sees opportunities to incorporate an instant pay use case into the buy now, pay later space.

“BNPL is still very much reproducing a credit card experience,” she says. “It’s sort of based on account-to-account, but it’s not that seamless, it’s not as instant as you’d like it to be. So, if you could start thinking about BNPL with a bill pay, instant payment sort of use case, that would also be interesting. It’s about delivering the right customer experience, at the end of the day, whilst creating a little bit of efficiency in getting those payments.

“In the US, there’s a huge bill pay industry that is available, but there’s less focus on open APIs, and being able to do the account-to-account in a consistent manner. Again, there’s a big opportunity to improve

“An example would be how can we attach a Request to Pay with an e-invoice, and make that seamless?” she says. “Cross-border e-invoicing is a real headache. There are some standards, but they vary and everybody uses different financial messages. How can banks create a really nice experience, where we join up instant Request to Pay and e-invoicing and make that seamless for a corporate that’s trying to do international payments?

“That’s why it’s so exciting to start seeing linkages between instant-payment central infrastructures cross-border as has already happened in Asia, with Singapore, Thailand, Malaysia signing MOUs, and linking up instant central infrastructures. We’re starting to see it across Europe and the US. That doesn’t mean that SWIFT doesn’t continue to be an important part of those transactions for cross-border, but it gives an alternative. It’s just a really interesting development that’s exciting for the industry. Ultimately, flexibility is what many customers have been looking for.”

20 PAYMENTS: INSTANT PAYMENTS USA TheFintechMagazine | Issue 27 ffnews.com

There's going to be some convergence between wires, ACH, and instant payments and it’s really going to be driven by customers’ preferences

Register Now! ► 45+ Speakers ► 2 Stream Agenda ► Allocation of Free Passes for Member Firms ► 250+ Delegates ► Network, Learn, Connect ► Agenda Created by Senior Industry Experts Event Facts & Figures www.fixtrading.org/nordic2023 Created by the industry, for the industry

Are we falling out of love with cards? If anything, our relationship is proving remarkably resilient, agree Alex Page from FIS Worldpay, G+D’s Alex Gatiragas and Kurt Schmid from Netcetera. Here, they discuss how tokenisation,

and how much it costs retailers and banks to support them as a payment method – and, with increasing adoption of open banking, how many payments might in future be made account-to-account and avoid using them altogether.

Various open banking payments platforms released a series of surveys last summer in which merchants and other payment decisionmakers supported the view that a stake was about to be buried into the heart of our flexible friend.

powered much of that card spend. Global retail e-commerce sales amounted to about $5.2trillion in 2021 and this figure is expected to rise by 56 per cent to about $8.1trillion by 2026, according to Statista.

How long will we persist with card-based payments that have, with a lot of effort, been retro-fitted into an online world?

It’s an important question, given how much is invested in the card economy

In one poll, 25 per cent of respondents in the UK predicted that open banking would become the most popular payment method by 2027. That would be some going, given that data from the British Retail Consortium showed that card payments still accounted for 90 per cent of all retail transactions in 2021, while UK Finance said cards made up 57 per cent of payments overall that year.

The popularity of e-commerce, accelerated by COVID-19 shuttering stores during pandemic lockdowns, has

But, even if cards continue to be the load bearers of that online spend in many countries, the way they are provisioned is changing dramatically. Which isn’t surprising: online is not an ideal transaction channel for cards, which were designed for an analogue and card-present payment era.

The biggest shift in their usage is revealed in the 2023 Global Payments Report from Worldpay by FIS, which tracks transaction trends over the previous 12 months. It showed that digital/mobile wallets were used in 48.6 per cent of e-commerce transactions by value. That would indicate that by now we’ve passed the 50 per cent watermark and are indeed living in the Age of the Digital Wallet. Even more flexible than the plastic on which they’re often based, wallets offer

PAYMENTS: CARDS

click-to-pay and secure customer authentication are all helping to keep the spark alive

TheFintechMagazine | Issue 27 ffnews.com 22

consumers a choice of underlying payment methods. While, more often than not that will still be a card, there are a plethora of other funding options available to them, including – increasingly – buy now, pay later.

As the so-called x-pays, like PayPal, AmazonPay and AliPay, make secure one-click payments a reality for more and more shoppers, companies including FIS Worldpay, G+D and Netcetera, are actively improving the customer experience and security for all card users, however they choose to provision them – and that’s come a long way in a short time since the pandemic.

Alex Page, vice president of solution consulting at payments and financial technology giant FIS, hands much of the credit for facilitating the rapid shift from in-store transacting to online in 2020 to the merchants.

“There has to be a huge amount of investment in marketing brand awareness to get consumers on to your website in the first place,” he says. “And once you’ve got them there, merchants need to focus on securing every customer possible and, ultimately, selling a product at the end of that journey – so, that means optimising the checkout, reducing the number of clicks, and offering consumers the payment experience that they’re after, with a global reach, tapping into local trends and payment methods.

“If, as a consumer, I go to somebody’s website, and I’m not comfortable with the payment experience that’s being offered – or maybe it’s a payment method I don’t trust – then that’s probably going to act as a very big barrier to me going ahead and clicking with that merchant, especially when there is probably a myriad of other providers that can offer the same product with a good experience and at a similar price. It’s a case of toeing that very fine line between implementing security/fraud management solutions and not impacting the customer journey.”

This is where payments tokenisation comes into play. Most of the time it’s invisible to the consumer – protecting their card credentials and other stored details. It can also be used to automatically update a customer’s payment credentials at a merchant if the card expires, or it’s

reported lost or stolen, for example. But there are some less obvious ways that it can benefit the customer, too, even if they don’t know it’s tokenisation, explains Alex Gatiragas, global head of digital solution experience at paytech company Giesecke+Devrient (G+D).

“There are subtle little things that give consumers confidence; like being able to provide the artwork of their digital or physical card, which reassures them that they’re using the appropriate card when they’re paying,” he explains. “Consumers don’t know it’s tokenisation, but I’m sure it helps with their checkout experience.”

Looking to the future, Gatiragas expects to see the self-service provisioning of tokenisation by merchants. A typical user journey then might be: a customer opens an account, receives a debit card, provisions it on to a digital wallet and then has the option to also push it to their favourite merchant – avoiding the necessity to update their card details with every single retailer.

The problem with MFA

One necessary hurdle to creating a truly seamless online retail card payment experience is the introduction of multi-factor authentication, which inevitably adds friction to the payments process – sometimes to the degree that it breaks it altogether if the customer doesn’t have the required device for authentication to hand.

It’s about building awareness among merchants, so they understand the different tools and levers they have at their disposal

Alex Page, FIS Worldpay

This is less of an issue on devices with a digital wallet, in which consumers can upload their card details to pay electronically. In the UK, the use of digital wallets for single transactions now stands at 30 per cent of sales, outstripping contactless payments in-store (24 per cent), conventional card payments online (21 per cent) and cash (17 per cent), according to a 2022

Barclaycard Payments survey. It is therefore unsurprising that an increasing number of online merchants are now using click-to-pay options that act as a shortcut to a customer’s digital wallet in order to facilitate a fast, easy checkout, particularly for those wanting to place an order as a guest.

Is there a perfect solution to balancing security and ease of use? Possibly not, although Page says that the closest we’re likely to get is using more real-time fraud monitoring.

“That involves capturing data around the customer, or prospective customers, using real-time decisioning on that data to say ‘is this a good actor, or potentially a bad actor?’ and therefore making the decision on where you’re accepting that order or not,” he explains.

In some circumstances that data can be used to make exceptions to the standard checkout journey. Page cites the example of one of G+D’s luxury retail clients, which attracts high-net worth individuals who are likely to spend hundreds of thousands of dollars in a single transaction.

“For these customers, it’s a case of just removing all the security elements that you might normally have in place, because the client knows that these individuals are going to spend a huge amount of money and they want the ultimate customer experience for them. That’s a decision they take, based on minimal risk,” he explains.

It highlights how the payments industry can offer granular bespoke levels of security for end users if it’s in possession of the right data. Page says there are already a myriad of different tools that it can use to achieve that.

“With real-time fraud checking solutions, potentially you can route higher risk customers down more stringent authentication routes as well as in those scenarios where you have a high level of trust with the customer, you, as the merchant, use exemptions and bear the additional risk and responsibility,” he adds.

“It’s really about building awareness among merchants, so they understand the different tools and levers that they have at their disposal, and relying on experts to guide them in finding that optimal journey and the decisioning across the organisation.”

ffnews.com Issue 27 | TheFintechMagazine

23

Kurt Schmid, marketing and innovation director for secure digital payments at digital payments solutions company Netcetera in which G+D recently took a majority stake, says the revised Payment Services Directive (PSD2), has already implemented such exemptions in strong customer authentication. But that means there’s also inconsistency in the user experience.

“Sometimes the user is asked to carry out authentication while other times they’re not,” he explains.

“One of the pains in payment processes today is if you get redirected to other devices – so, if you shop on your tablet, but then you need to do a payment authentication on your mobile phone, etc. You’re redirected back and forth from the issuer page to the merchant page. I think that we are seeing improvements in this, but, ultimately, we should not redirect the consumer back and forth on the user journey.”

His preference would be to make ‘authentication that easy, and that convenient’ that nobody would object to doing it. “Then we would have a consistent process. For sure, we would also have a bit more friction, but if we reduce this friction to a minimum, I think that would be a good way forward.”

An answer might be to use existing biometric technology – which many consumers are already using to access functions in their banking app – to validate a wider range of transactions, suggests Schmid.

were with an issuer that challenges every payment, but uses an easy and understandable authentication process.

“It delivers consistency, but it’s trained, and it’s easy, it’s secure, and this is the perfect experience because it is really delivering on the security we want,” Schmid concludes. “So, exemptions and risk rating is one element, but let’s try, as an industry, to remove barriers and make authentication as easy as possible, so people use it frequently.”

Europe is currently engaged in drawing up the next iteration of the revised Payment Services Directive, which laid the foundations for open banking, as it moves towards a regulatory architecture for open finance.

"We’re already seeing quite a lot of disruption within the payments ecosystem, and new, emerging methods that are challenging the card schemes, and the card networks," says Alex Page.

“I think, if we were to fast-forward 20 years, though, we’ll still have the card schemes around, they’ll still be processing a lot of transactions, but we’re going to see more challenge coming into their environment.”

Of course, there are regional differences. In markets such as Brazil and India, real-time payments over non-card networks dominate whereas others, such as Africa and South America are leapfrogging cards altogether in their payments evolution.

Meanwhile, Europe and Australasia are among those already seeing open banking enabling an ever-increasing amount of

Kurt Schmid, Netcetera

“So, for example, if you log on to your computer using biometrics, or if you use Face ID on your phone, this is totally convenient; you typically do this many times a day. And then, if you use the same authentication for payment authentication, it delivers almost no friction,” he says.

Netcetera is a large provider of 3D secure (3DS) services for many issuing banks and has recently been examining authentication success rates. It found that the highest successful conversion rates

"We’ve obviously seen regulation that’s come into the industry to facilitate more account-to-account, or open banking-style payments, and this is an area that I really want to watch closely, over the coming years. There’s still work that needs to be done, as far as I’m concerned, to try to get to parity on consumer experience from an open banking checkout. There are also questions around chargebacks and disputes, and how that would mirror into the open banking environment. But it is an area that has had quite a lot of investment. There are substantial growth figures of open banking payments, and the schemes will undoubtedly want to react to that, and do their best to protect their businesses, going forward.

account-to-account payments. The UK alone saw 6.5 million successful open banking payments in August 2022, up from 2.4 million the year before – a 267 per cent increase. But cards have the advantage of being a physical tried-and-trusted method of payment for many – even if they’re then digitally provisioned onto to another device, such as a smartphone or watch.

“The reality is, consumers recognise the brands for the card networks. I think we’ll continue to see those networks grow – and that’s certainly what we’re seeing through our issuers,” says Gatiragas.

“The other thing to remember is that for some of these alternative payment methods, the primary funding instrument is still a card.”

24 PAYMENTS: CARDS TheFintechMagazine | Issue 27 ffnews.com

The reality is, consumers recognise the brands for the card networks. I think we’ll continue to see those networks grow Alex Gatiragas, G+D

Exemptions and risk rating is one element, but let’s try, as an industry, to remove barriers and make authentication as easy as possible, so people use it frequently

Age of the Digital Wallet: But the underlying payment method is, more often than not, still a card

Mission crıtıcal

“The stock is destroyed, we’ve lost everything. We don’t have insurance; we were refused after the floods in 2012. It would cost us £10,000 a year plus £20,000 for excess.”

That’s a quote from a distraught small business owner whose comic book shop in Hebden Bridge, West Yorkshire, was inundated by the Boxing Day floods that devastated northern England in 2015. Four months later, still one third of the town’s businesses remained shuttered.

When the waters stirred up by the sequential storms Eva, Desmond and Frank finally subsided, victims across the region were left counting the cost in the billions. Some in Hebden Bridge gave up and moved out. Others figured that the chances of a ‘one in 100-year’ event hitting again in their lifetime was remote and soldiered on. They were wrong: in 2021, Storm Ciara rolled in, causing the fourth major flood in their valley in just eight years.

No matter where they occur in the world, the emotional and financial impact of extreme weather events is severe. And, according to risk modelling experts, the human and economic cost of such

disasters is increasing, as rising sea levels and drought increase the frequency and severity of flooding and wildfires.

On any day of the week, the United Nation’s global disaster map pulses with climate-related emergencies – the majority among populations with the least access to financial products that could protect them against the worst happening.

Their vulnerability to weather events that are driven by global warming, which is caused mostly by richer nations, led the G7 to launch Global Shield at the recent COP 27 climate talks in November, a plan to provide such countries with pre-arranged insurance and disaster protection funding.

What a Karachi tailor who’s seen his workshop swept away by deadly monsoons in Pakistan and a comic book trader standing knee-deep in sludge in West Yorkshire want most, of course, is affordable insurance that pays out instantly so they can get their lives back on track. And one way that could be achieved is through parametric technology.

Parametric insurance was born in the late 1990s, but leaders in the insurance space didn’t fully start to offer coverage until the early 2000s when AXA, Swiss RE and

Munich Re began to provide policies that paid out according to set limits as soon as a prespecified trigger was met, regardless of the actual loss.

“One of the most exciting things about parametric insurance is the straightforwardness of the claims process,” says Phil McGriskin, co-founder and CEO of Vitesse, a payment provider that bridges the gap between the insurer and customer by offering a range of payment options –including across borders in multiple local currencies – and helps shorten the payout time from months to a matter of hours.

“Since claims are paid automatically upon verifying that a trigger has been met, insurers are reducing costs related to a claims settlement. In a lot of cases, there is no need to send an adjuster out to inspect damage or to waste employee resources in administrative tasks associated with loss adjustment,” continues McGriskin.

“This is a huge cost saving that can be passed on to the consumer. This opens up access to cheaper insurance, which is key to supporting vulnerable communities.”

In December 2022, Vitesse partnered with climate risk insurance platform and Lloyd’s of London coverholder Yokahu,

PAYMENTS: PARAMETRIC INSURANCE 26

Rising anxiety: Businesses in northern England were refused cover or had it priced out of their reach following the 2012 floods

TheFintechMagazine | Issue 27 ffnews.com

Payments provider Vitesse is helping a new wave of parametric insurers deliver funds where they’re needed, when they’re needed – often in a matter of hours. Co-founder and CEO Phil McGriskin explains the dramatic impact that can have

– which had launched its first parametric hurricane insurance in the Caribbean islands seven months earlier – and parametric insurtech FloodFlash. The latter combines computer models, the Cloud and the Internet of Things to provide cover to businesses specifically at risk of flooding.

“Almost every country in the world has a flood under-insurance problem,” says McGriskin. “In 2021, this amounted to $82billion in global losses, which is almost a third of all economic losses due to natural disasters. Clear and defined parameters in parametric policies mean customers know what is and is not covered; in a time of stress and crisis, this gives them clarity and comfort in what they will be able to claim for. It also gives the underwriter the ability to know their client needs them and that it’s time for them to step into action and help. And that’s where we come in.”

In May 2016, nearly 18 months after the floods that devastated Hebden Bridge, the Association of British Insurers gave an update on how many of those who had cover and who claimed had been paid. Fifteen per cent were still waiting.

“Ninety per cent of small companies fail within a year if they cannot resume operations within five days,” says McGriskin. “To get their customers back on their feet, insurers need to be able to process the claim and make that payment, as quickly as possible.”

Vitesse’s first experience of paying a full commercial flood claim under parametric insurance followed Storm Franklin, which hit the UK in early 2022.

“Measuring not from claim submitted to claim approved – which is how most insurers would measure it – but from water hitting their client’s building to cash hitting their bank account, we achieved a payout for them in five hours and 36 minutes. That makes a material difference to the survival of a business,” says McGriskin.

“Processing cash through the market can be a fairly convoluted process, but through more efficient treasury processing we’re able to ensure there’s the right money, in the right place, at the right time. We can pull funding down from those pots of cash instantly, every time, to service a claim.

“Giving insurers a single platform in which to manage and process payments to reach small business owners within 24 hours, helps people, businesses and communities recover from catastrophe quicker.”

Parametric cover isn’t all about headline-grabbing weather events –although it’s clearly where it can have the most profound impact. Increasingly, the technology is dramatically improving the customer experience in more everyday situations that are faced by both businesses and consumers.

“Parametric providers have been focussed on insuring natural catastrophes, as they’re easy to monitor and confirm something’s happened. You can put up a flood or wind monitor, and you know that, once a limit has been exceeded, a certain amount of damage will have been done. But now we are seeing parametric insurance being used more and more in vehicle and travel insurance, and beyond,” says McGriskin.

are harder to come by and a welcome holiday could be marred by a cancelled flight. An insurer can provide cover to activate upon cancellation so the insured can purchase a return flight home without worrying about how they pay for it.

“Such parametric covers are quite closely twinned with embedded finance. And I still think that has a long way to run. As we do more and more online, the ability to tick a box to have what you’ve just bought covered for a small price is very appealing. And having that one-click digital experience replicated across the claims process, right the way through to payment, is how you win the market.”

As a paytech, Vitesse made its mark by offering a single connection to a network of domestic clearing systems for insurers, financial services companies, e-commerce and other corporates, landing full value payments as quickly as possible with the payee, while also giving its clients a simple, real-time view of their global liquidity.

“Software is intrinsic to the process because it allows everything to happen in real time,” says McGriskin. “Parametric covers rely on businesses like McKenzie Intelligence Services, a software provider that taps into data sources that will allow parametric providers to understand where in the world a problem is occurring, how severe it is, and to what extent the goods that they have covered are damaged.

“A lot of vehicles being sold now will be fitted with onitoring systems that record if the vehicle is damaged somehow. The claim will be initiated by the car’s systems and sent off to the manufacturer or the insurance provider. It's paid and settled without the driver having to get involved, which is great for the driver's insurance experience and for the manufacturers themselves because it keeps the customer within their dealer/ repair network, keeping their costs leaner.

“Parametrics also feed down into the travel space, which many of us can relate to – I think we all have experienced delays and cancellations across the past couple of years. Companies have seen this pain point and are building covers around that.

“That’s all the more important with the cost-of-living crisis, when disposable funds

“But software also includes payments,” he continues. “It’s about making sure that once you have all of this information and you've made your decision, that you’re not making the customer wait to get their money and that it’s paid in the way that’s going to make the most difference to them.

“It might be a real-time payment to a card or a multimillion dollar-to-peso payment to a bank account in Mexico. You have to make sure you have that in place because there’s no point in saying I can give you a judgement on your claim immediately, but you get your money in two weeks.

“I would like to think Vitesse is getting a bit of a reputation for innovating across the insurance space and we are uniquely placed to do that,” McGriskin adds.

“We’re looking forward to being the payment partner of choice for parametric insurers. To that end, we’ll continue to innovate, bringing real value to our customers and most importantly, to the end consumer.”

27

Ninety per cent of small companies fail within a year if they cannot resume operations within five days

Disaster relief: Parametrics are key to supporting those most vulnerable to climate events

ffnews.com Issue 27 | TheFintechMagazine

Better Manage Market Ups and Downs

Cutting-edge solutions help you value and risk manage your derivatives and fixed income portfolios

• Adapt to market change and uncertainty with world-class analytics that enable improved investment decisions.

• Maximize returns and minimize losses with powerful tools that empower you to try out your trading ideas.

• Understand the impact of market conditions with granular insights into the drivers of risk and return.

• Get flexible deployment options ranging from a single desktop to a high-performance cloud solution.

Get in touch today: Or visit us at: info@fincad.com www.fincad.com

Terrie Smith, Co-founder and Global Ambassador at wearable tech pioneer DIGISEQ, on why issuers should open their eyes to a new dawn in wearable payments

The age of contactless payments has arrived. Now accounting for more than 50 per cent of all POS transactions worldwide, contactless technology has evolved to become even more efficient, affordable and user-friendly, with wearable payment tech leading the way among a spate of new services hitting the market.

Mobile POS (mPOS) services – such as Apple’s Tap to Pay – are enabling millions of merchants, from small businesses to large retailers, to convert their iPhones or iPads into POS devices that can accept contactless payments, digital wallets, and any wearable tech item with a simple tap – without the need for specialised POS terminals or hardware. In fact, it is estimated that there will be as many

as 34.5 million retailers using mPOS solutions globally by 2027.

The continuing convergence of contactless and mPOS is music to the ears of banks and issuers aiming to capture more contactless transactions through their mobile banking apps and digital wallets. In the UK alone, new data from Barclays – which sees nearly half of the nation’s debit and credit card spending – reveals that a record 91.2 per cent of all eligible card transactions were made using contactless payments in 2022, a sign that consumers and businesses are continuing to shift to next-generation technology when buying and selling.

With merchants in all industries adopting mPOS solutions, wearable technology is being pushed into more applications, use cases and areas where, until recently, only cash could be utilised.

When the first contactless payment card was introduced to the UK market in 2007, users could only make low-value purchases of £10 or less – ideal for fast food restaurants, coffee shops, and other perishables that could be purchased on-the-go. However, successive increases in the contactless limit have allowed customers to utilise contactless to pay for more expensive items from a wider variety of in-store merchants.